Automate cash management for your mid-sized company

Standardise Group finance processes with a collaborative tool and data consolidation

Optimise your short-term cash flow

Gain visibility on your long-term forecasts

Improve finance team efficiency

Optimise your cash flow with more accurate management

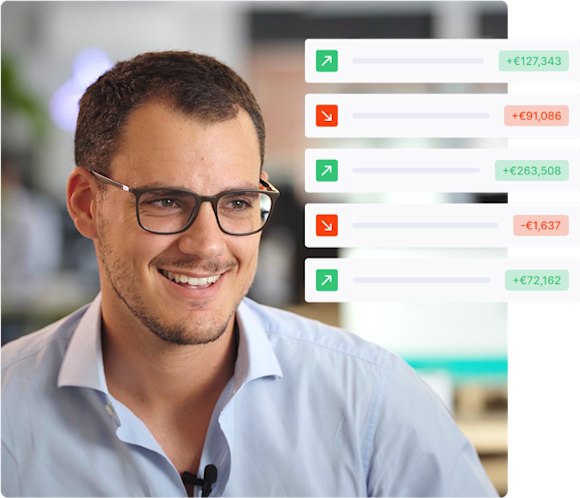

Switch easily from a consolidated view to a view per entity, bank, or bank account

Connect all of your bank accounts on one interface

Collect and categorise your cash flows automatically with our bank connections

Visualise your balance tables and anticipate your corporate finance operations

Include multi-currency transactions in your cash flow analysis

Save time on data consolidation and increase reliability

Automate your cash flow forecasting

Synchronise your accounting, AP or AR tools to track your outstanding amounts

Convert, with a few clicks, your P&L into a cash forecast

Compare several possible scenarios easily and make the best decisions

Gain visibility on your cash landings: anticipate overdrafts or mobilise your idle cash

Optimise the perfomance of your company

Facilitate cross-team collaboration through a common interface

Save up to 10 hours per week for the finance team with automated cash management

Communicate to your financial partners with one-click report export

Explain cash flow mismatches by company to define an associated action plan

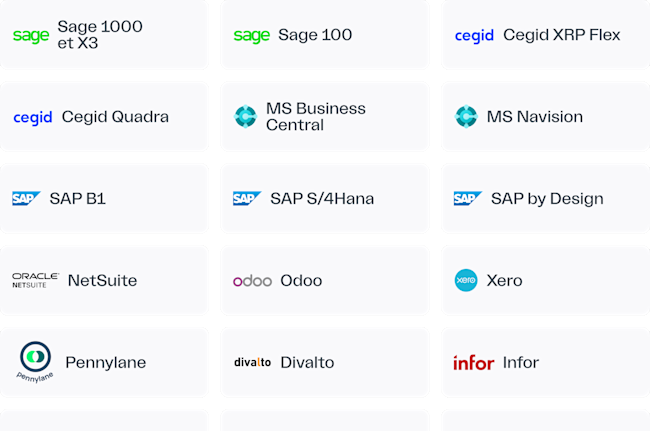

Synchronise Agicap with your business management tools (ERP, AP, AR, accounting, etc.)

Collect your outstanding supplier and customer invoices, purchase orders, and quotes automatically

Monitor your short-term forecasting on a daily basis

Is your tool not on the list?

We can provide a custom synchronisation with a SFTP server

The three perks of using Agicap

1/ Premium support with a dedicated account manager

Set up Agicap in just a few weeks

Benefit from expert advice to increase your cash management skills

Get instant and quality answers, during set-up and during your long term use

2/ Manage user access rights

Define access permission according to different user profiles

Guarantee the confidentiality of your company’s financial data

3/ Cash at your fingertips, thanks to the mobile application

View your bank account balances wherever you are

Track your cash receipts and payments in real time

View cash flow variations by month, as a whole and by company

Frequently Asked Questions (FAQ)

What is a midsized cash management software?

Typically, cash software aims to monitor and optimise the current cash situation of a company to arrive at reliable forecasts of cash flow. The term ‘cash management software’ is thus used interchangeably with ‘cash flow software’.

Aimed at companies that are larger than small businesses but smaller than corporations, mid sized cash flow software will usually address four areas of performance:

Cash management: supervising the cash entering and leaving the business to minimise financial risk in the short-term.

Liquidity planning: otherwise known as ‘liquidity planning’, this means using the data generated by cash management to model accurate forecasts of liquidity over the long-term.

Business spend management: tidying up the supplier side of the business. Activities might include verifying and digitising supplier invoices and categorising spend for analysis.

Cash collection: tidying up cash inflow from creditors. This might involve automating processes like resolving disputes and collecting late payments.

Banking connectivity : Provide maximum connectivity with banking systems and partners for the freshest, most realistic view of your data.

How important is cash management for medium-sized companies?

Cash management for mid sized companies has never been more important. “This is no time to be caught short of cash, or long on inventory, or both,” observed the Harvard Business Review in 2023. Mid sized firms could face “a liquidity crisis caused by the combination of rising costs, pandemic-driven changes in customer behaviour, lingering supply chain problems …[and] … uncertain sales.” These challenges are going nowhere.

Avoiding cash shortage over the long-term means managing cash well in the short-term. Companies that marshall their cash inflows and outflows efficiently can improve their working capital. This underpins future liquidity.

Optimising costs and revenues should also be teamed with enhanced monitoring. If medium-sized companies do not have a bird’s eye view of their cash landscape right now, how can they expect to make accurate forecasts of their future liquidity and use them to plan strategic investments and loans?

Which mid size company structures make cash management essential?

Many mid size companies are structured with a central management company governing multiple subsidiaries. This presents challenges of cash management that SMEs operating as a single entity do not face.

Cash flow needs to be managed and monitored at subsidiary level, but the central management company also needs the big picture of consolidated cash flow. The best mid sized cash flow software makes this possible, as well as automating financial processes across subsidiaries - including cash pooling - for group efficiency.

Agicap client VetPartners, for example, uses Agicap to manage cashflow across 36 clinics. VetPartners can pay suppliers that clinics share with one click. What’s more, Agicap’s custom dashboard feature enables the VetPartners Financial Controller to instantly collate data from all clinics for presentation to shareholders.

Rigorous cash management is also particularly important for companies structured around debt-driven development and intensive M&A operations (like Agicap client Sterimed).

What are the key features of cash management software for medium-sized companies?

Mid sized cash flow software offers tools to suit everyday cash operations that a smaller company might face, as well as powerful aids for managing larger business structures:

Consolidation: a consolidated cash flow plan takes into account the cash flow status of all entities in a business group. Good software allows CFOs to view cash flow reports at both consolidated and entity level.

Bank reconciliation:.there are ways to make the month-end process of financial reconciliation easier, but ultimately mid sized cash flow software that automates it all is ideal.

Multi-currency management: agility between currencies is vital for many medium-sized companies serving an international client base - like Sterimed, global leader in medical packaging, who use Agicap to manage 5 currencies across 60 bank accounts. Cash flow software can unleash many efficiencies.

Automation of receivables and payables: cash management software saves time and reduces error by centralising both supplier management and cash collection.

What are the most important integrations of cash management software for a medium-sized company?

Cash management solutions should solve integration issues, rather than add to them. Medium-sized companies often suffer from what experts call a “cobbled tech stack”. Their existing software tools that has been “cobbled” together over time without any thought for compatibility. The resulting business processes are - like a cobbled street - far from smooth.

The first integration priority for mid sized cash flow software is live connectivity with a company’s bank accounts. Otherwise real-time cash monitoring is not possible. This is a given: Agicap, for example, connects to over 3,000 banks.

Tacking a “cobbled tech stack” means integrating with a company’s existing suite of financial software. Linking with over 300 software packages, Agicap has found that medium-sized companies particularly appreciate integration with four favourites:

SAP: centralised data management and business process optimisation.

Sage: HR, finance and payroll management.

Oracle: database management.

Cegid: HR, retail and finance management.

How can Agicap help you on your midsized cash management strategies & monitoring?

“What would have taken previously an hour to do now takes about 30 seconds.” says John Canning, Group Finance Director of hospitality incubator White Rabbit Projects, who used Agicap to escape “very painful spreadsheets” from over 50 global subsidiaries. What made the job of the group finance team particularly difficult was that many of the subsidiaries were separate legal entities. Agicap excels at automatically integrating data from different sources for the purposes of reconciliation and consolidation.

As well as easing financial tasks across groups, Agicap can underpin success in centralised financing strategies such as investment and debt management. Agicap client Sterimed - a global leader in medical packaging - took advantage of Agicap’s oversight advantage to manage debt. Agicap’s many efficiencies at the level of day-to-day cash management made all the difference. Florence Sicault, Operational Administrative and Financial Director testifies to a “clear view of the cash flow which we could regularly check to repay the LBO debt.”