The cash flow management tool for construction companies

Improve visibility and anticipate your working capital requirements as far in advance as possible for worry-free management of your cash flow over the coming months.

Clear and reliable visibility and projections of forecasts

Save time thanks to automated, real-time monitoring

A collaborative tool that is very easy to use

Effectively manage your working capital requirements

Invoices for public works, structural jobs: your business requires a good view of WCR. Agicap gives you a clear picture of your long-term cash flow so you are never caught out.

A complete, easy to use tool

Maintain a global view of your cash flow in a simple and structured way. Agicap is installed in 2 clicks, and our team is available all day long to help you with the installation.

Save time and be more efficient with automated monitoring

No more manual cash flow analysis in Excel! Agicap automatically synchronises and categorises all your banking flows, securely and without errors. Effortlessly monitor your company's cash flow in real time.

Collaborate easily with your colleagues

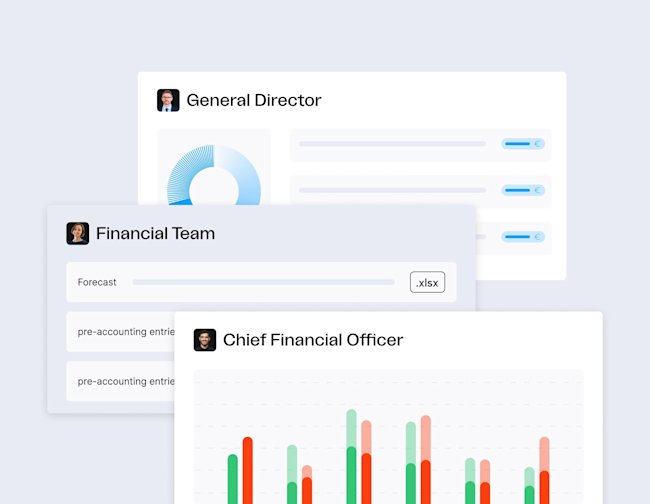

Co-manage your cash flow as a team by sharing your dashboards in real time with your manager, CFO, accountant and financial partners.

Frequently Asked Questions (FAQ)

What is a cash management software for the construction sector?

Construction cash flow software is no different from other cash flow software; but, in the construction industry, managing your working capital requirement is infamously tough. Because of the big costs and long projects involved, construction companies need software that shows the scope of cash inflows and outflows on both a project and company level, as well as construction cash flow forecasts over the short- and long-term.

Monitoring cash flow over the short-term is automated by construction cash flow software like Agicap. That means no more spreadsheets. What’s more, this continuous data analysis underpins the long-term liquidy forecasts that are so vital in the construction industry - given that projects can take years to complete, costs are high, and interim fees may be irregular.

A further key feature of construction cash flow software is how easy it is to present working capital overviews and liquidity forecasts to colleagues using custom dashboards.

How important is cash management for construction companies ?

The construction industry is notorious for having a high vulnerability to cash management failure. During the long, complicated projects that are typical in construction, companies without construction cash flow software can struggle to maintain an equilibrium of working capital. Challenges include the high cost of materials and labour, the need for specialist equipment, inventory mismanagement, invoicing delays and contractor failure.

When the inflow and outflow of capital on a single construction project is mismanaged, the entire company can fall. As Mutti and Hughes observe in their paper Cash flow management in construction firms, ‘cash flow problems and shortage of working capital can, in extreme circumstances, push [even] efficient and profitable firms into insolvency.’ Citing a 2000 study by Arditi, Koksal and Kale, this paper shows that 83% of company failures in the construction industry involve cash flow factors; see Chart 1 below.

What are the key features of cash management software for construction companies ?

Construction cash flow software typically aims to tackle 5 key pain points that construction companies face:

Supplier management: aimed at saving a company time throughout the entire purchasing cycle. Typically, purchase orders are assimilated onto a central platform which is then used to monitor and automate key processes, including preparation for accounting.

Consolidation: viewing a construction company’s cashflow at two levels: group, and consolidated entity. Often a tool will also consolidate different currencies in use within a company group and automate exchange rate strategies.

Daily cash flow monitoring: usually squarely aimed at leaving manual spreadsheet entry and analysis behind. Typical features include automatic synchronisation with bank accounts, as well as automatic categorisation of payment categories.

Cash flow planning: the centrepiece of construction cash flow software. Despite its limitations, cash forecasting can make or break a construction firm.

Connectivity: without it, cash management in the electronic age is a no go.

What are the most important integrations of cash management software for a construction company?

Arguably the most important integration for construction cash flow software to achieve is the linkage of site budgets with company budgets.

A company may have several construction projects on the go. Unless live data relating to the working capital of each project is fed into a central overview, a construction company is at risk of losing control. This happens. In their paper Cash flow management in construction firms, Mutti and Hughes conclude that, “apart from poor management, lack of adequate financial control is the most common characteristic of declining firms.’

When it comes to integration with a construction firm’s existing software, the best construction cash flow software aims for versatility and completeness. Agicap, for example, links with over 300 common business software tools. And any further tool can be linked on request. Typically integration will focus on the key areas of file storage, spreadsheets, payment solutions, invoice management, banking and ERP.

How can Agicap help you on your construction cash management strategies & monitoring ?

On a project level, construction cash flow software by Agicap provides real-time cash monitoring, automatic invoice management as well as tackling a key pain point of construction project management. As Thomas Haustein, managing partner at Agicap client Bau-Consult Hermsdorf explains, “The problem we always had is that a forecast was usually only possible over a relatively short period of time.”

Agicap’s software makes long-term liquidity planning a reality. And intensive support for clients means the learning curve is manageable for busy staff. “Even a structural engineer can manage to make a plausible forecast of his liquidity planning,” says Thomas, “Agicap is not a nice-to-have. Agicap is a MUST.”

Another key advantage offered by Agicap is in providing CFOs with oversight at both group and consolidated level. Marco Casadie, CFO of Agicap client Renova Red testifies that, “the main benefit Agicap has brought to the company is flexibility and immediately available data.”