A unique, detailed approach to cash flow forecasting

Leverage top-notch forecasting and scenario planning to fuel growth and mitigate risk with both short-term and long-term perspectives

Make the right decisions

based on accurate future projections

Automate forecasting processes

to free up time

Cover risk exposure

with hedging decisions

Learn how how to build a long-term cash forecast from your P&L in this 2-minute-video

Secure financing and overcome uncertainties with accurate forecasting

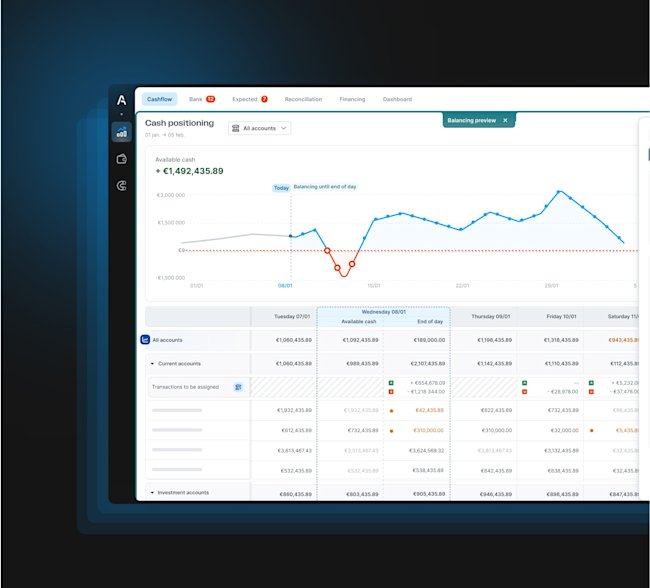

Leverage forecasting to optimise your short-term cash management

Combine banking aggregation with forecasting data from AP/AR and other predictable flows (rent, salaries, taxes, debts, investments...)

Maintain your short-term forecast accuracy and reliability with advanced treasury reconciliation

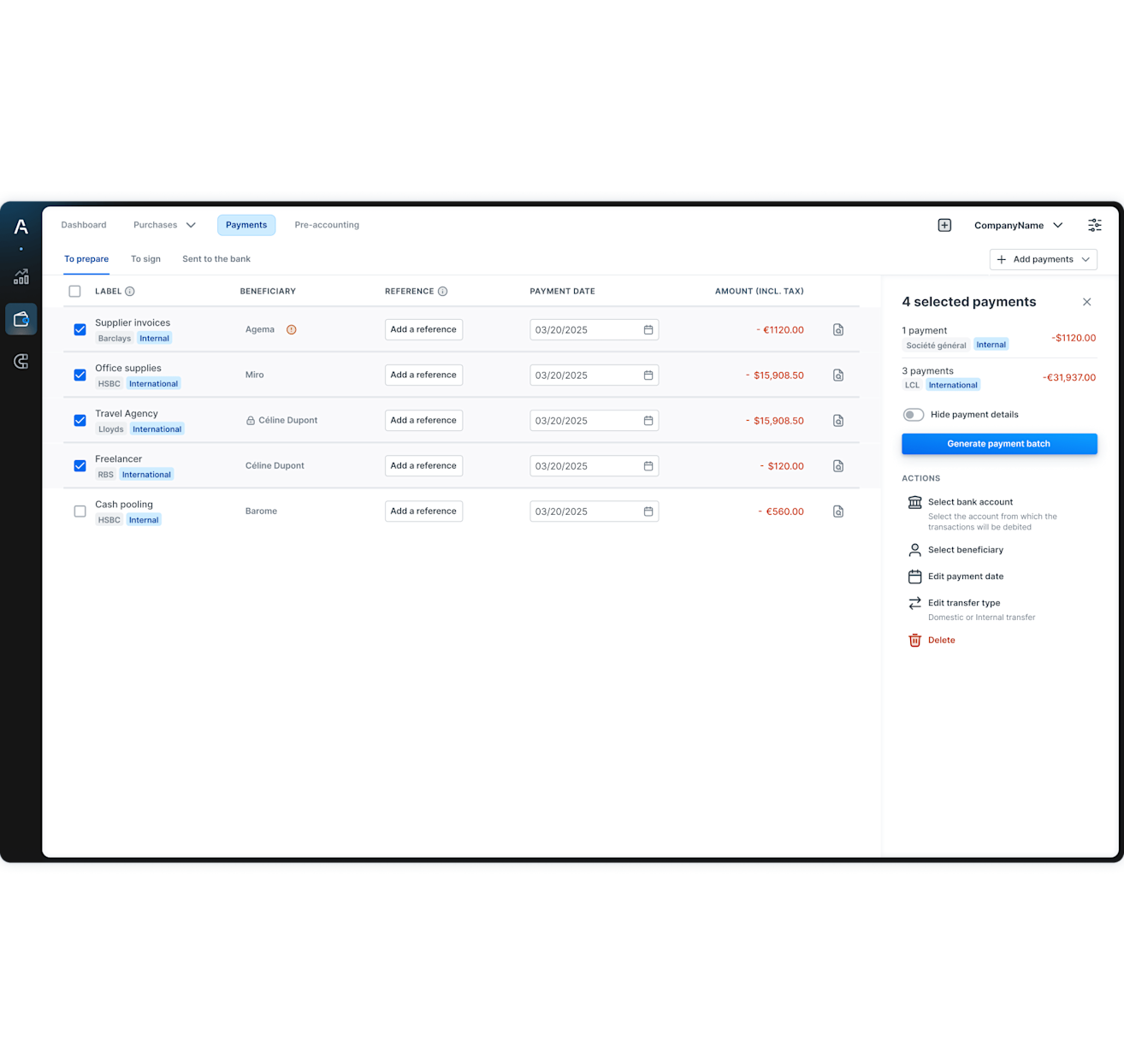

Leverage cash position anticipation at group level to optimise cash allocation with cash pooling and supplier payment campaigns

Extend the visibility period with a 13-week forecast to anticipate financing needs and ensure day-to-day operations

Anticipate financing needs with an accurate long-term forecast

As your FP&A team prepares yearly forecast P&L or budgets, easily transform it into a cash vision with Agicap’s dedicated converter

Improve the cash forecast accuracy with historical analysis and assumptions-based forecasting

Automatically take into account the impact of the company’s DSO on your cash flow forecast

Build multiple scenarios to test development opportunities (hiring, new market...) and cover risk with effective hedging decisions

Easily reforecast to take into account a changing context

Perform a variance analysis with actual-plan or plan-plan comparisons

Dig into the gap analysis at group, division, or entity level and drill down into projects details to evaluate gap impact

Build variance analysis dashboards, and share reports to explain trajectory gap rationale

Import your newly updated P&L into Agicap with our converter to automatically take changes into account and update your forecast