Invoice Management Software – How to Manage Invoicing in 2026

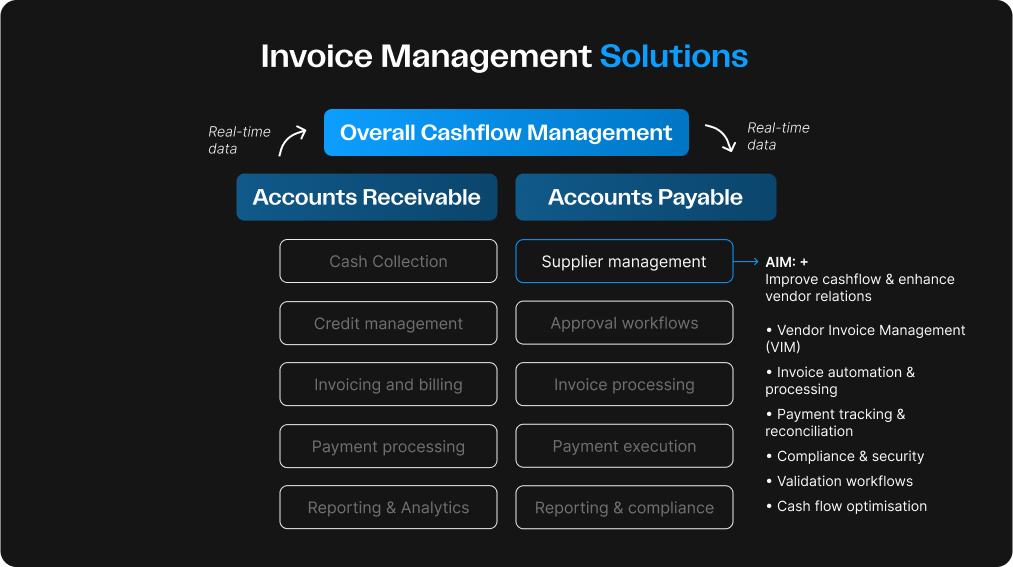

A company's cash flow is the net result of two flows: cash inflows (coming into the company) and cash outflows (going out of the company).

Paying invoices is critical to both these flows:

- When cash is coming into the company via the Accounts Receivable (AR) department, invoices are used to request payment from customers.

- When cash is going out of the company via the Accounts Payable (AP) department, invoices are sent into the company by vendors/suppliers, and then paid by the company.

What is invoice management software?

Many modern companies will have some form of cashflow management software (like Agicap) in place. Depending on the size of the company, this is likely to have a module of AR automated services (managing the flow of cash into the company) as well as a mirroring module of AP automation software (managing the flow of cash out of the company).

Typically 'invoice management software' refers to the AP module ie. automating the process of paying invoices rather than issuing them. Only rarely a company will advertise its product as invoice management software when it handles the issuing of invoices. If a company's software handles both AP and AR, it will commonly be called "billing and invoicing software".

The bottom line is this: if a package is marketed as 'invoice management software' without any clarification, it usually means it is part of Accounts Payable (AP) ie. managing cash outflows.

Key features and capabilities

Here are 6 key features you can expect with a powerful package of invoice management software:

1. Vendor Invoice Management (VIM)

This means taking a comprehensive grip of invoicing from start to finish of the process - sometimes reaching right back into the early phases of automated procurement. Everything with VIM centres around a centralised repository for all supplier invoices. Advantages include:

- Improved accessibility, with all vendor documents in one place.

- Streamlining of the invoice approval process.

- Efficient payment of valid invoices - and avoiding paying suspect invoices.

Advanced features of VIM which a company might opt for include AI-driven anomaly detection in invoices (for fraud prevention) as well as self-service supplier portals for clients to submit their invoices.

2. Invoice automation and processing

Invoice automation centres on using AI and OCR to "dematerialise" invoices - ie. capture all relevant information on them electronically. This offers the advantages of:

- Speeding up the invoicing cycle, leading to more efficient cashflow.

- Reducing potentially costly errors due to a human entering data incorrectly via manual capture.

- Saving time.

An advanced feature of invoice automation is the use of machine learning algorithms to improve the accuracy of data extraction over time.

3. Payment tracking and reconciliation

Matching invoices to payments makes for accurate reconciliation - and this is boosted with invoice management modules (like Agicap) that are strong in the area of real-time synchronisation with bank accounts. Advantages include:

- Up-to-date transparency of transactions.

- Simplified reconciliation process.

- Enhanced accuracy in reporting.

Advanced features emerging are AI-powered predictive analytics which aim to forecast payment behaviours (and adapt to them), as well as automated alerts for unmatched transactions.

4. Compliance and security

Agicap is not alone in prioritising adherence to regulations like GDPR. As well as holding an ISO 27001 certificate for information security, Agicap implements regular security audits and updates. The advantages of an invoice management package with a strong security awareness are:

- Sensitive (and potentially priceless) financial data is protected.

- Trust can be developed with stakeholders and clients.

- Legal penalties for non-compliance with regulation can be avoided.

Multi-factor authentication for user access is one advanced feature in this field.

5. Validation Workflows

The bigger a company gets, the more complicated it becomes to get a particular invoice in front of the people authorised to sign off payment. The sequence of invoice approvals that vendor invoices need to chart in order to be validated for payment is called a validation workflow.

Key features of strong validation workflows are:

- Customisable hierarchies: in other words, teams can change the validation route at any time

- Automated rule-based routing: alternatively, the invoices can be set to flow according to predefined rules.

- Real-time notification for pending approvals: keeping authorising staff on their toes!

Validation workflows ensure that suspect invoices do NOT get paid, but regular invoices DO get paid on time. A key advantage of workflows like this are that a crystal-clear audit trail is left within the system, which is perfect for compliance purposes.

Advanced features coming onto the market include integrating workflows with smartphone apps so approvers can give the go-ahead whilst they themselves are on the go.

6. Cash flow optimization

Not all invoice management packages offer cash flow management. And that's not just down to the size of the software; it's often a matter of focus.

For Agicap, cash is king, and high-powered cash flow optimisation and forecasting are central differentiators that the company offers. So invoice management data is much prized for the valuable insights it provides on an ongoing basis into a company's cash flow situation.

Typically, having cash flow monitoring dashboards based on accurate AP invoice data improves the overall financial stability of a company - and helps in a more immediate way to identify potential cash shortages.

Advanced features in this area centre on AI-powered recommendations for optimising payment schedules.

What areas of invoicing are generally not handled by invoice management software?

Typically we would not expect to see invoice management software automatically handle:

- Commercial invoices: these are effectively customs documents necessary for cross-border trades.

- Preparation for invoice financing: invoice financing is the process of raising debt from a lender on the strength of outstanding AR invoices. However, we would not expect generic invoice management software to handle the invoice factoring which determines the percentage of invoice amount applicable in the provision of this lending.

Invoicing can be confusing. This is particularly the case given it applies to both Accounts Payable (AP) as well as Accounts Receivable (AR) areas of business. Use an invoicing glossary to get new team members up to speed.

Benefits for businesses of an automated invoice application

The benefits of invoice automation depend on the size of the company:

Small businesses (1-50 employees)

The smallest companies typically lack a finance team. So any form of automation is welcome - provided it is not over-complicated.

- Saves time: automates manual entry as well as approval. This frees up staff for other tasks.

- Reduces errors: minimises mistakes from manual input.

- Faster payments: improves cash flow.

- Affordability: a simple invoice package can cost far less than a full-time or outsourced accounts payable specialist.

Medium-sized businesses (51-500 employees)

When its comes to paying invoices, mid-sized businesses might handle high volumes as well as high complexity. So what is important to them in invoice management is visibility and efficiency.

- Workflow automation: appropriate software will automate all the invoice approvals necessary to get invoices (including recurring invoices) signed off and paid.

- Cash flow control: real-time tracking of invoices, due dates and spend,

- Compliance: automated processes mean audit trails and regulatory requirements can be fully adhered to.

- Scalability: the right software will accommodate any growth a mid-sized company might make to enterprise size.

- ERP integration: not a priority for smaller companies, but for mid-sized firms an advantage of the right invoice management software is that it will link to its existing tech stack, whether that be Enterprise Resource Planning (ERP) software, or advanced financial management tools like Agicap.

Enterprise-sized businesses (500+ employees)

The biggest companies need invoice management systems that can support huge volumes across the globe without compromising security or efficiency.

- End-to-end automation: from invoice capture to payment, with as little human involvement as possible.

- ERP integration: even more of a priority for enterprise-sized businesses than for mid-sized firms; appropriate invoice management software can become a powerful driver of efficiencies across the company's entire tech stack if it can feed data efficiently and accurately.

- Support for global multi-entities: so much time can be saved if the invoice management software can manage multiple currencies, languages and regional tax directives.

- Advanced analytics and reporting: the bigger the company, the more important it is to have powerful tools to detect fraud, as well as monitor performance and spending.

- Complete workflow control: larger firms have more complicated sign-off protocols for invoices (as well as significant sums payable) - so a full workflow customisation suite is very useful.

Best invoice app for specific industries

With numerous options on the market for invoice management, certain industries tend to favour particular features.

In areas like retail, manufacturing and tech - where cash flow visibility is as critical as invoice efficiency - Agicap's cash-centred approach is highly-prized.

In retail, Agicap's ability to handle high invoice volumes is appropriate. And Agicap's emphasis on cash flow visibility helps manage seasonal fluctuations - as Agicap client Café Coton have shown.

In manufacturing and hospitality, where cash timing is critical, Agicap is popular because it allows businesses to schedule payments based on liquidity forecasts. That's because AP, and all invoice management, is embedded within Agicap's cash flow ecosystem designed to offer maximum real-time visibility as well as immediate forecasting power.

In construction, where company survival comes down to adept cash flow management, Agicap makes it easy to track payment due dates and keep a constant eye on the cash flow situation. Its cloud-based accessibility, as well as smartphone app, suits construction teams working onsite, at home and at head office.

AP invoice management software: cost considerations and ROI

In a field as variegated as cash management, it is almost impossible to compare like for like.

Many treasury management packages offer invoice management - ranging from the smallest and cheapest packages, like Xero (with a Hubdoc integration), up to the multi-functional powerhouses like Agicap, Tipalti, HighRadius and Coupa. But how does a business isolate the specific function and cost of AP invoice management from the function and cost of the whole package?

Well, when it comes to costs, certain generic areas need to be considered:

- Subscription costs: SaaS providers often charge per user, per month.

- Implementation and setup costs: some complex packages may require onboarding packages.

- Training costs: A hands-on provider may offer training at extra cost.

- Integration costs: this is the cost of connecting the software with the business's existing tech stack; with a provider like Agicap, the huge range of pre-existing conversion modules would likely see this cost as zero.

And when it comes to ROI, we can get more specific around invoice management:

Time saved by invoice processing: a rule of thumb is that any invoice typically takes at least 10 minutes to process manually. Automation can reduce this time to 1-2 minutes. So a company can save itself 8 minutes per invoice. If a firm processes 1,000 invoices a month, that's 133 person hours saved; and 1596 hours per year. At a sample rate per FTE of £28 per hour, that's a yearly saving thanks to invoice automation of £44,000.

Reduction in late payment penalties and/or lost early payment discounts: another rule of thumb is that companies which use the alert services on invoice management packages can save themselves 2-5%.

Improved cash flow forecasting: it is very difficult to account for savings specifically, but the better cash flow forecasting that arises from invoice management packages can help reduce overdraft fees, optimise short-term cost management and reduce emergency borrowing.

Conclusion: what is the best software for invoicing?

The best invoicing software for your business depends primarily on the size of your business. There is no point, for example, in a small firm adopting an enterprise-level system like Coupa or HighRadius; or for an enterprise-sized firm spread across the globe to try and make freeware Zoho invoice work for all its staff.

Software like Agicap - that is both scalable and modular - can offer great utility to all sizes of company, as our 8,000+ clients have discovered:

- Streamline your invoicing.

- Boost visibility on all invoice processing.

- Improve financial efficiencies.

- Drive heightened control of invoice payment through robust validation processes.

- Feed your existing accounting systems with reliable data from invoice processing.

- Avoid automated reminders from vendors and late payments.

- Get one step ahead with automated and flexible accounting preparation.

- Enhance overall cash flow forecasting with real-time Accounts Payable (AP) data.

Agicap invoice management software provides a straightforward foundation that offers real stability and power. It can be scaled up in size indefinitely, particularly given Agicap's existing depth in providing for multiple business entities in different countries.

Vendor Invoice Management (VIM)

Use one platform to collect and monitor all invoicing paperwork - and exercise full and transparent control over payments.

Automated Invoice Processing

Base your VIM on reliable data. Agicap uses AI-enhanced Optical Character Recognition (OCR) to scan invoice materials (invoices, purchase orders, delivery notes etc.) and automatically extract key information.

Real-time cash flow insights

Smart invoice tracking means the business can track spending in real time. What's more, teams can reach deep into any purchase stream for instant retrieval of historical data.

- What happened with that invoice? Well, with Agicap you can find out for sure.

- Compare paperwork to ensure the payment stream is in perfect order: what was ordered, what were the payment terms, what has been delivered, and what was paid.

Full control over access rights

Agicap provides a flexible system of access rights and validation workflows. It just takes a few clicks to assign a route for an invoice so that it ends up in front of the staff members who are authorised to sign off payment.

Multi-currency support

Support for multiple currencies is standard with Agicap. Invoice automation will spot what currency is being used during the OCR phase and ensure that currency data is appropriately encoded as it is passed up the information chain.

Automation and exporting of pre-accounting entries

Agicap's provision of invoice automation extends even beyond the order-to-payment cycle. As a holistic system, Agicap always has an eye on any element can benefit the greater picture. So with Agicap, invoice processing includes pre-accounting convenience. You can:

- Automatically generate entries in your purchase journal.

- Group invoices by cost centre.

- Export all purchase entries to your other accounting systems or ERP system (or keep them within the wider Agicap platform if that's what you have as your main cash management solution).

Agicap's Accounts Payable (AP) Automation

Take control of your Accounts Payable (AP) with Agicap’s powerful automation solution. Simplify invoice management, eliminate manual errors, and put an end to overdue invoices that disrupt your cash flow.

Agicap helps you streamline approvals, automate payment tracking, and gain real-time visibility on outstanding invoices — so you can pay on time, strengthen supplier relationships, and optimize your cash position.

Unlock greater efficiency, stronger forecasting, and smarter decision-making for your business today. Discover how Agicap transforms AP management — watch the video.