All your payments on a single platform

The Agicap Payment Factory enables you to automate and secure all your payments, directly linked to your cash forecasts and integrated with your banks and ERP.

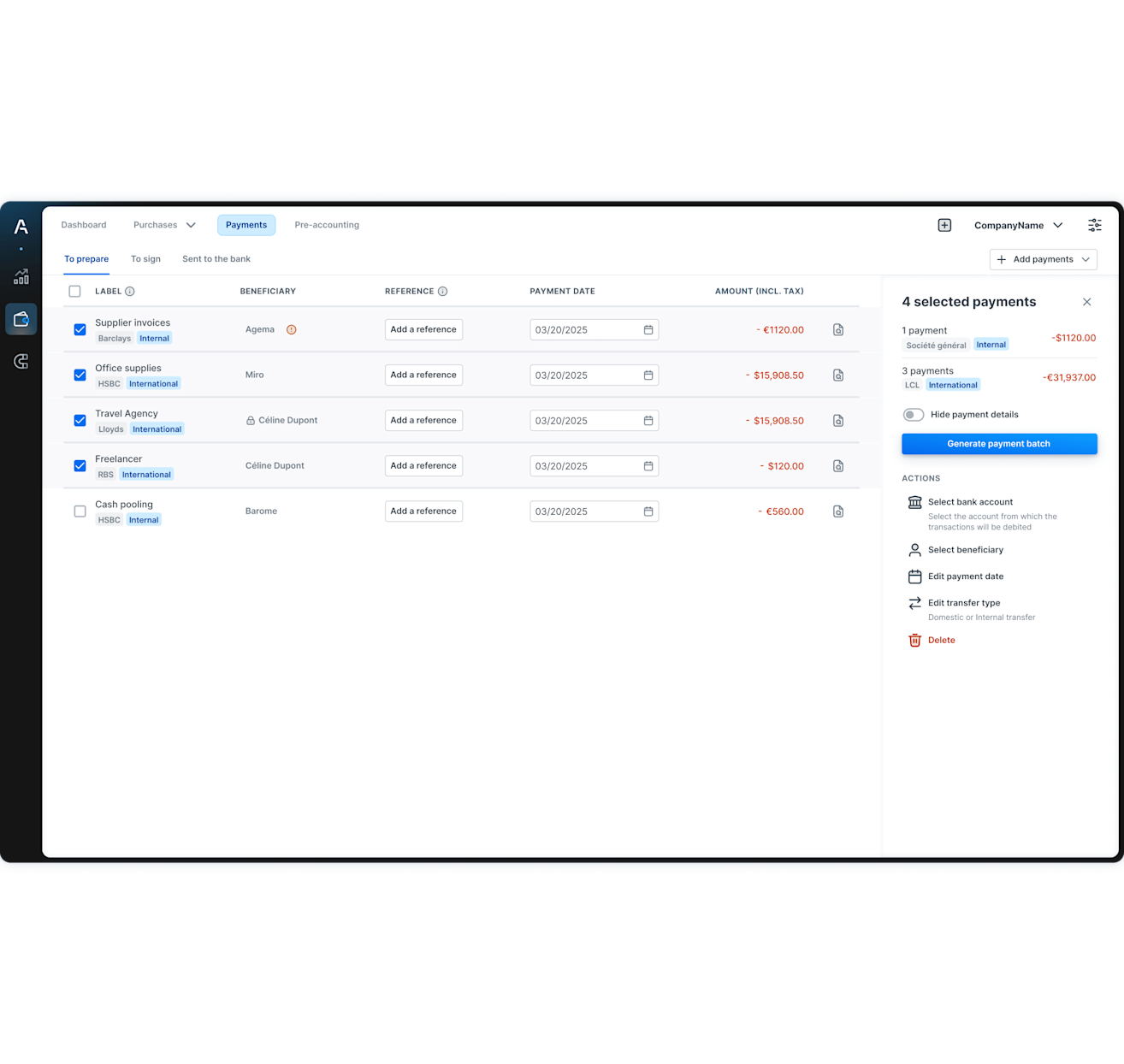

Execute all your payments

in one place, for all your banks

Automate and stay in control

with advanced validation workflows

Improve reliability and visibility

with direct bank & ERP connections

The Payment Factory that enables you to optimise your cash flow

Centralise all your payments in one place

Execute all your payments directly from the platform: suppliers, payroll, internal balance transfers

Improve data reliability thanks to direct connections with all your banks for all your entities, and with your ERP if you want to import payment files

Connect your banks to the relevant network or protocol depending on the countries where your entities' banks are located (Bacs, EBICS, Host-to-host)

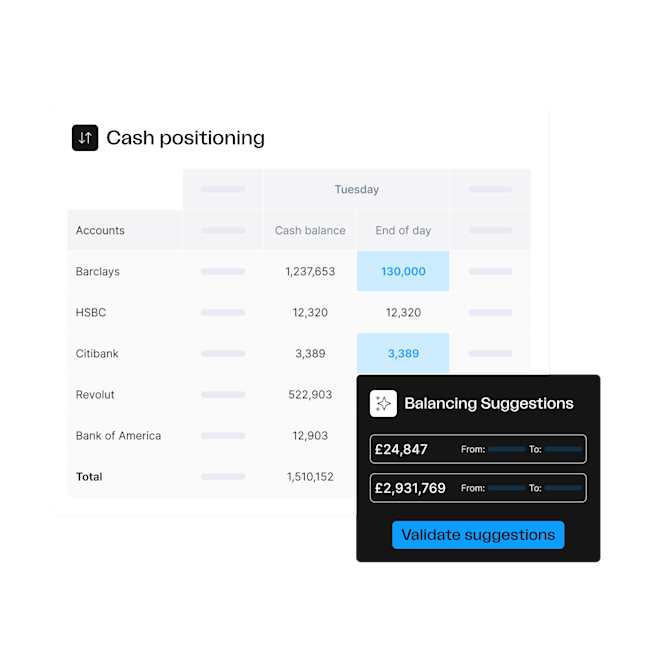

Benefit from a seamless integration with your cash forecasts

Monitor the impact on your cash flow of all your payments in the short, medium and long term

Anticipate your cash outflows to mitigate shortage risk, avoid bank fees, and negotiate with your suppliers

Optimise your liquidity at group level with our cash pooling feature and easily invest your available cash

Keep your payments secure

Your money moves safely with the standard Bacs payments system and the related encryption technology

Keep control on each cash outflow with advanced validation workflows and final approval on desktop or mobile app

Prevent fraud or errors thanks to user-rights management and multi-factor authentication (MFA)

Discover other Agicap products

Questions fréquentes

What is a Payment Factory like Agicap ?

A Payment Factory is a feature offered by financial SaaS (usually Treasury Management Systems, TMS, like Agicap). It is a centralised platform designed to handle all payment processing activities within an organisation. By having a direct connection with the banks (through protocols such as Bacs, EBICS, Host-to-Host, SWIFT) and an integration with the ERP, the Payment Factory helps the companies to streamline their payments to providers, employees (salaries) and their internal balancing transfers and loans. The Factory also includes security and fraud management features, such as multi-factor authentification (MFA) or user-rights management. This model not only reduces operational costs and minimises errors but also enhances visibility and control over cash flows.

What are the main features of Agicap's Payment Factory ?

Direct connection to banks with secured protocols such as Bacs, EBICS, Host-to-Host.

Advanced validation workflows, with final approval on mobile application.

Direct link to Agicap Cash management and Cash forecast features, to follow and anticipate closely the impact of the payments on the company’s cash flow, and set up a Cash Pooling process in the organisation.

Security and fraud management features: multi-factor authentification (MFA), user-rights management, protocols encryption.

What are the benefits of Agicap’s Payment Factory compared to other TMS?

Apart from the main features you can expect from a Payment Factory, Agicap comparative strengths are its agility (the quick implementation and user friendly interface), its integration in the Agicap all-in-one solution, with advanced and accurate forecasting features, short-term cash management that allows you to perform automated balancing transfers, Accounts Payable Automation, Accounts Receivable Automation and Spend management modules, and its recognised quality of customer support.

How secure are payments made from a Payment Factory?

Payments made from a Payment Factory are highly secured and reliable, thanks to data encryption implied with the main banking connectivity protocols (e.g SWIFT, Bacs, EBICS), to validation workflows and digital signatures, and to multi-factor authentification (MFA).

Which types of payments can be processed in the Payment Factory?

You can process any type of payment from the Payment Factory: supplier payments, salaries, internal balancing transfers, cash pooling.