Treasury management system: features, benefits and comparator in 2026

A Treasury Management System (TMS) is typically a SaaS application that provides comprehensive management of cash, liquidity and financial risk.

For a CFO, choosing a TMS is a huge step that will impact their whole business. Gone are the days when a treasury system was only used for obscure financial functions; now, a TMS will often act as the central platform for all financial software systems of a company to feed into.

It's about modularity, cash visibility and instant data. Sure, on an operational level, a good TMS implementation will increase the amount of available cash in your company as well as optimise its use. But nowadays the strategic role of the TMS is arguably even more important: to provide a gold standard of financial information upon which the CEO and Board can base winning strategic decisions around investment, financing and expansion.

In our modern information economy, a TMS is absolutely about getting the right information to the right eyes at the right time. So it's critical to choose the right one.

Core features of a Treasury Management System

Integrating with a company’s existing ERP and bank accounts, a TMS tackles many of the key functions of cash management software - such as cash forecasting and automated AP and AR - as well as key treasury functions like the management of currency/interest rate risks and debts/investments.

-

Cash visibility and management Real-time tracking of cash positions across multiple accounts, currencies and entities.

Consolidation of cash balances to provide a centralised view of liquidity. -

Cash forecasting

Liquidity predictions - AI-based or rule-based - over the short- and long-term. -

Risk management

Tools for managing financial risks in FX and interest rates.

Real-time market integration for hedging strategies like forwards and swaps.

Compliance monitoring for regulatory requirements. -

Debt and investment management

Tracking of loans, credit facilities and repayment schedules.

Risk-reward calculation for investment opportunities to use excess cash.

Portfolio oversight for financial instruments. -

Accounts Receivable (AR) cash collection

Automated invoice tracking and payment reminders to reduce Days Sales Outstanding.

AR aging reports for prioritised collections. -

Accounts Payable (AP) payment automation

Automated approval workflows and payment scheduling.

Multi-currency payment processing with SWIFT and SEPA compliance. -

Payment processing

Automatic reconciliation with bank accounts.

Fraud detection and prevention via AI.

Secure payments across multiple channels. -

Reporting

Customisable dashboards to show cash positions, forecasts and risk exposures.

Automatic production of accounting reports to GAAP and IFRS standards. Smartphone app. -

Analytics

Variance analysis to pin down differences in projected vs. actual cashflow positions (as well as projected vs. projected scenario comparison). -

Integrations

Integration with existing tech stacks - including ERP systems, accounting software and banking platforms.

Open APIs for full modularity, integrating third-party financial tools.

Full data aggregation.

How a TMS works

A simple way to understand how a TMS works is to consider that it has 3 areas of operation:

Area 1: Connectivity

That means integration with the existing tech stack of a company (including ERP, bank accounts, file storage and spreadsheets) and also payment and spend processing. This is the foundation.

Area 2: Tools

Exploiting a secure foundation of connectivity, the TMS achieves tasks using four main tools: reporting, forecasting, tracking and automation.

Area 3: Fields of impact

The TMS exercises its four types of tool (reporting, forecasting, tracking and automation as above) across four main fields:

-

Cashflow and liquidity

This means monitoring and automating cash inflows and outflows, supplying forecasts, ensuring the company has sufficient funds (both in the short and long term), as well as optimising any surplus. -

Risk (credit, currency and reputational) Mitigating the risks of dealing with multiple currencies, credit and interest rate fluctuations - and also reducing the change of a reputational crash due to financial/regulatory error.

-

Investment & debt

Using cash forecasting to assess investment opportunities for **improved investment ROI; centralising management of existing loans and optimising repayment strategies. -

Suppliers and payments Optimising AP and AR processes and using live data from them to support accurate cash forecasting and variance analysis.

Benefits to a CFO of implementing a TMS

If you are a CFO, the absolutely key thing to grasp about a TMS is that it WILL save you money.

Almost immediately you can expect savings from streamlined internal cash flow, reduced cash buffer, reduced Days Sales Outstanding (DSO) and increased Days Payable Outstanding (DPO). These are just the inevitable fruits of having your various departments integrated via one software system rather than a tenuous net of spreadsheets or mismatched modular apps.

Not only is the amount of available cash going to be greater as a result of more efficient, centralized processes. But, thanks to powerful cash management, the USE of available cash will also be improved:

- Increased invested amounts - with accurate cash forecasts, you can increase the amount you invest without running the risk of cash shortages.

- Increased investment rates - better visibility means you can optimise maturities.

- Reduced borrowed amounts - thanks to balancing transfers between accounts.

- Reduced borrowing costs - with better visibility, you can afford to self-finance more (without risk) and borrow less.

- Reduced bank fees - through automatic detection of discrepancies between theoretical and paid amounts.

And that's just operational cost-savings. Risk management is a key area where a TMS immediately makes a big impact, both in currency, interest rates and regulatory compliance. Is your work as a CFO making your company safer? With a good TMS, you can categorically report to the Board that the answer to that question is yes. And, of course, in the bigger picture, the enhanced cash visibility and control offered by a strong TMS means the quality of the financial information you can offer the Board is excellent.

Choosing the right TMS for your organisation

The best treasury management systems for 2026 include:

Best TMS - characteristics

When it comes to choosing a good treasury management system, companies should ask themselves the following questions:

- Does the TMS have all functionality we need (including automation, reconciliation, monitoring, forecasting, investing and debt management, consolidation)?

- Is - like Agicap - this TMS integrated fully with our ERP, our bank accounts and our existing business software?

- Will the reporting capabilities offered by this TMS support convenient sharing of data with colleagues, as well as dynamic, filtered presentation to stakeholders?

- If there is a high price tag associated with subscription, is it worth it? Is the counter-risk of investing in sub-standard software worth it?

- What do other clients say about the training and support provided by the TMS provider?

- Is the TMS future-proofed? Is it modular? Is it grounded in a level of connectivity that means it can link with software we install in the future?

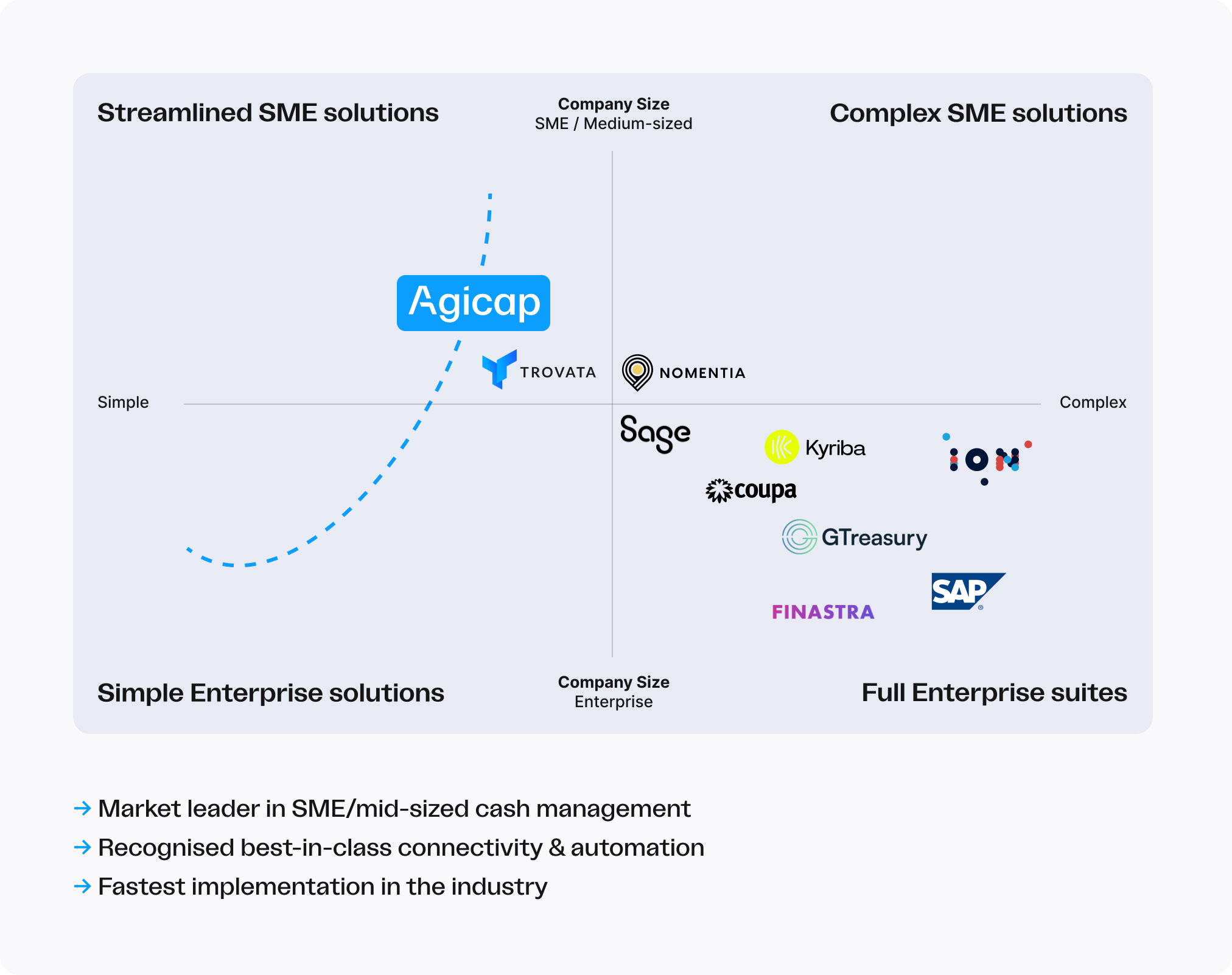

Agicap

Acclaimed as the market leader in cash flow management in Europe, Agicap serves 7,000+ clients spread across 12 countries and has developed 150+ commercial and technological partnerships.

Agicap’s Treasury Management System (TMS) is based on a comprehensive integration of a company’s existing bank network, ERP system, and suite of software tools. Leveraging this connectivity, Agicap treasury management software offers powerful solutions to unlock cash performance:

- Cash flow management: real-time overview and automation of cash flow, with numerous advanced features such as cash pooling; clients point to consolidation of group entities as a speciality.

- Cash flow forecasting: Powerful and intelligent projections of liquidity.

- Debt management: centralisation of repayments and instant KPI overview.

- Investment management: Agicap’s eagle-eye oversight of a company’s finances empowers clients to seize excess cash, lower their cash buffer and optimise maturities.

Kyriba

Serving close to 3,000 clients in 170 countries, Kyriba’s global reach is matched by its ambition to deliver fully-integrated liquidity management platforms. Cloud-driven and driven in part by AI (like many TMSs, including Agicap), Kyriba offers functions in:

- Treasury: cash management, forecasting, netting and pooling.

- Risk: monitoring and management of exposure to FX, commodities, interest rate - as well as valuations and hedging.

- Payments: Real-time payments and fraud detection.

- Connectivity: API connectivity to banks, ERPS and apps.

- Working Capital: Supply chain and receivables finance.

Kyriba targets its software at finance teams in medium-sized and enterprise companies. 25% of clients named its commitment to security as one of the main reasons for selecting Kyriba.

SAP Treasury and Risk Management

This is actually a module within SAP's S/4HANA cloud package. SAP is a giant in the field of Enterprise Resource Planning, and this product is a popular choice with multi-entity structures (global operators typically) with complex needs. It's a favourite in manufacturing, energy and pharmaceutical industries thanks to the depth of its offering:

- Liquidity management - banking integration, forecasting and real-time visibility.

- Debt and investment management - tracks loans, bonds and other financial instruments.

- Automatic financial reporting - in line with IFRS and GAAP.

- Financial risk management - including FX/interest rates and integrating with trading platforms for derivatives and hedging

- In-house banking - centralised payment processing and intercompany netting.

ION Treasury

Much like SAP above, ION Treasury is built for treasury teams with a need for enterprise-grade control over risk and capital structures. That means a client base of 1,250 mostly large, multinational companies - often working in manufacturing, pharma and finance. Unlike with Agicap, significant training is required to learn ION (as with SAP) and unlock its in-depth offering of:

- Cash & liquidity management - real-time visibility of the cash situation across multiple legal entities.

- Risk management - across FX, interest rates, commodities and credit.

- In-house banking - centralised intercompany transactions.

- Debt & investment management - compliance tracking for all financial instruments.

- Workflow automation - automated reconciliations and approvals.

Sage

A 10,000-strong firm based in the UK, Sage has made a name for itself in accounting systems. Its treasury management capabilities are showcased in its Sage Intacct and Sage XRT packages. Unlike Agicap, Sage's focus here is on in-depth treasury needs rather than powerful cash analysis:

- Cash & liquidity management - real-time visibility across multiple entities.

- Cash forecasting - based on automated bank feeds (like Agicap) and predictive algorithms.

- Treasury accounting - integrated general ledger and full accounting compliance (IFRS, GAAP)

- Multi-entity and multi-currency support - consolidates global operations with localised compliance.

Sage TMS is an obvious choice for mid- to large-sized companies with complex TMS needs - as well as existing integrations with Sage software.

Finastra Fusion

Like Sage and ION, Finastra's treasury offering is aimed at the largest of companies. Finastra's client base centres on large financial institutions, with a focus on Tier-2 to Tier-5 banks.

Whilst offering a similar level of enterprise risk management to Sage and ION, what makes Finastra stand out is its open-by-design philosophy as software: it is very easy to plug other software into it, and this distinguishes it as a backbone for institutions managing high-volume, high-stakes financial processes.

In comparison with Agicap, Finastra offers liquidity management, compliance and automation to suit corporations with very complex, global needs; whereas Agicap's emphasis on both cash visibility and user-friendliness make it an obvious choice for smaller businesses with conventional AP and AR requirements.

Trovata

A relatively small company HQed in California, Trovata have picked up some big-name enterprise clients like Krispy Kreme, Eventbrite and Square.

Trovata positions itself squarely as a cash management specialist, citing that 98% of executives and financial professionals said they could be more confident about the financial visibility they enjoy. Trovata aims to “manage cash with a single source of truth”, and leverage that clarity to support CFOs in strategic decisions:

- Cash flow analysis: automatic bank data aggregation, AI-driven reporting and google-like transactions search.

- Cash forecasting: no more spreadsheets - centralised data and improved forecasting thanks to machine learning.

- Cash reporting: Real-time cash positions, enhanced categorisation of cash flows, and smartphone app access.

- Accounting: integration with FloQast and sage Intacct for streamlined, automated reconciliation.

Coupa Treasury

Whilst the Coupa TMS does include the dual functions of risk and cash management that we would expect from a twin treasury management system, its focus is very much on spend management.

“Make Margins Multiply” is Coupa’s brand proposition. This sums up their interest in helping clients to optimise their procurement and supply chain strategy. Coupa have been named a leader in the 2024 Gartner Magic Quadrant for Source-to-Pay suites:

- Smarter procurement: precise spend management tools, proactive monitoring for compliance/supply chain risks and savings reinvestment.

- Supply chain strategy: scenario planning for resilience and AI-driven management of trade-offs and blind spots.

- Resilient IT: Pre-built ERP connectors and open APIs to ensure seamless Coupa integration.

GTreasury

Although GTreasury boosted its cash collection capabilities in 2021 with the acquisition of CashAnalytics, it still cannot match Agicap as an all-in-one cash management powerhouse for mid-sized companies. For companies seeking simple but powerful solutions to cash collections and cash payments, GTreasury's solutions are arguably too complex.

GTreasury - like ION, Finastra and SAP - is actually aimed at larger enterprises needing massive scalability across international entities, and is a popular choice for larger companies in manufacturing and real estate who need FX, commodity and hedging support.

Despite having a strong reputation for robust connectivity, some GTreasury users have reported long setup times for integrations with certain banking software and occasional lags in data processing.

Nomentia

Like Trovata, Nomentia is a small company which offers a solid suite of modular tools centred on cash flow management and liquidity management:

- Payments: global hub for automation and streamlining.

- Cash management: central tracking and control.

- Treasury: cash forecasting, loan optimisation and workflow tracking.

With a Scandinavian focus, Nomentia has picked up clients like Stihl (chainsaws), Stena (recycling) and Lufthansa.

Nomentia stress their commitment to efficient implementation of their software, citing 6 phases: (1) definition, (2) implementation, (3) key user training, (4) testing, (5) go-live, (6) hypercare. Similarly, customer care is cited as a high priority, with 40% of support enquiries receiving a response within an hour and 36% of cases resolved within 5 hours.

Common challenges in TMS adoption

Culture, culture, culture. The most nebulous aspect of software implementation - but arguably the most potent.

Do not allow the culture of your business to become overwhelmed by the culture of software that is too big and too complicated.

At Agicap we often find ourselves picking up the pieces after somebody else has made an unsuccessful attempt to impose an enterprise-grade TMS on a medium-sized company that really didn't need it. There really is such a thing as too much customisation, for example - Agicap's standardised, modular approach (CashCollect and CashPayment being obvious examples of key modules) keeps things simple for companies, whilst powerful integrations mean the cashflow forecasting on offer is truly formidable.

Apart from culture, lengthy and costly implementation is the biggest bugbear we hear about. Agicap minimises implementation hassles through:

- A single point of contact for the client - in the form of a dedicated project manager.

- Onboarding managers who specialise in setting up specific Agicap modules, under the guidance of the dedicated project manager.

- Connectivity experts - working again under the project manager - who handle banking and ERP integration.

- A strategic advisor: essentially a 'big cheese' with direct oversight of the implementation project and the power to make big decisions.

- Support team: available on the chat function with a 2 minute average response time, a whole of training and a 98% satisfaction rate.

Agicap avoids a common challenge in TMS adoption - which is ensuring the software works with all existing software and accounts.

- 35% of treasurers interviewed as part of the TMI 2024 Global Corporate Treasurer Investment report cited 'integration challenges' as a key obstacle in adopting TMS technology.

We make banking and ERP connectivity the absolute, first priority - and wrap it up successfully before moving onto the next implementation phases ii) cash management, iii) cashflow planning iv) business spend management v) cash collection and vi) reporting and analytics. The temptation to do it all at once is one we have learnt to avoid.

Future trends in treasury solutions

The use of AI is the most obvious trend in TMSs right now.

- Generative AI, for example, underpins powerful chatbots like Agicap's AI assistant - providing instant data and analysis within the user interface of the TMS.

- Predictive AI is in widespread use for cash flow forecasting, fraud detection and personalised strategies for debt recovery (DSO reduction).

Already gaining impetus is the notion of Banking-as-a-Service (Baas) - with TMSs likely to offer CFOs and treasurers banking services like loans and hedging from directly within the user interface.

Personalisation of interfaces and User Experience (UX) is another key technological trend. Customisable dashboards are already standard as part of Agicap's intuitive UX, for example - and those of many other TMSs. In future, the emphasis of differentiation via roles is likely to continue. (ie. different screens and metrics for CFO/Treasurer/accountant etc).

Possibly the biggest trend of all is so big it is almost transparent - and that is of simplification. In the past, treasury management has been a very specialised field. But increasingly the trend is towards centralised, cash-based solutions offering AR, AP and cash forecasting on one easy-to-use platform. Naturally the TMS risk management functions to do with FX, interest rates, debts and investments remain 100% necessary for larger companies; but, for everyone but the giant corporations, cash visibility is increasingly the priority.

Treasury cash management systems: customer reviews

The benefits of an excellent TMS do not go unnoticed.

A global leader in medical packaging, Sterimed is a French group enjoying a turnover of over €250m that has used Agicap to ace the specific challenges of an ambitious M&A growth strategy.

Sterimed have deployed Agicap’s debt management function to optimise the repayment of the debt they incurred in their second LBO (leveraged buyout). This involved pooling cash from subsidiaries, and was only possible thanks to the comprehensive cash oversight that Agicap provided.

Watch this video to see how Agicap made life easier for Sterimed

On an operational level, Sterimed have used Agicap to link 60+ bank accounts in different countries and co-ordinate the tracking and flow of multiple currencies.

“Thanks to Agicap, we were able to be more precise and more efficient in managing our cash flow, as well as abandon our multiple Excel files altogether.”

Florence Sicault, Financial Director, Sterimed

The Scheppach Group - a successful multinational manufacturing and trading company - is another Agicap client who has found the implementation of our TMS revolutionary.

Review all our customer feedback classified by issues and sector of activity.

Frequently Asked Questions (FAQ)

What does TMS mean in treasury management?

TMS stands for Treasury Management System.

How does a treasury management system work?

A TMS is a single platform that links with a company’s existing ERP and business software to oversee and automate financial transactions. The best TMSs further support decision-making in strategic activities such as growth planning/investment strategies, liquidity planning and debt management.

What are some treasury management system examples?

Effective treasury management is provided by a number of brands including Agicap, Kyriba, Coupa, Trovata and Nomentia.

What is the difference between ERP and a Treasury management system?

The major difference between Enterprise Resource Planning (ERP) systems and Treasury Management Systems (TMS) is one of focus.

ERPs provide a general integrated software platform that centralises and automates the operations of an entire business - incorporating procurement, human resources, general operations and, of course, treasury. By contrast, TMSs focus exclusively on treasury functions.

What are the four basic tools of treasury management?

Cash management, risk management, funding and capital management, and banking and relationship management.

What is the purpose of treasury management?

The purpose of treasury management is to manage the 'treasury' of a company - ie. its financial resources - such that its liquidity is sound.