Debt collection software: in‑depth review & best options for 2026

Accounts Receivables has got tougher since COVID-19 brought chaos to the business world. As top US bank JP Morgan observes, "organisations began receiving more late payments and delinquencies during the pandemic, and the problem has persisted."

Yet Agicap's targeted research reveals that only roughly 40% of companies use debt collection software that automates the recovery of payments.

Getting paid on time, every time is a prerequisite of any firm's basic liquidity. Why wouldn't you optimise the process of securing payment from customers? Income aside, without the the data intelligence offered by debt collection software, businesses can't hope to produce the accurate cash forecasts necessary to preserve their liquidity going forward. It's time to take debt collection software seriously.

What is debt collection recovery software?

Debt collection software, also called Accounts Receivable (AR) software, helps keep companies liquid by optimising the flow of cash into the business. This is achieved by offering:

- •

Overall visibility into payments due to come in

- •

A suite of automated options for requesting and chasing payment

- •

Full data integration with other financial processes and software

With a host of features including debtor profiling, payment tracking, automated dunning letters, reporting, analytics, and compliance management, debt collection software is the modern solution to getting a grip on your invoicing situation.

It is estimated by Researchandmarkets.com that the UK’s debt recovery software market is growing at an impressive compound rate of 9.27% to be worth £276 million by 2028.

What do companies really want from commercial debt collection software?

Accounts Receivable (AR) challenges | The debt collection software solution |

|---|---|

Lack of visibility over what is owed by which company | Centralised platform showing all data |

Low Days Sales Outstanding (DSO) | Automated follow-ups, credit management, predictive analytics |

Time-consuming chasing of late payers | Automated, customisable follow-ups (dunning letters) |

Low integration of AR with rest of company | Seamless integration with other processes and software |

Failure to leverage AR insights | Improved cash forecasting - with scenario planning - based on real data from AR |

How does bill collection software make a huge difference?

When it comes to the impact of debt collection software, marketing departments are fond of making claims about how their software reduces the key metric of Days Sales Outstanding (DSO).

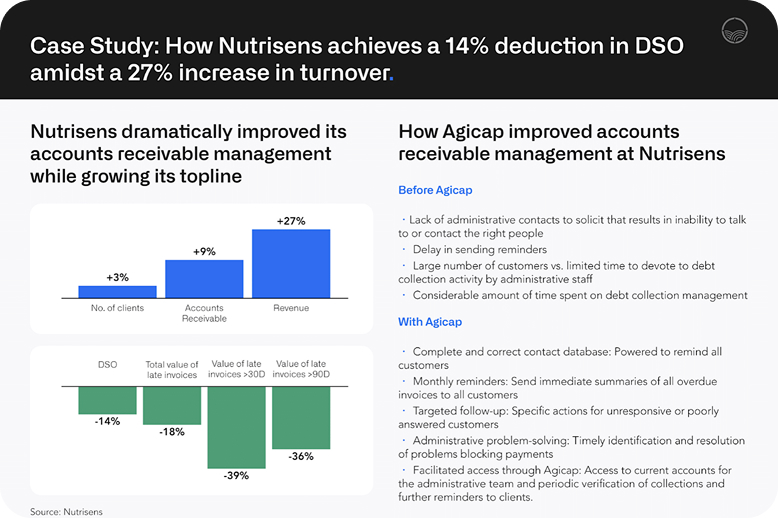

Well, don't take it from us - take it straight from the horse's mouth. Roberto de Bonis, CFO of Agicap client Nutrisens, confirms that, "with Agicap, in just three months , we managed to reduce our DSO by 12 days , approximately 14%, overdue invoices by 19% , and invoices overdue by more than 30 days by 39% . "

With a turnover of €150m and 1,500 invoices going out every month, European nutrition expert Nutrisens faced challenges around getting paid that will be familiar to all SMBs.

Visibility was a critical problem. CFO De Bonis explains that "the lack of timely information ... prevented our commercial department from focusing ... on the most important and reliable customers." Agicap changed all that.

And, after streamlining their Accounts Receivable with Agicap, Nutrisens increased their revenues by 27%.

With our personal service, get a free estimate of the true cost of your receivables as well as a free demo of Agicap CashCollect.

What are the essential features of cloud based debt collections software?

Most debt collection packages are provided online in Software-as-a-Service (SaaS) format. This offers many advantages to clients, not least that any problems with the software can be tackled immediately by the developers without the need for a site visit.

Nowadays, debt collection management software typically incorporates the following features:

- •

Workflow automation: Automates all repetitive tasks and sends timely payment and follow-up reminders and notifications for a streamlined debt collection process.

- •

Account management: Maintains a comprehensive database of debtor account information for easy access, organisation, and tracing.

- •

Customisable templates: Offers letter and email templates for sending out tailored payment reminders to save time while maintaining consistency.

- •

Payment tracking: Comprehensively tracks payments to manage collections and monitor outstanding balances, and records payment history for easy data retrieval.

- •

Integration: Gets easily integrated into your organisation’s accounting, CRM, and ERP systems and other communication channels, including email, SMS, and phone connectivity, for effective debtor communication.

- •

Reporting and analytics: Analyses debt collection performance and reports payment and collection trends, offering actionable insights and meeting audit and compliance requirements.

Debt collection process

While a debt collection process varies across companies, it usually begins when the client misses their scheduled payment and ends with the initiation of court proceedings if they fail to make the payment. The main steps of a debt collection process are:

Send payment reminders: Debt collection begins by sending regular payment reminder emails, messages, and emails for the first six months. The creditor firm can also offer better terms or alternate payment methods. Automate your payment reminders with Agicap.

Hire collection agencies: In case the debtor fails to make a payment, the company can solicit help from debt collection agencies or law firms. It pays a commission to these third parties on the recovered amount.

Send a letter before action (LBA): When debtors miss out on payments, they are sent an LBA detailing the amount owed and a new payment deadline, which would result in legal action.

Initiate court action: The firm can initiate court proceedings with the help of the collection law firm if the client fails to make the payment. Alternatively, the creditor firm can write off the debt and sell it to an agency/debt buyer.

File a claim form: After taking legal action, the creditor firm must fill out a claim form, which the court forwards to the debtor. The debtor can either pay up within 14 days after acknowledging the service or file for defence within 28 days.

Await court decision: The case is automatically settled if the debtor makes the payment. In the case of an acknowledgement of defence, the case will go to trial. In the event of no response, a judgement in default is given, where the court unilaterally decides the justification of creditor claims.

Debt collection software reviews

With several dedicated accounts receivable software products available on the market, including powerful cash management software like Agicap that come complete with integrated debt recovery modules, selecting the debt collection software most suited to your needs can be complicated. Below, we review some of the top debt collection software solutions and their main features:

Debt collection software | Features | Advantages | Company size |

|---|---|---|---|

Agicap CashCollect | Automated reminders Real-time AR tracking Ideal for SMBs wanting cash visibility and forecasting | Simple UI Great integration with banks and ERPs 30% reduction in non-payments & 50% time saved in receivables Part of a full cash management platform | 500 employees |

Clearnox | Customisable reminders Dashboards & AR monitoring Suited to small to mid-market firms | Good accounting integration Strong on dashboards Scalable | <50 |

Eloficash | Credit management Dispute resolution Good for larger companies | Detailed debtor insights Streamlined debt recovery Multilingual support | <50 |

LeanPay | Multi-channel reminders Payment portals SMB-focussed | User-friendly Good automation Some risk management | 100 |

Upflow | Payment tracking CRM syncing Good for growing SMBs | Good accounting integration Strong DSO reduction figures Collaborative UI | <100 |

Bilendo | Automated dunning Dispute management Aimed at SMBs & mid-sized firms | White-label payment portals Good on compliance Strong customizations | <50 |

Invoiced | Invoice automation Payment tracking & credit checking Aimed at larger companies | Strong API Scalable Fast onboarding | <50 |

Billtrust | Invoicing Credit management Enterprise-sized client base | Enterprise-level scalability End-to-end AR automation Global reach | <50 |

Automate collections with Agicap

Why does Agicap have such an excellent reputation in Accounts Receivable management?

Well, it's not just that our CashCollect module is easy to use with an intuitive interface. It's also well calibrated for the needs of SMEs, with its simplified, no-nonsense debt collection. And what really makes CashCollect stand out is the automation and analytics that feed into decision-making. Agicap CashCollect underpins a level of cash visibility and forecasting capability that firms find indispensable once they get a taste of it.

Watch this 2 minute video to learn more about Agicap CashCollect.

- •

Monitor - sync all invoices to isolate KPIs and prioritise your collection strategy

- •

Optimise - with automated dunning workflows; customise, or use our templates

- •

Analyse - Review your KPIs by customer/type of account/salesperson

- •

Forecast - Build an accurate cash flow forecast and use it optimise your working capital

- •

AI - Use CollectAI to customise follow-up emails based on payment behaviour

Curious to see how it works for your business? Book your free demo today and start transforming your collections with Agicap.

Clearnox

Like Agicap, Clearnox is aimed at small to mid-sized firms. But it does not offer the level of real-time cashflow forecasting that is at Agicap's heart. The two packages share a low learning curve for their Accounts Receivable software as well as quick deployment. Clearnox is known to integrate well with French accounting software like Sage and Cegid.

Eloficash

Enterprise clients praise Eloficash's depth and flexibility. This is an end-to-end AR powerhouse, featuring modular architecture: you can switch on or off processes relating to credit, collection, disputes and cash. It's ideal for multinationals seeking a competitive advantage in co-ordinating debt recovery across business entities.

LeanPay

Note this is Leanpay.io - not leanpay.com. With its bright, intuitive interface and simple approach to debt recovery, LeanPay takes a few pages out of Agicap's book. It offers some smart tools too, like promise-to-pay tracking, which lets teams log in and follow up on customer payment commitments. Reminder automation is multi-channel. No cash forecasting capability.

Upflow

Targeting growing B2B firms, the focus of Upflow is collaboration. It's an AR platform designed to support a real team effort between sales and finance. Dunning sequences are customisable. CRM integrations are well-supported (including Salesforce and HubSpot). There's functionality around multiple business entities and an analytics suite to track DSO, aging balance and other metrics.

Bilendo

Well-reviewed in DACH (Germany, Austria, Switzerland) countries for its rigorous support for local regulations and languages, Bilendo makes accounts receivable as much about credit risk management as automated collections. It offers built-in credit scoring, for example, integrated with German credit bureaus. And it's hot on audit trails too, with automatic GDPR-compliant record-keeping.

Invoiced

A big player, Invoiced is aimed at mid-sized to large B2B companies - especially in the US and international markets. Powerful end-to-end automation is on offer here. Key features include automated collection workflows, self-service customer payment portals, integrated payment options directly from invoices and strong accounting integrations (QuickBooks, NetSuite, Oracle and others). Standout features centre on AI cash forecasting and customer payment analysis.

Billtrust

Like Invoiced, Billtrust is aimed at big companies. It's no surprise then that deep ERP integration underpins full automation of the order-to-cash process. Standard features include AI payment/invoice matching, customer payment portals, E-invoicing, SOX/GDPR inbuilt compliance and a custom collections workspace with prioritised queues, account notes and aging reports.

FAQs on web-based debt collection software

What are the essential features of a debt collection software platform?

i) Intuitive interface ii) integration with cash management and forecasting tools iii) automated reminders iv) payment tracking v) reporting and analytics tools.

What are the different KPIs for the debt collection process?

Key KPIs include i) DSO (Days Sales Outstanding) - how many days it takes for the firm to collect payment and ii) Aging rate - indicates the percentage of bills that remain unpaid over 30, 60 & 90 days.

How to choose debt collection software for mid-sized companies?

Consider the levels of customer support as the number one priority. Whatever the software configuration you need, having personalised assistance you can rely on will always be invaluable.

How much does debt collection software cost?

As a very rough guide, you might expect to pay:

No more than €500 per month for basic AR automation with limited users

€500-1500 a month for full AR automation, integration & analytics

€1500+ per month for advanced features, unlimited users, global compliance, limitless scaling and personalised support

With Agicap, you get ongoing personalised support and full scalability for absolutely free.