Worldwide payments have never been easier

Agicap's Payment Factory connects to your banks and ERP for safe, automated transactions.

Multi-protocol and multi-currency coverage

More secure payment processes

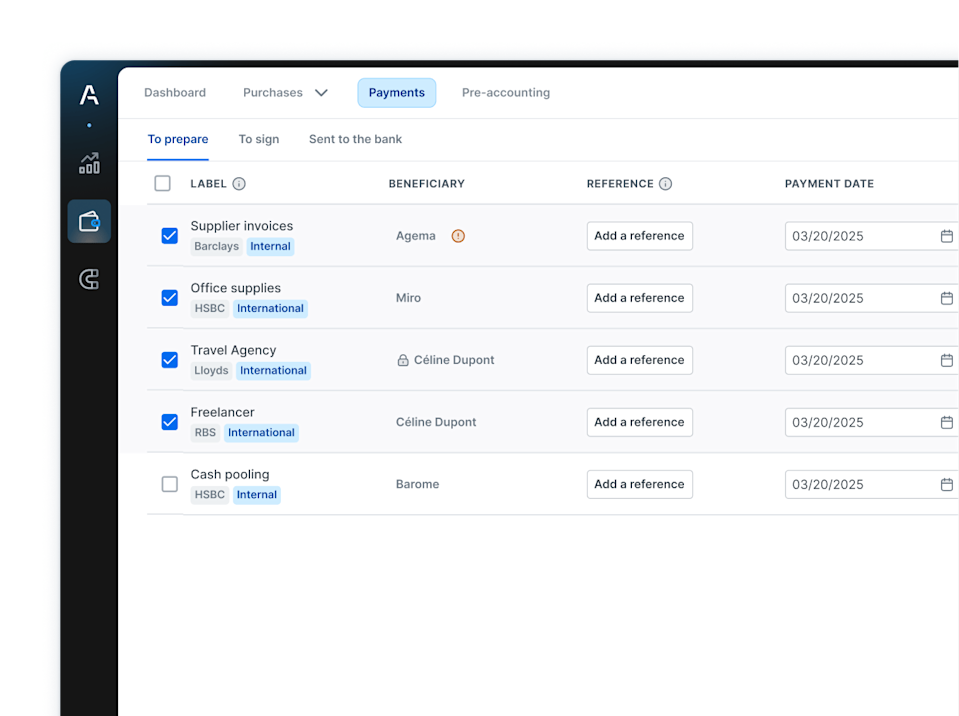

All payments centralised on a single interface

Make payments from any bank, in any currency

Multi-protocol solution

Make payments using the most robust protocols on the market: H2H, SWIFT, EBICS TS, BACS.

Multi-currency payments

Generate payment files in the required formats and currencies. Stay compliant with ISO 20022 standards.

PSR management

Receive all confirmation levels supported by your bank, directly with Agicap.

Secure your payment processes

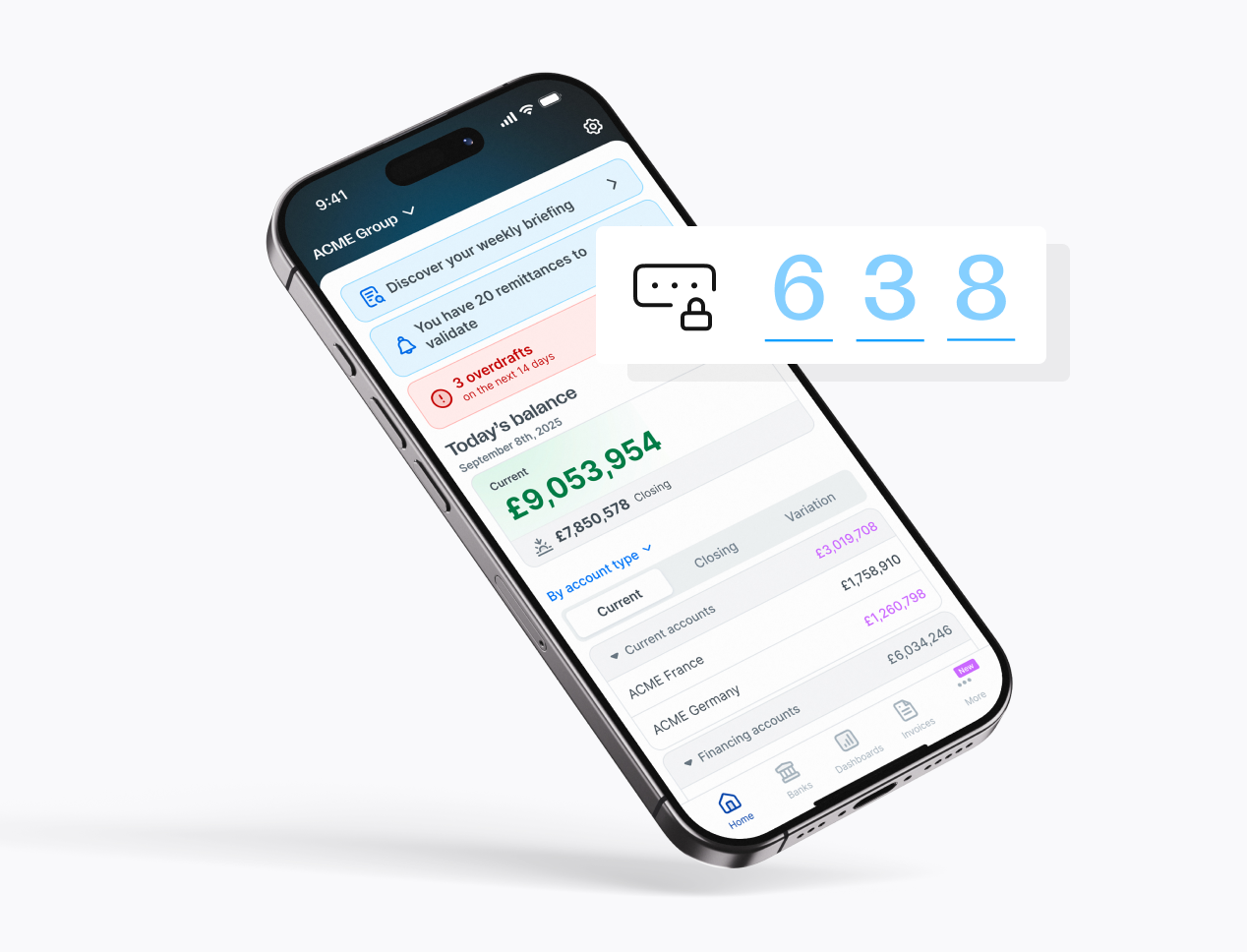

Two-factor authentication (2FA)

Enhance your security by using 2FA via the mobile app.

Signature rules

Set up single or dual approval flows based on your organisation’s needs.

Beneficiary management

Create secure processes for adding and updating beneficiaries. Receive instant alerts for any changes in your third-party database.

Signature history

Keep a clear audit trail of all approvals for every payment run.

Centralise all your payments on our unique interface.

Discover how our platform can power your treasury

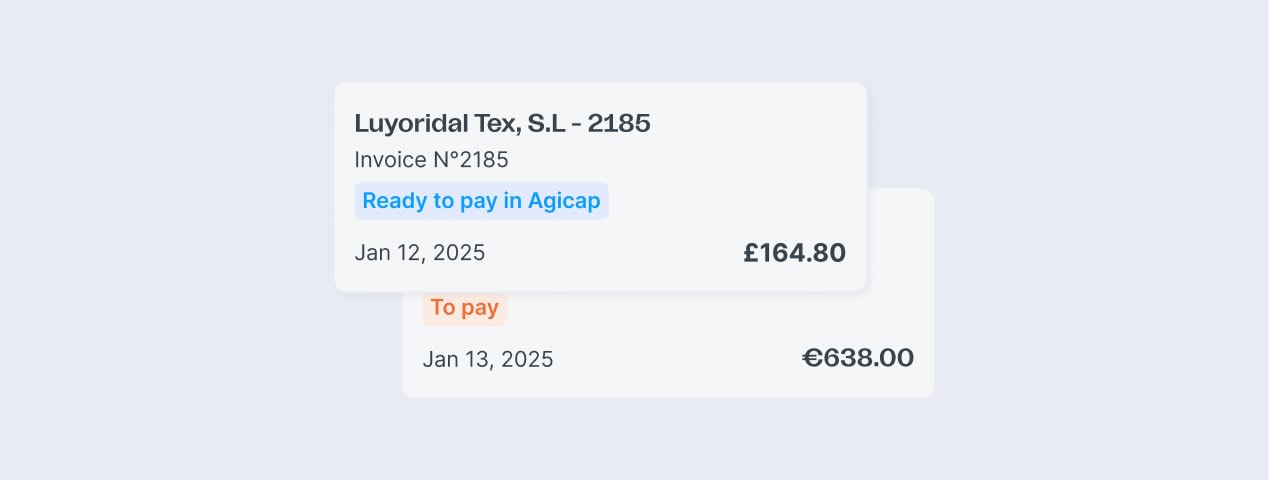

Streamlined accounts payable management

Automate your purchasing workflows. Stay in control of your spending. Create reliable forecast with 360-degree visibility.

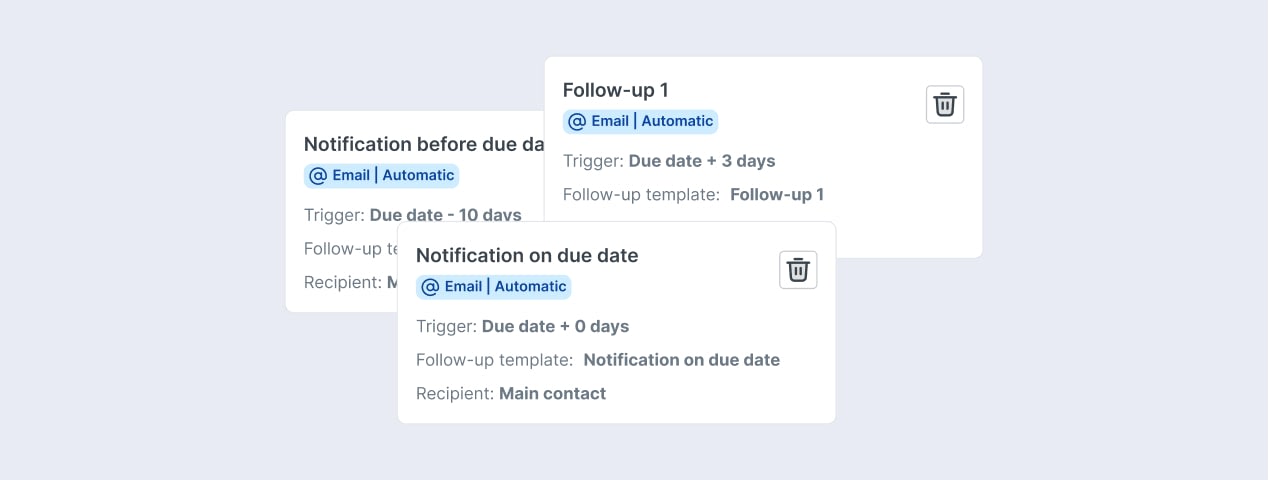

Impactful accounts receivable management

Automate customer reminders. Get paid faster and effortless. Improve collection and reduce DSO.

Integrated treasury management

Connect, forecast and optimise your cash flow precisely.

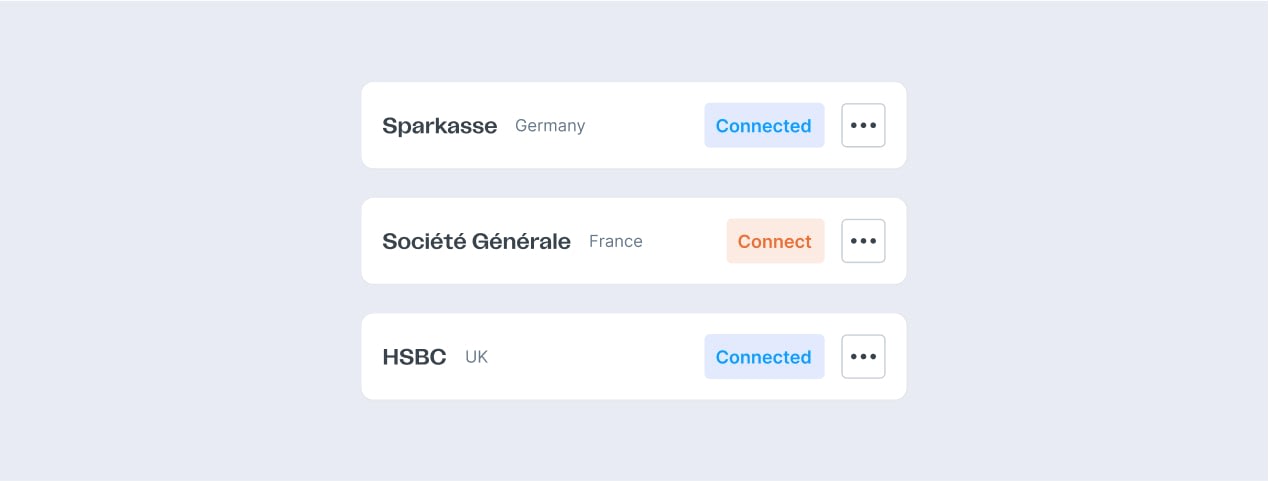

Improved connectivity

Connect all your banks and ERP systems. Benefit from a single source of truth and and easily sync data with your finance tools.

Frequently asked questions

What is a Payments Automation Software (or Payment Factory)?

A Payments Automation Software enables you to manage all your payment campaigns (supplier invoices, payroll, intercompany transfers, etc.) from a single platform—eliminating the need to log in to each of your banks’ online portals.

With direct connections to banks (via protocols such as BACS, Host-to-Host, SWIFT, and others) and your ERP system, a Payment Factory—also known as a Payment Hub—helps finance departments save time on payment processing.

A Payments Automation Software like Agicap typically includes security and fraud management features, such as multi-factor authentication (MFA) and user rights management.

This type of software not only helps reduce operational costs and minimise errors, but also improves cash visibility and control.

What are the key features of Agicap’s Payment Factory?

Direct bank connectivity using secure protocols such as BACS and SWIFT.

Advanced validation workflows, with final approvals possible via mobile app or secure signature token (e.g., SWIFT 3SKey).

Support for local (GBP) and international currency payments, ensuring compatibility with UK-based and global transactions.

Seamless integration with Agicap’s short-, medium-, and long-term cash management features, enabling finance teams to closely monitor and anticipate the impact of payments on company liquidity—and implement a Cash Pooling process across the organisation.

Robust security and fraud prevention features, including multi-factor authentication (MFA), user access management, and encryption via secure protocols.

These capabilities make Agicap’s Payments Automation Software a powerful solution for streamlining payment processes while maintaining full control and visibility over cash flow.

What are the advantages of Agicap’s payments management compared to other TMS solutions in the UK?

Direct bank connectivity through secure and widely used UK and international protocols such as BACS and SWIFT.

Advanced validation workflows, with final approvals available via mobile app or secure signature token (e.g., SWIFT 3SKey).

Support for both domestic (GBP) and international currency payments, ensuring seamless transactions across borders.

Native integration with Agicap’s short-, medium-, and long-term cash management features, enabling UK finance teams to monitor and forecast the impact of payments on liquidity—and implement a Cash Pooling process across entities within the organisation.

Robust security and fraud prevention tools, including multi-factor authentication (MFA), user access management, and encryption via secure protocols, ensuring compliance with UK financial regulations and best practices.

By combining payment orchestration and cash visibility, Agicap’s Payments Automation Software offers UK businesses a streamlined, secure, and cash-focused alternative to traditional Treasury Management Systems (TMS).

What types of payments can be processed in a Payments Automation Software like Agicap?

With Agicap's Payment Factory, you can process a wide range of payment types, including:

Supplier payments (e.g., invoices)

Employee salaries and payroll

Bank account balancing transfers (e.g., intercompany transfers)

Local and international payments

And more.

Can a Payments Automation Software be integrated with all ERP systems?

Agicap offers integrations with the most popular ERPs and business tools used in the UK.

Some examples of integrations include: SAP, Sage 50, Sage 200, Sage X3, Oracle Netsuite, Microsoft Dynamics 365, QuickBooks, Xero, Access Dimensions, Pegasus Opera, Excel, and more.