14% decrease in DSO in 3 months: the Nutrisens case

In just 3 months, Nutrisens was able to improve its financial management through streamlining the debt recovery process and enhancing its commercial strategy, thanks to Agicap.

Read more

Key takeaways

Nutrisens’ challenges in managing receivables and treasury stemmed from the high number of customers and 1,500 monthly invoices, requiring up to two days of work per week. Payment delays limited operations and diverted resources from other investments.

The goals were to optimise the debt collection process by reducing the time spent managing receivables and improving cash flow through continuous and automated monitoring. This would have allowed operational resources to be freed up for strategic investments and increased the overall efficiency of the company.

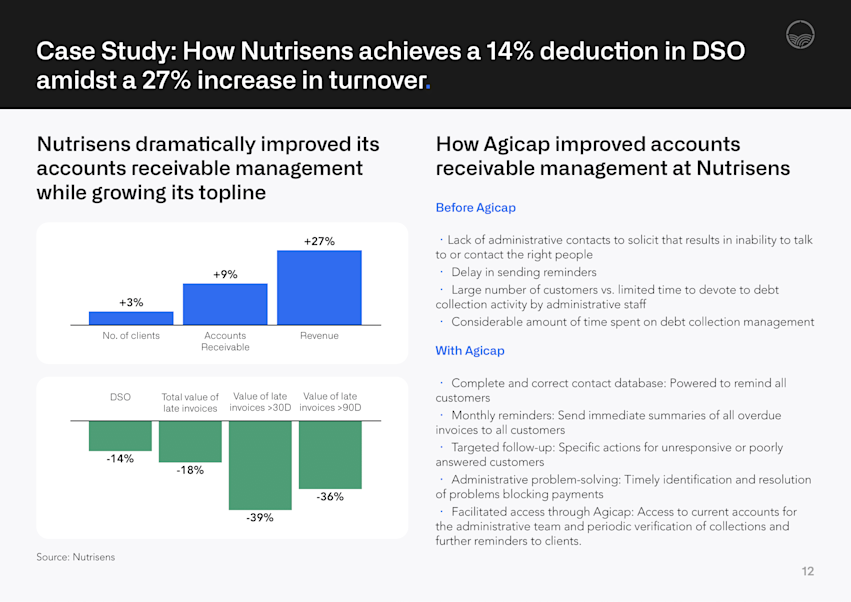

With Agicap, Nutrisens optimised debt collection and improved cash management, reducing the DSO by 12 days and overdue amounts over 30 days by 39%. The integration of bank accounts and real-time updated forecasts strengthened financial control, ensuring greater efficiency and accuracy.

" With Agicap, in just three months, we managed to reduce our DSO by 12 days, approximately 14%, overdue invoices by 19%, and invoices overdue by more than 30 days by 39%. "

14%

DSO reduction in just 3 months

39%

reduction in overdue invoices exceeding 30 days

10,000 customers

across Italy, France, Germany, Spain, Portugal, and the UK

Nutrisens

Customer’s history

Nutrisens is a France-based international group specialising in clinical nutrition, with operations in Italy, Spain, Germany, the United Kingdom, and Portugal. Generating a turnover of €150 million, the group employs over 500 people and operates six production sites, serving primarily hospitals and public and private care facilities.

In Italy, Nutrisens has been active for about 11 years and, in 2023, expanded its operations by acquiring another company, Pharmaelle. The entire company is now based in Collegno, near Turin, and has a team of 30 employees.

" In Italy, Nutrisens works with around 500 customers, while internationally, the company serves approximately 10,000 customers across its operating countries. "

Customer’s needs

Nutrisens faced significant challenges in credit and treasury management due to the high number of customers. With approximately 1,500 invoices issued each month, keeping track of all these customers required a substantial amount of time, taking up at least one or two days a week.

Before implementing Agicap, the debt recovery process was unstructured. The customer payment schedule was reviewed only once a month, and payment reminders were sent manually via email following this analysis.

Issues related to debt recovery affected not only operations but also other aspects of the business, diverting resources that could have been allocated to more strategic investments.

“The lack of timely information on the status of our customers,” explains De Bonis, “prevented our commercial department from focusing its strategy on the most important and reliable customers.”

Solution

The implementation of Agicap allowed the administrative department to streamline the debt recovery process: the customer payment schedule is now automatically imported into the tool, where a comprehensive customer database has been created.

" Having a centralised database in Agicap, has allowed us to keep contact information constantly updated and ensured we always have active and available counterparts. "

This enables the team to set up personalized reminders - to about 100 customers per month - with a tone tailored to the specific delay in payment.

But that’s not all. Thanks to Agicap, Nutrisens significantly improved its DSO in a very short time, reducing it by 12 days, while also decreasing overdue invoices by 19% and those overdue by more than 30 days by 39%. Besides improving the DSO, Nutrisens also increased its revenue by 27%, as shown in the graph below.

Another benefit of implementing the tool has been the ability to centralise all bank accounts within a single platform. This allows for quick and direct verification of all cash inflows and outflows, enabling constant liquidity monitoring.

The monitoring of DSO and accounts receivable is closely integrated into the liquidity management process: the tool allows you to check which invoices have been paid and automatically update cash flow forecasts, ensuring continuous and accurate control of the company’s financial position, at all levels (bank accounts, subsidiary and group).

" This allows us to compare actuals with forecasts whenever needed and to analyse the reasons for any discrepancies "

Conclusion

The CFO and the finance-administration team at Nutrisens are highly satisfied with Agicap, as it has enabled them to optimise working capital, refine their commercial strategy, and redirect administrative operations toward higher-value customer segments.

Agicap has transformed Nutrisens’ financial management by optimising treasury and debt recovery processes, enabling more effective and timely communication with customers.

Other interesting testimonials

Hornberger Consulting

Business Sector:

Business services

Where:

Hamburg, Germany

Cashflow Problem:

Anticipate cash flow shortages beforehand, craft scenarios that are based on actual financial data, extend ERP-systems with cash flow management capabilities

M2A Media

Business Sector:

Media Agency

Where:

London, United Kingdom

Cashflow Problem:

Manage multiple entities during internalization, managing different currencies and different banking providers