How Madeo Group automated 95% of bank reconciliation

Francesco Madeo (Finance Director) and Pierfrancesco Rima (Treasurer) explain how implementing Agicap enabled the Group to centralise treasury on a single platform, automate bank reconciliation, and gain real-time visibility over liquidity.

Read more

Key takeaways

Madeo is a family-owned agri-food group specialising in premium cured meats (black pig and Calabrian PDO products). With 5 entities, €30M in turnover, over 50% export, and 150 employees, the main challenge was monitoring cash flow and liquidity in real time without wasting time on data collection.

To support the finance team’s day-to-day operations, the Group was looking for an all-in-one solution that would allow multiple people to work on the same platform, simplifying training and collaboration and providing consolidated visibility over collections, payments, cards, and liquidity.

Before Agicap, treasury management was fragmented: daily logins across multiple banking portals, downloads of transactions, and manual postings in the ERP, involving two or more people and taking time away from analysis.

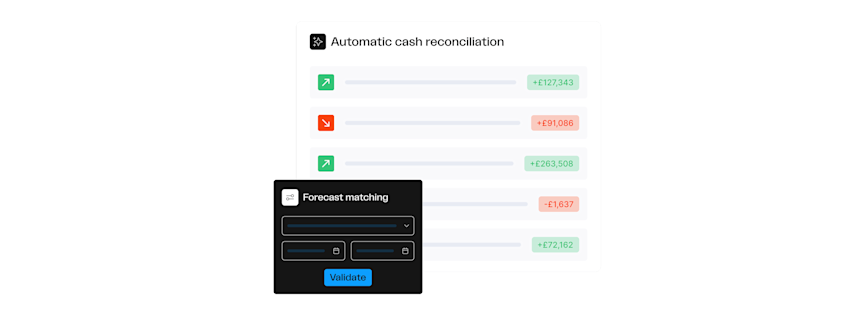

With Agicap, the Madeo Group centralised management on a single platform: bank connectivity and consolidated transactions; automated matching between transactions and invoices (open-item settlement); and automation of the creation and export of accounting entries up to 95%, thanks to rules and AI-based suggestions; a 13-week forecast to reduce balancing transfers and optimise cash pooling; bulk payments; and simpler card management with automated reporting and reconciliation.

" We chose Agicap because using an all-in-one platform brings many advantages. Working with a single platform simplifies staff training and collaboration between different departments. Today, 8 people in our team work on the same platform — from collections and payments to credit card reporting and liquidity monitoring. "

€30M

in turnover

5

entities

150

employees

Madeo Group

Customer’s history

The Madeo Group is a family-owned agri-food business specialising in the production of premium cured meats, including black pig and Calabrian PDO products. Today, the Group is organised into 5 entities covering every stage of the production process, with revenue of around €30 million, over 50% export, and 150 employees. Its model is an integrated value chain, where farming, livestock rearing, processing, and commercialisation are handled within the Group’s companies. This set-up is also capital-intensive, with significant invested capital in both working capital and fixed assets.

In a multi-entity context, treasury and liquidity management required constant coordination across people, departments, and banks. For the finance team, the priority was to gain a reliable, real-time view of cash flows, reducing time spent collecting information and increasing time dedicated to analysis and decision-making.

Customer’s needs

To manage liquidity more effectively and reduce manual work, the Madeo Group needed to modernise its treasury processes. Key needs included:

Gaining immediate visibility over group liquidity in a capital-intensive business structured across 5 entities, with multiple banks and over 25 current accounts — shifting from data collection to analysis.

Eliminating manual reconciliation and postings linked to bank statements: previously, the team had to log into banking portals every day, download transactions, and manage multiple statements, spending nearly half a day just updating balances, involving two or more people.

Supporting decisions with a reliable 13-week forecast, improving cash flow planning and optimising cash pooling and debt maturities thanks to a forward-looking view of transactions.

Modernising payment execution: moving from manual entry of individual transfers (5–10 minutes each, around 150 transactions per month) to secure bulk payment files compatible with banking standards.

Simplifying corporate card management and expense reporting: moving beyond the complexity of multiple cards and waiting for statements, by introducing dedicated limits, receipt upload via app or portal, and automated reconciliation to gain more timely control over spend.

Optimising working capital (WCR) and customer credit monitoring: centralising visibility over outstanding amounts across a portfolio of 900 customers to automate collection workflows, thereby accelerating cash inflows and reducing DSO.

Solution

Agicap was adopted as an all-in-one platform to centralise the Group’s treasury and automate operational processes — from bank visibility and reconciliation to payments, cards, and receivables management.

1) Consolidated bank visibility and automated reconciliation (via journal entries)

With bank connectivity enabled, Agicap automatically retrieves transactions without the team having to log into online banking portals. For Madeo, which works with 7 banks, this represents an estimated daily saving of 15–30 minutes.

Based on this data, Agicap helped automate two distinct activities, both central to day-to-day operations:

Matching transactions to invoices (open-item settlement): when a payment is recorded by the bank, the platform supports matching it to the related invoice, drastically reducing manual search, verification, and settlement work.

Creating and exporting journal entries: transactions are categorised and converted into journal entries directly in Agicap. This step is now largely automated thanks to rules and AI-based suggestions, delivering the biggest operational gains across volumes of around 1,200 transactions per month (about 50 per day).

Finally, the entries are exported to the ERP, ensuring continuity with accounting processes and drastically reducing manual intervention. Today, Madeo has automated 95% of the creation and export of journal entries from bank transactions.

" The lack of an overall view of Group treasury and cash flows had a negative impact on business decisions, especially in a business like ours that is strongly growth-oriented. Today, with Agicap, we can review Group liquidity and forward-looking cash movements in just a few moments. As a result, it is now much easier for me and our team to make strategic decisions, such as planning investments. "

2) 13-week cash forecast and cash pooling optimisation

With Agicap, Madeo adopted a 13-week forecast to anticipate debt maturities and key bank movements. This helps minimise balancing transfers, optimise cash pooling, and automate liquidity balancing at group level.

3) More efficient payments: from manual transfers to bulk flows

The payment process was modernised by moving from manual entry of individual transfers (around 5–10 minutes per payment) to a more structured approach using XML files compatible with banking standards. Today, the team can run bulk payments of up to 50 transfers in a single batch, reducing operational time and error risk.

4) Corporate cards: simplified management and expense reporting

After migrating cards into Agicap, expense reporting became more streamlined: receipts uploaded via app or portal, review and approval by the treasurer, and automated reconciliation via bank account debits. The result is improved expense traceability and more timely control.

5) Receivables and DSO: consolidated view and customer portal

With Agicap, the Madeo Group uses a dedicated receivables module that provides a dashboard to monitor the entire customer portfolio: top debtors, exposures, average days past due, and unpaid invoices. In addition, the customer portal allows customers to view both overdue and upcoming invoices, encouraging more timely payments and supporting the DSO reduction objective.

Key benefits achieved:

True centralisation in a single platform: 8 people work in the same environment across collections, payments, cards, and liquidity, with simpler training and collaboration.

Automation and time savings: with bank connectivity and accounting entries, the process shifts from daily manual work to a largely automated flow (95%).

Faster, better-informed decisions: a 13-week forecast to plan cash flows, debt, and cash balancing more reliably.

More efficient operations: bulk payments and streamlined card management, with fewer steps and lower error risk.

" To monitor liquidity on a daily basis, we simply open Agicap. Just click “Sync” to get a consolidated view of our treasury. "

Conclusion

Thanks to Agicap’s all-in-one solution, the Madeo Group centralised treasury management on a single platform, reducing operational fragmentation and gaining more immediate visibility over group liquidity. Automating bank flows helped streamline both the matching of transactions to invoices (open-item settlement) and — above all — the conversion of transactions into accounting entries and their export to the ERP: a process that is now automated at 95%, thanks to rules and AI-based suggestions that speed up classification and pre-accounting.

Building on these results, Madeo continues its digitalisation journey, consolidating Agicap as the reference platform for group treasury.

Other interesting testimonials

Hornberger Consulting

Business Sector:

Business services

Where:

Hamburg, Germany

Cashflow Problem:

Anticipate cash flow shortages beforehand, craft scenarios that are based on actual financial data, extend ERP-systems with cash flow management capabilities

M2A Media

Business Sector:

Media Agency

Where:

London, United Kingdom

Cashflow Problem:

Manage multiple entities during internalization, managing different currencies and different banking providers