Treasury management software: a comprehensive guide for modern CFOs

Times are changing in the world of Treasury Management Software (TMS).

Not only is the role of treasury management widening, with CFOs nowadays expected to run a tight financial ship AND help steer the company's future with real-time cash oversight and data-led insight.

But also the way in which treasury functions are managed is changing; as leading management consultants Accenture observe, "for many years ... companies have looked primarily towards banks for their treasury management needs." But a 2023 Accenture survey of 300 businesses found that a huge 44% of organizations are considering moving their treasury capability to a fintech provider like Agicap. Try Agicap for free.

Banks are out, and software is in. And treasury management systems are a whole lot easier to use than they used to be - delivering a whole new level of oversight, forecasting and analysis.

What is Treasury Management Software?

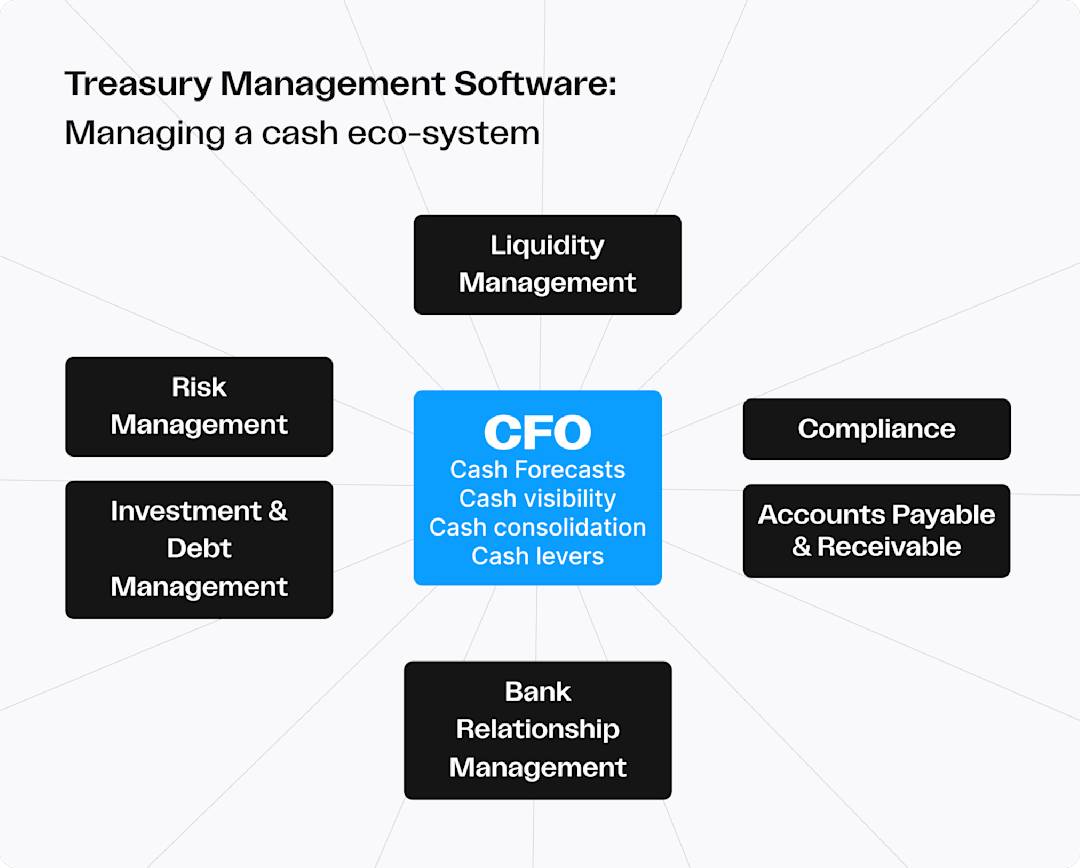

Treasury Management Systems (TMS) nowadays put CFOs and finance managers in the driving seat when it comes to managing key financial operations - as well as leveraging cash to save and make more cash.

Traditional vs. modern corporate treasury management software

Traditional treasury functions include:

- •

Liquidity management

- •

Bank relationship management

- •

Payments processing

- •

Investment management

- •

Foreign Exchange (FX)

- •

Risk management

- •

Compliance

But with modern software like Agicap , treasury has moved on from the traditional. It is no longer the preserve of financial specialists tinkering with hedging strategies and foreign exchange strategies; treasury in the late 2020s is about empowering the whole company with access to real-time cash data, automation, integration with other financial software tools and, of course, predictive analytics.

Who benefits from modern treasury cash management?

In businesses that are growing or have multiple entities, scalable cash management is critical. And in any company, it is the Chief Financial Officer (CFO) who is most likely to see the benefits of the right software first.

Why businesses need a core treasury system

Here's the reality: without Treasury Management Systems, businesses would a) have no idea of where their finances stood and b) not have the tools to manage (let alone optimise) their financial standing.

High-level help for CFOs & treasurers

CFOs and Treasurers face a world of new treasury challenges. But with straightforward software like Agicap, neither CFO nor Treasurer needs software expertise or specialist teams to get the job done. Agicap believes that if software isn't easy to use, it's not fit for purpose.

Suppose sales aren't doing great and the CEO wants to present at a range of 3-month liquidity scenarios?

No need to quickly bring in the finance team to model impacts on key financials in Excel. With Agicap, the CFO can build multiple 'what if' scenarios using simple drag-and-drop tools.

Suppose cash burn is increasing, and the CEO wants to know why?

The CFO can use Agicap to track budget vs. actuals in real-time, as well as pinpoint specific deviations - down to business units and even individual line items. Then Agicap's easy export tools mean a clear visual overview can be shared with the CEO on the spot.

And that's just the big picture.

Low-level clarity

In the nitty-gritty of ground-level operations, software like Agicap - with its plug-and-play consolidation of data from bank accounts, other software tools and its own feeds - can take away from CFOs a huge nightmare ... called Excel.

The problem with Excel-based cashflow management is not just the human error and lack of real-time visibility. As industry experts from global bank HSBC point out, Excel is no longer fit for purpose nowadays at all when "data analytics has become a key pillar of modern treasury management ... and antiquated models [in Excel] cannot cope with the overwhelming volume of relevant data, nor the need to adapt and leverage large data sets."

Literally hundreds of Agicap's 7,500+ clients have found Agicap to be the perfect, no-nonsense solution to the problem of Excel-based accounting in a growing company.

How to choose the right TMS

As a provider of a treasury management solution, Agicap is privileged to get a closer look at the issues facing companies on the lookout for new software.

What comes out as the top concern? The quality and duration of support from the vendor.

You can't realistically hope to implement a robust treasury management solution without ongoing personalised support .

Speed of implementation too is a key concern, as is compatibility with existing systems and bank/ERP connections. And then there's the scale of your enterprise. If you're a large multinational, you will need the full gamut of treasury functions offered by the likes of TIS, FIS and SAP; if you're any smaller, you can take advantage of the simplicity and user-friendliness offered by streamlined assets like Agicap.

Best Treasury Management Software in 2025

Let's have a closer look at some of the best-known treasury management vendors:

Software | Target business | Strengths | Stand-out feature | Company size |

|---|---|---|---|---|

Agicap | Mid | Easy to use | Real-time cash flow forecasting | ~500 employees |

Atlar | Mid to large | API-first integrations | Real-time treasury operations | ~50 employees |

Kyriba Treasury Management Software | Mid to large | Huge treasury toolset | AI-driven liquidity management | ~1,300 employees |

SAP Treasury and Risk Management | Large | Deep ERP integration | End-to-end treasury processes | ~100,000 employees |

FIS | Large, especially multinationals | Scalable | Real-time cash visibility | ~55,000 employees |

TIS | Mid to large | Centralised payment processing | Extensive fraud prevention suite | ~200 employees |

Ion Treasury | Large | Modular | Advanced analytics | ~10,000 employees |

GTreasury | Mid to large | Unified platform | Visual risk analytics | ~300 employees |

Agicap

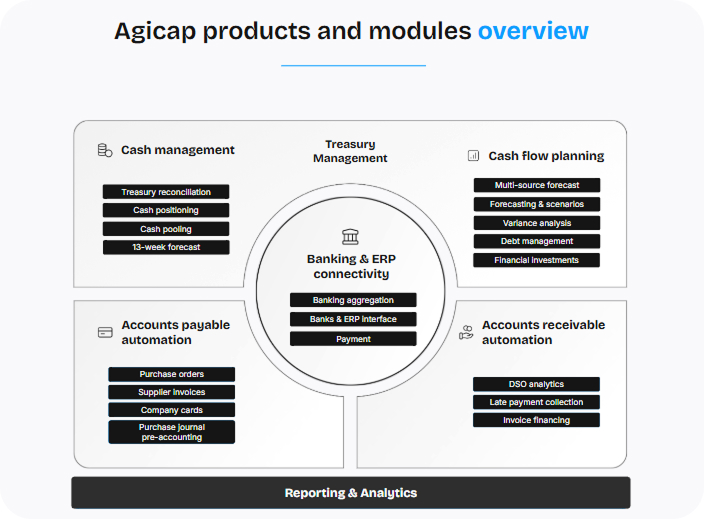

Agicap is aimed at mid-market organisations that don't need the heavy end of traditional treasury capability (like complex hedging, derivatives and FX management). Instead, Agicap places ease-of-use and real-time cash flow visibility as top priorities - bringing all the key features and benefits that putting cash first can bring:

Automated cash flow forecasting

- •

Granular, real-time forecasts by customer, supplier, or business unit

- •

Scenario planning (e.g., best/worst-case)

- •

Dedicated module to convert your P&L statement into a cash forecast -

- •

Automatic bank feed connections

- •

Real-time cash visibility across multiple accounts

Seamless bank aggregation and third-party integration

Budgeting & variance analysis

- •

Compare actuals vs. forecast

- •

Alerts on deviations

Collaborative treasury

- •

Role-based access for finance teams

- •

Commenting and tagging features for internal coordination

Straightforward Accounts Receivable (AR) & Accounts Payable (AP)

- •

Visibility into upcoming collections and payments

- •

Simple, automated collection and payment processing

User-Friendliness

- •

Designed for non-specialist users

- •

Intuitive dashboards and reporting

Watch this brief overview of Agicap's next-gen treasury capabilities.

Atlar

Atlar's emphasis on cash visibility and accurate forecasts means it follow's Agicap's lead. Like Agicap too, Atlar prides itself on speedy implementation as well as a simplified architecture that syncs easily with banks, payment providers and ERPs.

Agicap's focus on useability and simplicity makes it a favourite with mid-sized companies, with Atlar and its developer-friendly API focus finding friends among larger businesses.

Kyriba Treasury Management Software

Suitable for enterprises with full treasury, risk and FX needs, Kyriba has a finance/treasurer user focus (compared to Agicap's cross-team workflow focus, for example).

For comprehensive liquidity and risk management, Kyriba is hard to beat - with enterprise-grade security features, audit trails and compliance with various ISO regulatory standards. Kyriba handles $15 trillion in payments every year.

SAP Treasury and Risk Management (TRM)

SAP TRM is an enterprise treasury solution that integrates deeply with SAP S/4HANA, which is an ERP. SAP TRM is a shoe-in for giant firms therefore with S/4HANA.

But for everybody else? There are plenty of alternatives that are easier to learn whilst offering the same array of global treasury functions. Needless to say, for mid to small companies, a streamlined cash-focused treasury solution like Agicap would be far simpler and cheaper.

FIS Treasury Management System

Like SAP TRM, FIS is aimed at the biggest companies. As such, it offers Treasury-heavy features like advanced risk, debt, FX and compliance management. Whilst FIS does aim to offer the cash visibility of more agile packages, its real strengths are in deep risk analytics and support for financial instruments (derivatives and hedge accounting, for example).

TIS

Suitable for businesses handling high-volume global payments, TIS specialises in secure centralized payment management. Unsurprisingly, fraud prevention is a top feature, along with compliance-friendly audit trails. Multi-bank connectivity (host-to-host), SWIFT, EBICS and API is strong.

Ion Treasury

Ion Treasury is a scalable treasury solution with no less than 7 modules to choose from (Wallstreet Suite for larger firms, for example, and Treasura for simpler needs). Ion Treasury offers an enterprise focus: with real-time cash visibility, risk management and IFRS/US GAAP compliance across 1,250 clients in 30+ countries in the banking and commodity sectors.

GTreasury

GTreasury serves 31+ industries globally with its versatile treasury management solution. Larger companies benefit from GTreasury's risk management and debt/investment tracking - as well as its real-time cash visibility and AI-driven forecasting. Feedback online points to quite a steep learning curve and occasional issues with banking software.

Example: how CFOs use Agicap

Ensuring businesses stay liquid is, of course, the primary function of a treasury management solution. And liquidity management is why top consultancy, Moore TK, based in Germany and Luxembourg, recommends Agicap to all the businesses on their books.

Moore TK partner, Christian Pätzold, explains that the company views liquidity management as a "crucial component" of its advisory service to clients; "for this," says Christian, "we needed a digital solution, which led us to Agicap ... the best solution available on the market". The firm particularly values Agicap's ability to offer a short-term cash overview without Excel, to integrate with German accounting software DATEV and to be so easy for clients to use.

Want to see how Agicap can transform your liquidity management? See Agicap in action — Book your free demo now and discover smarter liquidity management.

FAQs on treasury management software solutions

What are the four basic tools of treasury management?

Experts would argue about the order of priority, but the four big areas of treasury control are undeniably i) cash, ii) risk, iii) funding/capital and iv) banking.

What does treasury management software do?

Old-fashioned Treasury Management Software (TMS) handles financing, FX management, risk management via derivatives and insurance, compliance, bank relationships and liquidity. Modern TMS like Agicap builds on this foundation by making high useability for non-technical staff a top priority.

What is the difference between an ERP and a treasury management system?

An Enterprise Resource Planning (ERP) system integrates data from all operations of a company, including HR, supply chain management sales, automation and of course finance/liquidity. A Treasury Management System (TMS) focuses only on the latter: finance/liquidity.

What is finance management software?

Finance management software handles accounting, budgeting and FP&A (Financial Planning & Analysis). By contrast, Treasury Management Software (TMS) takes a narrower focus, centering on liquidity, risk and of course some accounting and analysis.