Trade war: How to Protect Cash Flow in Uncertain Times

In today’s economy, where instability has become the new normal, cash flow management can no longer be treated as a back-office function. It is a strategic lever for ensuring financial strength, responsiveness, and sustainability.

This article is based on a recent webinar that highlighted key lessons from past crises to help protect liquidity in times of uncertainty. The advice draws particularly on the experience of Maxime, our treasurer, who has over 15 years of experience and successfully navigated the COVID-19 and Brexit crises.

Want to dive deeper into the strategies shared in the webinar? Watch the full recording to explore insights on how to protect your cash flow in today’s volatile market.

Global volatility: what’s really behind it?

The trade war between the United States and China, reignited in 2025, has led to the announcement of tariffs of up to 130% on various Chinese products, followed by strict export restrictions on advanced semiconductors from major US companies.

Initially, the U.S. administration postponed broader tariff increases on most countries to mitigate economic fallout and respond to market concerns. However, tariffs against China were intensified, reaching as high as 145%, further straining global supply chains and raising fears of a potential U.S. recession. This escalation has already led to significant economic repercussions, including a contraction in China’s manufacturing sector, with April’s factory activity expected to slip into contraction territory (Reuters – China factory activity forecast). At the same time, U.S. small businesses are experiencing growing financial stress amid slowing demand and rising costs, partly driven by trade tensions (Reuters – Small businesses signaling trouble).

On May 12, 2025, the United States and China announced a temporary suspension of certain tariffs for a period of 90 days, while trade negotiations between the two countries will continue. At the time of publication, this is the latest information available.

In parallel, the US has placed pressure on allies such as Japan, the Netherlands, and South Korea to also limit their exports to China. In response, Beijing has implemented controls on strategic metals like gallium and germanium.

The consequences are clear:

- Currency volatility: the US dollar weakens while the British pound gains ground.

- Unstable interest rates, affecting access to credit and the overall cost of liquidity.

- Downward revisions of GDP growth forecasts: according to the OECD, global GDP growth for 2025 is now expected to be 3.1% (vs. 3.3% previously projected), while the Bank of England estimates only 0.75% growth for the UK in 2025. In the US, in Q1, GDP shrank by 0.3% according to the U.S. Bureau of Economic Analysis.

- Slowdown in global trade: the WTO forecasts a contraction of international trade between 0.2% and 1.5%, compared to earlier expectations of a 3% growth prior to the escalation of trade tensions.

The evolution of the VIX index, which measures market volatility, serves as a useful proxy for assessing the level of uncertainty in real time and comparing it to that of previous crises. Announcements from the White House regarding tariffs triggered the third-largest spike in volatility over the past 20 years, surpassed only by the COVID-19 crisis and the 2007–2008 financial crisis.

How to Build Robust Scenarios

In today’s volatile economy, scenario planning is no longer a tactical exercise or an annual budgeting ritual. It has become a strategic discipline that empowers finance leaders to simulate uncertainty, assess the financial impact of key business decisions, and maintain resilience under pressure.

The process begins with building a strong baseline—typically a 12-month cash flow forecast with monthly granularity. Even in the absence of mature models, historical data from the last 12–24 months can be used to map seasonality, tax outflows, and customer payment cycles. This nominal scenario represents business-as-usual conditions in the absence of external shocks.

From there, companies should develop at least two alternative cases:

- A moderately adverse scenario (e.g. -20% revenue decline),

- A worst-case scenario (e.g. minimal operations, similar to Covid lockdowns).

These simulations help test the feasibility of actions such as exiting a market, acquiring a competitor, or delaying capital expenditures. They also provide a strong foundation for financing discussions with banks or investors, especially when justifying risk-mitigation needs like state-backed loans or liquidity buffers.

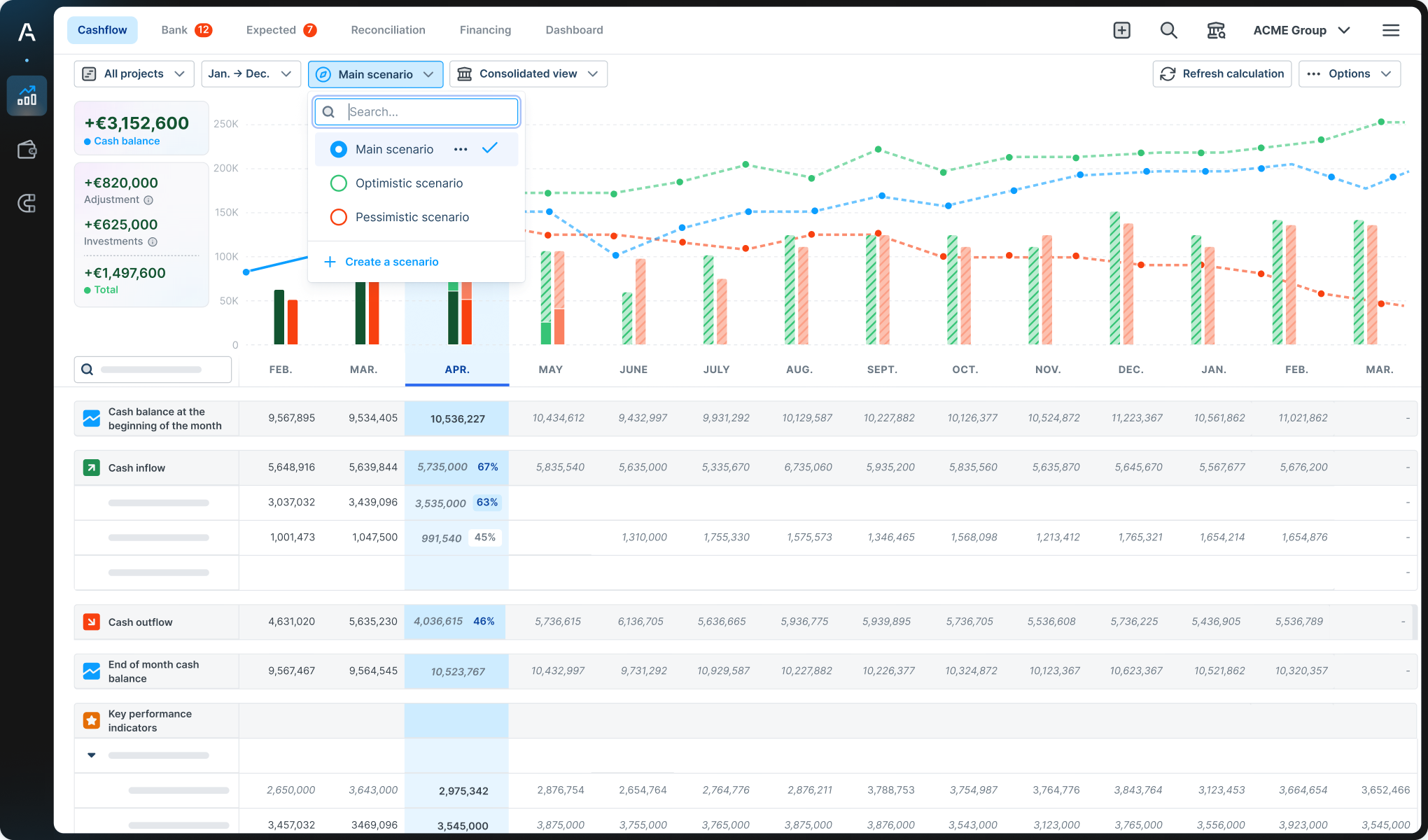

If you are building these scenarios in Excel, you will quickly encounter the tool’s limitations, particularly its inability to manage multiple dynamic scenarios simultaneously. We therefore recommend selecting one scenario as your new baseline after completing the stress tests we mentioned earlier. This scenario—and the corresponding Excel file—should be the one you update regularly. However, do not discard the other scenarios and Excel files. Instead, archive them in an easily accessible way, so that if circumstances change and make one of the alternative scenarios more likely, you can quickly build on your previous work rather than starting from scratch.

If you are using Agicap, however, you can easily create multiple dynamic scenarios and even layer them on top of one another, while instantly seeing the impact of changing assumptions on your cash flow forecasts and key indicators.

How to Monitor Scenarios in Real Time

While scenario planning provides the structure, real-time monitoring ensures those scenarios stay relevant as market conditions evolve. Without regular updates, even the most sophisticated models quickly become obsolete.

To maintain effective scenario governance, finance teams should focus on early-warning signals—leading indicators that anticipate disruptions to cash flow, margins, or operational stability. Examples include:

- Weekly order volumes in strategic markets

- Shifts in forward exchange rates (e.g. EUR/USD)

- Changes in average payment delays (DSO)

- Price spikes in raw materials or shipping

Monitoring these metrics allows teams to detect deviations from their baseline assumptions and respond before issues escalate. For example, an unexpected increase in DSO might trigger a short-term funding review or adjustment to receivables collection strategies.

Agicap enables real-time data capture and dynamic scenario linking, allowing teams to adjust variables once and immediately apply changes across all simulations. This reduces manual errors and enhances agility, especially in volatile periods.

Finally, don’t overlook low-probability, high-impact risks. While rare, black swan events like sudden regulatory bans or supplier failures can disrupt entire liquidity structures. Teams should proactively model these risks and define internal response playbooks—combining financial stress tests with operational contingency plans.

Strengthening Receivables Management: an Often Overlooked Lever

Strengthening your collections process is one of the fastest, most effective ways to improve liquidity—especially in volatile environments. Yet many businesses still rely on outdated, manual approaches that leave too much room for delay and inconsistency.

Here are the key steps companies can take to modernize and streamline receivables management, based on insights shared during the webinar:

Why Collections Matter More Than Ever

Even the most robust scenario plan can collapse under the weight of poor receivables performance. In periods of economic uncertainty, late payments become more frequent. According to an Agicap survey, by the end of 2024, 58% of CFOs in the UK reported an increase in DSO—a trend further amplified by growing geopolitical and commercial tensions.

One real-life example shared during the webinar illustrates the point: a company with €150 million in revenue was managing its collections manually, with just one part-time employee and no digital tools. Follow-ups were subjective, irregular, and entirely paper-based. The result? Rising DSO, heavier reliance on factoring, and mounting pressure on liquidity—despite healthy margins.

Best Practices to Build a Scalable, Professional Collection Process

1. Automate reminders and follow-ups

Replace manual, ad-hoc outreach with automated workflows that adapt to customer profiles—based on amount due, delay duration, and past behavior.

Agicap users, for instance, have tripled the probability of collecting within 60 days of the due date through structured dunning automation. AI also supports message drafting, helping to strike the right tone.

2. Shift the effort before the due date

70% of successful collections happen before invoices are technically overdue. That’s the most impactful window:

- Send proactive reminders 10–5 days ahead of due dates

- Include direct payment links in emails

- Give customers access to all their open invoices through a dedicated portal

3. Clarify roles and KPIs

Avoid conflicts by separating sales and collections responsibilities. Define measurable KPIs such as:

- DSO

- % of overdue invoices

- Response rate to follow-ups

- Recovery by segment or age bucket

4. Segment your efforts and set priorities

Not all receivables are equal. Focus recovery efforts where the risk is higher:

- Strategic clients or invoices overdue >60 days

- Apply risk scoring and behavioral analysis to tailor your strategy

5. Make collections part of scenario planning

Late payments don’t just impact working capital—they distort forecasts. That’s why it’s crucial to:

- Integrate DSO and overdue trends into liquidity planning

- Flag early deviations from expected collection timelines

- Inform treasury and funding teams to adjust credit lines or payment terms proactively

From Admin Task to Strategic Lever

Collections shouldn’t be treated as a back-office chore. When managed proactively, receivables become a powerful lever to stabilize liquidity and reduce reliance on external financing. Especially in volatile environments, neglecting this function means increasing working capital needs—and the pressure that comes with it.

Want to accelerate your cash flow and cut your DSO? Download our free ebook and discover proven strategies to optimize collections, automate follow-ups, and strengthen your cash position.

Reducing Extra Spend: Policy, Control, Visibility

In an unstable economic environment, unplanned expenses can undermine even the best financial planning efforts. According to research conducted by Agicap on European mid-market companies (€30–500M in revenue), nearly 60% reported that extra spending is a recurring issue, with direct impacts on budget control and forecasting accuracy.

During the webinar, a particularly telling case was shared: a company had implemented a “soft” spending freeze, vaguely asking managers to reduce costs. The outcome? Some teams eliminated operational activities entirely (e.g., events, team building), while others simply split large purchases into smaller orders to avoid CFO approval thresholds. This highlights the importance of clear policies, effective governance, appropriate tools, and a shared culture.

Best Practices to Reduce Rogue Spending

1. Establish Clear and Shared Spending Policies

Define explicitly what expenditures are frozen, permitted, and the thresholds for each. Communicate the rationale behind these policies—such as protecting liquidity to avoid layoffs or additional debt—and align them with company values to foster widespread accountability.

2. Implement Multilevel Approval Workflows

Set up approval processes based on expenditure amounts: for example, expenses under €500 require team lead approval, €500–2,000 require a manager’s approval, and over €2,000 need CFO approval. Standardize these processes across business units to prevent inconsistencies and workarounds, and introduce automatic blocks for overspending or when budgets are exhausted.

3. Utilize Proactive Tools

Adopt tools like Agicap to set budgets by cost center, department, or project. Enable automatic alerts for budget overruns or pending approvals, and use smart corporate cards with user-specific and category-specific limits to manage spending effectively.

4. Monitor Continuously and Communicate

Develop monthly dashboards with targeted KPIs, such as the percentage of overspend, number of exceptions, and volume of out-of-policy expenses. Recognize high-performing teams and share internal best practices. Track not only visible overruns but also attempts to bypass rules, like split purchases.

5. Integrate into Scenario Planning

Simulate the impact of selective cuts in areas like marketing, hiring, travel, and events. Assess the effects on cash needs and P&L in both the short and medium term, strengthening the link between authorized spending and financial sustainability, even under adverse scenarios.

Adopting advanced tools for spend control is no longer optional

Manual processes increase the risk of “invisible” or unauthorized expenses. Moreover, AI advancements make it easier to falsify receipts, underscoring the urgency for automated verification and audit-proof control. Agicap, for instance, includes built-in document verification features.

The key takeaway? Transforming spend control into a cultural mindset—not just an administrative task—is essential. Only then can financial governance truly be effective and resilient.

Looking to gain control over your company’s spending? Discover how Agicap helps finance teams track, validate, and manage business expenses in real time—ensuring budget compliance and protecting liquidity. Explore the feature.

Conclusion: Resilience Starts with Liquidity

In an era of constant volatility—driven by trade tensions, supply disruptions, and financial uncertainty—static forecasts and EBITDA-focused decisions fall short. Liquidity must become the cornerstone of financial strategy.

Scenario planning, automated collections, and proactive cost control are essential to protect cash and build resilience. But they require updated data, collaboration, and the right tools.

Agicap brings all of this into one platform—empowering finance teams with real-time visibility and the agility to respond quickly, even in uncertain times.

Curious how Agicap can help you protect liquidity in uncertain times?

Start your free trial and discover how to streamline scenario planning, receivables, spend control, and real-time cash flow visibility—all in one platform.