How to write a dunning letter for effective debt collection

Credit serves as a valuable tool for businesses to improve their sales and foster customer loyalty. However, such practices entail an inherent risk of customers defaulting on their payments, prompting firms to resort to sending dunning letters to recover their dues.

In this article, we explore the utility and methods of writing a dunning letter, in addition to highlighting other debt collection strategies that are equally effective.

What is a dunning letter or reminder in business? | Meaning

A dunning letter is a written communication sent by the business (the creditor) to a customer (the debtor) to remind them about an outstanding debt and request payment. It constitutes a crucial part of the debt collection process and urges clients to voluntarily fulfil their financial obligations.

All dunning letters or payment reminders state the date and serial number of the unpaid invoice, the amount outstanding, and any levy of late payment fees or penalties. As they serve as the first point of contact, they maintain a polite tone, with the tone becoming more stringent as time progresses. Traditionally sent through registered mail, they are now delivered through fax, emails, or text messages.

In which cases to write a dunning letter?

A dunning letter is a versatile tool that can be written under various circumstances, as long as the debtor owes money to a creditor, whether an individual or a business. For instance, a business can send payment reminders to a customer who fails to pay his dues on the appointed day.

Similarly, banks and financial institutions use dunning letters to remind borrowers about missed loan payments. Lenders, too, deliver these reminders to their tenants when rents become overdue.

What is the dunning process ?

The dunning process involves a structured approach to debt collection and is governed by several regulations to protect the rights of creditors and debtors. Here's an overview of the typical dunning process:

-

Find delinquent accounts: The first step in the dunning process is to run an account receivable (AR) ageing report to identify the customers who have defaulted on their payments. These clients are later classified into different categories based on when the invoice became outstanding, with the majority of businesses following the 30-, 60-, 90-, and 120-day overdue conventions.

-

Draft reminder letters: After finalising the list of delinquent accounts, the collections team typically creates separate dunning letters for all stages, with the first letter politely reminding of an outstanding invoice and the follow-up letters growing more assertive. A copy of the overdue bill and information about payment options are also included to ease the debt settlement process for the customer.

-

Send final notice: When all previous collection attempts fail, the creditor may send a final reminder, notifying the debtor of their intention to initiate legal action or hire a collection agency if the invoice is not settled within a specified period.

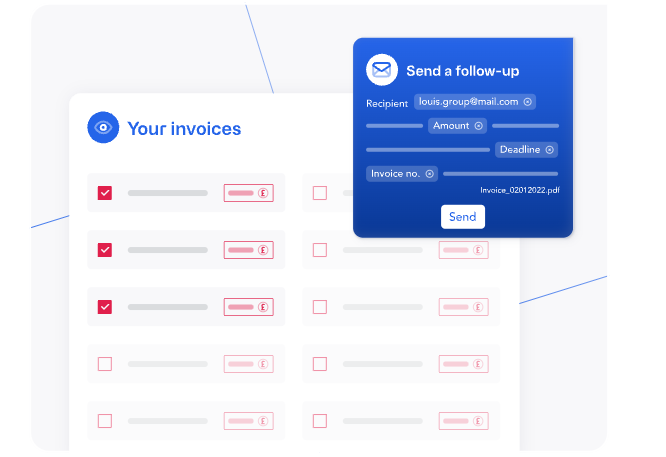

However, over time, companies have been automating the dunning process using collection software. These modern tools automatically generate and send payment reminders to the customers when thereceivables become due, reducing DSO and improving collections.

How to write an effective dunning letter?

Writing a well-crafted dunning notice is essential to increasing the likelihood of debt recovery. Some of the best practices to keep in mind are:

- Keep the letter crisp and concise, with the subject line immediately setting the stage. Initial reminders should be friendly and urge the customer to pay up. You can even complement the letters with a phone call the next day.

- Follow-up emails must clearly reference the previous emails sent and should grow assertive in tone, with the last reminder clearly mentioning legal action.

- Avoid any financial jargon and focus on communicating the most important information, such as the invoice number, the amount due, and the payment methods. Include an invoice copy and clear instructions on how to pay. You may also offer discounts and incentives for early payment.

When sending out dunning emails, use professional email addresses like [email protected] or [email protected] and not generic email addresses, such as [email protected], to add an element of personalisation.

Key components of a dunning letter

While there are no standardised templates, a dunning letter usually has the following sections:

- Header: Company information and contact details

Begin the reminder letter with the company's letterhead, including its name, logo, and contact information. Ensure that the contact details are accurate and up-to-date.

- Salutation and introduction

Address the debtor courteously, preferably by their name, and politely introduce the purpose of the letter, which is to prompt invoice payment.

- Statement of outstanding debt

Follow the introduction by clearly mentioning the outstanding invoice details, including the number, the exact amount owed, and late fees, if applicable.

- Explanation of the debt and its origin

Elaborate on the debt details, including the date of the original transaction, the goods or services provided, and the payment terms agreed upon.

- Request for payment and due date

Clearly communicate the expectation for payment by a certain due date. Also, elaborate on digital payment methods to enable the customer to settle the invoice instantaneously.

- Offer of assistance and payment options

After stating your expectations, express your willingness to assist the client in resolving their concerns, and provide contact information for negotiations. You may also include payment plans or offer partial payment options in extreme cases.

- Consequences of non-payment

Close the letter by informing the customer of the potential consequences of non-payment, namely a late fee levy, the involvement of collection agencies, the filing of lawsuits, or reporting to credit agencies.

Compliance and legal requirements

All dunning letters must comply with certain laws and regulations, which are listed as follows:

-

The Consumer Credit Act 1974: It defines the rights and obligations of both parties to consumer credit agreements. It mandates the reporting of the amount owed, the terms of repayment, and the consequences of non-payment by the creditor to the debtor.

-

The Late Payment of Commercial Debts (Interest) Act 1998: It allows creditors to charge at least 8% interest on the invoice and other debt recovery costs.

-

The Data Protection Act 2018: A complement to Europe’s General Data Protection Regulation (GDPR), it protects debtors’ personal information and its processing by creditors.

-

The Consumer Protection from Unfair Trading Regulations 2008: It prohibits the use of harassment and coercion with customers.

Additionally, companies may have to adhere to the guidelines issued by the Financial Conduct Authority (FCA) to ensure full compliance.

Strategies for effective debt collection

There is more to collecting debts than sending dunning letters to delinquent customers. Some of the most effective strategies to enhance your debt recovery efforts and improve liquidity are:

There is more to collecting debts than sending dunning letters to delinquent customers. Some of the most effective strategies to enhance your debt recovery efforts and improve liquidity are:

-

Communicate early: Send out clear and complete invoices to the customers after the goods or services have been delivered. Follow them up with a friendly reminder before the invoice becomes due for payment.

-

Formalise a collection strategy: Standardise your dunning process by sending out follow-up letters at regular intervals where the invoice remains unpaid. Adopt a collaborative approach and be willing to work with debtors to find mutually acceptable solutions.

-

Leverage technology: Implement advanced A/R management software like Agicap’s CashCollect to streamline the dunning process and send automated reminders while easily tracking payment statuses.

Examples of different types of dunning letters | Templates

Dunning letters can take various forms depending on the severity of the situation and how far out the receivable is due. Some common reminder letter examples are:

Early payment reminders:

Subject: Invoice No. #6789; Due by []

Body: We would like to draw your attention to an outstanding invoice for the amount of [£] related to [invoice reference number] that is due for payment on [due date].

We kindly request that you settle this invoice at the earliest possible time to avoid any further inconvenience. Please find the invoice attached for your easy reference, and the payment options are [details].

If you have any questions or require assistance, please do not hesitate to contact our dedicated customer support team at [contact].

Sincerely,

[Company Information]

Overdue payment notices:

Subject: Invoice No. #6789; Overdue by [30/60/90 days]

Body: We are writing to address the matter of the outstanding invoice dated [Invoice Date] for the amount of [£] that remains unpaid despite our previous reminders.

We urge you to take immediate action and settle this debt. The new due date for payment is [date]. You may use any of the following payment options [online/bank/cheque].

Please understand that continued non-payment will result in a levy of penalties and the initiation of a formal collection process. Should you have any questions or require further assistance with payment arrangements, do not hesitate to contact our collections team at [details].

We look forward to receiving your payment.

Sincerely,

[Company Information]

Final demand letters:

Here's a template:

Subject: Invoice No. #6789; Final Notice

Body: This is our final reminder that the invoice [reference number] for the amount of [£] originally due on [date], remains unpaid, despite our previous communication on [date 1/2/3].

We strongly urge you to take immediate action and settle your payment obligation. The payment options are as follows: [details]

Please note that this letter serves as our final attempt to resolve this issue amicably. Failure to pay by [date] will result in the immediate initiation of legal action against you.

If you have any questions, require clarification, or wish to discuss payment arrangements, please contact us at [details].

Sincerely,

[Company Information]

Dealing with customer responses

While sending dunning letters mostly involves one-way communication, there may be times when customers respond to these reminders. Below, we outline some strategies for tackling different client responses:

Handling delinquent and persistent debtors

-

Non-responsive debtors: Continue to follow your established dunning process and send follow-up letters with firmer language and deadlines. When this fails, hire a collection agency or pursue legal action.

-

Partial payments: If a customer offers to pay partially, you may choose to accept it, especially if it represents a substantial portion of the invoice, and clearly document the agreement.

-

Alternative payment plans: Negotiate alternative arrangements with debtors facing financial hardship. This will prevent your debt from going bad completely while making it easier for the customer to settle their dues.

Advantages of using technology and automation software - Agicap

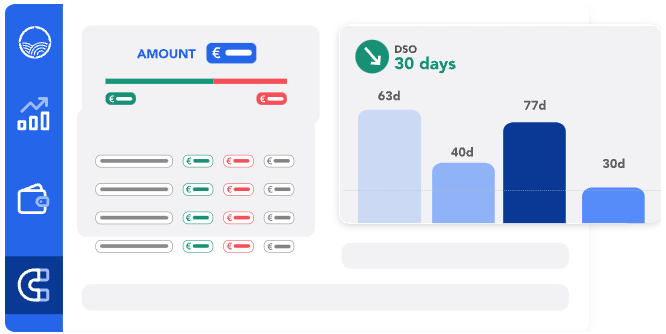

Agicap, with its CashCollect platform, has been transforming the way businesses collect debt, enabling them to reduce the frequency of non-payments by a massive 30%, in addition to softening the administrative burden. Through Agicap’s AR automation tool, you can enjoy several features and advantages, such as:

-

Monitor your outstanding invoices and their ageing balances in real-time. Prioritise your collection actions accordingly and track their progress seamlessly.

-

Centralise, automate, and customise your payment reminders, or use Agicap’s standardised templates that progressively escalate their tone based on the dunning stage.

-

Gain real-time insights into your company's financial health and liquidity planning, including payment collections and working capital management, and automatically update your cash flow forecasts.

Read our debt collection software comparator