Cash flow investments: How do they help businesses maximise financial growth

One of the common ways to classify cash is as follows — cash flow from operating activities, cash flow from financing activities, and cash flow from investment activities. Out of the three, cash flow from investment activities—or cash flow investment—provides valuable information about a business’s long-term health and growth potential.

Positive cash flow from investing activities means more cash is received than spent on investment activities. It indicates the business is either selling its assets or receiving interest or dividends. Negative cash flow investment suggests the company is buying new assets or paying principal or interest on its loans.

Cash flow from investment can help businesses maximise returns and financial growth. How? Continue reading to find out.

What is cash flow investment?

Cash flow investment reports the total change in a business’s cash position from investing its cash. Cash flow from investing activities is a section on the cash flow statement. The latter is a financial report that shows how much cash a business spends or generates during a period.

The investment activities include the following cash flow examples:

-

Cash inflow

- Sales of property, plant, and equipment

- Proceeds from sales of assets

-

Cash outflow

- Purchases of marketable securities

- Purchase of property, plant, and equipment

- Investment in joint ventures

- Payments for business acquired

A positive company cash flow from investing activities might mean the business is liquidating its assets or reducing its investments, which might limit its future profitability.

On the other hand, negative cash flow from investing activities might suggest the company is expanding its assets, enhancing its future profitability.

However, negative cash flow investment could also mean the company generates enough cash from its operations or financing activities.

What are examples of company cash flow investments?

Some examples of cash flow investments are real estate, dividend stocks, bonds, or buying other profit-generating businesses.

Why do cash flow investments?

- To expand their operations and increase their market share. 📈🏢

- Improve efficiency by streamlining processes, reducing costs, and enhancing quality. ⚙️💰✨

- To diversify their portfolio, reduce risk, or generate income from dividends, interest, or capital gains. 📊📉💸

- To innovate and create new products to gain a competitive edge or meet customer needs. 💡🆕🚀

Types of assets to invest in - What are good assets to buy

Businesses can choose from long-term or short-term investments and equity or debt to invest in, depending on their business goals, needs, and risk tolerance.

⭐ Download our excess cash placement free ebookhere ⭐

Long-term vs. Short-term Investments

If you invest in an asset for over a year with the expectation of long-term growth and profitability, it’s a long-term investment. On the other hand, short-term investments are the ones you hold for less than a year to generate quick returns and exploit market opportunities.

Choosing between long-term and short-term investments depends on your goals, needs, and risk tolerance. If your financial flow is stable, and you have a long-term vision and low-risk appetite, then long-term investments might be suitable for you.

Real estate investment opportunities

Real estate properties that a business can buy, sell, rent, or develop for profit. It can give you various benefits such as rental income, capital appreciation, tax advantages from depreciation and deductions, and equity from leverage and mortgages.

Cash flow investing in stocks and bonds

If you aim to generate consistent and predictable income, stocks and bonds are the way to go. Plus, they pay dividends and interest.

It can provide you with opportunities for diversification and ensure a regular income stream, and the assets come with growth opportunities.

What income-generating assets to buy?

Companies could select income-generating assets based on the following six factors:

- Risk appetite

- Debt levels

- Time horizon

- Availability of capital

- Return objectives

- Emergency funds

Based on these factors, companies could consider the following income-generating assets:

-

🏡 Real estate: Do you have industrial, residential, agricultural, or commercial properties you could rent or sell for a profit? You can generate income from rental fees, capital appreciation, equity, or tax benefits.

-

📈 Stocks: Buy ownership in a company by purchasing and selling those shares for a profit. A business can also generate income via stocks from dividends, capital gains, or stock splits. Besides, you have voting rights and influence over the company’s decisions.

-

💵 Bonds: A business can lend money to governments or another business using bonds in exchange for interest payments and principal repayment. You can generate income from interest, capital gains, or coupons. Bonds can also add stability and security to your cash investments.

-

🏢 REITs: REITs are companies that finance, operate, or own real estate properties. REITs can help you diversify and offer liquidity while helping generate income from rental fees, dividends, and capital appreciation.

-

🌐 Peer-to-peer lending: Peer-to-peer lending connects borrowers to lenders online without the involvement of financial intermediaries. Businesses can participate as lenders and generate income from interest, fees, or commissions.

-

🏪 Businesses: You can buy other profit-generating small businesses and generate income from the sales, profits, and royalties. You also get to have business ownership and control over operations and strategies.

Benefits and risks of cash flow investment

Here’s a table that summarises some benefits and risks of cash flow investment for businesses:

| <!----> | <!----> |

|---|---|

| Benefits | Risk |

| Expand their operations and increase market share | Reduce the liquidity and flexibility of businesses by spending cash that could otherwise be used. |

| Improve their efficiency and productivity | Expose businesses to market volatility and economic downturns by investing in securities that may fluctuate in value or become illiquid. |

| Diversity their portfolio and reduce risk | Increase the debt and leverage of businesses by borrowing money to fund investments. |

Evaluating the risk-return profile

Cash flow analysis is a method that businesses use to measure and evaluate the performance of their cash flow investments, using the following indicators and tools:

-

Net present value (NPV): Calculate the present value of the future cash flows from an investment minus the initial cost of the investment. It shows how much value an investment can add to the business. A positive NPV indicates the investment is profitable.

-

Internal rate of return (IRR): Calculates the annualised rate of return on investment that makes the NPV of an investment equal to zero. It shows how efficiently an investment can generate returns. A higher IRR means the investment is attractive.

-

Payback period: Calculates the time it takes for an investment to recover its initial cost from its generated cash flow. It shows how quickly an investment can break even. A shorter payback period indicates less risk.

How do we mitigate risks?

Cash flow investment includes various risks such as market, liquidity, credit, operational, and legal risks. Some strategies to manage these risks are as follows:

-

Diversify: Investing in different types of assets, industries, markets, and regions helps reduce the impact of a single or correlated event on your cash flow. It helps you balance risk and return.

-

Due diligence: Research and analyse the potential cash flow investments before ensuring they suit your goals, needs, and risk tolerance.

-

Monitor cash flow: Tracking and reviewing the performance of investments in your cash flow report regularly to ensure they generate the expected income and growth. And then adjust your strategy accordingly.

What are high returns from cash flow investments?

High returns from cash flow investments are the amount of money a business makes from its cash flow investments relative to the amount of money it invests.

These investments generate more cash income than cash expenses and indicate that a business makes profitable and efficient use of its cash. It also indicates a positive NPV and IRR for its investments.

Cash flow investment strategies to avoid over-investment of free cash flow

High returns from cash flow investments are the amount of money a business makes from its cash flow investments relative to the amount of money it invests.

These investments generate more cash income than cash expenses and indicate that a business makes profitable and efficient use of its cash. It also indicates a positive NPV and IRR for its investments.

⭐ Download our excess cash placement free ebook here ⭐

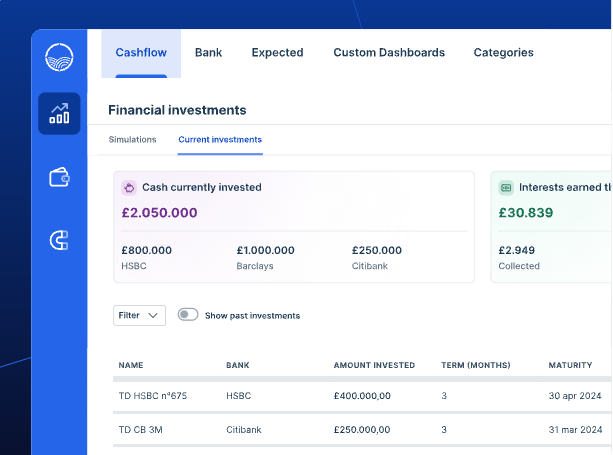

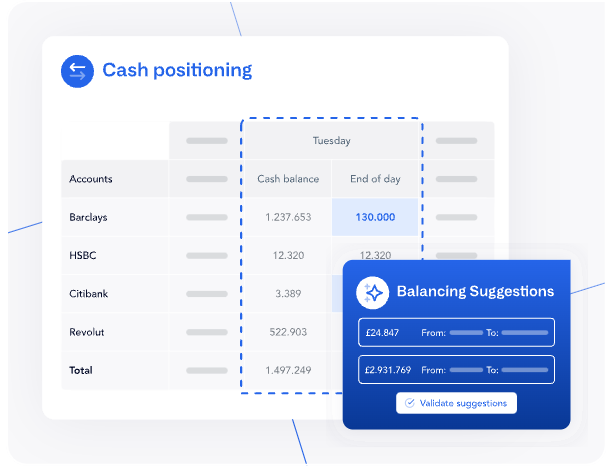

Analysing cash flow statements for better cash position understanding with Agicap

Agicap is a cash flow management software that helps businesses manage and optimise their cash flow. It allows businesses to analyse their cash flow statements better to understand their cash position.

Having a better understanding of cash position, including the money in the bank account, can help them to make data-based decisions about their cash flow investments. For example, how much to invest, when to invest, where to invest, and when to divest.

Building a cash flow-driven investment portfolio

A cash-flow-driven investmentportfolio is a collection of assets that generate consistent and predictable income from dividends, rent, interest, or profit. It can help businesses achieve various financial goals, such as managing risk.

To build a cash-flow-driven investment portfolio, consider cash flow needs, return expectations, risk preferences, and diversification benefits.

Yield-focused vs. Growth-oriented financial flow strategies

A cash-flow-driven investment portfolio is a collection of assets that generate consistent and predictable income from dividends, rent, interest, or profit. It can help businesses achieve various financial goals, such as managing risk.

To build a cash-flow-driven investment portfolio, consider cash flow needs, return expectations, risk preferences, and diversification benefits.

Leveraging compounding and reinvestment

Compounding and reinvestment are two powerful techniques businesses can use to increase returns from their cash flow investments. Compounding means earning interest on interest, which can exponentially increase the value of an investment over time.

Reinvestment means using the income from an investment and buying more of the same/different investments. This can enhance the growth and diversification of your portfolio.

Cash flow investment benefits from cash flow accounting and report

Cash flow investment offers various income-generating, value-creating, and risk-reducing opportunities to businesses. However, it requires careful planning and analysis, as it involves spending cash that could otherwise be used for other purposes.

You also need to consider the liquidity, profitability, and growth potential of your free cash flow investments and the opportunity cost of not investing in other alternatives.

How Agicap can help you invest in cash flow ?

In conclusion, understanding cashflow investment is vital for achieving financial growth and sustainability. Effective cashflow investment allows businesses to maximize their returns and make strategic financial decisions.

At Agicap, we understand the intricacies of investing cash flow efficiently. Our innovative software automates the analysis and management of your cashflow investments, providing real-time data and advanced insights to help you optimize your financial strategies. With Agicap, you can easily monitor investments, generate accurate forecasts, and make data-driven decisions.

At Agicap, we understand the intricacies of investing cash flow efficiently. Our innovative software automates the analysis and management of your cashflow investments, providing real-time data and advanced insights to help you optimize your financial strategies. With Agicap, you can easily monitor investments, generate accurate forecasts, and make data-driven decisions.

Discover how Agicap can enhance your cashflow investment strategies. Visit our website today to learn more.