Best account payable softwares in 2026

What is accounts payable management software?

Typically, accounting systems divide the cashflow of businesses into two streams:

- Money coming in

- Money going out

Accounts Receivable (AR) software handles money coming in. Accounts Payable (AP) automation software handles money going out.

What strategic objectives does accounts payable software tackle?

The accounts payable process offered by cloud-based software focuses on automating AP tasks so they are more efficient. In the wider picture, this:

- Maximises value from company spending, whilst lowering costs. This is a business critical concern, with 57% of 500 UK CFOs interviewed by Agicap admitting that they struggled to tame rogue spending.

- Boosts relationships with suppliers (by paying them on time)

- Reduces the risk of non-compliance in the area of taxation and other legislation (such as the ruling in France that all domestic invoicing must be electronic as from 2026)

- Improves visibility on spending

- Supports company-wide centralised cashflow management and liquidity planning (particularly if AP automation is part of a complete financial platform such as Agicap)

- Automates a significant chunk of pre-accounting

- Enhances security through structured process architecture

What formats does accounts payable software typically come in?

Common formats for AP software include:

Part of a complete centralised cashflow solution: this means that the AP component is available as part of a wider platform (as with Sage Intacct, for example) - and sometimes also available as a standalone component (as with Agicap, for example).

Part of a limited expense management solution: a common grouping of components is i) AP automation ii) expense management iii) corporate credit cards and iv) procurement. Ramp, Coupa and Tipalti follow a similar configuration. Another common grouping is simply to provide a dual offering of Accounts Payable and Accounts Receivable (as Bill.com and Esker do, with an optional cash management module).

Critical to the success of any AP software is its level of connectivity with existing Enterprise Resource Planning systems. If the software does not integrate seamlessly with the company's existing tech stack, it become a source of problems rather than solutions. Firms like Agicap, therefore, put a high premium on banking and ERP integration.

Accounts Payable Software Showdown: Compare Top Solutions

What are the main accounts payable management software packages in 2025?

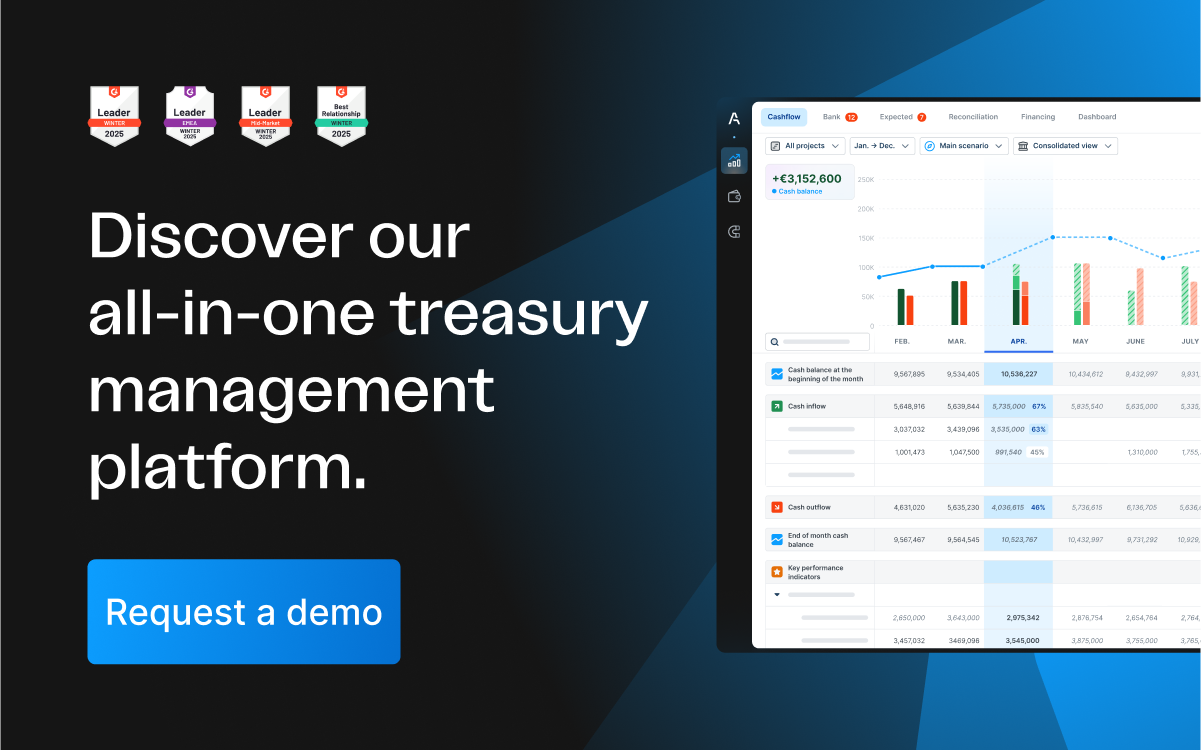

Agicap

Agicap's Accounts Payable software (called Agicap Payment) is a key part of the company's success in establishing a reputation as Europe's foremost provider of cash management software. As with Agicap's entire platform, the emphasis with accounts payable is on fault-free, powerful delivery of efficiencies:

- Improving visibility of all invoices

- Boosting control (and peace of mind) with straightforward validation rules

- Saving time with accounting preparation

Agicap centralises all invoices on a single platform, capturing them with custom OCR (enhanced by AI). Finance teams can manage purchasing processes from the Purchase Order stage and keep an eye on the bigger picture with real-time dashboarding - as well having the ability to zoom into individual order streams.

Whereas other AP providers might opt for more variegated complexities at the AP team level, Agicap is all about simple AP execution backed up by rigorous levels of live support. AI, for example, is leveraged to support key processes like OCR - as well as provide the helpful Agicap AI conversational assistant - but the technology is very much tamed and trained. The emphasis is always on the bigger picture of feeding senior management with clear data conclusions they can use to manage cash and liquidity, rather than bogging employees down with complicated processes.

In 2024 Agicap was named among the Top 10 Titans of Tech startups by analysts GP Bullhound.

Like many of its competitors, Agicap provides pricing information on a custom basis. Interested parties can activate a full demo mode of Agicap Payment - linking their own bank accounts safely - on the Agicap website, without the need to speak to a representative.

Bill

Headquartered in California with 2,000+ employees, Bill.com is a AP/AR platform complete with some cashflow forecasting capability. The company explicitly targets mid-sized businesses as well as sole traders, offering AP automation based on some simple principles:

- Easy dematerialisation of invoices, with multiple ways to quickly import invoices

- Simplified approvals workflows with automated routing

- Enhanced flexibility and control over payments with multiple payment options (ACH, credit card, cheque, wire transfer) across extensive existing Bill network of vendors

- Improved integration with automatic 2-way syncing with leading accounting systems and ERPs such as QBO, Xero, Oracle NetSuite and Sage Intacct.

Pricing is transparent with Bill: starting at $45 per user, per month for an Essentials Package; followed by $55 per user, per month for Team; $79 per user, per month for Corporate; and custom pricing for Enterprise level functionality. Automatic 2-way syncing with accounting software is available from Team level up, with additional customization kicking in at Corporate level.

Sage Intacct

So is this Sage then? Yes. The Sage Group bought the Intacct Corporation - and its consolidated e-commerce and ERP finance features - in 2017 and rebranded it as Sage Intacct. Sage is, of course, a huge name in business management software serving over 2 million customers worldwide from its HQ in the UK.

Focusing on small and mid-sized businesses, Sage Intacct offers an accounts payable solution as part of a wider suite of modules including accounts receivable, cash management, general ledger, order management, reporting and purchasing. Sage Intacct promises to cut the accounts payable process time in half with its AI-powered streamlining of invoicing and payments.

Clients include fintech firm ClearScore, consultants Eden Mccallum and ambulance provider ERS Medical.

Pricing for Sage Intacct is by bespoke quotation only.

Ramp

Ramp's accounts payable process software is offered as part of its wider platform handling expense management and procurement. The AP component aims to:

- Handle complex invoice dematerialisation with OCR

- Manage recurring bills, batch payments and vendor boarding

- Sync in real-time to popular ERPs and accounting systems such as Xero, Netsuite, Sage and Intuit Quickbooks

- Offer intelligent routing of approvals with customizeable settings

Ramp makes the bold suggestion that users can 'handle 10x the invoices with the same headcount' and reports that 7,548 companies run Ramp's accounts payable solution, including internet knowledge base Quora, data provider Clearbit, and skin care brand Skin Pharm.

This is the one of the few providers offering a free version (with undisclosed functionality). The Plus level of subscription is priced at $15 per month, per user - and beyond that pricing for Enterprise implementation is on a custom basis.

Tipalti

A serious player in AP automation, Tipalti is headquartered in California, with roughly 1,250 employees spread across 7 international offices. The company was named 2024 CNBC World's Top Fintech Company.

Tipalti offers 4 main modules: AP Automation, Mass Payments, Procurement and Expense Management. The AP module tackles four areas of operation:

- Automated invoice management - powered by AI.

- Self-service supplier management - a common feature offered by the majority of competitors.

- Built-in tax compliance - supported across 60+ countries.

- 2 and 3-way Purchase Order matching - ensuring companies are audit-ready.

Extensive ERP compatibility is offered by Tipalti, including pre-built configurations suitable for specific ERPs - for example, the Tipalti NetSuite integration for AP automation.

Having acquired cloud procurement firm Approve in 2021, the firm has raised over $700m in venture capital funding to support future growth.

For AP, Tipalti offers 3 subscription prices: Starter at $99 per month, Premium (custom pricing) and Elite (custom pricing).

Coupa

This California-based company offers AP Automation as part of a total package of Business Spend Management that it brought out in 2021.

Coupa uses AI to power e-invoicing, touchless invoice automation (with 2-way and 3-way Purchase Order matching), built-in approval workflows, and real-time spend analytics. Compliance-as-a-Service (CaaS) is a top priority, with Coupa AP automation automatically validating country-specific requirements when issuing an invoice.

As with its competitors, Coupa advertises some striking metrics reported by clients, with Molina Healthcare announcing a 250% efficiency increase in their AP processes, GameStop declaring a 20% reduction in AP headcount and reddit revealing a 60% reduction in close time.

Coupa does not advertise prices directly - but does offer an online ROI calculator relating to putative savings possible with its Total Spend Management platform.

Airbase

Accounts Payable Automation is one of four modules offered by Airbase, alongside Guided Procurement, Expense Management and Corporate Cards. Conveniently, Airbase AP Automation can be implemented as a standalone product, syncing with a business's existing ERP.

Airbase offers a typical suite of AP automation services including domestic and international bill payments, AI-powered OCR for invoice automations, Purchase Order management, tracking and scheduling of payments as well as batch approvals and a vendor portal for submitting invoices and payment tracking.

The company has some traction with mid-sized clients, numbering working capital platform Fundbox, email security specialists Abnormal Security and API platform Postman (who boast 30 million registered users) amongst its service base.

Airbase offers custom subscription prices based on number of users: Standard <200 users, Premium 200-500 users and Enterprise 500-10000 users.

Stampli

Winners of the Best Accounts Payable Platforms Integrations prize in the 2024 FinTech Breakthrough Awards, Stampli present their point of difference in a crowded market as being 'the only finance operations platform centered on AP'. Aside from AP automation, Stampli offers payments, cards and vendor management - as well as 'Cognitive AI' for the matching of purchase orders.

Although it might be a stretch to claim, as Stampli do, that, 'with other solutions, AP is an afterthought', Stampli's confidence in the area of AP automation is contagious. The firm boasts 5,000+ clients and some impressive metrics from client testimonials:

- 93% faster invoice intakes for Spanish Fork

- 98% faster approvals for Beyer Mechanical

- 75% shorter invoice processing time for Wenspok Companies

Stampli pricing is available only on request.

What key tasks does accounts payable software tackle?

Centralisation of all invoices on a single platform

This feature is ubiquitous across all AP providers in our review here. The organisation of supplier documentation in one place is the obvious starting point for improved efficiency.

Centralisation means the purchasing process can be tracked via dashboards from start to finish: from the issuance of Purchase Orders, through to the receipt of invoices, payment and eventually the reconciliation of the payment with the respective invoice.

Invoice dematerialisation

'Dematerialisation' is an industry term that means capturing printed data and transforming it into digital data. The tool that typically achieves this is OCR (Optical Character Recognition) scanning. With this method, invoices are manually placed in a flatbed scanner and the software manages the collection of all relevant data.

When this type of UCR technology works, it is enormously productive; but when it doesn't, it can waste more time than it saves. Companies like Agicap, Airbase and Coupa use OCR technology enhanced by AI; it's a safe and efficient application of AI because scanning is all about learning from previous mistakes, which is of course the speciality of machine learning technology.

Handling payments

Some AP providers offer overlapping modules of payment management which leverages an existing payment network. Some, like Agicap, offer simple and direct options from within the AP module itself:

- Pivot account: the client funds the account Direct Debits and pays suppliers from this account using SEPA transfers

- XML Export: the client can generate and download a .xml standardized file for import to their own bank interface

- Direct Banking Connection: standardized EBICS payment

- Direct Banking Connection - Host to Host (for Italian clients only)

Integration with existing ERPs

All AP providers in our review offer extensive integration with Enterprise Resource Planning software, as well as the top accounting systems. Particularly useful for clients is the existence of pre-built customising applications. Among many examples, Tipalti provides a pre-built component for NetSuite compatibility and Agicap provides a similar function for compatibility with accounting software Xero.

Spend Management

Spend management means facilitating the use of corporate credit cards and the payment of company expenses from a central management platform. French company **Spendesk (**not reviewed here) is a big name in this field. Agicap offers its own streamlined Spend Management tool as part of its AP module, whereas companies like Airbase offer a more in-depth service. Choosing how sophisticated a company's Spend Management should be depends very much on headcount, as well as the frequency with which employees need to spend company funds.

Structured buying process: validation workflows

It's all very well being able to pay vendors who have presented an invoice; but the key question is - should you? The decision to pay (or not) is definitely not one that should be left to software or AI. On this point, AP providers are generally agreed.

Thus, integral to many AP platforms are a system of rules which govern which key individuals in the company can sign off on the payment of invoices. With what are called validation workflows, the software automatically brings such decisions to the attention of the correct individuals.

Streamline Your Accounts Payable Process with Agicap 🚀

Managing accounts payable efficiently is crucial for maintaining financial stability, controlling cash flow, and ensuring strong supplier relationships. With Agicap Payment, you can eliminate manual inefficiencies and gain full control over your AP process—all in one centralized, automated platform.

Why Choose Agicap for Accounts Payable?

Agicap goes beyond simple AP automation, integrating directly into your financial ecosystem to provide real-time visibility and strategic cashflow management. Here’s what makes Agicap Payment stand out:

✅ Centralized Invoice ManagementNo more scattered documents—store, track, and manage all invoices in one place with AI-powered OCR for automatic data extraction.

✅ Automated Approval WorkflowsReduce bottlenecks with customizable validation rules ensuring compliance, accuracy, and timely payments.

✅ Flexible & Secure PaymentsEasily execute supplier payments via SEPA, XML, or direct banking connections (EBICS & Host-to-Host for Italian users)—all from within Agicap.

✅ Seamless ERP & Bank IntegrationAgicap syncs effortlessly with leading ERPs and accounting systems like Xero, QuickBooks, NetSuite, and Sage, ensuring real-time financial accuracy.

✅ Actionable Cashflow InsightsUnlike standalone AP solutions, Agicap provides real-time cash flow forecasting, allowing finance teams to anticipate liquidity needs and optimize working capital.

Ready to Experience Effortless AP Management?