Manage all your business spending with our Treasury Powerhouse

Monitor, optimise and integrate your accounts payable on our easy-to-use interface.

Full control over spending and budgets

Faster and easier purchases

Intuitive experience for immediate adoption

Stay in control of your purchase workflows

Manage every step of your procurement workflow from one integrated platform. Get a complete overview, and track every stage precisely with our smooth navigation.

reduction in manual tasks

reduction in spending

faster at closing the books

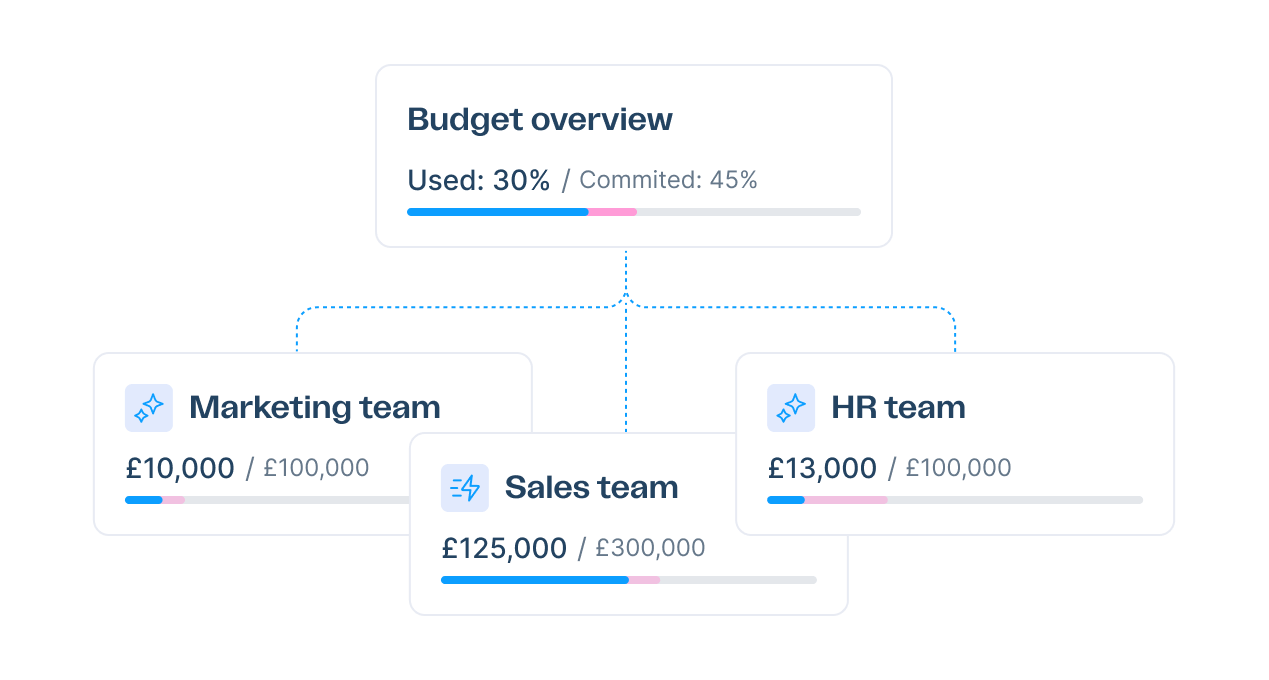

Keep your costs down and manage your budgets in real time

Track your budgets by cost centre

Create costs centers, easily assign budgets, and help your teams manage their spending. Monitor your budget and the impact on your treasury in real time.

Automatic expense categorisation

Automatically assign and categorise expenses by cost centre. Get more visibility over your budget.

Purchase requests & approval workflows

Every business expense is pre-approved before it's committed.

Set payment limits

Control spending by internal spending rules.

Digitise and automate your purchasing processes

Automatically import your invoices and receipts

Easily import documents by email, mobile scan, or PDF upload. Automatically separate invoices when uploading in bulk. Extract the information you need with industry-leading OCR technology.

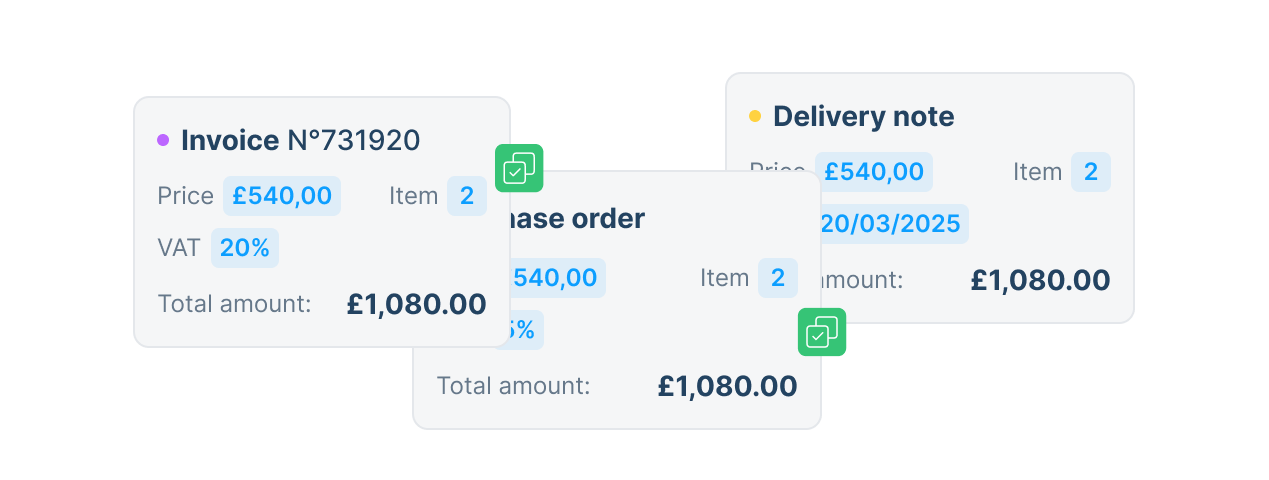

Manage purchase orders and delivery notes

Centralise your POs and delivery notes directly in Agicap. Match them with invoices to simplify 2- or 3-way reconciliations and ensure each payment is traceable.

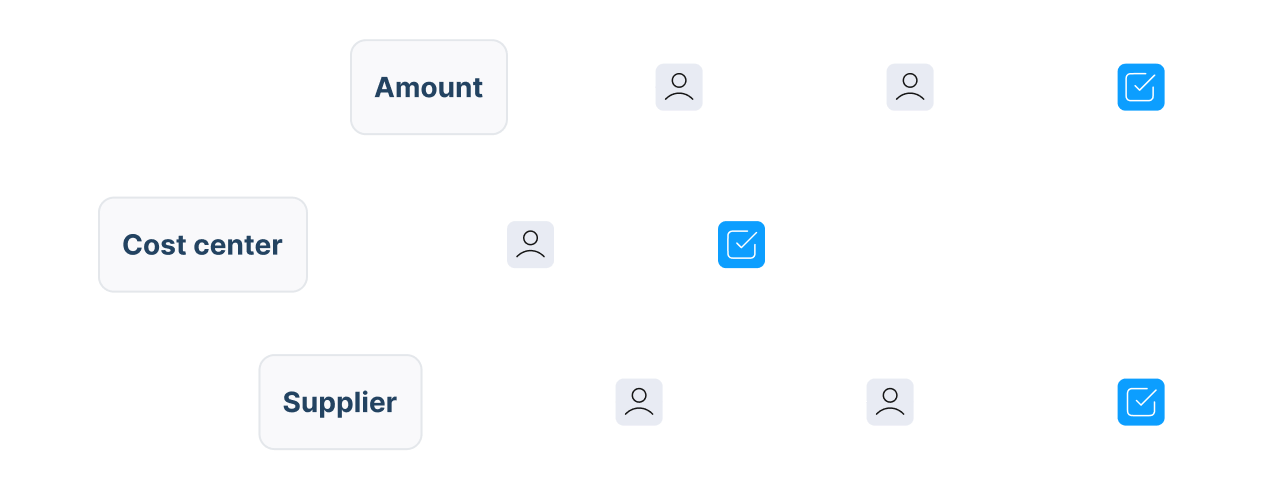

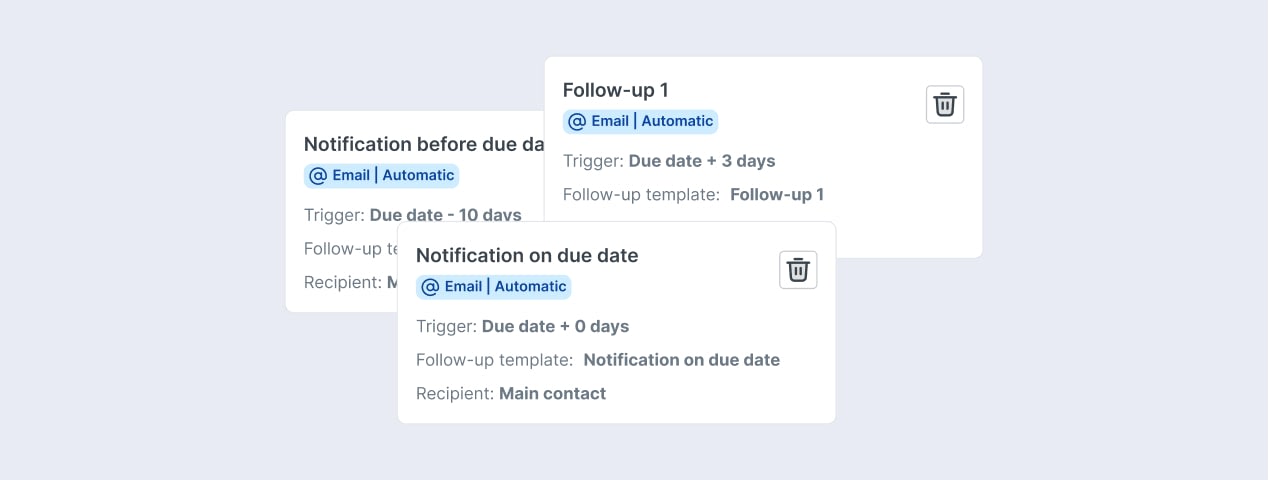

Customise your approval workflows

Set up approval flows based on supplier, amount, or cost centre. Instantly notify the right people to keep everything running smoothly.

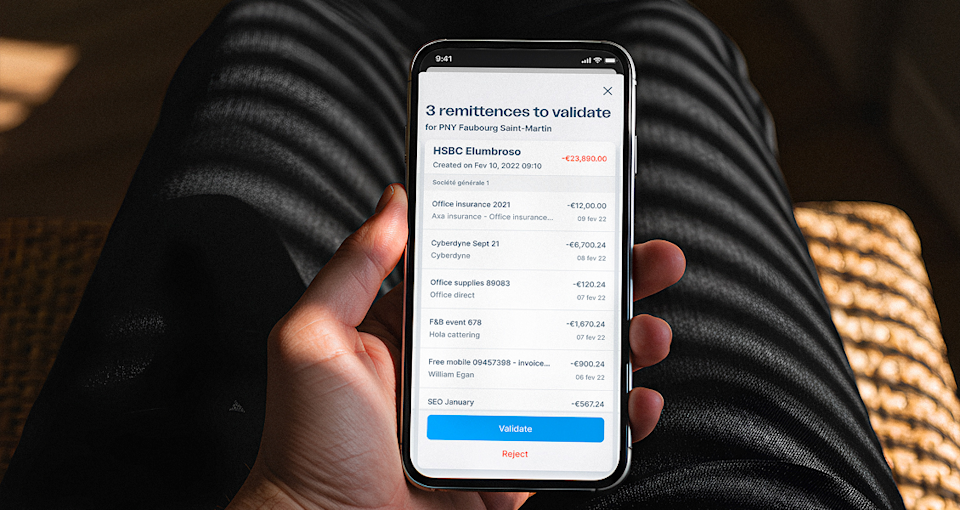

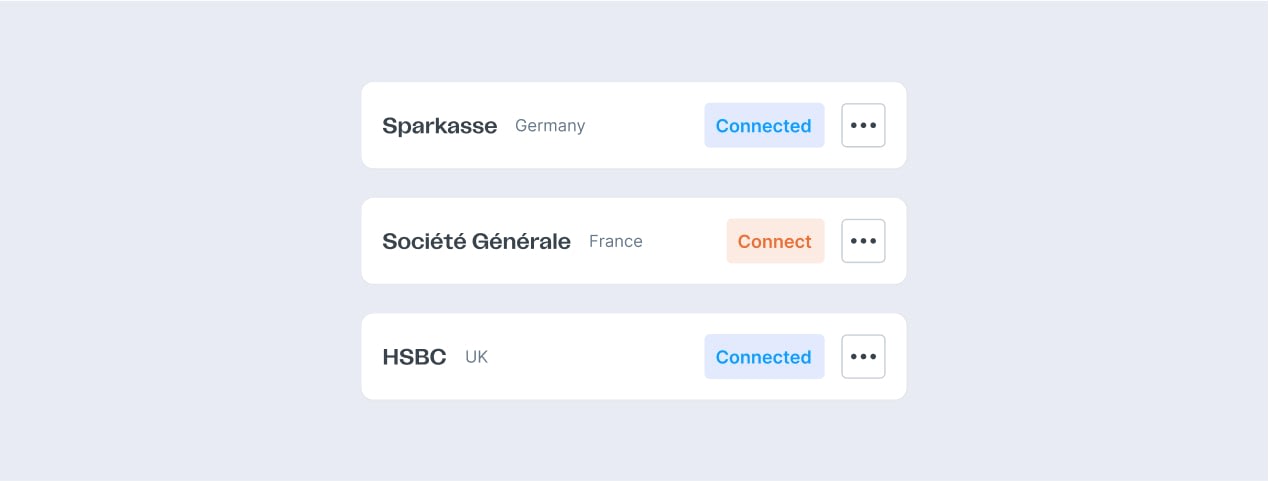

Send secure payments across the globe - directly from Agicap

Easy, secure payments for peace of mind

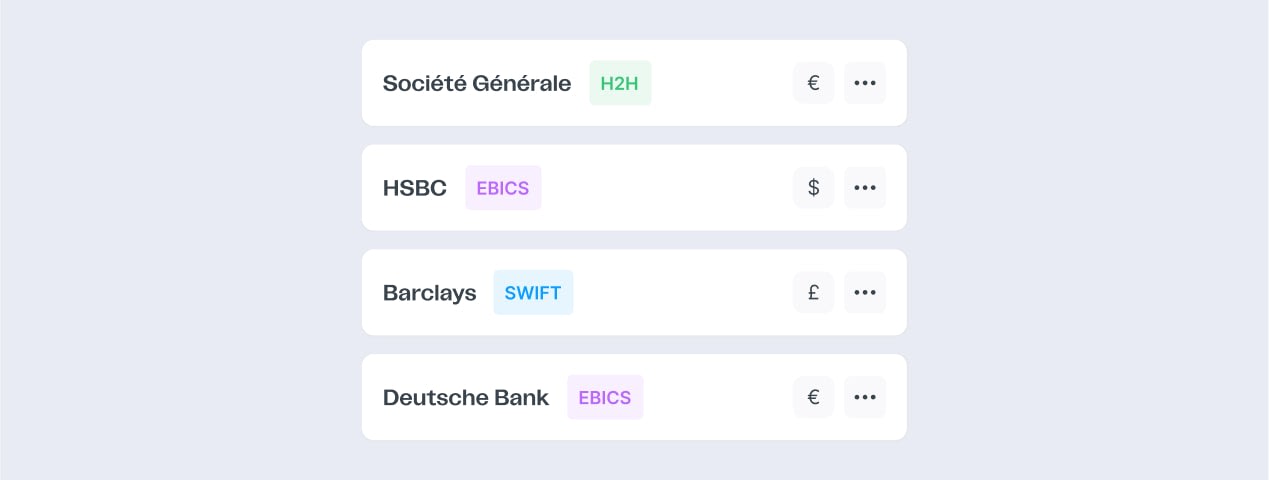

Make payments directly from your bank accounts using the most secure local and international protocols (H2H, SWIFT, BACS, EBICS TS and more).

Beneficiary management

Add and update beneficiaries with full control and security. Get instant notifications whenever there's a change to your records.

Multi-currency support

Generate payment files in the required formats and currencies, fully compliant with ISO 20022 standards.

PSR management

Receive all confirmation levels supported by your bank, directly with Agicap

Monitor budgets and spending. From Your Phone

Close your books faster and more accurately

Pre-accounting information

Automatically tag every expense to the correct chart of accounts based on the supplier or cost centre. Say goodbye to time-consuming manual entry.

Purchase journal generation

Create your purchase journal in the exact format your ERP requires in a few simple clicks.

ERP connectivity

Automatically export entries to your ERP and keep your chart of accounts in sync. No more annoying duplicate updates.

Discover how our platform can power your treasury

Impactful accounts receivable management

Automate customer reminders. Get paid faster and effortless. Improve collection and reduce DSO.

Improved connectivity

Connect all your banks and ERP systems. Benefit from a single source of truth and and easily sync data with your finance tools.

Seamless payments

Make secure payments through one single platform. Execute transactions around the world in all your currencies. Don't juggle different passwords for different bank accounts anymore.

Integrated treasury management

Connect, forecast and optimise your cash flow precisely.

Frequently asked questions

What is an account payable automation software ?

An Account Payable Automation Software streamlines and automates the management of a company’s payables. It reduces manual data entry, improves accuracy, and enhances efficiency by automating invoice processing, approval workflows, and payment execution.

For midmarket companies, it optimizes cash flow, reduces administrative costs, and allows finance teams to focus on strategic financial tasks, ensuring error-free and timely payments

What are the main features of an account payable software ?

The main features of an Account Payable Software include:

Automated invoice capture: Reduces manual data entry and improves processing speed.

Approval workflows: Ensures invoices are reviewed and approved by the right stakeholders.

Payment scheduling: Automates the timing of payments, optimizing cash flow management.

Integration with accounting systems: Seamlessly connects with your financial tools for accurate data syncing.

Real-time visibility: Provides an up-to-date overview of outstanding payables.

Compliance management: Helps ensure adherence to payment terms and regulatory requirements.

Fraud prevention tools: Protects against unauthorized transactions and errors.

Reporting capabilities: Delivers actionable insights to inform financial decision-making.

Audit trails: Tracks all activities for transparency and accountability.

With Agicap's Account Payable solution, these features are seamlessly integrated to enhance efficiency, security, and financial control.

Ebook : Why CFOs struggle with accounts payable management ?

What are the best practices to manage AP with Agicap ?

The best practices for managing Accounts Payable (AP) with Agicap include automating invoice processing to reduce manual data entry and minimize errors. Implementing approval workflows ensures compliance and accuracy before payments are made, while optimizing payment scheduling helps maintain timely payments and manage cash flow effectively.

Monitoring cash flow in real-time provides a clear overview of outstanding payables, and integrating with banking & ERP systems ensures accurate, up-to-date data synchronization. Additionally, maintaining strong controls with fraud prevention and audit trail features safeguards against unauthorized transactions and ensures transparency.

By following these practices, CFOs can ensure efficient, secure, and compliant AP management with Agicap.

Where does accounts payable go?

Accounts Payable (AP) is a liability on the company's balance sheet. Specifically, it is classified as a current liability because it represents amounts the company owes to vendors and suppliers that are due for payment within a year.

When invoices are processed and approved for payment, the amount owed is recorded in the AP account. Once payments are made, the liability is cleared from the balance sheet, and the corresponding cash or bank account is reduced.