Agicap’s Debt Schedule Template: Track Your Maturities and Cash Outflows

Download our free Excel debt tracking template.

This template will help you:

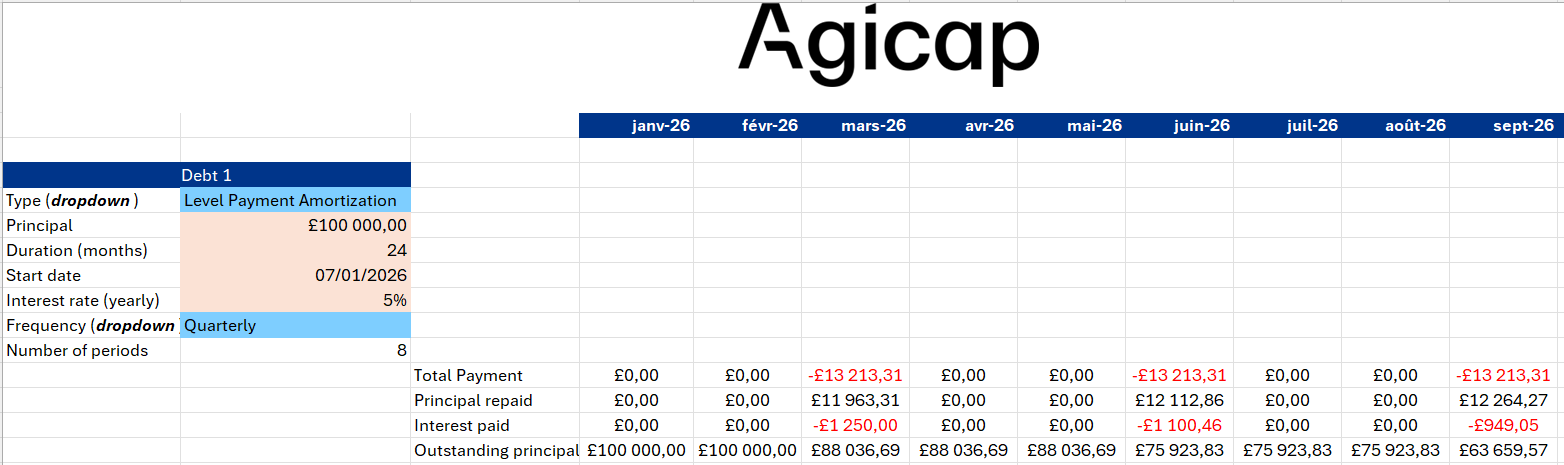

Centralise your debt portfolio: Consolidate all loan (fixed interest rates) schedules and maturities in a single source of truth.

Forecast cash flow impact: Project the liquidity requirements for new financing, including both bullet and amortising loans.

Analyse debt service costs: Automatically calculate the split between interest expense and principal payment.

Monitor outstanding principal: Track your remaining exposure to plan for refinancing or strategic early repayments.

Optimize your funding strategy: Visualize your maturity profile to identify "debt peaks" and provide clean data for your covenant reporting.

Avoid the liquidity trap: Gain full visibility over your interest and principal milestones

As your debt portfolio expands, tracking fragmented maturities becomes a significant operational risk. This complexity scales with varying payment frequencies—monthly, quarterly, or annual—and diverse structures, such as bullet loans or level payment debt.

Agicap centralises all of your debts, automatically projecting interest and principal outflows into your short- and long-term cash forecasts. Unlike Excel spreadsheets, Agicap enables you to track both floating-rate and fixed-rate loans.

Gain full visibility over your debt service here: https://agicap.com/en/products/cash-management/

How to use our Excel template

If you aren't yet using a dedicated management tool, our Excel template provides a professional framework to consolidate your debt deadlines.

Its dynamic structure allows you to centralise existing debt and simulate the liquidity impact of new financing, covering:

- Amortising Loans: Calculate the shifting balance between principal and interest for fixed-payment structures.

- Bullet Loans: Map out periodic interest servicing and prepare for the final principal payment at maturity.

Once your debt service schedule is populated, you can seamlessly integrate these outflows into your cash flow forecast. If you need a starting point for your overall liquidity, download our dedicated forecast template here: https://agicap.com/en/excel/cashflow-forecast-download/

Discover how Sterimed oversaw the repayment of its LBO debt thanks to Agicap

The Sterimed Group is the world leader in medical packaging. It has experienced impressive growth, quadrupling in size in just seven years. Sterimed operates in 120 countries, employs over 1,300 people, and has more than 20 entities and 12 factories worldwide. Sterimed has acquired numerous companies, including EEE (Mexico) and Green Sail (China).

This growth was financed in part by a second leveraged buyout (LBO) in 2019: Sagard acquired Sterimed and its debt was refinanced by Société Générale and Capza.

For the group, anticipating the payment deadlines of this senior debt is crucial. The finance department uses Agicap to integrate payment amounts and due dates into the consolidated cash flow forecast. They manage the cash flow from subsidiaries based on this consolidated forecast and each subsidiary's individual forecast to ensure debt repayment without jeopardising the liquidity of each subsidiary.

Florence Sicault, Operating CFO of the Sterimed Group, explains how the implementation of Agicap has enabled the group to better monitor its debt: https://agicap.com/en/clients/sterimed/