Ebook: How to Choose the Perfect TMS (Treasury Management System)

A practical step-by-step guide for CFOs, treasurers and IT managers who want to make a confident, future-proof TMS choice.

Use this ebook to:

Navigate your selection project with confidence

Compare vendors with a ready-made matrix

Build a compelling business case with real ROI examples

Why This Guide, Now?

The treasury tech landscape is evolving rapidly. CFOs are under pressure to manage risk, reduce costs, and streamline processes. A new-generation Treasury Management System (TMS) can unlock cash visibility and efficiency like never before.

60%

of CFOs say their TMS delivers a high ROI.

Source: Bain survey (2024)

100+ Companies

have already chosen Agicap rather than an enterprise-first TMS

6 years

Average lifecycle of a TMS for mid-sized companies.

Source: Forvis Mazars survey (2025)

What You'll Learn

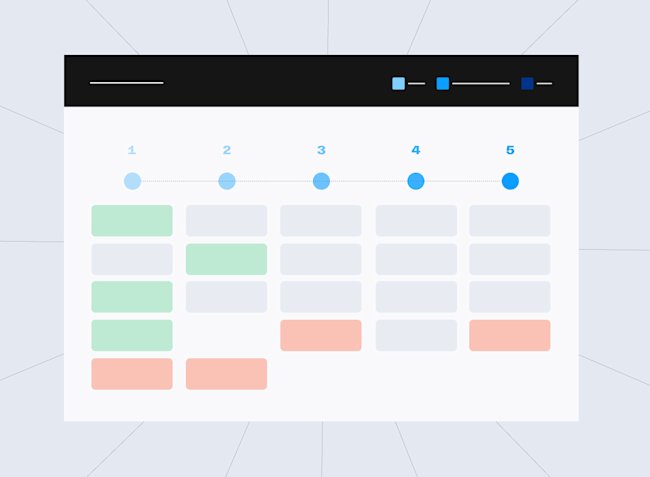

Project Roadmap

This guide walks you through the five key phases of a TMS selection process—from initial scoping and defining project objectives to vendor evaluation and final selection.

You'll learn how to structure your process, assemble the right steering committee, document your internal treasury landscape, and conduct product demos that yield actionable insights.

The methodology presented is flexible enough to accommodate both formal RFPs and leaner selection approaches.

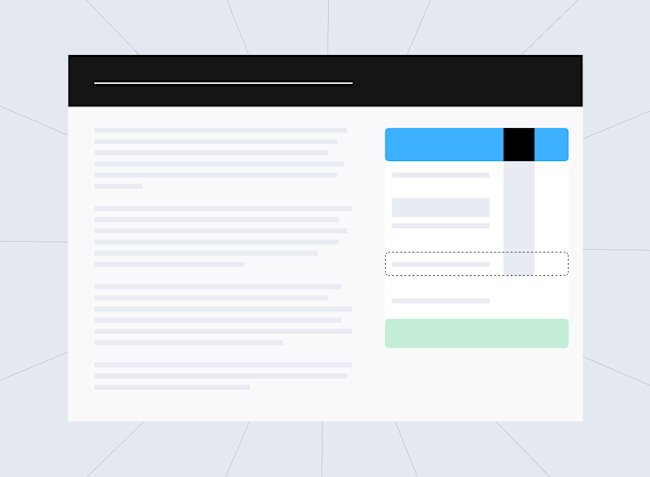

Vendor Scorecard

Gain access to a comprehensive evaluation framework covering functional coverage, technical fit, interoperability, cost structure, vendor viability, and service quality.

The guide details a scoring matrix and RACI model to help your team assess trade-offs and ensure alignment across departments.

You'll also understand how to interpret references and demos, and how to structure due diligence across areas like compliance, integration, and contract terms.

Build the Business Case

Learn how to articulate the strategic and financial rationale for investing in a TMS, using quantified benefits such as reduced overdraft fees, better liquidity allocation, and minimized manual errors.

The ebook includes a real-life case study from an M&A-driven company that used TMS data to reduce external financing costs and justify the project’s ROI.

Finally, a detailed impact-effort matrix helps you prioritize features based on your treasury team's capabilities and constraints.

About Agicap

Agicap is the all-in-one platform for managing your entire cash flow with a single tool: cash management, forecasting, payment execution, supplier management, and collections.

Agicap enables companies to finance their growth by optimizing their working capital requirements and cash flow within groups. The platform improves financial performance by investing excess cash and reducing financial expenses. It boosts team productivity by automating cash management.

More than 8,000 companies in Europe and the United States trust Agicap to make cash flow a performance lever.