[Survey] CFOs' Treasury Priorities 2025-2026

In a context of high uncertainty in 2025, we reached out to CFOs of SMEs and mid-market companies to understand their treasury management priorities.

Our study answers the following questions:

➡️ What are the main priorities of finance departments regarding their cash flow and its use?

➡️ What levers of action are CFOs prioritizing to address the uncertainties of the current environment?

➡️ What obstacles limit finance departments' ability to act?

Download the survey's results by completing this form ➡️

Methodology: we surveyed 500+ CFOs of SMEs and mid-market businesses via the independent research institute Innofact.

A detailed peer benchmarking study to help you evaluate your strategy.

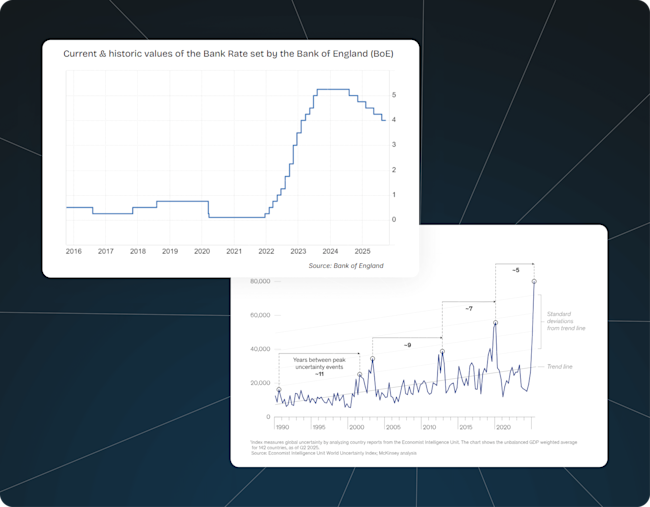

The new economic climate is forcing finance departments to refocus their different strategic initiatives.

The often small size of finance departments of SMEs and mid-market companies forces CFOs to make choices to preserve their teams' bandwidth.

Analyze the main priorities chosen by your peers to ensure you have no blind spots in your strategy.

Study includes an analysis of the current context to help you understand the choices of the surveyed finance departments

Our study puts the choices of the 500+ finance departments surveyed into perspective, taking into account the new constraints of the current environment, as well as their company's size, sector, tools, and revenue and profitability projections.

This interpretation helps you identify the priorities of companies similar to yours and understand the priorities they have prioritized to the detriment of other strategic initiatives.

A study presented to 600+ finance departments

Our survey on treasury priorities was presented to several hundred CFOs at Agicap Days events across Europe.

It provides a basis for reflection to refine your finance department's roadmap, priorities, processes, and tools.

About Agicap

Agicap is the all-in-one platform for managing your entire cash flow with a single tool: cash management, forecasting, payment execution, supplier management, and collections.

Agicap enables companies to finance their growth by optimizing their working capital requirements and cash flow within groups. The platform improves financial performance by investing excess cash and reducing financial expenses. It boosts team productivity by automating cash management.

More than 8,000 companies in Europe and the United States trust Agicap to make cash flow a performance lever.