Unlocking the Power of AI in Finance

Key Insights from the Agicap Webinar “How to Prompt AI for Finance”

Introduction

In a rapidly evolving financial landscape, the integration of artificial intelligence (AI) into finance functions is no longer a distant prospect but a present-day reality. This was the central theme of a recent Agicap webinar to explore how AI, and more specifically, prompt engineering, can transform the daily operations of CFOs and treasurers in mid-sized companies.

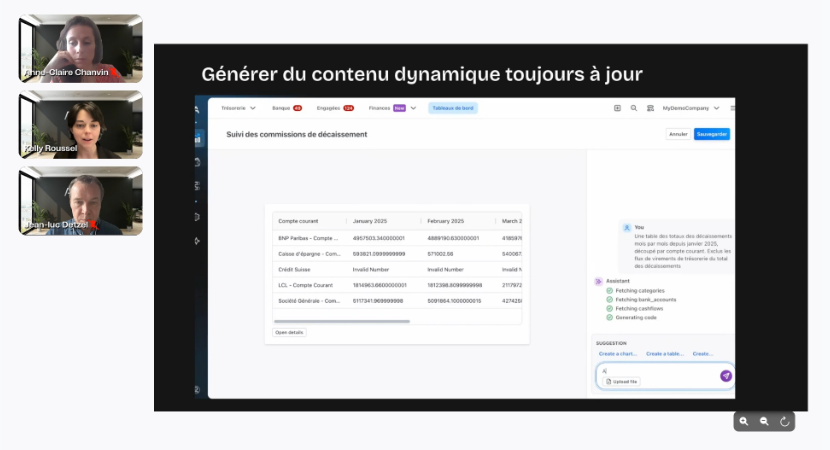

The webinar brought together two expert speakers: Anne-Claire Chanvin, part-time CFO and founder of Finup 360, and Kelly Roussel, AI engineer at Agicap. Anne-Claire Chanvin has more than 10 years of experience in finance, having worked within major companies such as PwC and L’Oréal, and now specializes in supporting companies with financial management and AI training. Kelly Roussel, meanwhile, is part of Agicap’s dedicated Lab team, focusing on generative AI and its integration into Agicap’s solutions to deliver tangible value for finance teams.

This article distills the key learnings from the webinar, offering a structured overview of best practices in prompt engineering, security considerations, practical use cases, and the latest innovations in AI-powered financial tools.

1. Mastering Prompt Engineering in Finance

1.1. The Importance of Structured Prompting to overcome common challenges

A central theme of the webinar was the critical role of well-structured prompts in leveraging AI effectively. Anne-Claire Chanvin emphasized that “everyone can write a prompt, but there is a methodology to follow to achieve good results.” She introduced the SCRIPT method—Situation, Context, Role, Instruction, Precision, and Tone—as a practical framework for crafting effective prompts.

The webinar’s interactive chat revealed that many finance professionals face different challenges when using AI tool. Doubts regarding the reliability of the outputs given by AI tools were a hot topic but another significant challenge was the translation of complex, finance-specific requirements into prompts that AI can understand and process effectively. Many professionals struggle to articulate their needs in a way that yields actionable results.

The SCRIPT method (Situation, Context, Role, Instruction, Precision, Tone) solves this issue. By breaking down requests into clear, detailed components, finance teams can bridge the gap between their domain expertise and the AI’s capabilities. For example, when asking an AI to identify financial risks associated with rapid growth, it is essential to provide detailed context (such as the business model and relevant KPIs), clear instructions (e.g., list five major risks), and specify the desired output format. This approach ensures that the AI delivers relevant, actionable, and context-aware responses, much like instructing a new team member.

Uncertainty about which tasks are appropriate for AI was also a common barrier. The webinar encouraged participants to start with “quick wins”—tasks that are manual, repetitive, error-prone, and easily automatable. Examples include summarizing documents, drafting standard emails, or generating routine reports. By beginning with these low-risk applications, finance teams can build familiarity and confidence in AI tools, gradually expanding their use to more complex analyses and strategic functions as their expertise grows.

1.2. Iteration and Continuous Improvement

A key takeaway was that prompt engineering is an iterative process. As Anne-Claire Chanvin noted, “Having a good prompt is not always enough; you need to iterate.” Just as you would refine instructions to a new colleague, prompts should be tested, reviewed, and adjusted based on the AI’s output. Advanced techniques such as breaking down complex queries into sub-questions (chain-of-thought prompting) and encouraging the AI to self-evaluate its responses can further enhance accuracy and relevance.

1.3. Practical Examples

The session also included practical demonstrations to showcase the precision of the outputs generated by AI.

One of the first examples focused on communication—a daily challenge for any finance department. Using a well-structured prompt, the AI was tasked with drafting an internal email to inform a finance team about the migration to Agicap for treasury management. By specifying the role (“Head of Finance”), the context (a team of 15, including two treasurers), the instruction (draft an informative and warm email), and the desired details (highlighting the main advantages and announcing a demo session), the AI generated a message that was not only clear and professional but also tailored to the team’s specific situation. This example demonstrated how AI can save time on routine communications while ensuring consistency and clarity.

Another practical use case addressed the challenge of synthesizing complex regulatory documents. The speakers showcased how AI can be prompted to summarize a 30-page IFRS standard into five key objectives, using technical language appropriate for a chief accountant. The AI was further instructed to present a comparative table of changes between the old and new standards, illustrating its ability to process and reformat large volumes of information into actionable insights. This capability is particularly valuable for finance teams who must stay abreast of evolving regulations and communicate their implications efficiently across the organization.

2. Ensuring Security and Data Confidentiality

2.1. Understanding the Risks

Security and confidentiality are paramount when integrating AI into finance. The speakers addressed the risks of errors, hallucinations, and data exposure inherent in generative AI models. As Anne-Claire Chanvin explained, “It is important to always have a human review and to be skeptical, just as you would with a new employee.”

The webinar outlined several best practices for safeguarding sensitive financial data:

- •

Use enterprise-grade AI tools (e.g., Copilot within Microsoft or Gemini within Google environments) that adhere to corporate data protection standards.

- •

Disable data training on your inputs when using non-enterprise AI tools.

- •

Anonymize data where possible, especially when using external or free AI services.

- •

Limit the sharing of sensitive information and use generic examples for brainstorming or process automation.

- •

Establish and communicate clear internal policies on AI usage, and ensure all team members are trained and aware of these guidelines.

2.2. The Role of Human Oversight

Despite advances in AI, human oversight remains essential. Finance professionals must validate AI outputs, especially when dealing with regulatory or high-stakes financial decisions. This dual approach—leveraging AI for efficiency while maintaining rigorous human control—ensures both innovation and compliance.

First, it acts as a safeguard against errors and “hallucinations”—instances where AI generates plausible but incorrect or misleading information. Even with well-structured prompts and advanced models, AI can misinterpret context, overlook nuances, or apply logic that does not align with company-specific policies or regulatory requirements. A finance professional’s review ensures that outputs are not only technically correct but also contextually appropriate and aligned with the organization’s objectives.

Second, human validation is crucial for compliance and auditability. Financial reporting, regulatory submissions, and internal controls demand a level of scrutiny and documentation that AI alone cannot guarantee. By systematically reviewing AI-generated analyses, reports, or recommendations, finance teams can ensure that all outputs meet internal standards and external regulations, reducing the risk of compliance breaches or reputational damage.

Moreover, human oversight enables continuous improvement of AI usage. By analyzing where AI outputs fall short or require adjustment, finance professionals can refine their prompts, provide better context, and develop a deeper understanding of how to leverage AI most effectively. This iterative process not only enhances the quality of results but also builds organizational knowledge and confidence in AI tools.

3. Real-World Use Cases for AI in Finance

3.1. Communication and Documentation

AI can significantly enhance communication within finance teams. Use cases include drafting memos, procedures, and reports, responding to emails, translating documents, and summarizing lengthy contracts. Tools like Copilot and Gemini can automate these tasks, freeing up valuable time for higher-value activities.

3.2. Analysis and Strategic Decision-Making

AI supports advanced analysis and strategic planning, from brainstorming investment decisions to modeling financial scenarios. For example, AI can help compare leasing versus purchasing options, identify revenue growth opportunities, or model funding plans for new projects. The integration of Python code within Excel for forecasting and modeling is a promising development for finance professionals.

3.3. Training, Support, and Process Automation

AI can serve as a virtual assistant for training and support, guiding users through unfamiliar software or processes, and even helping improve language skills for international finance interactions. Additionally, AI can automate routine tasks such as creating alerts in spreadsheets, optimizing client follow-up processes, generating board slides, and building checklists for monthly closing or audits.

3.4. Enhanced Reporting and Dashboards

Kelly Roussel, AI engineer at Agicap, showcased the latest AI-powered dashboard features in Agicap. “The idea is to enrich our existing dashboard feature with AI, allowing users to create graphs and tables directly through natural language,” she explained. This innovation enables finance teams to generate custom reports and visualizations effortlessly, with the AI assistant accessing all relevant data and executing complex calculations on demand.

Conclusion

The Agicap webinar provided a comprehensive overview of how AI can be effectively and securely integrated into finance functions. Key takeaways include:

- •

The importance of structured, context-rich prompts for maximizing AI effectiveness.

- •

The necessity of iterative refinement and human oversight.

- •

Best practices for data security and confidentiality.

- •

A wide range of practical use cases, from communication to advanced analytics and automation.

- •

Agicap’s commitment to innovation, with new AI-powered features designed to simplify and enhance financial management.

Finance leaders are encouraged to:

- •

Review and update internal AI usage policies.

- •

Train teams on prompt engineering and data protection.

- •

Experiment with AI-driven tools for routine and strategic tasks.

The integration of AI into finance is not just a technological upgrade—it is a strategic imperative for mid-sized companies seeking to remain competitive and agile. As demonstrated in the Agicap webinar, the right approach to prompt engineering, security, and practical application can unlock significant value for finance teams. As explained by finance executives during the panel discussion “The Treasury Department in 2030” hosted by Agicap, prompting AI is now an essential skill for finance teams — just like mastering Excel.

We invite you to test Agicap’s AI-powered solutions to stay ahead in the evolving world of financial management. As explained during the webinar, “This is a topic that evolves daily… what we presented today may be completely different in six months.”

Link to the webinar replay: https://agicap.ondemand.goldcast.io/on-demand/96c7fef6-8624-4c91-a575-4f7c3b3feec5 (French only)