Treasury Challenges and Priorities: What to Expect in the Next 12 to 24 Months According to European Treasurers

Corporate treasury management is continuously evolving, influences by economic crises, technological innovations, and new market demands. The EACT 2024 study, conducted with the support of PwC, provides a clear overview of the main priorities and challenges that European corporate treasurers will face in the coming months. Here is an overview of the key topics that emerged.

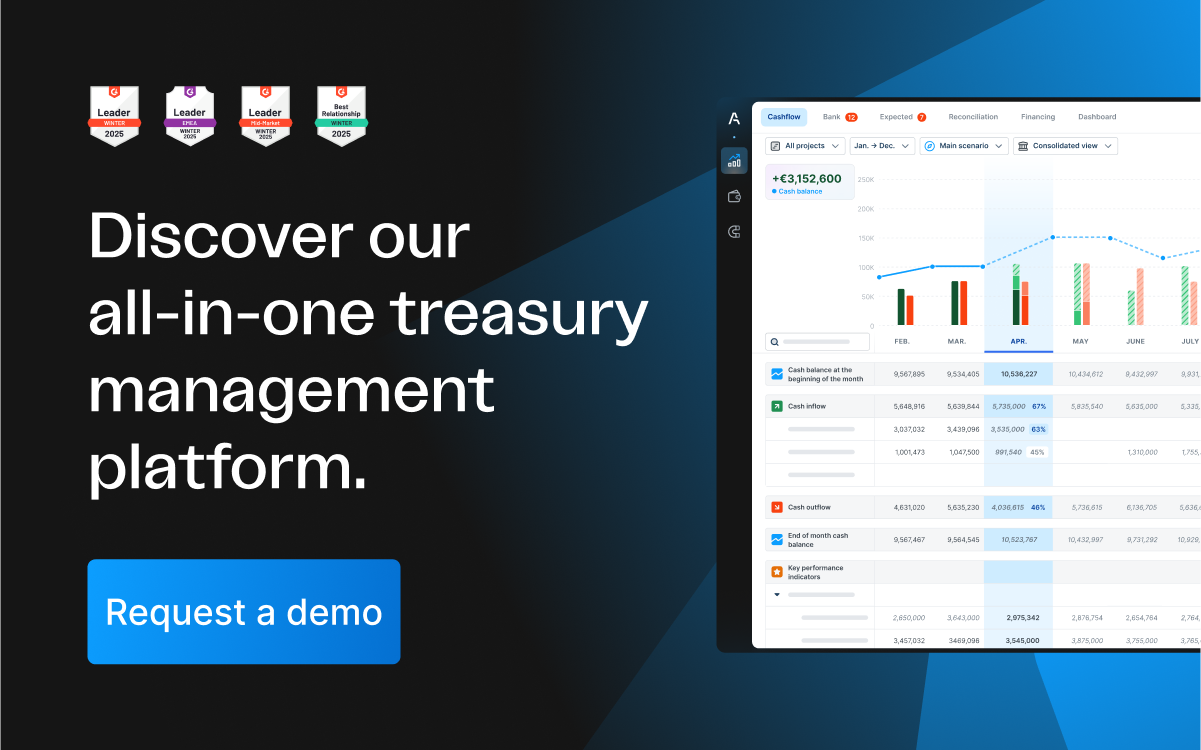

Corporate treasury management is undergoing a significant transformation. According to this year’s study by EACT - The European Association of Corporate Treasurers (Agicap is a partner of AFTE in France and if AITI in Italy), major European companies are redefining their priorities due to several key factors: the rapid rise in interest rates, banking crises, and an unstable geopolitical landscape.

In this context, treasurers are facing complex challenges such as long-term funding, accurate cash flow management, and optimizing capital structure. At the same time, the drive toward digitalisation and automation of financial processes has become essential to ensure efficiency and resilience. Additionally, difficulties related to process standardisation, fragmented IT systems, and a shortage of specialised resources persist.

In this article, we will explore the findings of the research, including emerging priorities for treasurers, technological innovations shaping the future of treasury, and best practices for addressing the challenges of centralisation and working capital management. Additionally, we will analyse the treasury’s growing role in the corporate ESG agenda and the importance of adapting to new financial regulations, before closing with some notes on the management of excess cash.

What are the main priorities for treasurers?

The research shows that treasurers’ priorities vary greatly due to the high degree of customisation in treasury activities and processes, as well as the complexity of the challenges each company faces.

11% of the responses indicate that long-term funding ranks first among these priorities highlighted by the treasurers surveyed. After a year marked by rapid interest rate hikes and banking crises, companies are focused on ensuring their financial stability through secure and diversified financing. In this context, the Capital Market Union (CMU) project takes on strategic importance, offering alternative sources of financing to traditional bank loans.

In second place are cash flow forecasts (which held the top spot last year), remaining a crucial priority. The ability to accurately predict cash flows is essential for maintaining corporate liquidity and responding promptly to crises. However, many treasurers struggle to obtain reliable forecasts due to the continued prevalence of manual processes. We also discussed this in our latest research “The 2025 State of Cash Flow Forecast Challenges in Mid-Market Companies”

Third place among the priorities is occupied by capital structure. Companies are reassessing their mix of debt and equity to optimise the Weighted Average Cost of Capital (WACC) and improve financial resilience. In an environment of economic uncertainty, maximising capital efficiency is essential to support long-term growth.

Real-Time Treasury: Immediate and Reliable Data as the Foundation for Decision-Making

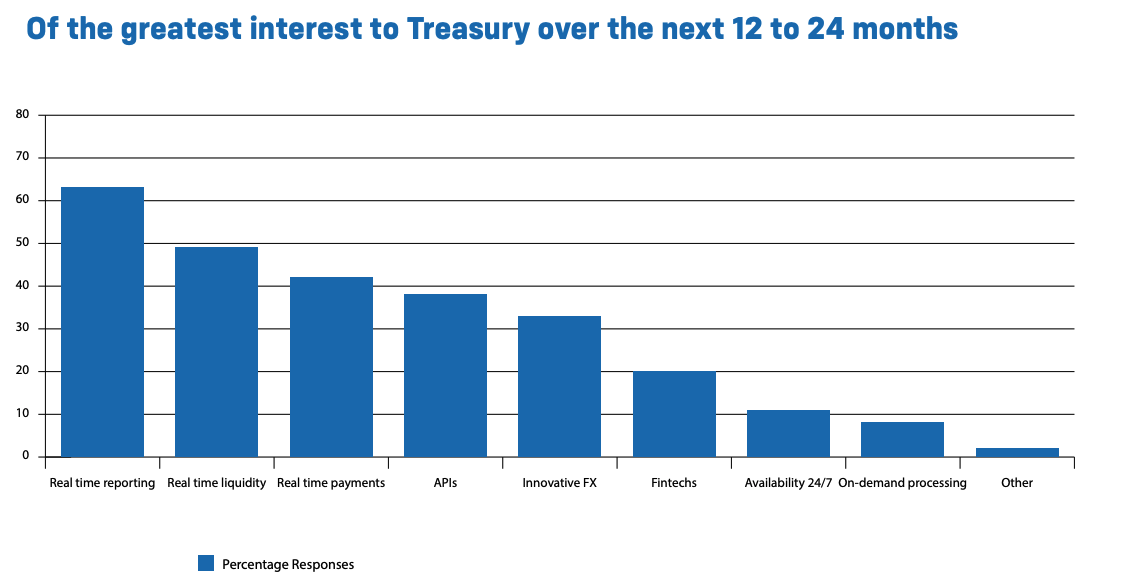

The research also reveals that, over the next 12 to 24 months, access to real-time information will be one of the main priorities for treasurers. The need for immediate data is driven by recent crises and the increasing importance of responding quickly to changes, especially for B2C companies and industries that require instant operational decisions.

Among the key areas of interest identified in the study are reporting and dashboard creation, followed by liquidity and payments. These are complemented by the adoption of APIs, foreign exchange management automation (FX Automation), and FinTech solutions.

In this scenario, FinTechs play a crucial role by offering innovative solutions that integrate traditional systems and simplify process automation. Having treasury management tools with advanced, customisable integrated dashboard features provides a real competitive advantage.

On the banking connectivity front, adopting tools capable of managing protocols like SWIFT — which provides real-time updates, unlike EBICS, which updates only once a day — is a strategic element.

Implementing real-time treasury management is therefore essential to accelerating processes, improving efficiency, and ensuring greater resilience in the face of current economic challenges.

Treasury Digitalisation: Current Tools, Automation, and Future Technologies

In recent years, the digitalisation of treasury and the automation of processes have become strategic priorities. Tools such as Treasury Management Systems (TMS) enable the integration of data from various sources (ERP systems, bank accounts, and accounting software) to provide real-time information. Additionally, the adoption of technologies like Robotics Process Automation (RPA) and, as noted, APIs, is facilitating the automation of daily tasks and enhancing operational efficiency.

When it comes to emerging technologies such as cryptocurrencies and Artificial Intelligence (AI), there is interest, but they are not yet a priority. The lack of standardised data and adequate infrastructure hinders the widespread adoption of these solutions. It appears that treasurers have other technical priorities to address before considering or being able to utilise these new technologies.

The Challenges of Centralisation

An important insight from the EACT 2024 study is that 20.4% of respondents state that difficulties in standardising processes and weak internal controls are the main obstacles to further centralising treasury activities. Additionally, the lack of adequate budgets and specialised human resources represents another barrier: treasurers often need to balance the drive for innovation with the limitations of available resources.

Last but not least, the fragmentation of IT systems complicates the management of financial data and increases the risk of fraud and cyberattacks. The need to consolidate and integrate existing systems is crucial for improving cash flow forecasting and liquidity management.

Working Capital Management: Tools and Best Practices

Working capital management remains a central focus, with CFOs and treasurers dedicated to optimising payment and collection processes to ensure efficient financial management. The treasury plays a crucial role in working capital management, though responsibilities can vary. Previous studies conducted by EACT revealed that over 50% of treasurers reported directly influencing working capital management, while only 20% had direct responsibility. Another 20% were partially involved or had no involvement at all.

Working capital optimisation projects are complex, as they involve multiple departments within the company. To be successful, strong support from CFOs, the appointment of dedicated Project Managers, and the commitment of all stakeholders are essential.

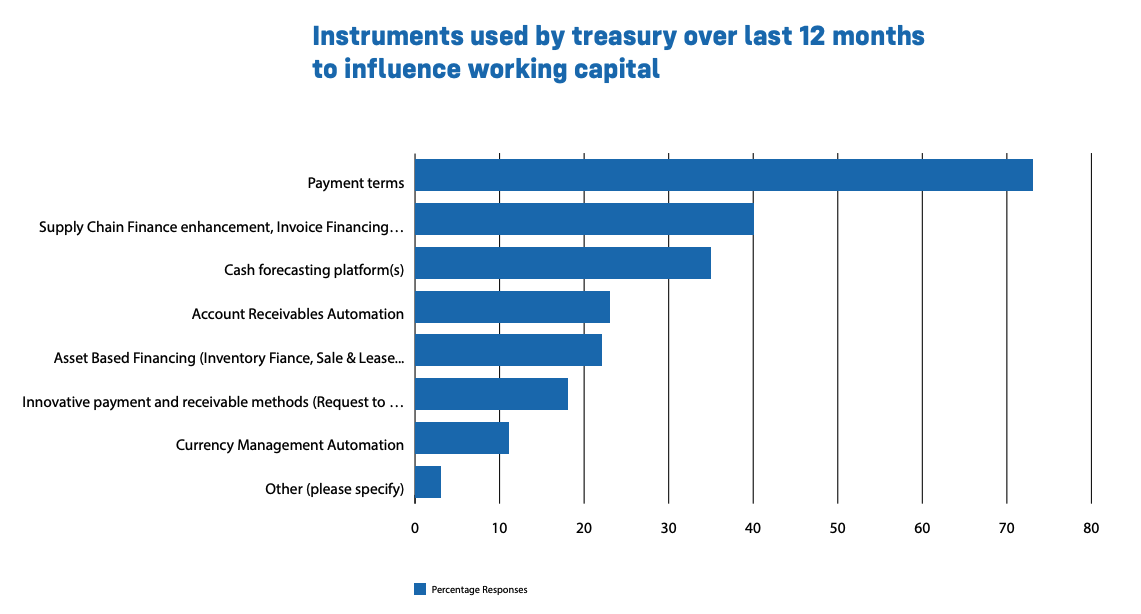

The most commonly used tools to improve working capital management include managing payment terms, Supply Chain Finance enhancement, cash flow forecasting platforms, and automating accounts receivable management.

The pandemic and subsequent crises, such as the war in Ukraine and Gaza, have underscored the importance of returning to the fundamentals of working capital management. CFOs and treasurers are therefore tasked with making the best use of available financial tools to optimise cash flows and improve operational efficiency.

The Impact of New Financial Regulations on Treasury

The number of financial regulations currently under review or evaluation is exceptionally high and could have a significant impact on treasurers. Among the key regulations identified as priorities are (the percentage of respondents has been included in parentheses):

- The ESG report (55%): The need to comply with new environmental, social, and governance reporting standards is considered the top priority by treasurers.

- ISO 20022 (42%): The adoption of this new standard for international payments requires significant adjustments to treasury systems.

- EMIR (EMIR Refit) review (37%): Changes to regulations on derivatives and reporting obligations introduce new compliance requirements.

- MiFID/R review (25%): The update to financial market directives impacts corporate operations and investments.

- PSD2 review (24%): Changes to the payment services directive will affect payment and collection processes.

- The Money Market Funds Reform (22%): The update of regulations on money market funds may impact treasury investment strategies.

The Role of Treasury in the ESG Agenda

More and more companies are involving the treasury in sustainability (ESG) initiatives.

Among the most common actions are issuing green bonds, investing in sustainable financial instruments, and adopting automated processes to reduce environmental impact. Treasurers can also support the ESG agenda by introducing specific KPIs, revising processes, and implementing further automation and controls. Other significant steps include reducing business travel and promoting remote work, actions that help lower CO₂ emissions.

Despite growing interest, the ESG topic has not yet reached full development and maturity. Many treasurers appear to underestimate the impact they could have on these initiatives. It is surprising to note that 20% of respondents state they are not involved in ESG processes at all.

Actively involving the treasury in these initiatives can not only enhance corporate sustainability but also strengthen internal governance and meet the increasing expectations of stakeholders.

Excess Cash: How Do Treasurers Invest It?

The final aspect analysed by the EACT 2024 study is the management of excess cash. The main finding is that 56% of treasurers report having liquidity available for short-term investment.

When it comes to investment methods, traditional bank deposits are still the most commonly used, followed by money market funds and savings accounts. Surprisingly, secured deposits and tri-party repos, which help manage counterparty risk, are rarely utilised. This gap has become more evident after the banking crisis of spring 2023.

Conclusion

The EACT 2024 survey highlights that treasurers are experiencing a period of profound transformation. The need to secure long-term funding, improve cash flow forecasting, and adopt new technologies is more urgent than ever. At the same time, challenges related to process standardisation, fragmented IT systems, and human resource management demand a strategic and proactive approach.

Investing in digitalisation, automating processes, and collaborating closely with other business functions will be essential to tackle future challenges and ensure increasingly efficient and resilient treasury management.

Read the full research here.