How to better manage payments with banking connectivity automation

There is nothing more valuable to finance teams than having clarity on the cash flow situation of a company at any given time. In order to keep the cash flow within the company healthy, it is crucial to manage payments effectively and without delays or other hiccups. Only if payments are made on time, in the correct amounts and according to the cash flow forecast, businesses can avoid cash flow issues, which in the worst case can lead to insolvency or bankruptcy. Allocating funds efficiently, covering expenses, paying employees and investing in growth opportunities – all of these measures can only be done effectively, if payments are managed in a swift and accurate way. Which is why the value of a dedicated banking connectivity solution as a prerequisite to handling payments has grown in relevance.

Managing Payments from ERPs Can Be Insufficient

The management of payments to vendors is usually processed through a company's ERP system. This involves many steps, including setting up vendor master data, creating purchase orders, recording goods receipt, processing invoices, and obtaining necessary approvals. The ERP system automatically matches invoices with corresponding purchase orders and goods receipts for accuracy. Depending on the company's internal controls, invoices may require approval before payment can be made. Once approved, the ERP system generates a payment proposal, which is reviewed and authorised before executing the payment through methods such as electronic funds transfer, wire transfer, or check.

The ERP records payment details, updates vendor account balances, and reconciles payments with corresponding invoices. It also provides various reports and analytics related to vendor payments, like payment history, ageing reports, and cash flow forecasts, helping the company monitor vendor relationships and optimise cash management. The specific steps and features may vary depending on the ERP system used and the company's unique requirements. Also, if the company has to deal with several banks, and is continually growing, the complexity of managing payments within an ERP will increase immensely. There is a need for better banking communication.

Improve Banking Communication for Payments

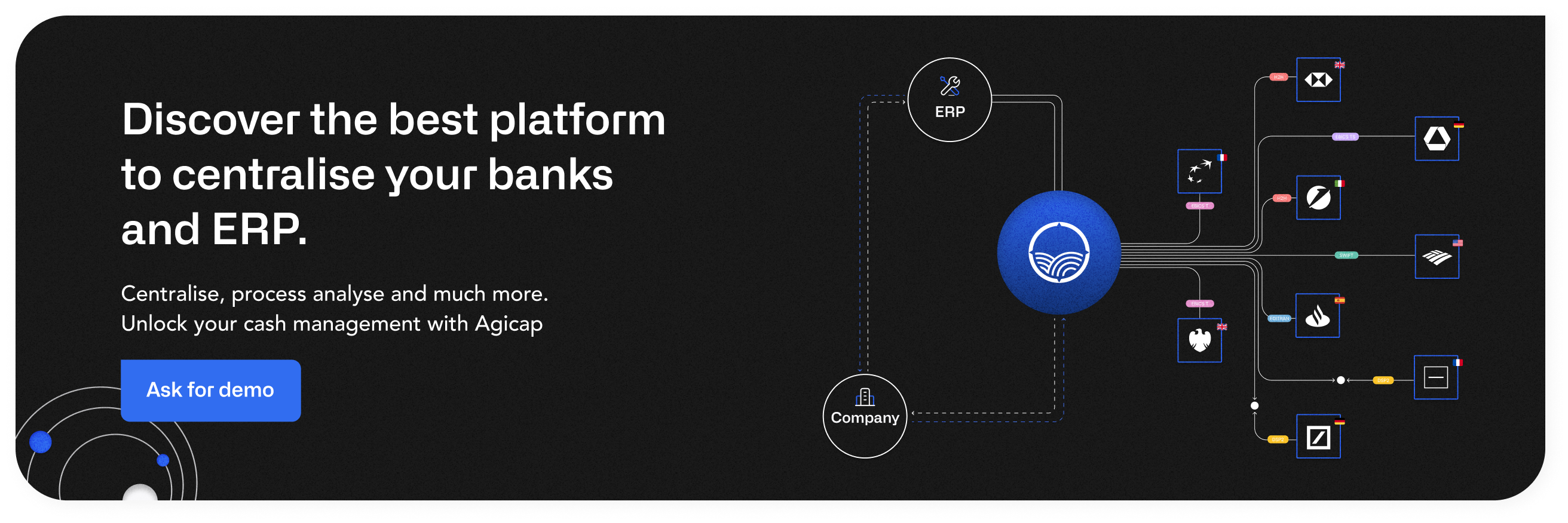

A banking connectivity solution serves as a tool for streamlining the transmission of payment orders, which are generated as files within an ERP system, to many banks. Instead of managing transactions on an individual basis for each bank account, this approach allows for the consolidation of payments from multiple accounts, enabling the execution of transactions from a multi-banking platform. Also, it facilitates swift reconciliation for matching purposes, thereby helping to prevent erroneous or fraudulent payments.

By integrating a banking connectivity solution into your financial software ecosystem, you can significantly enhance visibility, stability, and security in payment processes and cash insights. To fully harness the potential of this technology, it is crucial to establish a unified workflow for managing banking connectivity.

Achieving this level of integration involves funnelling all outbound payments, incoming statements, and reports across various group and entity levels, countries, banks, bank accounts, and the financial tech stack through a single solution capable of addressing global requirements. This comprehensive approach ensures that your organisation can effectively manage its banking connectivity needs, regardless of its size or complexity.

The advantages of payments with automated banking connectivity are:

- Companies with a high volume of transactions would benefit from the capability to process bulk payments in a single transaction to save time.

- Cross-border payments are sometimes facilitated by including currency conversion and compliance with international regulations.

- Payment visibility is generally enhanced by providing the status of payments, including confirmation of successful transactions and alerts for any payment failures or delays.

- Payment security is guaranteed to protect sensitive payment data and prevent fraud or unauthorised access.

- Last but not least, payment reconciliation with invoices and other financial records can be a real time-saver to ensure accuracy and efficiency in the accounting process

How a Banking Connectivity Solution Improves Your Payment Management

A banking connectivity-as-a-service like Agicap offers you one interface to orchestrate all your payments to streamline processes and avoid silos, while keeping control and improving security. You can use the tool to choose among different payment methods (EBICS TS, xml, pivot account) based on your constraints and preferences, and validate multi-bank payments directly from the Agicap interface via double validation. At the same time, you can ensure the security of your transactions with customisable validation rules and personalised user rights. Best of all, you can actively leverage cash visibility and control the impact of your supplier accounts on your company’s cash position by optimising payment dates down to the day.

Over 7.000 companies already use Agicap as a banking connectivity as-a-service, including many more features for cash flow management and related financial processes.

Try Agicap in a free personalized demo !