How to Implement an ERP Faster with Banking Connectivity as a Service

Implementing an ERP (Enterprise Resource Planning) system in your company is by default a complex and time-consuming project that can last up to one year or even longer, depending on the size and scope of your organisation. One critical aspect of this process is establishing banking connectivity, which is essential for efficient financial management and seamless integration of accounting functions within the ERP system. But there is a way to speed up this process by having an advanced banking connectivity solution in place. It not only helps in setting up a new ERP system, but also in transitioning from an old ERP to a new one.

What are the basic steps for ERP implementation?

The ERP implementation process is designed to streamline business processes, improve efficiency, and provide valuable insights. The first step involves assessing current systems to identify areas for improvement and gaps in functionality that an ERP system can address. This includes reviewing financial, manufacturing, inventory, sales, and customer relationship management (CRM) systems. Key areas to focus on include financial systems, manufacturing and production processes, sales and marketing systems, data management and reporting, IT infrastructure and software, business processes, and user experience.

After assessing current systems, the next step is to define the scope and goals of the ERP implementation project. This involves determining the specific tasks and processes the ERP system will handle, the data that needs to be integrated, and the business objectives the system will support. Defining the scope and goals helps create a clear roadmap for the implementation process and allows for effective communication of objectives and expected outcomes to stakeholders. Setting specific goals and objectives also enables the measurement of project success upon completion.

Once the scope and goals are defined, the next step is to choose an appropriate ERP software solution. This involves researching and evaluating different ERP software options to determine which one best aligns with business requirements and objectives. Factors to consider when selecting an ERP solution include functional requirements, integration with current systems, reporting and analytics capabilities, scalability, vendor reputation, total cost of ownership, and implementation timeframe. Consulting with an ERP expert or professional services firm can help guide the selection process.

Where Banking Connectivity Helps to Accelerate

The final steps in the ERP implementation process involve configuring the chosen ERP system, preparing and migrating data, testing the system, training employees, implementing the system fully, and providing ongoing maintenance and support. Configuring the system includes setting up the organisational structure, customising the software, defining user access control, and integrating with other systems. Data migration requires cleaning, validating, and transforming existing data for compatibility with the new system. And this is where banking connectivity as a service plays a crucial role.

Banking connectivity enables the ERP system to receive bank statements automatically, which in turn facilitates various accounting actions such as generating journal entries and performing bank reconciliations. This ensures that the organisation's financial records are accurate, up-to-date, and compliant with regulatory requirements.

There are two scenarios to consider when implementing an ERP system in relation to banking connectivity:

-

If your company already uses a banking connectivity as a service before implementing an ERP system, you can potentially reduce the time and effort required for the banking connectivity phase during the ERP implementation. By leveraging the existing banking connections in the banking connectivity solution, you can seamlessly deliver the necessary financial data to the new ERP system. This not only saves time but also ensures a smooth transition and minimises disruptions to your financial operations.

-

If your company does not have a banking connectivity as a service yet and is considering switching from one ERP system to another, implementing the solution can be a strategic move to streamline the transition process. By shifting the banking connectivity from the old ERP system to the banking connectivity solution, you can save time and resources during the transition. When you begin implementing the new ERP system, you will already have the banking connectivity established through the banking connectivity software, effectively putting you back in the first scenario.

Final steps for implementing an ERP

Incorporating a banking connectivity solution into your organisation's financial management processes can significantly enhance the efficiency of implementing a new ERP system. By simplifying the banking connectivity aspect, the banking connectivity solution allows your organisation to focus on other critical aspects of the ERP implementation, ultimately contributing to the overall success of the project and your organisation's growth.

Testing the system ensures functionality and data accuracy, while employee training ensures proper usage. Once the system is fully implemented, it is crucial to establish a process for ongoing maintenance and support, including regular maintenance checks, software upgrades, and troubleshooting.

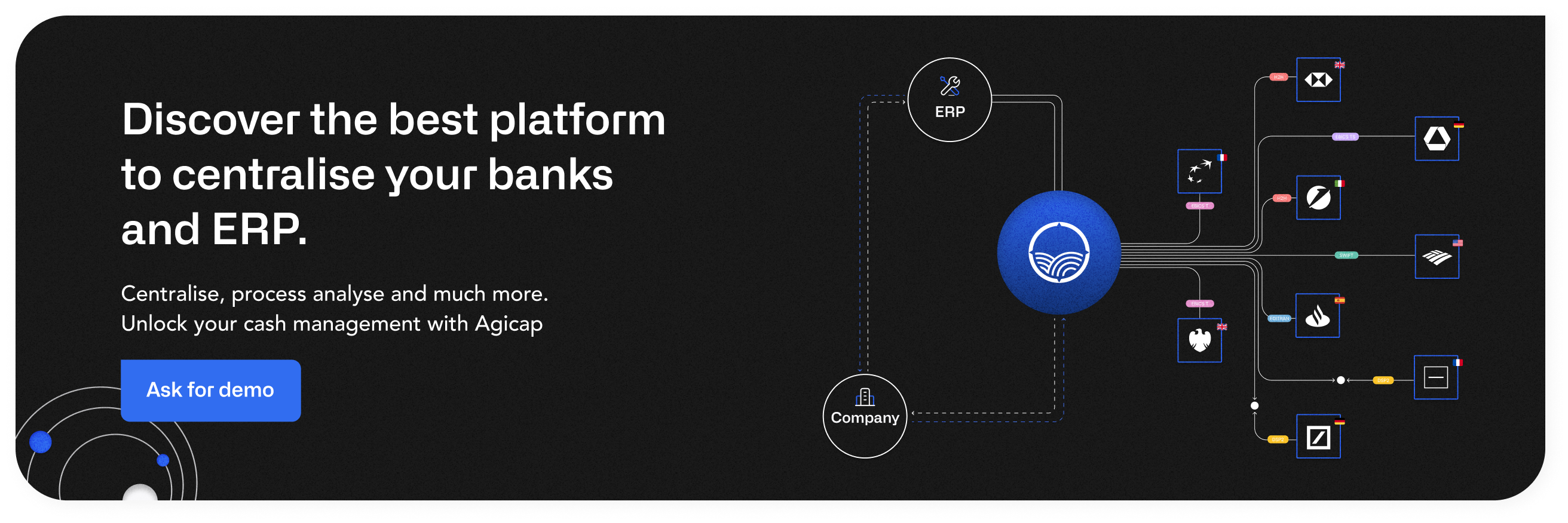

Over 7.000 companies already use Agicap as a banking connectivity as-a-service, including many more features for cash flow management and related financial processes. Try Agicap in a free personalized demo !