How to Build the Optimal Finance Team for Treasury Management

We conducted an analysis of over 5,000 client companies and interviewed several CFOs to help you optimize the structure of your Finance team and streamline its treasury management tasks.

Key challenges CFOs face when structuring their team and the factors that shape its organization

The structure of a finance team reflects the complexity of the company, its business model, and its cultural choices. When focusing on cash management, several key factors influence the team’s size and the need for specialized roles:

- Volume of transactions (payments, client invoices)

- Working capital requirements (WCR) and their volatility

- Number of subsidiaries and the degree of centralization or decentralization in treasury management

- Number of banks and bank accounts, as well as the need for cash pooling or intragroup funding

- Capital structure and financing (e.g., public vs. private, IPO preparation, significant debt levels), which impact reporting requirements and their nature

- Exposure to foreign exchange (FX) or commodity risks

- The company’s finance IT infrastructure

Adapting the Finance Team to the Size of the Company: At What Thresholds Does the Finance Department Take on New Tasks and Which Roles Emerge?

As businesses grow, each stage of development brings distinct challenges that demand specific roles and skills to address them effectively. To explore this in depth, we focused our research on companies with revenues between $10M and $200M, while also offering insights into the $1M–$10M range.

Our study identifies the optimal organizational structure for five revenue thresholds:

- $1m-10m

- $10m-25m

- $25m-50m

- $50m-100m

- >$100m

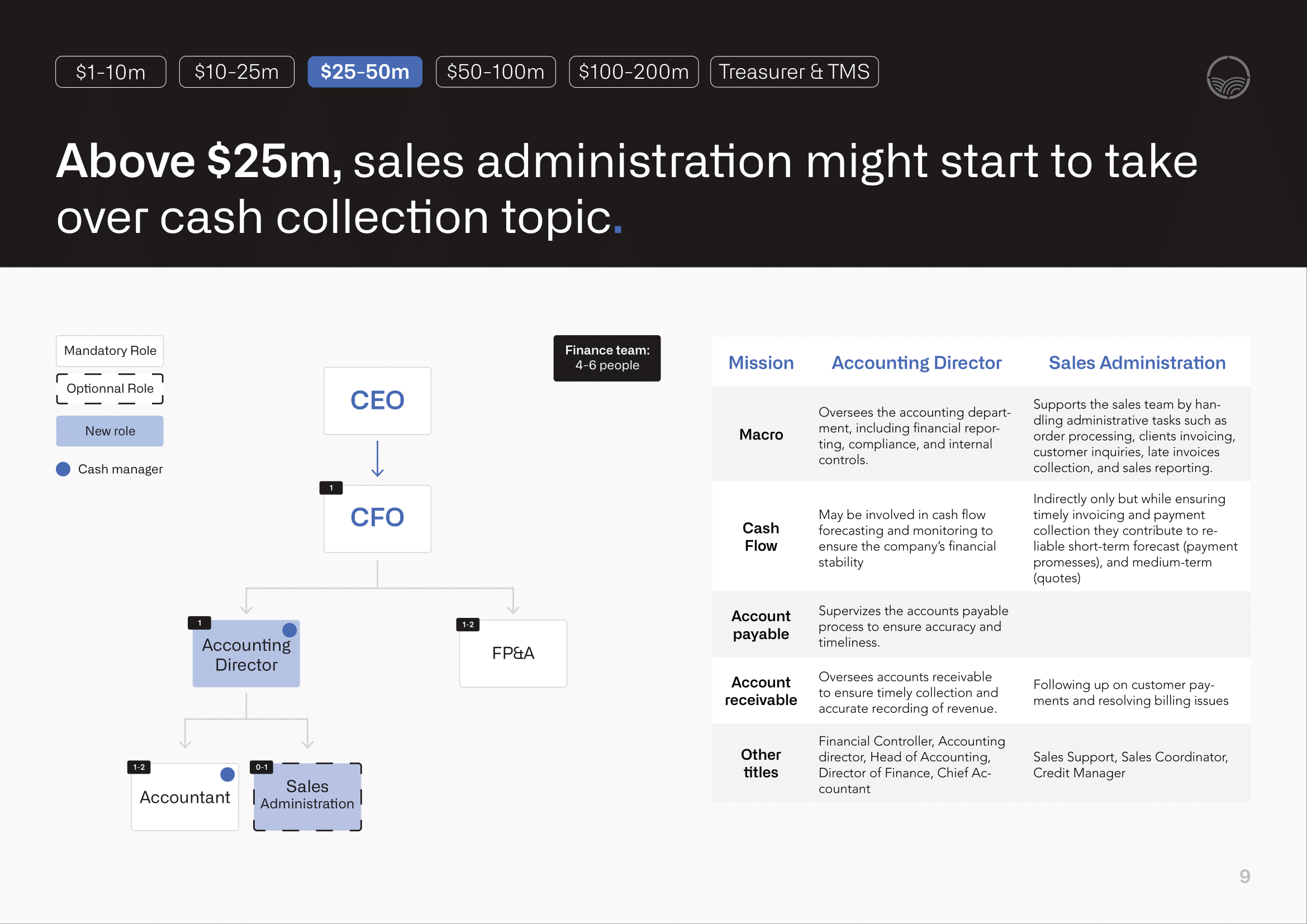

For each threshold, we provide a detailed organization chart that includes:

- the number of team members and their roles

- the necessity of each position (mandatory or optional)

- job titles

- key individuals responsible for cash management

We also outline the new roles introduced as the company grows, specifying their job descriptions, particularly for positions related to cash management (e.g., treasurer, typically added after reaching $50M in revenue). Each description highlights key responsibilities and alternative titles for these roles.

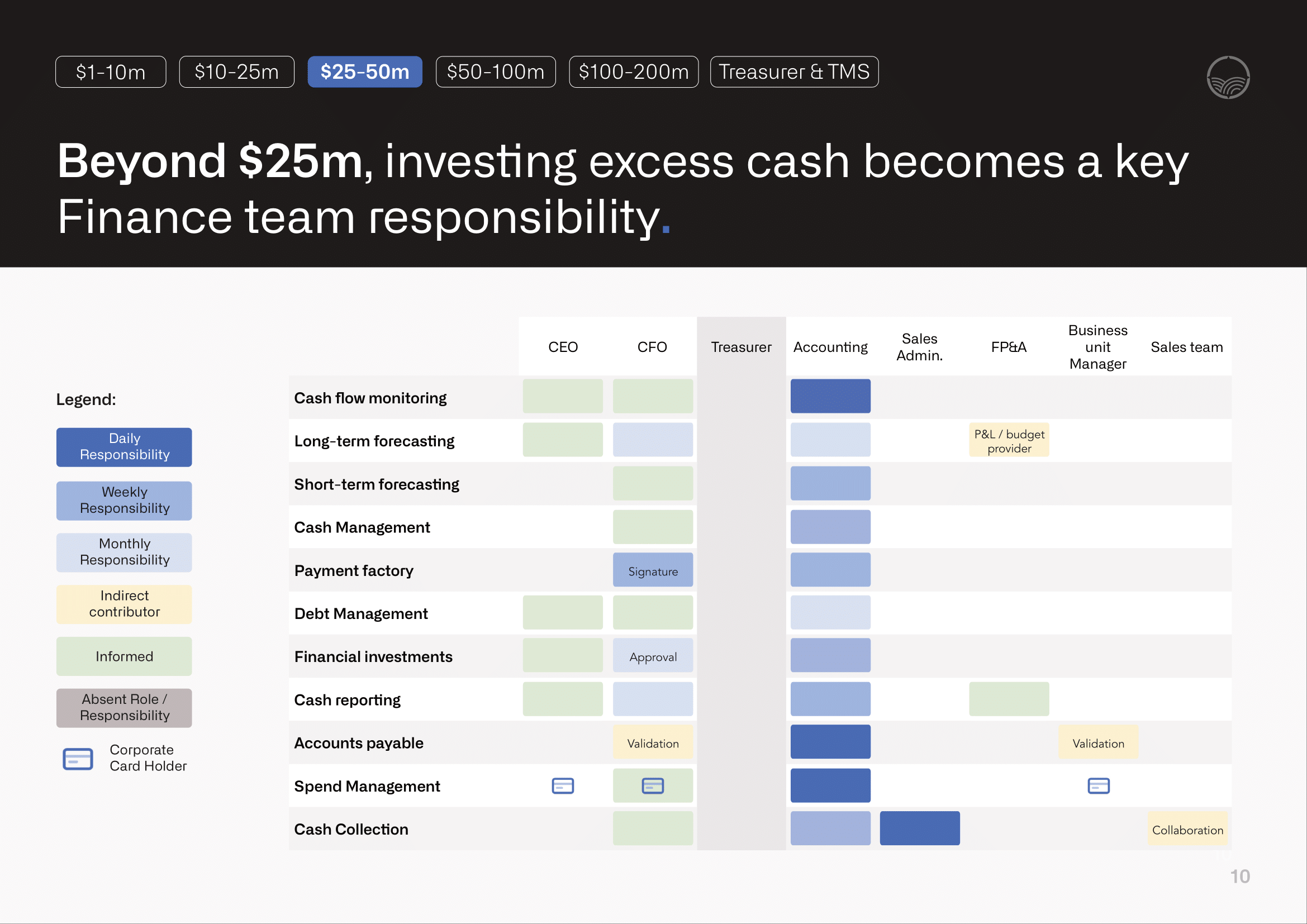

Additionally, we present a table for each revenue size, detailing:

- Cash management tasks

- Role of each team member (responsible, contributor, informed)

- The frequency of task execution

For instance, as shown in the image above, companies with revenues exceeding £25M should update their short-term forecasts more diligently on a weekly basis, typically handled by the accounting team. This allows short-term liquidity to be invested to generate financial returns, rather than leaving it idle in accounts, and reduces the need for large safety margins.

Additionally, these companies often have a greater number of bank accounts and entities, making regular cash management an essential process. CFOs in these organizations frequently need to transfer cash between accounts to ensure optimal liquidity management.

Bonus: 3 case studies with the finance team's organisation chart, responsibilities, context and objectives

In the document, you can also find 3 interesting case studies. The CFOs of 3 client companies, operating in different sectors, share with us the current organisation chart of their Finance team:

- Professional training: >$30m turnover, 20 subsidiaries in 12 countries, 7 people in the finance team;

- Renewable energy producer: >$50m turnover, 70 subsidiaries in 4 countries, 11 people in the finance team, backed by a Private Equity fund, NetSuite user;

- Manufacturer of industrial packaging: >$90m turnover, commercial presence in 70 countries, 11 people in the finance team, backed by an investment fund.

Download the ebook now to benchmark your team’s organisation chart and responsabilities to those of your peers!