Mastering financial risk management: essential concepts and strategies Unveiled

What is meant by Financial Risk Management (FRM)?

'Risk management is the systematic process of identifying, assessing and mitigating threats or uncertainties that can affect your organisation'. That's the definition given by the esteemed Harvard Business School - and it's a good one, because it stresses how financial risk management is as much a practice as a theory; it's a hands-on activity, requiring continual investment and activity from a business.

Why is financial risk management important?

If businesses and financial institutions do not apply risk management techniques, the bottom line is they are going to lose money. Specifically, if their approach is not one of managing the relationships between risk and reward, firms are unlikely to be able to optimise their financial performance, maintain stakeholder confidence, comply with regulation, guarantee the continuity of their business and - most importantly - defend their assets and capital.

Businesses face countless financial risks. The approach proven to reduce their impact is to be systematic in categorising risks, as well as being methodical in tackling them.

How to manage financial risk?

Risk management techniques can be broken down into five modules of risk-related activity:

- Identify

- Analyse

- Evaluate

- Treat

- Monitor

In order to minimise potential losses, businesses apply this modular process across five key commercial fields: credit risk, market risk, liquidity risk, operational risk and legal/regulatory risk.

What are the 5 types of financial risks?

There are different approaches to categorising the relationships between financial risks, but an accepted division is to view them through the lens of credit risk, market risk, liquidity risk, operational risk and regulatory/legal risk.

Credit risk

Credit risk centres on the relationships between financial institutions (such as banks) and other companies to whom they lend money. Credit risk also applies to specialised lending businesses which deal with private individuals. In either case, the principle is the same:

The Corporate Finance Institute puts it with appropriate simplicity when they observe that 'credit risk is the risk that a lender will extend credit to a borrower but will not be paid back.'

Examples of credit risk being realised would be a borrower not paying back a loan, or a customer failing to pay an invoice as agreed.

Numerous systems of credit scoring exist to evaluate risk - ranging from the assessment of corporate treasury with Moody's credit risk assessments, for examples, to the evaluation of private individuals with Experian credit scoring.

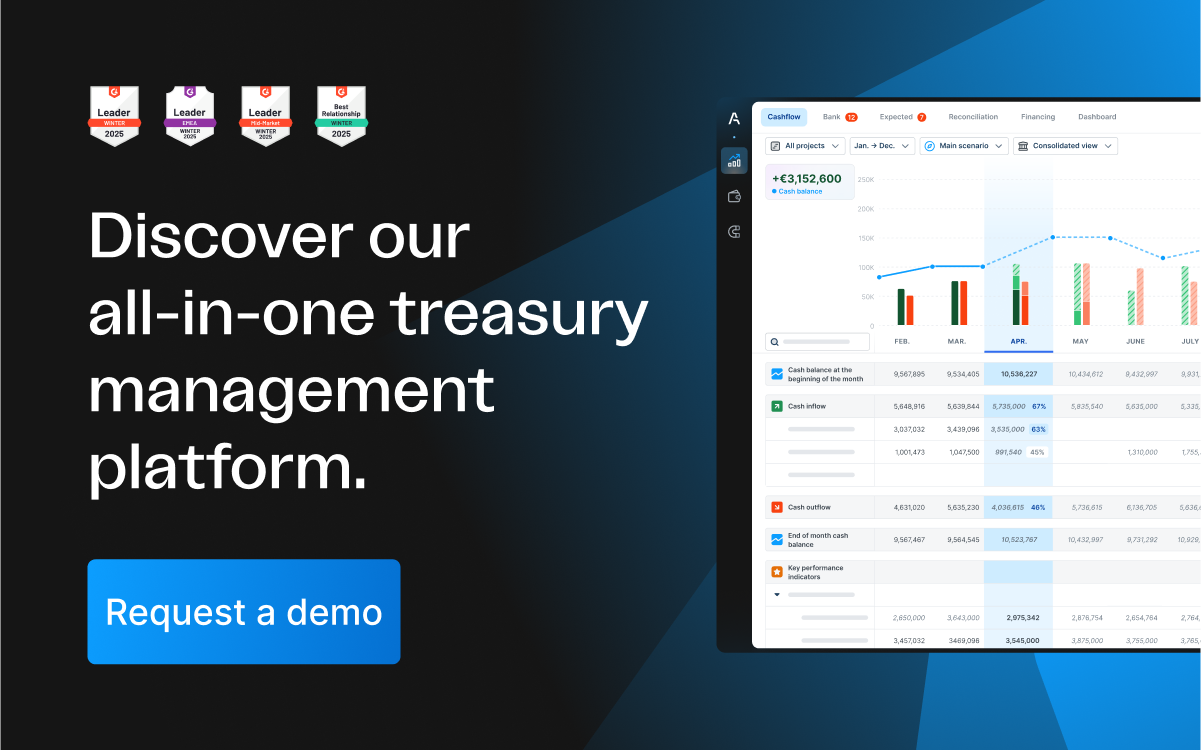

Many treasury management systems (TMSs) offer specific credit risk modules to monitor and manage client risk exposure; Agicap, for example, offers a simple Credit Limit system that is accessible via Agicap's CashCollect Risk Management tab.

Market risk

Also know as systematic risk, market risk defines the possibility of costly exposures which apply to a whole market at once - whether that it is the financial system as a whole (in the event of recession, for example), specific markets or entire classes of assets and liabilities:

- Commodity risk relates to fluctuating price of commodities (like oil). For example, in 1986, world oil prices dropped by roughly 50% and energy prices overall reduced by almost a quarter; this was a disaster for oil-producing companies and other companies that supplied them with services and products.

- Foreign exchange risk relates to changes in the price of one currency compared to another.

- Interest rate risk relates to volatility in interest rates and typically applies to fixed income financial instruments whose return is predicated on these rates.

By contrast to systematic risk, 'unsystematic' market risk relates to individual assets or liabilities.

Treasury management platforms typically approach market risk with:

- Specific hedging features which manage foreign exchange risk in particular.

- Stress-testing/scenario planning, in which the software applies theoretical constraints and challenges to a company's finances to show what would happen. This is often a key part of liquidity risk management (see below).

Liquidity risk

Liquidity risk is a potential problem that faces all financial entities. This risk centres on cash flow, and describes the possibility that a company may not be able to meet its short-to-medium term liabilities.

Examples of liquidity risk being realised would include a company failing to meet debt repayments, or being unable to pay its suppliers because it is waiting for a payment coming in from a client.

Liquidity risk is typically tackled by cash flow management software. A package of this type provides finance teams with a real-time overview of the company financial landscape, and furthermore provides accurate forecasts of the cashflow situation (ie. liquidity) going forward.

Operational risk

Operational risks are considered to be among the easiest risks to understand. That's because they relate exclusively to a company's day-to-day operations. Generally operational risks correspond to internal processes and systems. Examples are:

- Software system failures

- Human errors in processes

- Cyber-attacks

- Fraud

In some cases, operational risk centres on outside influences which relate to internal operations; one such example would be the failure of a third-party to supply appropriate equipment on time to a manufacturing line in a factory.

There's also the simple reality of keeping up with advancements in technology. 79% of CEO respondents to the Price Waterhouse Coopers 2022 Global Risk Survey reported that 'keeping up with the speed of digital and other transformations is a significant risk management challenge'.

In the area of software, cash management is a key tool in the mitigation of operational risk:

- Automation of cash tracking, reporting and forecasting reduces the risk of human error in manual entry of figures

- Streamlining and regulating workflows via software lowers the risk of errors through irregular practice

- Detailing and recording all transactions in one place improves accountability and lowers the risk of unauthorised activity.

Legal and Regulatory risk

Legal and regulatory risks are viewed as one single category, since most risks relating to regulation carry a legal penalty; but there are legal risks, such as those relating specifically to lawsuits, that are not regulatory.

Commonly, the following risks would be considered as legal/regulatory risks:

- Failure to adhere to financial reporting standards

- A breach, whether accidental or not, of laws regarding data privacy - most relevantly in the European Union, the General Data Protection Regulation that defends the data security of private individuals as 'the toughest privacy and security law in the world'

- Failure to meet regulatory requirements in audits, contracts and any form of financial transaction; for example, France is planning to make e-invoicing compulsory for domestic transactions from 2026 - failure to have appropriate software in place to handle this would be considered a regulatory (as well as operational) risk

Financial institutions and businesses endure a heavy load of legal/regulatory risk, with penalties from regulatory infringements results in heavy potential losses.

What other types of risk are there?

Reputational risk is a further key concern of businesses. This is the risk that the company name be undermined through association with scandal, malpractice or outright criminality. Even court cases can pose a reputational risk. Typically, this form of risk is considered - like franchise risk below - to be a supra-risk ie. one that is triggered in the event of other, more basic risks, being mismanaged.

Another way of looking at types of risk is to categorise some risks as strategic. Strategic risks focus on the business as an entity, and overlap with operational, legal/regulatory and market risk to encompass:

Asset impairment risk: When a company's assets lose significant value - for example, when a factory is destroyed owing to fire.

Competitive risk: this is a broad-reaching risk, potentially encompassing legal, market and operational risks. Competitive risk describes the possibility that a company loses its ability to stand out among the crowd of its competitors and deliver value on that basis. It can be realised under a wide variety of circumstances; from as simple a situation as a rival doing better to a complex interplay of market and legal forces acting against a firm.

Operations (not operational) risk: when internal problems undermine the flow of services or products to market. Typical examples include tainted organic products, and outbreaks of illness disabling the workforce.

Franchise risk: this is the catastrophic risk that stakeholders lose confidence in a business (often because that business has failed to manage the rest of the risks facing it).

FAQs on finance and risk management

What is risk management in investment management?

It means helping a fund manager responsible for investment decisions regarding a portfolio of assets to minimise potential losses. Investment management is a great example of how all types of risk can apply in one area:

- Credit risks of borrower or bond issuers defaulting

- Market risks of fluctuating equity values, interest rates and currencies

- Liquidity risks of trading in large quantities of assets without affecting the price

- Operational risks relating to frauds and error

- Legal/regulatory risks relating to the technicalities of financial dealings

Fund managers measure risk using metrics like Beta - which measures the sensitivity of a portfolio to moves in the market, as well as Standard Deviation - which measures the volatility of returns. Risk is then tackled with diversification, hedging and strategic asset allocation.

What is a Garp Financial Risk Manager?

GARP stands for the Global Association of Risk Professionals. The 90,000+ GARP Financial Risk Managers (FRMs®) have - according to GARP - achieved 'the true standard for educational excellence in risk management ... ready and able to assess, measure and monitor risk in real-world situations'.

Among professional certifications, GARP is highly prized in sectors such as banking, insurance and investments. Key areas of knowledge include:

- Risk management techniques

- Financial risk as it pertains to markets, regulation, operations and portfolio management

- Current trends in financial risk management

FRM® candidates must pass a two-part examination as well as possess two years work experience in risk management. They are typically employed as risk analysts, fund managers and compliance managers.

Apart from GARP, what risk manager programs and risk management certification are there?

There are at least ten other recognised professional certifications in financial risk. Here are three which are deemed to be particularly influential:

1) Professional Risk Manager (PRM)

Endorsed by the Professional Risk Managers' International Association, this is a coveted certification often seen as a rival to GARP certification. It covers both theoretical and practical applications of financial risk, and is typically favoured by professionals in quantitative finance and risk analysis roles.

2) Certified Enterprise Risk Analyst (CERA)

Offered by the Society of Actuaries (SOA), CERA focuses on enterprise risk management, with a strong emphasis on strategy and governance risk. Grounded squarely in the mathematics of risk, this certification is a favourite of actuaries.

3) RIMS-CRMP

This stands for Risk and Insurance Management SocietyCertified Risk Management Professional. Holders are recognised to have learnt a suite of risk management techniques suitable for guiding enterprise-size businesses through all types of risk; a blend of theory and practice.

What is the Journal of Risk and Financial Management (JRFM)

This is one of 463 open access academic journals published online every month by Swiss firm MDPI.

Typically, articles in the JRFM tackle diverse topics around the theory and practice of financial risk management. 2025 articles include, for example, Beyond the Buzz: A Measured Look at Bitcoin's Viability as Money as well as Cybersecurity in Digital Accounting Systems: Challenges and Solutions in the Arab Gulf Region.

What is risk management services?

Risk management services is a commercial term which overlaps with financial risk.

A typical example of a risk management service provider is, for example, UK-based firm Marsh Commercial, which offers a diverse suite of largely operational risk management services encompassing:

- Business continuity planning (ie. having a planned process in place to keep a business running in the event of emergency)

- Fleet risk management (managing vehicles)

- Cyber risk management (internet security)

- Fire risk assessments (Health and Safety monitoring)

- Employment law (managing operational and legal risk)

As this example demonstrates, risk management is ultimately always about the money, but it is not always about the finance.

Financial risk: conclusion

Fortunately for businesses, financial risk is relatively simple to understand and well-supported by a recognised professional sector of risk analysts and managers. Ultimately, it is unavoidable - as Professor Robert Simons of the Harvard Business School confirms: 'competing successfully in any industry involves some level of risk.'