Cash Flow Apps : Streamlining Your Business Finances for Success

Cash flow management is one of the most challenging business operations. According to reports, inadequate cash flow management is responsible for almost 80% of small businesses failing. This is mainly because of improper cash management due to a lack of cash flow management apps.

Cash flow management apps assist you in determining where your money is going, which expenses are superfluous, and which accounts should be consolidated or paid from reserves.

Continue reading as we discuss cash flow apps and how they can help streamline your business’s operations.

What is a cash flow app?

Cash flow apps are a digital solution that helps you track your key financial metric and your business's cash flow, analyse it, and make better-informed decisions.

These tools help you automate your cash management tasks, create and analyse cash flow reports, and develop new strategies. Some apps even send you alerts regarding any problem that arises.

Why to use cash flow applications?

Some key features of cash flow manager apps that make them essential for your business are:

-

Intuitive management: These apps boast user-friendly interfaces that facilitate swift and efficient input and categorisation of transactions.

-

Seamless income logging: Businesses can effortlessly log various income sources, such as salaries, payments, or sales, within these apps. This simplifies the task of recording earnings, providing a streamlined approach to income management.

-

Effective budgeting tools: Cash flow apps offer valuable budgeting features, allowing users to establish spending limits across different categories and supporting prudent financial planning.

What cash flow management tools are available in apps?

Here are some of the cash flow management tools available in these apps to help businesses:

Daily cash flow transactions monitoring

With cash flow apps, you can keep a close eye on your day-to-day cash flow and record each transaction as it happens.

For example, in a coffee shop, the sale gets recorded on the app each time a customer pays for coffee or snacks. The owner can easily monitor sales trends and ensure accuracy in financial records by getting real-time daily updates on their earnings.

Income and expenses tracking in cash flow app

With cash flow apps, you can easily track different sources of income and categorise your expenses properly.

For example, you can list your sales, advance payments, or other income sources in the app. Similarly, when you pay your vendors, utility expenses, or transportation fees, you can record those expenses, too.

Budgeting in your cash flow app

Budgeting features in a cash flow app help you avoid exceeding your business’s budget. For instance, a software company sets aside £10,000 for marketing, but they want to run a campaign that costs £15,000. When this occurs, the app promptly notifies them that they have exceeded the limit, preventing unforeseen expenses and ensuring proper resource allocation.

Cash flow app to forecast

Cash flow forecasting tools help you accurately forecast your business’s cash inflows and outflows.

For instance, if you've consistently spent less than you earned for the past few months, the app might forecast a positive balance in the upcoming months. On the other hand, if your spending has been high, the app might warn you about a possible shortfall.

Reporting directly in cash flow app

With cash flow reporting apps, you can generate summaries of your cash flow over a specific period to analyse trends and identify your best-selling products. For instance, you can view a summary of your balance sheet or a report that details your revenue and expenses for a specific time.

How do you use cash flow apps?

Some ways that you can use cash flow apps to streamline your business’s operations are:

Easy cash flow management

Cash flow apps streamline business financial management by simplifying tasks such as tracking expenses, recording incomes, and monitoring balances.

All sources of income, such as client payments and project revenues, can be recorded within the app, providing a comprehensive overview of earnings.

Online real-time cash flow tracking

In cash flow apps, transactions are updated online as they occur, giving businesses immediate insight into their financial activity and cash flow online. ReportingCash flow reporting apps allow you to generate summaries of your cash flow over a specific period in order to analyze trends and identify your best-selling products.For example, you can view a summary of your balance sheet or a report that provides details on your revenue and expenses for a specific time period. How do you use cash flow apps? There are several ways in which you can use cash flow apps to streamline your business operations:

-

Easy cash flow management: Cash flow apps simplify tasks such as tracking expenses, recording income, and monitoring balances, making financial management easier for businesses.

-

Comprehensive overview of earnings: All sources of income, including client payments and project revenues, can be recorded within the app, providing a comprehensive overview of earnings.

-

Online real-time cash flow tracking: Transactions are updated online in cash flow apps as they occur, giving businesses immediate insight into their financial activity and cash flow.

For example, a marketing agency can instantly see a client's payment for a recent campaign, facilitating quick assessments of cash flow health. Additionally, should there be a sudden drop in income, the app can promptly highlight the underlying cause.

Customisable weekly and monthly reports and analytics

Weekly and monthly cash flow apps offer insights through personalised reports and analytics, empowering businesses to analyse their financial data comprehensively.

By generating reports comparing planned budgets with actual spending, companies can gain a clear picture of where adjustments might be necessary.

Selecting the best cash flow app for your business

All that was about the features of cash flow apps and how they can benefit your business. But, with the wide range of applications available, how do you choose one?

Here are some factors that you should take into consideration before selecting the best cash flow app for your business:

-

Assessing your financial needs and goals: Are you a small retailer or a large corporation? Do you need advanced cash flow forecasting apps or basic income and expense tracking? Determine your business’s objectives and browse for applications that best align with these objectives.

-

Evaluating user-friendliness and interface design: While looking at what the application can do, business owners should also analyse how easily things can be done using the solution. Usability and ease of use should be the top key characteristics for any automation program, not only cash flow accounting software.

-

Security and data privacy considerations: The app must offer features such as data encryption, two-factor authentication processes, and compliance with data protection regulations.

-

Free trials and demos: Many cash flow apps offer free trials or short-term demos. Take advantage of these to explore the app's features hands-on — test its functionality and ensure it aligns with your workflow.

When is it better to use an app and cash flow software?

Cash flow apps are typically user-friendly and designed for individuals, freelancers, and small businesses with relatively straightforward financial management needs.

In comparison, cash flow software is more robust and suitable for larger businesses, enterprises, and industries with complex financial operations.

Here are some differences between cash flow software and a cash flow app to help you make more informed decisions about the future:

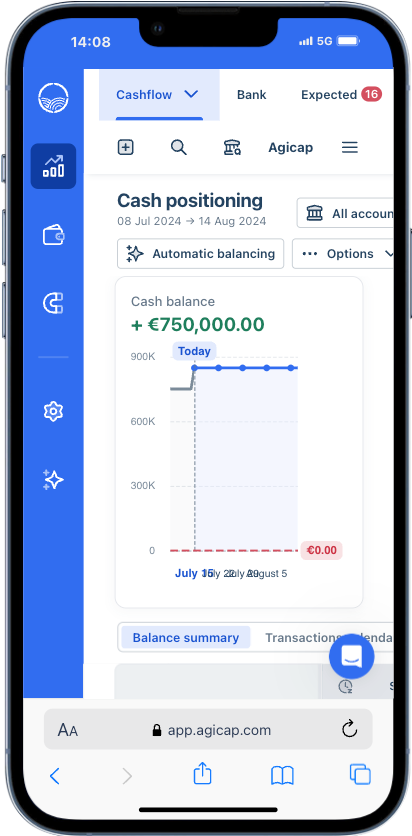

Download Agicap’s application and track your cash flows

Agicap is a liquidity management solution that simplifies real-time cash flow management by centralising all cash flow monitoring on a single platform. You can then integrate this data with your management and ERP solutions to obtain comprehensive real-time insights.

Agicap’s easy cash flow app also syncs and categories your financial transactions (in different currencies) to make cash flow management effective.