Cash pooling: A complete guide to optimising group liquidity

For any corporate group with multiple subsidiaries, managing cash efficiently across every entity is a constant challenge. Some entities might be struggling with short-term deficits while others hold inert cash surpluses, leading to unnecessary borrowing costs and missed investment opportunities.

We’re taking a closer look at what all-encompassing cash pooling is like in practice, including the main methods you can use, which legal points to watch out for, and how to simplify the entire process.

What is cash pooling? A definition

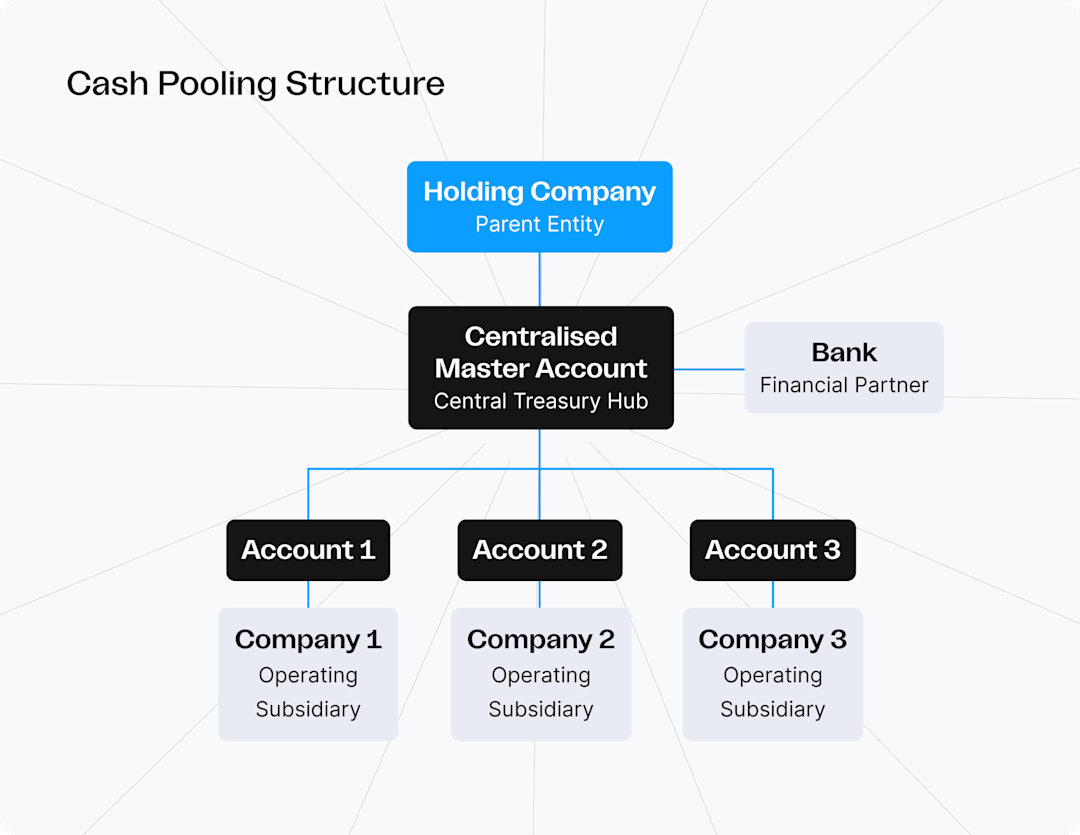

‘Cash-pooling’ is a type of cash management technique typically used by companies with multiple legal entities to optimise liquidity and consolidate cash balances group-wide. Rather than subsidiaries managing finances separately, the group as a whole can use the entire ‘pool’ of internal funds to meet liquidity needs on an aggregate level.

The holding or parent company hereby acts as the central hub, managing fund movements to serve the interests of each subsidiary and the broader corporate group as a whole.

The core principle is to balance the bank accounts of all subsidiaries. Often, some subsidiaries in a group experience cash deficits and must resort to expensive short-term financing like overdrafts, even while other entities within the same group have excess cash sitting unused in their accounts, which creates costs and inefficiencies — exactly what cash-pooling can prevent.

A cash pooling arrangement solves this costly imbalance by:

- •

Covering deficits: The group can support subsidiaries in difficulty with internal funds, limiting borrowing costs and reducing dependency on single bank accounts being in deficit.

- •

Effectively using surpluses: The group can capitalise on cash surpluses from every entity, leading to better treasury function through higher-volume transactions and potentially higher interest rates.

A subsidiary will transfer its surplus cash to a primary "master account" (an upstream movement). If a subsidiary's balance is in deficit, the master account provides the necessary funds (a downstream movement). Cash pooling is, hence, in a nutshell, a strategy for centralising cash and then redistributing it.

The main cash pooling methods explained

Groups primarily use two types of cash pooling, each with different mechanisms and outcomes — physical cash pooling or ‘notional’ cash pooling. The choice between those primarily depends on the group’s structure, geographical footprint, and strategic priorities. Many large organisations also use a third, hybrid approach that combines elements of both.

Physical cash pooling

With physical cash pooling, real funds are ‘physically’ (via bank transfer) transferred between the subsidiary accounts and the central master account. This movement, often automated by a bank or treasury management system, is also known as "sweeping" and ensures direct control over the group's cash flows.

Types of physical cash pooling

Overall, there are three ways or methods to physical cash-pooling:

Method | How it Works | Best Used For | Key Advantage | Main Consideration |

|---|---|---|---|---|

Zero Balance Account (ZBA) | All subsidiary account balances are swept to the master account daily, resetting them to zero. Funds are swept back to cover any payments. | Groups that require maximum centralisation and the tightest possible control over a group's entire cash position. | Complete utilisation of all available funds across the group, minimising borrowing costs. | Reduces the autonomy of subsidiaries, which can lead to operational friction or a loss of a sense of ownership. |

Target Balance Account (TBA) | Only the funds above a pre-agreed minimum balance in subsidiary accounts are swept to the central master account. | Groups where local entities need to permanently maintain a certain level of working capital for their daily operations. | Provides a good balance between centralised control and the operational freedom required by local business units. | Some cash is left at subsidiary level, meaning the central treasury cannot access 100% of the group's funds at all times. |

Fork Balance Account (FBA) | Accounts are brought to a specific, fixed amount daily (e.g. £5,000). Any excess is swept out, and any deficit is topped up to this fixed amount. | Situations demanding predictable daily operational cash levels in subsidiary accounts, regardless of the previous day's activity. | Gives subsidiaries a stable and consistent amount of operating cash each day, simplifying their local cash management. | Can be more administratively complex to set up and manage than a standard ZBA or TBA structure. Less common. |

Notional cash pooling

Unlike physical methods, notional money pooling is a service offered by banks that does not involve the ‘physical’ transfer of funds. Instead, the bank virtually consolidates the balances from all participating group companies (within the same country and currency). By notionally offsetting debit and credit positions, the bank calculates interest on the single net balance. This ‘virtual’ method allows the group to avoid paying high interest on accounts in overdraft and earn more on positive balances without having to move cash between different accounts.

The primary advantages of notional pooling:

- •

More attractive interest rates: The bank can offer better lending and borrowing rates on the pooled total than each entity could negotiate individually in a notional cash pooling arrangement.

- •

Greater subsidiary autonomy: Because cash isn't physically moved, each entity continues to manage and operate from its own bank accounts and credit lines independently.

How notional pooling saves real money: A practical example

Consider a corporate group that has three subsidiaries — A with a cash surplus, and B and C with overdrafts. Without pooling, each individual subsidiary and consequently the group pays high interest on overdrafts but earns low interest on surplus.

Line Item | Account A (+£500k) | Account B (-£400k) | Account C (-£200k) | Totals (for the Group) |

|---|---|---|---|---|

Scenario 1: Individual Interest (Without Pooling) |

|

|

|

|

Lending Interest Received (at 3%) | £15,000 | - | - | +£15,000 |

Borrowing Interest Paid (at 5%) | - | -£20,000 | -£10,000 | -£30,000 |

Net Financial Position (Standalone) | +£15 | -£20 | -£10 | Net Cost = -£15,000 |

Scenario 2: Notional Pooling |

|

|

|

|

Combined Net Balance for Pooling | +£500,000 | -£400,000 | -£200,000 | Net Balance = -£100,000 |

Borrowing Interest Paid (at 5%) |

|

|

| -£5,000 |

TOTAL SAVING FOR THE GROUP |

|

|

| £10,000 |

Notional pooling consolidates the subsidiaries into a single group balance, whereby it reduces the net interest cost, because any surplus offsets any overdrafts. The example shows how notional pooling improves cash efficiency by netting positions to minimise interest costs.

Physical cash pooling vs. notional cash pooling compared

To compare the various methods:

| Physical cash pooling | Notional cash pooling |

|---|---|---|

Mechanism | Actual funds are physically transferred from subsidiary bank accounts to a central master account in a process known as 'sweeping'. | No physical movement of funds. Bank account balances are notionally offset, and the bank calculates interest on the net position of the entire pool. |

Pros | • Maximises interest benefits by concentrating real funds. • Simpler to implement from a legal and tax perspective in many jurisdictions. • Provides absolute control over group liquidity. | • Preserves subsidiary autonomy as no funds are moved. • Avoids complicated inter-company loans and documentation. • Reduces foreign exchange risks in multi-currency contexts. |

Cons | • Reduces subsidiary autonomy. • Creates inter-company loans that require management and can have tax implications. • Can incur transfer fees. | • Regulations in many countries may restrict notional pooling • Usually requires all entities to use the same bank. • Bank fees can be higher due to complexity. |

How to set up a cash pooling structure in the UK

Before implementing cash pooling in the UK, a business must take key legal and accounting steps to ensure compliance and avoid potential disputes.

Legal and accounting prerequisites

In the UK, the rules for cash pooling are outlined in HMRC’s INTM503100 manual. It requires, amongst other points, that for tax purposes, the interest rates on inter-company balances created by the pool reflect an 'arm's-length' principle—meaning they should be comparable to what would be agreed with an independent third party.

Some key requirements:

Arms-length principle

UK groups must comply with the 'arm's length' principle for intercompany interest rates in cash pools, comparable to third parties. They must maintain detailed documentation justifying cost/benefit allocations between participants to prove profit shifting is not occurring, as required by transfer pricing regulations.

Corporate Interest Restriction (CIR)

The UK's Corporate Interest Restriction rules limit the net interest expense a group can deduct for tax purposes. Cash pooling arrangements are impacted, with net pool interest subject to the deduction limits. Highly leveraged groups, in particular, must model the CIR impact to avoid disallowed interest deductions.

Withholding Tax (WHT)

For cross-border cash pools, UK firms must consider withholding tax on intercompany interest, usually 20%, unless exempt. Though double taxation treaties may reduce this, the exemption is not automatic — firms must actively apply.

Furthermore, the company statutes must permit this activity. To minimise risk, the parent company and its subsidiaries must always sign a formal cash management agreement outlining the terms, transfer conditions, participating entities, and duration.

Maintaining the interests of each company

A core principle of cash pooling is that it must not unfairly prioritise the group's interest at the expense of a single subsidiary. Each transaction must remain commercially justifiable for every legal entity involved to avoid issues such as the misuse of corporate assets or confusion of assets.

Ready to gain better visibility of your group's cash flow? See how the Agicap platform enables a central visibility of your company's cash balances

Example Challenges in Group Treasury Management – and How Agicap Delivers Clarity

While cash pooling offers major benefits, managing group liquidity across multiple subsidiaries comes with its own operational hurdles—especially when you lack integrated real-time systems. Many UK finance teams struggle not with the pooling concept itself, but with the visibility and coordination needed to support group-wide cash decisions.

Challenge 1: Disconnected data sources

Group structures often mean dozens of bank accounts across various subsidiaries and banking partners. Without a unified view, gaining real-time oversight of consolidated cash positions is extremely difficult—which can delay strategic decisions and make effective pooling hard to execute.

Solution: Agicaps’ banking connectivity synchronises all your bank accounts into a single, centralised dashboard.This comprehensive visibility does not automate transfers, but it provides up-to-date, consolidated cash data across entities and banks—a vital foundation for accurate cash pooling analysis and planning.

Challenge 2: Manual and error-prone processes

Manually calculating interest, tracking intercompany loans, and reconciling balances is incredibly time-consuming and prone to human error, especially at scale. This administrative burden undermines the efficiency gains that pooling is supposed to create.

Solution: Agicap automates many of these manual tasks. Our platform helps track intercompany balances and offers powerful reporting features that save finance teams countless hours — as our client Scheppach Group discovered, freeing up two hours per day for their team.

Challenge 3: Inaccurate forecasting and loss of autonomy

Without reliable forecasts, it is difficult to anticipate future funding needs or surpluses for each entity, complicating liquidity transfers. Furthermore, subsidiaries often resent the loss of autonomy that comes with centralised control.

International and multi-currency cash pooling

When a company operates across different countries using subsidiaries and branches, the challenges of implementing a cash pool are higher — the business needs to consider different legal frameworks, tax regulations, exchange rates, and rules around intercompany lending that vary by jurisdiction. Generally speaking, cash-pooling is possible and legally allowed in most advanced economies, although there may be certain jurisdictions with high scrutiny and stricter rules than others.

Hence, implementing cash-pooling requires careful alignment with local jurisdiction, banking partners and tax laws.

How international cash pooling works

To manage cross-border complexity, international pooling is typically structured on two levels. Generally, a banking partner in each country will perform a first-level, in-country sweep, consolidating funds from all local subsidiaries into a single domestic 'master account'.

An international 'overlay' bank then performs a second-level cross-border sweep from these various master accounts into one central, global cash pool. Managing this structure requires having a robust network of banking partners or, increasingly, a Treasury Management Platform like Agicap that can centralise visibility across all of these different relationships and accounts.

Post-Brexit considerations for UK-EU pools

Post-Brexit, moving funds between UK and EU entities has become more complex. Loss of passporting means banks may treat UK-EU transfers as higher-cost international payments rather than seamless intra-EEA transfers previously. Setting up new sub-pools in the EU, like Ireland, is a common workaround.

Multi-currency cash pooling

Managing multiple currencies adds another significant layer of complexity. While physical cash pooling is most often used for a single currency, establishing and manually overseeing separate pools for every currency a group handles is highly inefficient and creates fragmented cash flow data. Furthermore, bank-managed solutions are often restricted to a single currency, forcing finance teams to contend with multiple platforms.

A successful multi-currency cash pooling strategy almost always requires a sophisticated and dedicated tool that can provide a single, consolidated view of all (multiple currency) cash balances, overcoming bank limitations and giving the parent company a true picture of its global liquidity after accounting for foreign exchange rate differences.

In-house vs. bank-managed cash pooling: Making the right choice

When setting up your cash pool, your organisation faces a fundamental decision: should you outsource the operational management to one or more of your banking partners, or should you manage it internally using a dedicated cash management platform? The optimal choice depends entirely on your group’s structure, in-house resources, and strategic goals for flexibility and control.

The bank-managed approach

A bank-managed cash pooling service is often a straightforward option for companies of all sizes, from SMEs to large corporations, especially those without a dedicated in-house treasury team or a sophisticated Treasury Management System (TMS). With this model, your banking partner handles the automated, daily sweeping of funds based on the rules you’ve established

The key advantage is that it requires very few of your company’s internal resources. Instead of managing daily transactions, your team’s main responsibility is signing the initial cash management agreement. However, this approach comes with significant limitations: bank-managed pooling is typically restricted to accounts held at that single bank and often in a single currency, creating data silos and hampering a true group-wide view.

Costs must also be managed carefully. These are usually based on account numbers and transaction costs, so a streamlined banking structure is essential. Before committing, it is vital to clarify whether transfer fees between the accounts are included in the bank’s service package.

The in-house approach

Many groups now deploy a cash management software to run their own cash pool in-house. Modern cash management software connects multiple banking relationships, automates daily sweeps, unifies multi-currency and multi-entity cash positions, and delivers real-time visibility at group level—solving the main operational hurdles of pooling. Managing your cash pool in-house using such a platform is the preferred method for groups seeking flexibility and holistic control—especially for businesses with numerous bank accounts across multiple banking partners and countries, as it directly solves the limitations of the bank-managed model.

The main benefit of in-house pooling is unmatched autonomy. Your treasury team can define and modify the intercompany rules at any time, perform sweeps on demand, and, most importantly, implement multi-bank and multiple currency cash pooling. This provides a complete and accurate picture of your true global liquidity. While this model traditionally required significant in-house expertise to operate a complex TMS, modern platforms like Agicap have simplified the process immensely through automation and intuitive design. The primary costs to negotiate are transfer fees with each banking partner.

The hybrid solution: Combining control with simplicity

You can combine the two approaches for maximum benefit. Agicap or another TMS can sit on top of banking relationships to provide the best of both worlds.

This hybrid model gives you complete visibility and forecasting across multiple banks through the platform, while automating complex manual work. Rather than being limited to one bank's system, you gain unified control over all cash balances to enable truly informed decisions. The hybrid approach allows real-time oversight of group cash plus automation, avoiding the limitations of either method alone.

Agicap: Centralising group cash visibility to support pooling activities in the UK

The ‘hybrid’ model represents the ideal state for modern cash pooling, but it depends on having a powerful engine to drive it. The challenge is no longer about choosing between a bank's rigid system and a complex in-house TMS; it's about unifying all your cash data into a single, intuitive platform. This is precisely what Agicap’s Treasury Management Platform is designed to do.

The biggest benefit we have from Agicap is visibility of the entire business. Agicap allows us to consolidate our business into one single view — which is hugely beneficial. Because that's the view the board needs if it is going to make strategic decisions, Kieron Kavanagh of Enterpryze details in our video:

Agicap’s treasury management platform is designed to provide true group-wide cash visibility and analysis—the foundation of any efficient cash pooling strategy.

- •

Eliminate Data Silos and Blind Spots: Connect every bank account across all your domestic and international subsidiaries into one real-time dashboard for full visibility.

- •

Anticipate Every Funding Need Proactively: Build reliable, multi-entity cash flow forecasts to move funds before shortfalls occur.

- •

Gain Group-Wide Control, Simply: Drill down from a consolidated group view to individual subsidiaries’ performance, simplify managing manual pooling processes until native UK automation is available.

Interested in how Agicap can centralise your cash visibility, forecasting, and support your cash pooling activities in the UK? Get a demo to see how our platform brings you one step closer to truly consolidated group liquidity.

Frequently Asked Questions (FAQ)

What is the difference between cash sweep and cash pooling?

A ‘cash sweep' is the action of physically moving money as part of a physical cash pooling arrangement. 'Cash pooling' is the overall strategy, while 'cash sweeping' (or cash concentration) is the specific mechanism used in physical pooling to transfer funds from subsidiary accounts to a master account.

What is a cash pooling arrangement?

A cash pooling arrangement is the legal and commercial framework governing how the pool operates. It's typically a master agreement between the parent company, subsidiaries, and often the bank, outlining the terms, such as interest rates, responsibilities, and rules for intercompany fund movements to ensure legal and tax compliance.

What is notional cash pooling?

Notional cash pooling is a method where account balances are aggregated virtually without any physical transfer of funds. A bank nets the positive and negative balances of all participating group accounts to calculate interest on the consolidated net balance, lowering interest costs while allowing each subsidiary to maintain control over its own account.

What is cash pooling in Treasury?

Cash pooling in Treasury consolidates the cash balances of multiple bank accounts, often belonging to different subsidiaries within a company, into one central account. It is a centralised cash and liquidity management strategy that optimises cash flow, reduces borrowing costs, and thereby improves financial efficiency.

Note: This text is based on publicly available information as of July 2025 and is subject to change. The information provided here is for general guidance only and does not constitute financial, tax or legal advice.