Cash flow management in practice: forecasting, automation & financial agility

Cash flow management is recognised as the foundation of good business. And it is not complicated. It's about having the basic cash liquidity to get through to next week, as well as the continuity of cash flow to underpin company transformation over the long-term.

Cash flow can always be better. And improvements don't take much work.

Recently top global management consultants Mckinsey revealed that, for firms to "optimise their accounts payable and receivable balance by 30 percent or more in a matter of weeks", all it took was for them to get a little clearer about some of their key processes and be open to new technology like automated collections (which is an Agicap speciality, of course).

Sorting out the nuts and bolts of cash flow means cash forecasting can forge a bright future for your company. Here's how.

Cash flow management and forecasting

As a CFO, you need to know how much money is entering and leaving your company. Why? So you can know how much money you will need in the future. Cash flow forecasting is built on the foundation of clear cash oversight.

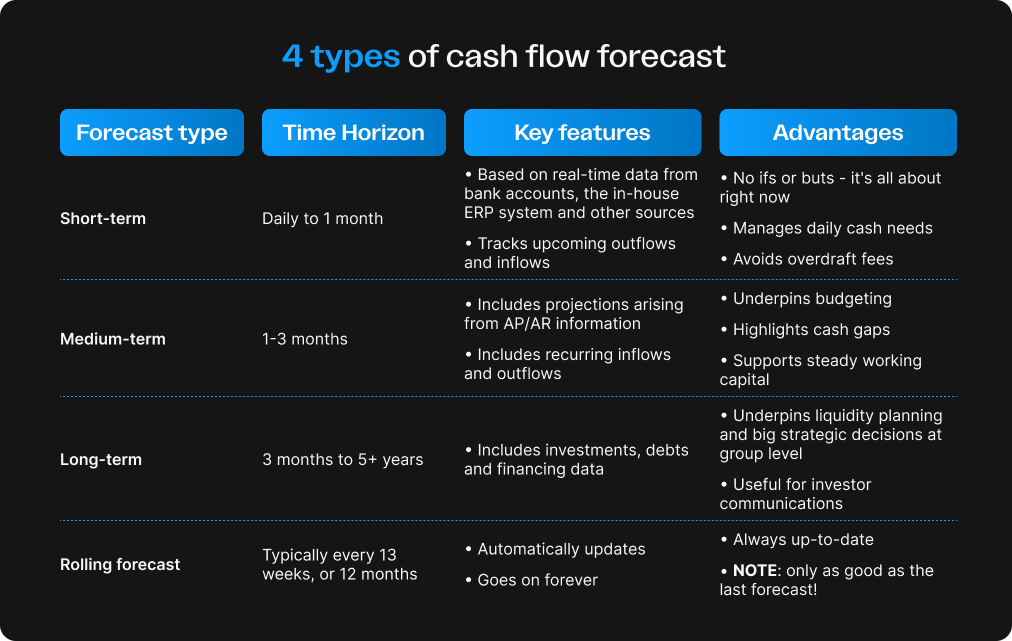

That’s why cash flow software like Agicap — favoured by CFOs of fast-growing and mid-market firms — is built around real-time control that enables forecasting across multiple time horizons.

Cash flow management: the basics

The financial health for a company fundamentally depends on ensuring a balance between the two cash flow types: inflows and outflows.

- •

Cash inflows: typically the bulk of positive cash flow stems from operations (such as payments from customers), alongside financial inflows like investment returns and loans.

- •

Cash outflows: operating expenses are generally the costliest outflow for a company - in the form of supplier purchases, salary payments, rent and taxes.

The number one priority in cash flow risk management

What about when times get really tough? When global uncertainties strike: the Pandemic, the Ukraine conflict? When inflation shoots out of control, pushing prices up and margins down? When payments become delayed as a matter of course because customers are barely holding on?

What's the single thing that a CFO then needs to attend to as a priority?

Advice from expert institutions is, in this regard, unwavering. What the UK business insolvency helpline says is typical: "most importantly manage your cash position relentlessly – preferably daily."

- •

These experts found that 38% of business startups which failed within 3 years did so because they "ran out of cash or failed to raise new capital."

Monitoring cash flow needs identifies cash flow issues before they can turn into real problems . Given today's economic uncertainty, there's every incentive to discover how dedicated software like Agicap can give you full control of your cash position - however well-established you are as a company.

Ways to improve your cash flow management

Modern software like Agicap targets negative cash flow in numerous ways:

- •

Real-time cash visibility:

Consolidate cash positions across accounts, currencies and subsidiaries , and identify cash flow problems before they escalate.- •

Cash flow forecasting:

With the fully-integrated feeds offered by software like Agicap, CFOs can prepare reliable short-term forecasts - as well as long-term cash forecasts using Agicap's custom P&L statement converter plug-in.- •

Automate Accounts Receivable (AR) and Accounts Payable (AP):

With automation tools like Agicap's CashCollect and CashPayment, accelerate cash inflows - and either delay cash outflows, or time them to pursue early payment rewards from suppliers.- •

Optimise Working Capital with data analysis:

Reduce cash tied up in operations by analysing WC components: receivables, payables & inventory.- •

Establish liquidity buffers:

Companies got caught out by the Covid effect, and nowadays prudent firms will maintain 3-6 months of operating expenses as a liquidity buffer - software like Agicap uses simple desktop alerts to signal when limits are getting tight.- •

Use cash pooling across group subsidiaries:

Modern software makes it easy to centralise cash pooling; the more complex the needs, the more of a treasury focus your software will need.- •

Hedge against currency and interest rate risks:

For larger companies, ERPs and heavyweight treasury management software allow CFOs to use financial instruments to balance out FX and interest rate volatility.- •

Offer dynamic discounting for early payments:

You can use software like Agicap to track and automate offers whereby you encourage customers to pay early in return for a percentage discount (ie. 2% off if you pay within 14 days).

Ready to see how Agicap can transform your cash flow strategy? Book a free demo and discover how real-time visibility, automation, and forecasting can make managing cash effortless.

Managing your business cash flow in practice

In practice, businesses often manage their cash flow and forecasting using Excel spreadsheets. As an example, check out this free Excel template for cash flow forecasting.

Excel: poor cash flow management

To be as user-friendly as possible, leading cash flow management software makes integrating spreadsheet data a piece of cake.

- •

Agicap, for example, features as standard an Excel conversion plug-in.

Using spreadsheets for cash flow management is not Best Practice, but we understand why companies do it. For decades, Excel was not only the best way - but the only way. Luckily nowadays costs have dropped dramatically on software that is specifically designed to pick up where Excel peters away in effectiveness.

Adios Excel!

Generally we find that Agicap customers reach a point in the growth of their business where spreadsheets simply don't cut it:

- •

Too complicated to co-ordinate spreadsheets from different departments/entities.

- •

Financial variables changing too quickly for spreadsheet cash forecasts to keep up.

- •

Too many errors from manual inputs.

- •

Too much time spent maintaining spreadsheets that then don't work properly.

- •

Pressure from the Board to present cash flow information graphically.

CFOs demand effective cash flow management

As a CFO, you will want your finance team leaders to have a smarter, more scalable approach. Because software like Agicap automates the data consolidation that Excel almost - but never quite - perfects, as well as integrates seamlessly with other software in your tech stack, you can trust the accuracy of cash oversight it brings. And so can your people. They can then spend their time tackling cash flow problems rather than fighting to establish what the basic cash flow situation is.

Dedicated software for cash flow management: Agicap case study

Renova Red SPA is one of numerous Agicap clients that found Agicap's ease of use around spreadsheets to be invaluable.

Based in Italy, this growing firm manages no less than 53 construction sites. This takes a high degree of financial co-ordination, particularly to arrive at a unified cash flow forecast for the company based on so many different sources.

CFO Marco Casadei uses Agicap's functionality with Excel to simply upload site budget spreadsheets onto the centralised Agicap platform, and then uses the dashboard function to keep a close and continuous eye on the overall financial picture.

"Agicap allows me," Casadei explains, "to prepare dedicated reports, site by site, on cash availability."

And team managers can access what they need to see on Agicap via their smartphones (thanks to the Agicap mobile app).

Watch this brief video to learn more about Renova Red and Agicap.

Cash flow management strategies for modern CFOs

A dual strategy in cash flow management that is highly-regarded is to:

Objective 1: Bring receivables, inventory and payables into alignment and lower the amount of cash necessary to run the company safely day-to-day; reduce the Working Capital Requirement (WCR) in other words; and ...

Objective 2: Make the best of the net amount of cash available. As a CFO or finance leader, you will likely agree that tensions can arise in a business over the best way to achieve either objective.

Objective 1: Reduce WCR of your company

To reduce the WCR, you need to be absolutely sure you know what is going on in terms of cash inflows and outflows in your company. Otherwise, you can end up with outright shortfalls and a permanently-stuttering cash machine.

- •

A whopping 43% of the 500 mid-market companies interviewed by Agicap in our recent CFO survey admitted that they regularly (every 20 days) face cash shortfalls over $50k.

So how do you persuade your CEO and Board that you have eye-in-the-sky capabilities when it comes to the cash flow of your company?

The answer is actually quite simple. You just need the right software. You need to be able to show a simple cash dashboard with key balances and metrics - and then share it with the right people.

So that's objective 1 covered of this dual strategy in cash flow management.

Objective 2: Optimise the use of existing cash

Objective 2 is also achieved on the basis of software that offers powerful cash oversight. Only by having a firm grip on the numerous cash inflows and outflows of a company can the CFO start to pull financing levers with confidence.

Before getting appropriate cash flow management software, CFOs can be unconvincing in their presentations to their CEO and Board: finance optimisation is ... well ... hazy.

After installing an integrated cash platform, it's a different story ...

Before the right cash management software | After |

|---|---|

Too much cash sitting on current accounts | A rolling forecast means a business can optimise periods of surplus liquidity - without running the risk of cash flow shortage |

Cash buffer is too high | More accurate cash flow analysis means any campaign of investments can be optimised over time, with a lower cash buffer allowing more investment |

Poor rates on short-term investment opportunities | Better cash flow visibility allows for more measured investment - which allows, in turn, for the negotiation of stronger returns |

Overdraft fees too high | Balancing transfers reduce fees - possible thanks to better CFF |

Self-financing low in proportion to debt taken out | Successful cash management and improved visibility means more company money can be invested without liquidity risk |

Expensive factoring of invoices used too much | Accurate cash flow monitoring enables proportionate usage of factoring, with reduced DSO thanks to AR automation reducing factoring cost |

Missed opportunities with trade discounts | Improved visibility over cash flow needs allows for more effective use of trade discounts |

High volume of banking transactions means checking commissions & fees not possible | Powerful options for analysis at an overview and detail level allow for far better management of banking costs |

How Agicap solves cash flow problems

- •

Simplified cash flow management for firms of all sizes.

- •

Accurate forecasting and scenario planning.

- •

Get the liquidity low-down in the short-term - plus long-term strategic insights.

- •

Full support for compliance and reporting.

Cash flow problems | Agicap: cash flow improvement |

|---|---|

Lack of visibility in anticipating cash flow needs | Powerful dedicated cash flow management & forecasting module |

Late payments from customers | Automated dunning processes for quicker cash recovery |

Complex consolidation across multiple entities | Dedicated group consolidation tools |

Long-term cash flow uncertainty | Long-term cashflow forecast |

Surprises from business risk factors | 360◦ cash flow analysis with centralised dashboard monitoring |

Short-term liquidity risk - running out of money | Increase positive cash flows with reduced DSO, increased DPO and - thanks to increased controls of outflows - a cash cushion that is not unnecessarily fat |

Inefficient positive cash flows | Turn cash into a lever for growth and profit across the whole business |

Manual errors in cash flow analysis | Cash flow forecasts based on fully-aggregated data from banks, ERPs and all other tech stack modules |

Slow Accounts Payable (AP) processes leading to missed opportunities | Automated AP - including intelligent invoice dematerialisation - means early payment discounts from suppliers can be targeted |

Communicating the cash flow picture to stakeholders | Custom dashboard facility - quickly build the picture you want with just a few drag-and-drops |

Watch this video to see how one Agicap business partner liked Agicap so much they installed it for themselves.

- •

Top French IT consultancy LimpidIT found that Agicap filled the gap in genuine live integration across multiple bank accounts that ERPs were generally lacking.

Conclusion: cash flow improvement

Let's widen our scope for a second. Cash flow management undeniably depends on the quality of software that manages it. And businesses need to be very clear about how highly they value that priceless cash flow clarity.

Why? Because it is difficult to hit the cash management sweet spot.

Treasury management systems are either overweight with complexity that companies don't need, or too narrowly focussed on their chosen speciality (like spend management, card management, or accounts receivable).

For continuous cash flow improvement, CFOs need software with a central focus on cash flow. Watch this brief video to see how Agicap can offer your company exactly that.

FAQs

What are the 4 types of cash flows?

Operating Cash Flow (OCF): Cash from core business activities.

Investing Cash Flow (ICF): Cash from investment.

Financing Cash Flow (FCF): Cash from financing activities.

Free Cash Flow (FCF): Cash remaining after OCF and capital expenditures.

What are some cash flow examples?

- •

A UK retailer SME has an Operating Cash Flow (OCF) of £150k (with £300k inflow from sales vs. £150k outflow from supplier payments).

- •

A European retailer has an Investing Cash Flow (ICF) of €30k (with €40k investment outflow for new store shelving vs. €10k investment inflow from selling old equipment.

- •

A US manufacturer has a Financing Cash Flow (FCF) of $50k (with $60k inflow from a short-term loan vs. $10k outflow from an interest payment on another loan take out before).

How can you improve cash flow?

CFOs typically anchor their cash flow management in i) obtaining good cash visibility ii) improving day-to-day liquidity through automation of key AP and AR processes iii) improving cash forecasting over all time horizons and iv) developing cash flow continuity through embedding Best Practices.

What is the formula for net cash flow?

Net Cash Flow = Total Cash Inflows - Total Cash Outflows . This is the sum of Operating Cash Flow (OCF), Investing Cash Flow (ICF) and Financing Cash Flow (FCF).

How do you calculate cash flow?

Either you use the formula for net cash flow - which takes all cash flows in a company into account- or you use the formula for Free Cash Flow (FCF), which focuses on discretionary cash. Get the low down on cash flow formulas with Agicap.