How the cash burn rate can help companies to better manage their cash flow

Cash burn rate is a key metric for companies - and particularly startups. It shows how quickly a company is spending cash.

So, combined with another key metric - cash runway, which shows how long a company's cash will last - cash burn rate is central to better cash management. The metric means CFOs can pinpoint, and then share, an indisputable indication of a company's rate of outgoings.

Cash burn analysis: why it is important

How quickly is a company spending cash? That's burn rate.

How long will that company's cash last? That's the cash runway.

Cash burn rate allows firms to put a figure on their spending. So the metric is often seen as the icing on the cake of excellent cash management ; specifically, if a company cannot specify what their cash burn rate is, then that means its oversight of cash is poor.

- •

That's because the calculation of cash burn rate involves knowing down to the penny what a company's operating expenses and revenues are.

Here we show you the different types of cash burn rates, how to calculate them and what the cash burn analysis is useful for.

Definition of burn rate

The cash burn rate indicates how quickly a company uses up its cash reserves within a certain period of time. It is therefore a measure of negative cash flow.

This ratio is of high importance for both established companies and start-ups, because it helps to plan future investments and shows how high the income (or loan amounts) must at least be within a period of time in order to compensate for the expenses.

In the case of start-ups, venture capital investors usually finance the cash, as the company has hardly any revenue in the early stages and this is put back into growth completely. To ensure that expenses are covered at all times, investors consult the cash burn rate so that they know how much cash they need to provide to the company so that it can cover its costs.

Calculating cash burn rate: formula

There are two types of burn rate: gross burn rate and net burn rate. These two burn rates are usually calculated for one month, so that a company knows its monthly expenses.

Gross burn rate

The gross burn rate indicates how much cash the company has to raise for all operating expenses each month:

Gross burn rate = Monthly operating expenses

Operating expenses include expenses such as staff salaries, rent and administration costs. The gross burn rate shows how high a company's total monthly costs are.

Net burn rate

The net burn rate indicates how high monthly expenditure is when income is also taken into account:

Net burn rate = Monthly operating losses = Revenue - Monthly operating expenses

Here, operating expenses are subtracted from revenue and operating losses are obtained. The net burn rate shows how much cash the company needs to keep its operations running.

Check out our glossary definition of burn rate.

Cash runway: formula

In connection with the cash burn rate, the key figure cash runway is also important for companies. This indicates how long the available cash will last if the company continues to lose money at a certain burn rate:

Cash runway (gross) = Total cash / Gross burn rate Cash runway (net) = Total cash / Net burn rate

Cash flow burn rate - which firms need to pin it down most?

For companies which have been going for a while, cash burn rate is an important metric; but for startups - ie. companies who have been founded in the last 7 years - it's an absolutely vital benchmark of financial health.

Startups: monthly cash burn rate

If they are funded by venture capitalists, startups typically receive their funding in rounds. The trick for the founders is to keep their cash burn rate sufficiently low so the company can stay afloat until the next round.

The cash burn rate is measured in months for startups - rather than by financial quarters - because the startup simply might not last a quarter. That's how precarious the startup world is. And US investment giant J.P Morgan research shows that the median period between funding rounds is, since 2021, typically getting longer every year.

In the UK, PricewaterhouseCoopers (PwC) - one of the Big Four global accounting firms - have confirmed that, in 2024, there were almost 11,000 insolvencies among UK companies that had been founded in the previous 7 years. For these companies, the cash burn rate was too high. They ran out of cash runway.

- •

J. Baker, startup specialist at PwC,said "overall insolvency levels remain at some of the highest seen in decades."

Established companies: cash burning rate

Even when a firm has been around for years, the cash burn rate remains an important metric.

According to Germany's Federation of Business Information Services, total 2024 corporate insolvencies were up 12% on 2023 to over 190k.

- •

In 15 out of 17 Western European countries, more firms went bust in 2024 than the year before.

Creditreform Austria observed that "small and medium-sized enterprises, which often have limited financial reserves, were particularly affected."

Firms with only a hazy idea of their cash burn rate are the first to go bust.

Is monitoring cash burn rate even possible without dedicated software?

Remember: Cash burn rate defines how quickly a business is spending cash, whilst cash runway defines the period of time for which that cash will last.

Businesses still relying on error-prone and unwieldy Excel spreadsheets to manage their cash will likely find it very difficult to pin down their cash burn rate. They simply won't have the visibility or accurate forecasting capability to get it right.

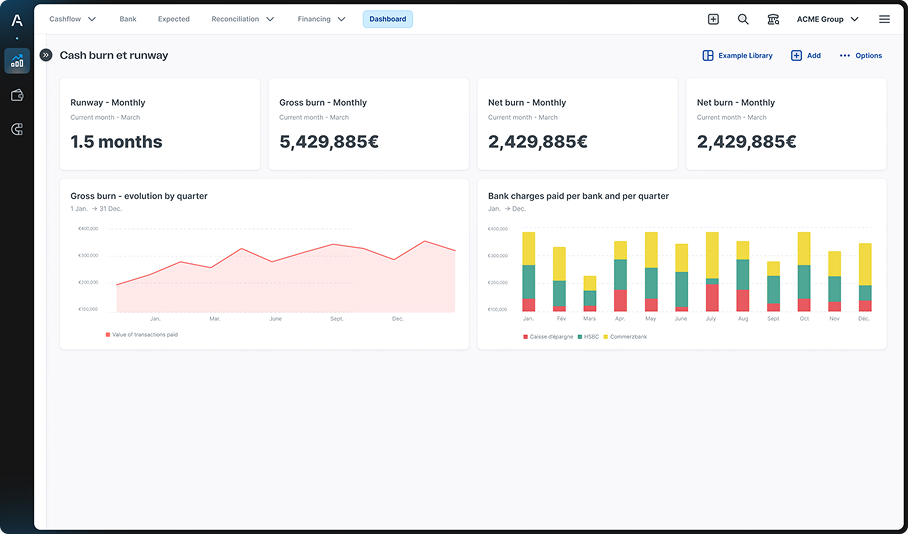

Agicap: keeping companies on top of cash burn

Top software like Agicap is specifically designed to empower your cash management. Watch this brief video to learn how.

It really couldn't be simpler to pin down your cash burn rate, because Agicap devotes a whole screen to it. Clear, simple and instantly on-demand: the hallmarks of the Agicap interface.

What's more, Agicap's standard cash management features work together for crystal-clear cash oversight - plus many ways to optimise Spend Management.

Agicap feature | How the feature helps to pin down the cash burn rate |

|---|---|

Real-time bank sync | Guarantees the accuracy of your real-time cash position - including the all-important expenses |

Custom cash flow categories | Your team can assign expenses to precise categories for 100% clarity |

Forecasting scenarios | Want to see what happens to cashflow under different market conditions? Different cash burn rates - that's what happens. |

Custom alerts | Set the system up easily so it flags unusual spending patterns |

Multi-entity aggregation | Get a consolidated group view of your firm's financial health - or zoom in for a detailed view of a particular division or entity's spending. Watch this quick video to see how easy this is to set up. |

German e-commerce firm Metallbude are one of thousands of Agicap clients who discovered that Agicap is the answer to their urgent need for short-term liquidity oversight. CEO T. Stermer says, "We see the cash flow every day and know how much we have left at the end of the day. This allows us to anticipate and mitigate liquidity bottlenecks early."

Book a demo with one of our experts to see how Agicap can work for you too.

How do you calculate cash burn rate from financial statements?

A company has a cash stock of £500,000. Its monthly operating expenses are £50,000 and its monthly revenue is £60,000. We now calculate the various burn rates and cash runway:

Gross burn rate = £50,000 Net burn rate = £60,000 - £50,000 = £10,000 Cash runway (gross) = £500,000 / £50,000 = 10 months Cash runway (net) = £500,000 / £10,000 = 50 months

Since the company in this example already has high revenues, the gross burn rate and net burn rate as well as the respective runways differ greatly from each other.

If revenues were to decline - in the worst case to 0 - the company would have enough cash for 10 months to cover its running costs.

How to reduce a high cash burn rate

If the cash burn analysis shows a higher burn rate than predicted by cashflow forecasts, it is often worth looking at the cost drivers in detail. Depending on what they consist of, various measures can then be taken to reduce the costs, for example:

- •

Savings in personnel costs

- •

Increase turnover through more sales

- •

Investing in product improvements, research & development, etc. to boost sales or reach new target groups.

- •

Sale of assets (e.g. capital investments or tangible assets)

- •

Taking out a loan for more freely available cash

FAQs

Why is a company's cash burn rate significant for its survival?

A company's cash burn rate shows how much more money it is spending over a given period than it is netting. If the cash burn rate is too high, its cash runway will run out, and it will become insolvent. Top cloud service software like Agicap keeps cash burn rate front of mind for CFOs by clearly displaying the metric on a user-friendly screen accessible at all times.

What is a good cash burn rate?

A good cash burn rate is less than zero. That's because a positive cash burn rate shows that a firm is spending more money (operating costs) than it is bringing in (revenues). Investors in startups typically focus their scrutiny on the company's cash burn rate because the formula is such a clear indication of financial health.