Coping with the Complexity of Banking Connectivity: How to Bridge Your ERP to Your Banks

Banking connectivity is of paramount importance to modern business operations, enabling seamless communication between your Enterprise Resource Planning (ERP) system and your banks. However, banking communication systems vary in terms of complexity – from a simple spreadsheet where you manually enter your banking data and reconcile it with your payment data to an advanced software which provides you with more or less fully automated banking connectivity as-a-service and other finance management functionalities like cash flow forecasting and payment reconciliation to boot.

Achieving the ideal banking connectivity can be challenging, especially if the requirements are that it should be easy, automatic, cheap, accurate, and offer global coverage. In this article, we will explore the complexity of banking connectivity and discuss how to bridge your ERP to your banks effectively.

How a Banking Connectivity Solution Improves a Company’s Tech Stack

ERPs have long been a basic component of the technology infrastructure for mid-market companies, streamlining business and financial work like Accounting, HR, CRM, and Supply Chain management. But the financial process management capabilities within ERPs tend to struggle to meet the intricate demands of large corporations, particularly those with global operations.

The shortcomings of ERPs become evident when considering the enhancements that a multi-banking connectivity system, acting as an intermediary between banks and ERPs, brings to financial analysis once integrated into a company's software ecosystem. While it is feasible to establish connectivity by manually transferring banking data via Excel files, the true value for finance managers on any level lies in achieving easy, accurate, automated, cost-effective, and global banking connectivity.

Reducing the Complexity of Manual Data Aggregation

For international corporations, the probability of working with multiple banks and bank accounts across various national and regulatory boundaries necessitates a multi-banking solution that consolidates and centralises vast amounts of data from diverse sources into a single interface.

Previously, centralising bank account information across an organisation involved manually accessing bank accounts, retrieving data via Excel file downloads from the bank portal, and filling spreadsheets, which were then linked to larger master sheets. These sheets were then imported into the ERP for analysis. This approach made it nearly impossible to quickly and securely access the cash positions of the group and single entities. It was also a form of banking connectivity, even if not a great one.

A contemporary multi-banking connectivity solution addresses this issue by connecting to each bank account through various connectivity options (ranging from banking networks to protocols), such as SWIFT, Host-to-Host, and EBICS, in such a way, that it will enable other tools to perform better, be it an ERP, an analytics tool, a cash flow management solution, and so on.

Advanced banking connectivity solutions go even further, enabling payment execution and reconciliation while requiring only a single login to view the short-term evolution of all bank balances by account, bank, entity, or group.

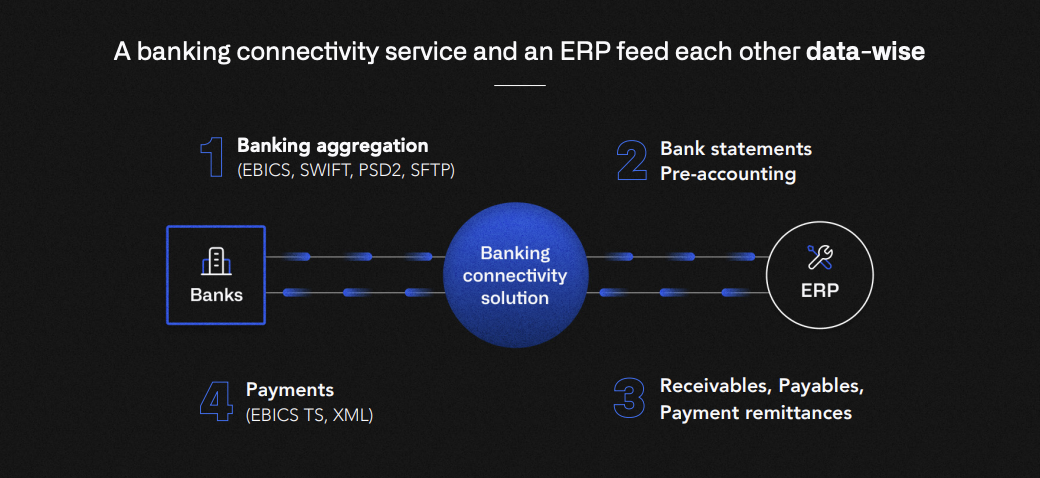

How a Banking Connectivity Solution Bridges ERPs to Banks

By providing up-to-date, cash-focused insights for decision-making, a banking connectivity solution effectively complements an ERP system. It serves as the vital link between banking data from banks and processes within the ERP, ensuring a continuous flow of information for accurate cash forecasting and liquidity management in both short-term actions and long-term planning. Without it, two incomplete systems would operate side by side.

A banking connectivity solution connects to both your company's bank accounts and ERP, facilitating an automated, seamless data transfer between the systems. On a daily basis, the ERP receives a feed of bank statements and pre-accounting data to aid reconciliation, which is increasingly crucial for companies processing thousands of payments weekly.

In essence, the banking connectivity solution becomes the ultimate source of truth for banking and cash data, feeding other systems to streamline reconciliation, accounting, and reporting processes. A cash flow management solution powered by banking connectivity like Agicap is able to then offer a comprehensive view of financial metrics in a visual reporting module designed for decision-makers..

In essence, the banking connectivity solution becomes the ultimate source of truth for banking and cash data, feeding other systems to streamline reconciliation, accounting, and reporting processes. A cash flow management solution powered by banking connectivity like Agicap is able to then offer a comprehensive view of financial metrics in a visual reporting module designed for decision-makers..

How to Rethink your Company’s Approach to Banking Connectivity

To fully understand and evaluate the benefits of a banking connectivity system, it is essential to explore how it functions and the key considerations before implementing or re-assessing your current solution.

To cope with the complexity of banking connectivity, businesses should consider the following steps:

1. Assess your current banking connectivity: Evaluate the existing connectivity between your ERP and banks, identifying any gaps or limitations that need to be addressed.

2. Research available solutions: Explore the market for banking connectivity solutions that can bridge the gap between your ERP and banks, taking into account the specific requirements of your business.

3. Implement the chosen solution: Work with your tech team or integrator to implement the selected banking connectivity solution, ensuring that it meets your needs and integrates seamlessly with your existing systems.

4. Monitor and optimise: Continuously monitor the performance of your banking connectivity solution, making adjustments as needed to ensure optimal performance and accuracy.

First Steps to Take Now

Coping with the complexity of banking connectivity requires a thorough understanding of the challenges and limitations of your ERP and banking systems. By assessing your current connectivity, researching available solutions, implementing the chosen solution, and continuously monitoring and optimising its performance, you can bridge the gap between your ERP and banks, achieving easy, automatic, cheap, accurate, and global coverage.

As technology continues to evolve, businesses must stay ahead of the curve to ensure that their banking connectivity remains efficient, secure, and future-proof. The first steps to take now is to reassess your company’s banking connectivity system, spot the elements that keep it from being an ideal solution and researching a possible alternative.

Over 7.000 companies already use Agicap as a banking connectivity as-a-service, including many more features for cash flow management and related financial processes.

Try Agicap in a free personalized demo !