AI-Powered Financial Insights: Agicap's New AI Assistant Unlocks Your Data

Artificial Intelligence remains the buzzword of the hour. Yet, beyond cool gimmicks and entertaining generative features, AI is rapidly transforming various industries. In finance, AI is not just a futuristic concept; it's becoming an essential tool for improving efficiency, accuracy, and decision-making.

The Dawn of AI in Finance

Agicap is leading this transformation with the introduction of the Agicap AI Assistant, a tool designed to revolutionise how CFOs, financial directors, and treasury managers interact with and utilise their financial data.

In this post, we will explore how the Agicap AI Assistant can empower your financial management by offering instant access to critical insights and facilitating smarter financial judgments.

Meet Your New Financial Companion

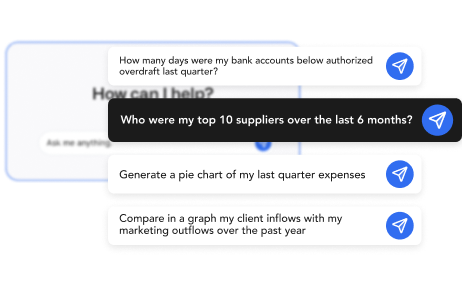

The Agicap AI Assistant functions as an on-demand financial expert. This sophisticated tool allows you to ask financial questions in plain language and get immediate, data-driven responses. Need specific information? Looking to analyse cash flow? Want to explore financial scenarios? The AI Assistant has got you covered, delivering answers through text, visualisations, or downloadable files.

How It Works

The Agicap AI Assistant is fully integrated with the Agicap platform, accessing a comprehensive range of financial data. This includes bank transactions, cash forecasts, accounts receivable and payable, debts, and investments. By leveraging this centralised data, the assistant can provide accurate, context-aware responses tailored to your business.

This integration significantly reduces the need for manual data processing and aggregation. Users can efficiently analyse trends, predict liquidity needs, and assess the impact of potential decisions.

Game-Changing Features That'll Enhance Your Financial Management

1. Rapid Data Access

The AI Assistant streamlines the process of accessing specific financial information. Users can quickly retrieve data points by asking questions such as, "What are my three biggest bills for the current quarter?" This capability enables swift, informed choices on accurate, up-to-date information.

2. In-Depth Insights

The AI Assistant doesn't just scratch the surface. It provides in-depth analysis of financial data. For instance, when addressing cash flow concerns, users can request a breakdown by category to identify root causes of fluctuations. This level of detail supports thorough financial analysis and proactive issue resolution.

3. Enhanced Decision-Making

One of the AI Assistant's notable features is its ability to run financial simulations on demand. Users can assess the potential impact of significant financial moves, such as large payments, on their cash position. Ask, "If I make a £150,000 payment in three days from my main account, will I have enough short-term cash?" The assistant will assess your current and projected cash positions for more informed financial planning and improved risk management.

Real-World Scenarios: Putting the AI Assistant to Work

The Agicap AI Assistant offers practical solutions for various financial management tasks. Let's dive into some practical examples:

1. Expense Tracking: Ask, "What was my biggest expenditure over the last 12 months?" Users can quickly identify major expenditures over specific periods, facilitating budget reviews and cost-optimisation strategies.

2. Cash Flow Analysis: When you notice a concerning trend, ask, "Why is my cash flow decreasing this month? Analyse the categories." The assistant can provide detailed breakdowns of cash flow trends, enabling proactive management of financial resources.

3. Forecasting Future Cash Flow: Just ask, "What will my cash position look like at the end of the next quarter if my revenue decreases by 15% each month?" The AI Assistant can simulate this scenario by analysing your historical revenue patterns and applying the specified decrease. The result is a clear projection of your future cash position, helping you prepare for potential downturns and make proactive adjustments to your financial strategy.

The versatility of the Agicap AI Assistant is demonstrated by its ability to address a wide range of financial queries. Here are some further examples of the types of questions and prompts it can answer:

- "Build a table with all the 2023 bank transactions containing the heading 'IKEA'."

- "How many days were my bank accounts below their authorised overdraft last quarter? Provide the number of days for each bank account individually."

- "Generate a graph of my 10 biggest customers last quarter."

- "What is the volatility of our income?"

- "Predict my runway if revenue deteriorates by 10% monthly."

Robust Data Security

At Agicap, data security has always been a top priority. The AI Assistant operates entirely within the Agicap system, ensuring that all data analyses are conducted securely on Agicap servers. No sensitive information is shared externally, and all inquiries remain within the confines of the platform. This robust security framework guarantees that your financial data is protected at all times, allowing you to use the assistant with confidence.

The Bottom Line

The Agicap AI Assistant isn't just another tool — it's your new financial ally. By harnessing the power of AI and Agicap's robust data capabilities, we're offering you improved speed, insight, and decision support. Whether you're looking to streamline operations or gain deeper financial insights, the Agicap AI Assistant is ready to enhance your approach to financial management.

Ready to embrace the future of finance? Discover how the Agicap AI Assistant can improve your financial strategy. Schedule a demo today. It's time to take your financial management to the next level.