From Complexity to Clarity: Why 2026 Is the Year US Mid-Market Firms Double Down on Investment Management Software

In 2026, US mid-market firms—especially those with significant cash reserves—are facing an increasingly complex investment environment. Unpredictable rates, fiscal uncertainty, and global disruptions mean that traditional approaches are no longer enough.

For cash-rich mid-market groups, relying on fragmented accounts or manual investment processes can now lead to missed opportunities and greater risk. As highlighted in JPMorgan’s 2025 Mid-Year Investment Outlook, agile and proactive investment management has become essential to safeguard yield and liquidity.

Investment management software provides a powerful solution—automating cash pooling, optimizing allocations across entities, and offering real-time oversight. This guide explores how cash-rich US mid-market organizations can leverage next-generation platforms to unlock higher returns and navigate 2026’s volatility with greater confidence and control.

What Is Investment Management Software?

Definition

Investment management software is a digital solution purpose-built for finance and treasury teams to centralize, automate, and optimize their investment processes. Going far beyond spreadsheets and manual trackers, these platforms enable organizations to:

- •

Maintain a complete, real-time overview of all investments across banks, entities, and asset classes.

- •

Rapidly identify excess or idle balances and simulate their allocation into short-term, secure investments.

- •

Track yields, maturities, and future cash unlock dates with precision.

- •

Ensure every investment aligns with policy, liquidity needs, and market opportunity—supporting both compliance and strategic decision making.

Unlike risk management platforms, which focus on exposure and protection, investment management software is purpose-built for maximizing group-wide yield while protecting operational liquidity. Every surplus dollar is analyzed for optimal deployment, transforming treasury from a cost center into a value driver.

Tangible Financial Gains: Scenario-Based Outcomes

By deploying investment management software, mid-market organizations can unlock measurable financial and operational improvements. The following modeled scenarios illustrate the potential impact for a typical cash-rich group:

- •

Real-Time Net Liquidity and Investment Visibility: Achieve immediate, consolidated oversight of cash and investments across all entities, maturities, and banking partners.

- •

Dynamic Allocation: Systematic pooling and allocation of surplus cash help maximize returns and reduce idle balances.

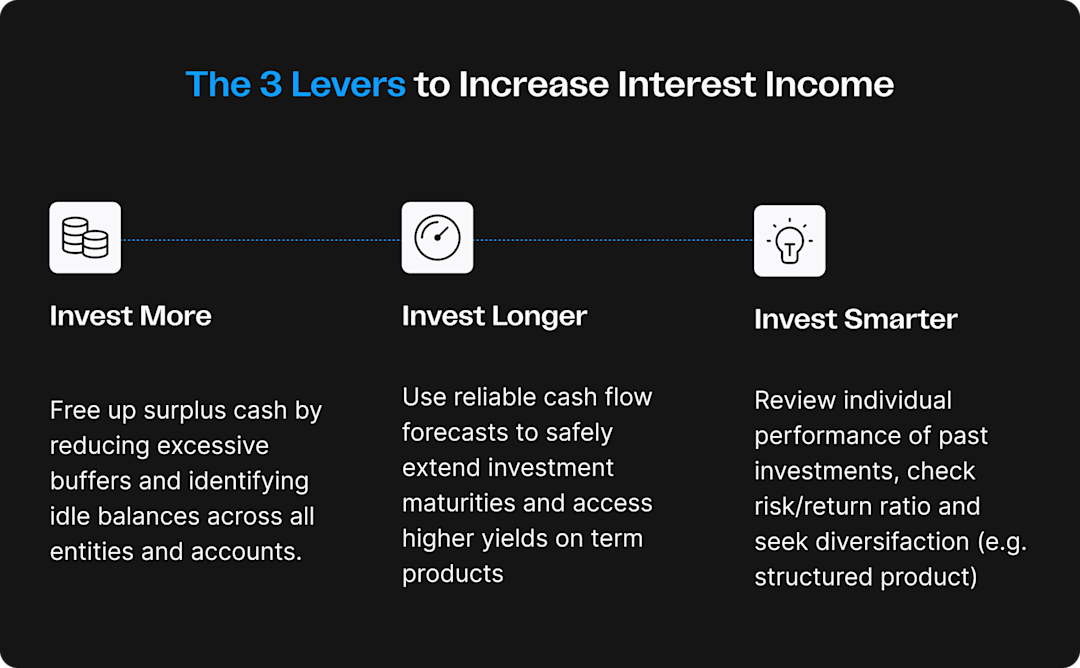

For example, in a modeled scenario, increasing average invested amounts from $6M to $9M at 3.5% would raise annual financial income from $210k to $315k (+33%).- •

Reliable Cash Flow Forecasting and Proactive Maturity Management: Accurate cash flow forecasts support better anticipation of liquidity needs, prevent cash shortages, and enable optimal investment scheduling.

Illustratively, reducing required cash buffers and optimizing maturities can generate $70k–$105k in extra annual yield.- •

Access to Higher Yields via Longer Investment Horizons: Reliable forecasting also allows companies to confidently invest surplus cash over longer maturities, unlocking access to more attractive interest rates.

Illustratively, more reliable cash flow forecasting can allow companies to reduce precautionary cash buffers by $2–3M and invest this surplus over longer maturities. Assuming a 2.5–3.5 percentage point yield uplift versus overnight liquidity, this translates into an additional $70k–$105k in annual financial income.- •

Actionable Performance Analytics: Continuous benchmarking of portfolio yield, duration, and policy alignment—making it simpler to refine strategies and outperform market averages.

Please note: All figures are for illustrative purposes only, modeled on typical mid-market scenarios and not representative of any specific client result.

Summary: These scenarios demonstrate how automation, real-time visibility, and improved forecasting can drive significant gains in yield, efficiency, and control—delivering tangible value for finance leaders in today’s complex market.

Modern Investment Management: The Mid-Market Challenge

Why Investment Management Is Especially Complex for the US Mid-Market in 2026

For US mid-market groups, structural complexity makes optimal investment management a constant challenge. Cash remains fragmented across entities, accounts, and banking partners, and many firms still rely on spreadsheets or basic banking tools. As highlighted in Goldman Sachs Asset Management’s 2026 Investment Outlook, this landscape of “multiple macro catalysts—from central bank shifts to trade changes, fiscal risks, and geopolitical volatility—demands proactive, real-time decisions.”

In this context, fleeting market opportunities, volatile rates, and the need to maintain operational liquidity force finance teams to act decisively. Any delay in identifying or pooling excess cash translates into tangible yield loss, while an overly conservative stance can trap capital needlessly. Robust scenario analysis and real-time consolidated visibility have become essential for balancing yield, liquidity, and compliance in a landscape where every investment decision counts.

Core Needs of US Mid-Market CFOs & Treasurers

Mid-market finance leaders—especially in private equity-backed firms—require investment tools purpose-built to manage this complexity and scale. Key needs include:

- •

Unified, Real-Time Portfolio Monitoring: The ability to instantly view consolidated cash, investments, maturities, and yields—by entity, currency, and account—across the group and all banking relationships.

- •

Automated Opportunity Detection and Pooling: Technology that continuously monitors for idle or excess cash, proactively proposes allocations based on pre-defined rules or liquidity thresholds, and facilitates group-wide cash pooling to maximize negotiating power and product access.

- •

Scenario Testing Embedded in Rolling Forecasts: Solutions must allow dynamic simulation of investment decisions within short- and medium-term cash flow forecasts, ensuring no excess commitment jeopardizes downstream obligations or violates group liquidity buffers.

- •

Automated Reporting: Efficient generation of complete, transparent reports for management, boards, lenders, and auditors.

Daily Pain Points in Investment Management

Despite modern IT stacks elsewhere in finance, investment processes are still too often hindered by legacy tools and manual workarounds:

- •

Manual & Siloed Aggregation: Group treasurers spend hours reconciling positions across spreadsheets and online banking portals—leading to timing gaps and lost visibility on centralized cash.

- •

Missed Yield or Overexposure: Without precise, real-time forecasts, excess liquidity can sit idle in non-remunerated accounts, or—conversely—be overcommitted and force costly external borrowing or overdrafts.

- •

Fragmented Transfer Operations: Internal transfers or sweeping between group entities typically require multi-platform navigation and manual signoff, slowing down rebalancing and increasing operational risk.

- •

Lack of visibility on cash access: Maturities and rollover decisions for term deposits and other fixed-income placements are often tracked in isolated files, making it unclear when funds will become available again and whether they are planned for renewal—complicating liquidity planning, and ultimately the service delivered to internal stakeholders and external clients.

In summary, for mid-market organizations, effective investment management means actively optimizing liquidity and performance in real time—despite ongoing complexity. Modern platforms make this level of agility achievable.

What Is the Best Software for Managing Investments in the US Mid‑Market?

Market Overview: Key Players

Below is a comparison table of the best investment management tools for US mid-market finance teams:

Software | Features | Main Advantages | Target Fit |

|---|---|---|---|

Agicap | Automated cash opportunity identification, smart investment allocation, scenario modeling linked to cash flow planning, centralized investment tracking, maturity visualization, instant reporting | Fast deployment, intuitive UI, built for lean/multi-entity teams | US mid-market groups seeking unified cash & investment control |

Kyriba | Modular TMS, investment modules, liquidity / cash/ FX, multi-bank integration | Highly configurable, broad connectivity, scalable | Complex groups or upper mid-market with IT / internal resources |

GTreasury | Investment / risk analytics, in-depth reporting, custom integration | Advanced analytics, risk, mature TMS stack | Mature treasury, larger IT, multi-country or complex group |

TIS | Multi-bank cash visibility, payments, basic investment tracking | Rapid implementation, easy payments / cash centralization | Groups prioritizing bank connectivity; less advanced investment |

HighRadius | Receivables, cash pooling, basic investment tracking features | Best-in-class AR automation, cash forecasting added | AR-focused, large receivables, pooling, some mid-market |

Reval / FIS | TMS, investments / hedging, cash/ FX modules | Robust, enterprise-grade, deep risk / hedging modules | Upper mid-market / large, global or complex risk needs |

The Best Investment Management Tools for Mid-Market Teams: Solution Overview

Agicap

Agicap is a treasury management solution (TMS) purpose-built for mid-market, multi-entity finance teams, offering:

- •

Automated excess cash detection and allocation based on customizable buffers and investment horizons to maximize returns while maintaining liquidity.

- •

Scenario modeling directly integrated with cash flow forecasts, enabling simulation of investment impact on group liquidity before execution.

- •

Centralized tracking in a single dashboard for all investments, maturities, and performance, with rapid reporting.

- •

Fast onboarding and operational efficiency for lean teams, eliminating manual work and spreadsheet silos through seamless data consolidation and automation.

Limitations: Agicap does not recommend or execute investments. It is optimized for fixed-income products (term deposits, bonds) and does not support equities, UCITS, money market funds, structured products, alternative assets, or crypto.

Kyriba

As a cloud TMS, Kyriba offers investment, cash, and liquidity modules as part of a larger treasury suite. Known for its configurability and bank connectivity, it suits organizations with advanced treasury needs and offers enterprise-scale deployment. Implementation, however, can be resource-intensive for smaller teams.

GTreasury

Provides advanced investment and risk analytics, with modeling and reporting capabilities. GTreasury is particularly well-suited for comprehensive, mature treasury environments requiring deep integration and customized workflow design.

TIS (Treasury Intelligence Solutions)

Specializes in multi-bank connectivity, cash visibility, and payment centralization, with basic investment oversight features. TIS is a strong fit for groups driving payment process harmonization, though investment functionality is more limited.

HighRadius

Focused historically on accounts receivable automation and cash pooling, HighRadius now offers basic investment monitoring and cash forecasting. It is particularly beneficial for organizations with complex receivables or cash pooling requirements.

Reval / FIS

A SaaS TMS aimed at upper mid-market and large corporates, supporting sophisticated investment, hedging, risk, and FX workflows. Reval/FIS offers risk management tools, but with a level of complexity best matched to larger, established finance organizations.

While each platform brings specific strengths, selecting the best fit requires a careful assessment of your organization’s needs, priorities, and constraints, and an understanding of the unique strengths each provider offers to mid‑market firms. The following section outlines the key considerations mid-market buyers should evaluate to make an informed decision.

What to Look For in Investment Management Software: Critical Features

When evaluating investment management solutions, mid-market finance leaders should use their core needs as a practical checklist and focus on a few non‑negotiable criteria when selecting a platform. These principles will help them quickly distinguish generic tools from the best tools truly built for multi‑entity, cash‑rich organizations:

- •

True consolidation: Real-time, group‑wide view of cash, investments, and maturities across all banks and entities, giving finance teams a complete view of their liquidity and investment posture at any moment.

- •

Actionable automation: Surplus cash detection plus concrete allocation proposals—not just static reports.

- •

Embedded scenario modeling: Investment decisions tested directly inside cash forecasts and liquidity buffers.

- •

Board-ready reporting: Fast, flexible reports for management, lenders, and auditors.

- •

Easy adoption & integration: Intuitive UI for lean teams and stable integrations with banks and ERPs. Strong integration capabilities ensure data flows automatically across your finance stack, reducing manual work and keeping cash and investment information consistently up to date.

Beyond core functionality, customizable dashboards help different stakeholders—CFOs, treasurers, and controllers—focus on the KPIs and views that matter most to their role.

Spotlight: How Agicap Transforms Investment Performance for Mid-Market Firms

Agicap’s Key Capabilities

- •

Automated Opportunity Detection: Instantly pool excess cash across group entities, apply custom-defined safety buffers and policies, and propose optimized short-term investments.

- •

Scenario Simulation Integrated with Cash Flow Planning: Visualize placements directly within cash flow plans—not in isolation—to protect liquidity and anticipate yields or lock-up implications.

- •

Increased Investable Cash Through Better Collections: By centralizing AR data, tracking overdue invoices, and supporting automated reminder workflows, Agicap helps finance teams reduce DSO and accelerate cash collections. This directly increases the amount of free cash available for short-term investment—without compromising operational liquidity.

- •

Centralized Portfolio Tracking: Full-life-cycle view of each placement, with at-a-glance understanding of available cash, locked funds, and soon-to-be liquid investments.

- •

Instant, Shareable Reporting: Easily produce clear investment summaries and downloadable reports to support communication with management, including details such as maturities and accrued interest.

- •

Designed for Lean Teams: Fast ramp-up, minimal change management, and intuitive navigation tailored to the time and resource constraints of mid-market treasury setups, with a strong focus on ease of use for non‑technical users.

US mid-market advantage: Quick onboarding, native cash visibility, and unrivaled market responsiveness—without “big enterprise” latency or complexity.

Client Example: Unlocking Idle Cash for Investment

After implementing Agicap, a leading insurance broker and administrator* was able to accurately track and differentiate between proprietary and non-proprietary cash for the first time. This new clarity enabled the finance team to invest surplus cash that previously sat dormant—and realize significant gains in financial income.

“It was only after implementing Agicap that we began to invest our excess cash, because it was the first time we could precisely track and distinguish available liquidity.”

Results:

- •

Over 50% of surplus cash actively invested

- •

+€400k in new financial income from optimized placements

*Industry example based on a mid-market insurance group managing 14 entities and 20 bank accounts. Figures for illustrative purposes.

This type of transformation illustrates how mid-market firms can turn previously idle balances into a stable source of financial income, while maintaining the liquidity required to serve their own clients.

Best Practices for Implementing Investment Management Software

- •

Prepare & Integrate Data: Audit, clean, and map all bank, entity, and investment data. Automate data connections to ensure real-time, consolidated oversight across the group.

- •

Set Up Policy Controls: Configure investment horizons, liquidity buffers, user rights, and approval workflows in line with your treasury policy and governance requirements.

- •

Train All Stakeholders: Deliver focused onboarding for treasury, accounting, and finance teams. Use pilot phases and internal champions to drive adoption and process consistency.

- •

Track KPIs & Iterate: Monitor key metrics like invested cash ratio, yield uplift, idle cash reduction, and reporting speed. Review results quarterly, collect feedback, and refine rules to maximize ROI.

Tip: Treat implementation as both a technology and process upgrade—strong data foundations, clear rules, engaged teams, and iterative improvement drive long-term value.

Future Trends in Investment Management Software

As technology and capital markets evolve, mid-market finance leaders can expect rapid advancements in how surplus liquidity is managed and deployed. The next generation of investment management platforms will drive a transformative shift in efficiency, integration, and decision support.

- •

AI-Driven Allocation & Dynamic Optimization: Next-generation platforms will leverage artificial intelligence to analyze cash flow patterns and market conditions, proactively suggesting or even automating the allocation and reinvestment of surplus liquidity. This shift will empower finance leaders to continuously maximize yield and minimize idle cash as rate environments and opportunities evolve.

- •

End-to-End Ecosystem Integration: Investment management tools will become fully embedded within the broader finance stack, connecting natively with ERPs, TMS, and forecasting platforms. This deep integration will allow holistic scenario analysis, unified reporting, and true end-to-end liquidity planning—from cash inflows to investment performance—enabling strategic, data-driven decisions at group scale.

Key takeaway: Tomorrow’s leaders won’t just automate investments—they’ll use AI-powered, fully connected platforms to orchestrate liquidity, optimize returns, and respond instantly to changing market dynamics.

Conclusion

For US mid-market, cash-rich companies, investment management software is no longer optional—it is essential competitive infrastructure. By embracing automation, real-time visibility, and seamless scenario modeling, finance leaders can ensure every dollar is working efficiently, risk is proactively controlled, and reporting is always audit-ready.

Next Steps:

- •

Audit your current investment pain points and readiness.

- •

Review your current investment level and performance by asking:

- •

Can I invest more without jeopardizing liquidity?

- •

Can I invest better—earning more with the same amount by investing longer or in different asset classes, within my risk and policy limits?

Set clear yield and efficiency targets: These targets should be aligned with your current financial situation, risk appetite, and the strategic objectives set by management and shareholders

Prioritize platforms aligned with your policy and user needs—schedule demos to validate reporting, automation, and real-time capabilities.

Modernize your investment management, and you’ll unlock higher yield, sharper insight, and new strategic agility—setting your organization apart in any market cycle.

Ready to see these capabilities in action?

Book a personalized Agicap demo to discover how our next-generation treasury management platform can help your team centralize cash and drive financial performance across your organization.

FAQ – Investment Management Software for US Mid-Market Teams

What sets next-generation investment management software apart from traditional tools?

Modern platforms like Agicap centralize both investments and real-time cash positions for the entire group, not just portfolios. Unlike traditional tools—often manual and disconnected from daily liquidity—they automate excess cash allocation, integrate scenario modeling, and deliver consolidated reporting. This enables mid-market teams to optimize yield, minimize risk, and act quickly with complete visibility.

How does investment management software help unlock idle cash and improve returns?

By aggregating data, identifying excess liquidity, and automating allocation decisions, software solutions make it easy to deploy surplus cash quickly and efficiently. Finance teams can thus capture market opportunities, reduce idle balances, and increase financial income without risking operational liquidity.

How quickly can mid-market organizations implement and see value from an investment management platform?

Deployment timelines vary by platform, but many solutions designed for the mid-market (like Agicap) offer rapid onboarding—sometimes in a matter of weeks. ROI is often realized within the first quarter through reduced idle cash, fewer manual processes, and improved decision speed.

What is the best investment management and portfolio management software for mid-market companies?

There is no single “best” solution, but mid-market companies typically need software that combines real-time cash visibility, automated investment opportunity detection, and robust reporting. Platforms like Agicap are designed specifically for multi-entity, cash‑rich groups, focusing on short-term, low‑risk placements and ease of deployment. The right choice depends on your complexity, asset scope, and internal resources.

What features should investment portfolio management tools include?

Essential features include consolidated views of cash and investments across entities and banks, automated detection of surplus liquidity, and clear tracking of maturities, yields, and cash unlock dates. For finance teams, tight integration with cash flow forecasting, configurable policies and limits, and board-ready reporting are also critical. User-friendly dashboards and strong data integration significantly improve adoption and impact.

How does cloud-based investment management software support multi-entity, multi-currency portfolios?

Cloud-based platforms centralize data from multiple banks, entities, and currencies in real time, giving finance teams a single source of truth for cash and investments. They allow you to define rules per entity or region, manage FX implications, and run consolidated or segmented reports instantly. This architecture also simplifies maintenance, connectivity, and scalability as your group structure evolves.

Is investment management software different from fund management or mutual fund management software?

Yes. Investment management software for corporates focuses on managing a company’s own cash and short-term investments, often in deposits or fixed-income products, with a strong link to treasury and liquidity needs. Fund or mutual fund management software is built for asset managers running pooled vehicles for external investors, with requirements around fund accounting, distribution, and investor reporting that go beyond corporate treasury use cases.