Mastering cash flow resilience: practical strategies for mid-market finance teams

Cash flow remains one of the biggest challenges for mid-market companies, especially in today’s uncertain economy. In a recent webinar, global finance influencer Oana Labes and Agicap’s General Manager US Mickaël Jordan shared hard-won lessons and practical strategies to help CFOs avoid liquidity pitfalls and strengthen financial resilience.

This recap highlights the key takeaways—real business examples, proven tactics, and the role of smart automation—to help your team turn cash flow risks into long-term growth.

For deeper insights, watch the full webinar replay featuring Oana Labes and Mickaël Jordan below:

Top 3 cash flow challenges in mid-market companies

During the webinar, Oana Labes asked participants to name their toughest cash flow issues. From the live chat and her extensive consulting experience, three common obstacles stood out as universal headaches for mid-market businesses:

Seasonal cash flow fluctuations: Many companies see their revenues rise and fall throughout the year, making it tough to cover expenses during slow periods and plan investments with confidence.

Late customer payments: Delayed payments from buyers create liquidity crunches, disrupt day-to-day operations, and force businesses into reactive cost-cutting or emergency funding.

Working capital tied up in growth and inventory: Ambitious expansion and excess inventory often mean crucial cash is stuck and unavailable for other needs, stalling growth opportunities or leaving businesses exposed to risk.

As Oana put it: “Most companies do not fail because of weak products or poor sales—they fail ultimately because of avoidable financial blind spots.”

These challenges are not signs of weakness, they are signals that financial management practices need to evolve. Addressing them proactively is key to unlocking resilience, stability, and long-term growth.

The power of strategic financial planning

Oana Labes cautioned that many companies believe they have a financial plan, but “in reality, what they actually have is a static twelve month budget.” This short-term vision leaves businesses unprepared for real growth, liquidity challenges, or unexpected obstacles.

She broke down three maturity levels she has observed:

- •

Level 1: The annual (accrual-based) budget

Most companies stop here. They plan revenue and expenses over 12 months but lack visibility into liquidity, leverage, or long-term capital structure.- •

Level 2: The three-statement budget

At this stage, companies begin to forecast across income statement, balance sheet, and cash flow. However, these plans are often built once a year and quickly become outdated when real-world conditions change.- •

Level 3: The strategic financial plan

Here, companies use a rolling, integrated model that aligns strategy, capital planning, and cash flow over a multi-year horizon. This approach provides advance visibility into liquidity needs, funding requirements, and the feasibility of growth initiatives.

Oana made it clear: “Without a cash flow plan, there is no execution plan.”

Relying on budgets built for compliance instead of robust, strategic forecasting leads to predictable disappointment: missed growth targets, last-minute crisis management, and reactive leadership. By contrast, a proactive approach integrates capital structure planning, cash flow modeling, and stress testing as ongoing, dynamic processes, unlocking true resilience and positioning a company to act, not just react.

Engineering working capital: From plan to practice

Moving from strategy to results means putting strong operational habits in place—what Oana Labes calls “engineering” your working capital. She emphasized that even the best financial plans can falter if your day-to-day cash flow drivers aren’t managed with discipline and clarity. Here’s how to navigate the four technical fault lines of cash flow management :

Receivables (DSO)

Lagging collections and concentration risk are major traps. When customers pay late or when a small number of accounts dominate your receivables, significant cash can become locked up and inaccessible for operations or growth.To mitigate this, assign clear ownership, monitor DSO closely, and implement policies that both shorten collection times and reduce overreliance on a few key customers.

Inventory (DIO)

Excess stock and high carrying costs can quickly turn inventory into a multi-million-dollar cash sink. When inventory isn’t aligned with real demand, capital becomes frozen and profitability declines.

Managing this fault line means regularly reviewing inventory aging, applying ABC analysis, and refining purchasing decisions based on dynamic demand forecasts.

Payables (DPO)

Timing is critical: paying suppliers too early unnecessarily drains cash, while waiting too long can hurt vendor relationships and lead to lost discounts.

Finding the optimal balance requires carefully tracking DPO—ensuring that payments are neither too early nor too late—and using dashboards to manage cash outflows efficiently while maintaining trust with suppliers.

Cash Conversion Cycle (CCC)

The CCC quantifies how efficiently your business turns investments in inventory and receivables into cash from sales.

Formula: CCC = DIO + DSO – DPO

Every additional day added to DIO or DSO—or lost from DPO—can lock up hundreds of thousands in working capital that could otherwise fund growth or cushion the business in tough times.

Oana pointed out that too many teams still rely on static spreadsheets to manage these critical cycles, making it difficult to spot issues before they escalate. She recommends embracing automation, real-time monitoring, and assigning clear accountability for each of these cash flow levers. This approach helps unlock trapped cash, reduce operational risk, and build long-term resilience.

As she summed it up:

"If strategy sets the destination, then the cash conversion cycle decides if you have enough fuel to actually get there without stalling on the highway."

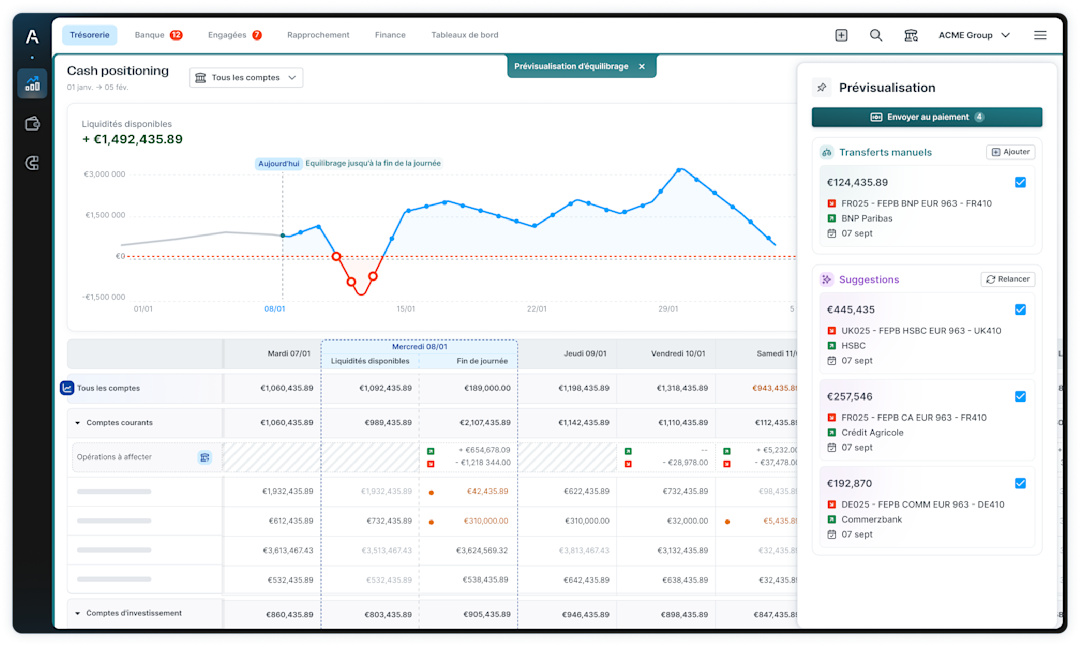

Agicap: A solution for better cash flow visibility

Agicap is a leading cash flow management software that empowers finance teams to move beyond time-consuming spreadsheets and manual processes, offering a new level of control and visibility.

Key features demonstrated by Mickael in the webinar included:

- •

Bank and accounting software connectivity: real-time transaction and cash position data pulled from banks via all major connectivity protocols and file formats. Two-way integrations with leading accounting systems such as NetSuite, QuickBooks, and Sage Intacct.

- •

Cash management and forecasting: AI-powered categorization and reconciliation, daily cash positioning and 13-week cash forecasting using the direct method.

- •

Payment factory capabilities: Domestic and international payments in over 120 currencies, including ACH, FedNow instant payments, and wires; management of payment batches, recurring payments, and internal transfers; customizable approval workflows for payment validation; mobile and desktop options to approve and sign payments.

- •

Scenario planning and reporting: Customizable dashboards, Excel plug-in for seamless data exports, a mobile app with full analytics, as well as scenario modeling, drill-down capabilities, and variance analysis.

During the webinar, Mickaël emphasized how Agicap complements FP&A tools. While FP&A software is built for long-term planning, Agicap is purpose-built for day-to-day cash management. It gives finance teams real-time visibility into actual bank positions, helps rebalance accounts, and delivers short-term cash forecasts—up to 13 weeks—based on actuals, not assumptions. Agicap empowers finance teams with the control they need to take action, not just make plans.

As Mickaël remarked during the session: “We’re delivering not only visibility but actionable insights into operating cash flow, investment plans, and financing needs—all in one system.”

Want to take control of your company’s cash flow? Discover how Agicap can help you gain real-time visibility, automate your cash management, and make smarter financial decisions.