The 2026 Guide to Cash Flow Management for US Mid-Market CFOs & Treasurers

For US mid-market CFOs and treasurers, cash flow management has become a strategic front line. As organizations grow more complex—multi-entity, international, PE-backed—the expectation is clear: boards want instant transparency, lenders demand more frequent covenant tests, and leadership teams rely on data-driven answers, not intuition or outdated spreadsheets. Managing fragmented banking, ERP, and FP&A environments is no longer just a technical nuisance—it’s a barrier to competitiveness and resilience—it’s a barrier to effective cash flow management, competitiveness, and resilience.

This guide goes beyond theory. You’ll find actionable frameworks to unify cash data, streamline daily reconciliation, and optimize working capital—across all group entities and currencies. Discover how to bridge the gap between your FP&A models and day-to-day cash realities, with technology benchmarks that support both granular cash positioning and group-level, board-ready insights. With the right strategy, treasury teams can shift from reactive reporting to proactive, value-driven decision-making—accelerating your group’s ability to unlock liquidity and outperform in any market environment.

Modern Cash Flow Management Definition for US Mid-Market Groups

Cash Flow vs. Profit vs. Working Capital: Key Concepts for Group Finance

For multi-entity mid‑market groups, cash flow in business is more than a line on a report—it is the foundation of effective cash flow management and day‑to‑day financial control. To steer liquidity, funding, and performance at group level, CFOs and treasurers must clearly distinguish between cash flow, profit, and working capital, and understand how each metric influences the others:

- •

Cash flow captures the actual inflows and outflows of liquid funds, reflecting the group’s true ability to meet obligations and seize strategic opportunities—regardless of accounting conventions.

- •

Profit, as shown on your Profit & Loss (P&L) statement, is calculated on an accrual basis. Because it incorporates non-cash items and deferred revenues or expenses, it can diverge significantly from the company’s true cash position—potentially obscuring short-term liquidity issues.

- •

Working capital encompasses the operational cash tied up in receivables, payables, and inventory, but does not on its own offer a full picture of group liquidity.

Recent industry research confirms this shift toward integration, technology and strategic agility. According to the 2025 PwC Global Treasury Survey, 74% of treasury leaders are expanding or actively using AI—especially for forecasting and cash visibility—while 65% plan to expand API-driven integration between their ERP, treasury, and bank systems. Across all company sizes, “cash and liquidity management” is now considered a top priority, with treasurers building real-time, connected, analytics-driven models to increase resilience amid volatility.

Modern cash management focuses squarely on this short-term horizon (Up to 1-2 weeks) and involves:

- •

Real-time quantification and consolidation of cash balances and movements across all business units and bank accounts.

- •

Daily reconciliation of prior day bank transactions, transaction tagging, and bank reporting.

- •

Monitoring net cash/net debt, intra-group positions, and the group’s true liquidity headroom.

In other words, what separates world-class cash management at group level is not just tracking “cash in bank,” but maintaining a holistic, accurate, and instantly available view of the entire group’s liquidity—enabling the finance function to proactively optimize cash and deploy resources with minimal risk.

Unique Challenges Facing Mid-Market Finance Leaders

Finance leaders in US mid-market groups face a unique set of complexities:

- •

Fragmented systems and visibility: Managing dozens or even hundreds of account relationships across multiple banks, ERPs, and currencies—often still reconciled by hand—makes real-time, consolidated visibility both urgent and hard to reach.

- •

Investor and lender demands (private equity, especially LBO sponsors and lenders): Increasingly, private equity sponsors and lenders require not only periodic covenant monitoring (typically quarterly or annually), but also clear evidence of liquidity discipline, timely consolidated net position reporting on request, and robust audit trails.

- •

Heightened risk and uncertainty: Frequent market shocks, FX volatility, and rising cost pressures demand agility—finance teams must adapt to the unexpected with zero margin for error or delay.

Bottom line: For mid-market groups, modern cash management isn’t just about survival—it’s about unlocking value, controlling risk, and maintaining credibility with your board and stakeholders in every market scenario. Consistent, tech‑enabled cash flow management is what turns this from an aspiration into a repeatable discipline.

Building a Resilient, Data-Driven Cash Flow Management Program

This section outlines a practical cash flow plan—and the core cash flow management techniques behind it—for managing cash across all entities, banks, and currencies in a US mid-market group.

Map & Centralize All Flows

Comprehensive cash visibility starts with a unified mapping of all inflows (customer payments, intra-group lending, asset sales/divestments, intercompany settlements) and outflows (AP, payroll, debt service, taxes, capital expenditures, financial investments) across every entity, business unit, and currency.

Legacy tools, Excel models and siloed bank platforms cannot support the scale or pace of modern group finance. To eliminate blind spots and delays, top finance teams centralize, automate, and unify all cash data across subsidiaries, banks, and ERPs—delivering a single, always-current source of truth.

In practice, this means capturing every recurring and exceptional cash inflow and cash outflow in one consolidated view, so nothing critical is left off the radar.

Cash Positioning & Treasury Reconciliation (Short-Term Focus)

Best-in-class cash management isn’t just about reporting—it’s a daily operational discipline with a focus on the short term (1–2 weeks):

- •

Daily/weekly cash positioning: Consolidate and reconcile prior-day bank transactions, tag movements, and update net cash/net debt group-wide—enabling confident, immediate liquidity assessments.

- •

Automation & protocols: Leverage robust connectivity (SWIFT, ACH, NACHA, SFTP, API, ERP connectors) to automate bank data retrieval, reduce errors, and get rid of manual reconciliation.

- •

Immediate actionability: Up-to-the-minute cash intelligence lets teams trigger intra-group transfers, balance pooling, or tactical payments instantly—minimizing unnecessary debt drawdowns, overdraft fees, or idle cash.

Key takeaway: True cash management is executed daily, with disciplined processes and automation as the backbone of risk control and agility.

Beyond Cash Management: Forecasting, Scenarios & Liquidity Planning

Note for Group CFOs: Daily/weekly cash management provides the operational “pulse” of liquidity. However, cash flow forecasting and scenario modeling operate at a strategic level—enabling forward-looking, data-driven decisions for capital allocation and risk mitigation.

- •

Multi-horizon rolling forecasts: Integrate actuals, budgets, AP/AR cycles, and debt servicing schedules to model liquidity across 4/13 weeks, 6 months, and year-end—crucial for covenant monitoring, defining an adequate cash reserve, and supporting investment planning.

- •

Scenario modeling: Build and compare multiple scenarios—Stress test for late payments, seasonal fluctuations in revenue or costs, M&A activity, and consequences on PE/LBO covenant triggers (DSCR, leverage), supporting robust board and lender communication.

- •

Strategic impact: Use forward-looking views to empower better board decisions, protect covenant headroom, and enable more effective capital planning.

Working Capital Optimization & Operational Integration

Working capital performance comes from rapid, data-driven action, not just visibility.:

- •

ERP/bank integration for a real-time view: DSO, DPO, receivables/payables aging, and cash conversion cycle KPIs are calculated automatically for every entity—enabling targeted, immediate improvements.

- •

Operational automation: Standardize AP/AR processes, collections, and dispute management; automate exceptions and escalation workflows to free working capital.

- •

Actionable insight: Use daily dashboards and analytics to mobilize local teams, address at-risk exposures, and harmonize group best practices.

Practical tip: Circulate performance metrics and working capital dashboards regularly to each BU/Entity controller to drive local accountability and rapid improvement.

Reporting & Stakeholder Alignment

Automated, standardized, and shareable reporting is no longer a nice-to-have: boards, investors, and lenders expect not only accurate cash flow statements, but also real‑time dashboards and drill‑downs they can trust.

- •

Real-time dashboards: Communicate with management, board, PE sponsors, and auditors—without spreadsheet chaos.

- •

KPIs that matter: Track net financial position, liquidity runway, variance to plan, and covenant headroom at group or entity level, with full drill-down.

- •

Controlled access & auditability: Role-based access control, audit trails, and versioning safeguard compliance and transparency

Decision-Making: Surplus, Shortfall & Funding Solutions

A strategic cash management cycle gives finance clarity and agility in decision-making:

- •

Act on daily cash positions: Detect and deploy surpluses for short-term investment or group pooling; identify and respond to shortfalls immediately.

- •

Optimize funding mix: Leverage RCFs, credit lines, intra-group loans, or factoring only when value-adding—minimizing avoidable costs and maintaining liquidity headroom.

- •

Integrated execution: Centralize and automate funding and investment decisions across the group, making every dollar count, every day

Turning Pain Points into Performance Drivers

Pain Point | Solution | Impact |

|---|---|---|

Fragmented cash data | Automated, group-wide consolidation and banking integration | Real-time, reliable cash visibility; less manual reconciliation |

Poor forecast accuracy | Automated rolling forecasting with scenario modeling, fueled with ERP / accounting data | Early warnings, board-ready projections |

Cumbersome reporting | Board / audit-ready dashboards updated in real time | Reduced delays, standardization |

Inconsistent M&A integration | Fast integration (1 month) to include acquired companies’ cash positions in consolidated overview | Smoother post-deal cash management |

Limited liquidity headroom analysis | Instant runway / KPI dashboards with covenant triggers | Enhanced risk management and stakeholder confidence |

Technology Deep Dive: Agicap for Mid-Market Teams

Unique Features: End-to-End Cash Visibility & Automation

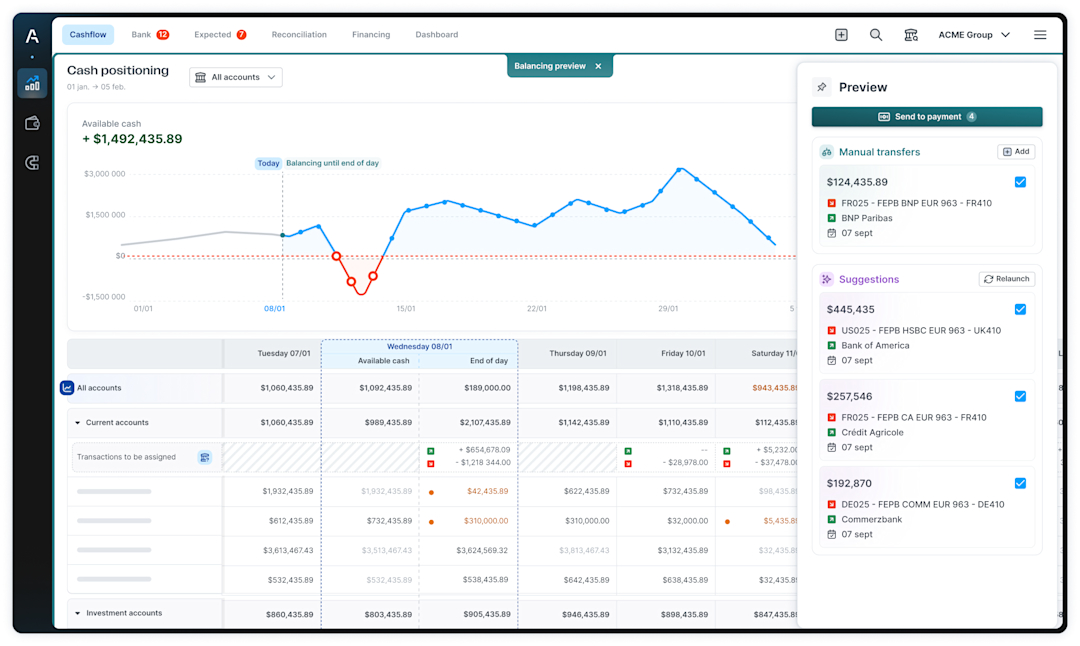

As a modern cash flow management software platform, Agicap bridges the gap between strategic FP&A planning and daily cash realities by seamlessly integrating with ERP, accounting, and planning tools. This ensures real-time cash data, daily reconciliation, and payment workflows are always in sync —eliminating data silos across group entities and stakeholders.

- •

Holistic group-level planning: ERP / accounting, banking, and FP&A integrations mean no more siloed systems—cash positions are continuously updated and visible at every level: by entity, business unit, region, currency, and for the group as a whole.

- •

Live daily cash positioning and reconciliation: Fully automated, multi-bank, multi-protocol workflows (SWIFT, ACH, SFTP, API) for reliable, low-touch group cash visibility.

- •

Cash pooling, intra-group lending, and investments: Automate calculations, transfers, and interest on all internal flows; full transparent reporting.

- •

Payments management: Secure, centralized payment processing, supporting multi-authorization, multi-currency, and real-time payment confirmations with the highest standards (incl. NACHA/ISO 20022).

- •

Bank journal automation: End-to-end automation, seamless integration to leading accounting systems (NetSuite, QuickBooks, SAP, etc.); Automated GL coding and posting as well as reconciliation automation reduce significantly manual errors and finance teammembers’ workload.

What Sets Agicap Apart for US Mid-Market

- •

Rapid, direct go-live: Deploy in just 3–6 months, with white-glove support .

- •

Finance-first usability: Modern, intuitive design purpose-built for finance/treasury teams; enables fast adoption, mobile access, and group-wide collaboration.

- •

Real, dedicated support: US-based account managers, and multichannel support with industry-leading response time.

- •

Continuous innovation and scalability: Cloud-native architecture, instantly adaptable to new entities, currencies, or reporting requirements as your group evolves.

How Do You Measure Cash Flow Management? KPIs & Dashboards Every CFO & Treasurer Needs

In today’s mid-market groups, trusted KPIs are the backbone of agile cash management. The goal isn’t just to monitor liquidity, but to drive strategic, group-wide action and make cash central to board-level and operational decision making.

Core KPIs and dashboards every finance leader should track:

- •

Net Cash / Net Financial Position: By group, business unit, entity, and currency. Foundation for liquidity risk, lender, and board reporting.

- •

Working Capital Metrics

- •

DSO : Days to collect receivables (improvement action: accelerate collections)

- •

DPO : Days to pay suppliers (improvement action: optimize supplier terms)

- •

Cash Conversion Cycle (CCC) : From inventory investment to cash—indicator of end-to-end working capital health.

- •

Liquidity Runway & Covenant Headroom: Real-time view: do you have the cash needed for operations and to meet bank/PE constraints, today and in the coming weeks?

- •

Aging Balances: Instantly spot overdue accounts receivable and at-risk invoices; monitor your customers’ payment behaviors and prioritize collection efforts.

- •

Dormant Accounts: Identify idle or temporarily inactive bank accounts and funds; track and unlock “trapped cash” to improve overall liquidity

- •

Forecast Accuracy / Variance: Monitor gaps between forecast and actuals to course-correct early.

- •

Income Earned from Cash Investments: Measure and benchmark returns from surplus cash to maximize financial ROI.

“I log on to Agicap twice a week, mainly to monitor and optimize our cash investments. Thanks to Agicap, we have increased the financial income from our investments by 30%.”— Nihal Atasay, Head of Accounting and Consolidation, OCEA Group

Best Practice:

Assign KPI owners, review regularly, and communicate in business language to align C-suite and operations. Use exportable, customizable dashboards to share insights with any stakeholder—board, investors, auditors, operational managers.

Bottom line:

Robust, real-time KPIs make group cash management proactive, not reactive—and ensure every dollar works for your growth

An Example of Effective Cash Flow Management: Hennecke Group with Agicap

Hennecke Group, a €160M, PE-backed global manufacturer, faced major cash flow management challenges: excessive manual work (32 hours/week), fragmented data across multiple ERPs and banks, and delayed visibility into cash positions.

Switching to Agicap allowed Hennecke to automate bank and ERP data consolidation, shifting from weekly Excel updates to daily, real-time cash visibility across all entities. The result? The finance team now spends just 2 hours a week on cash monitoring—saving over 1,200 hours annually—while errors and uncertainties have been dramatically reduced.

“The introduction of Agicap has brought a new level of efficiency and reliability to our cash management. We have saved more than 1,200 hours a year, minimized errors, and now have real-time information at our fingertips.” — Yves Souguenet, Group CFO, Hennecke Group

Hennecke’s example shows how automating and centralizing cash management with Agicap delivers efficiency, real-time insight, and greater confidence for fast-scaling, multi-entity finance teams.

Curious to see how these results could look in your organization? Book a tailored Agicap demo and discover what automated, group-wide cash management can do for your finance team.

FAQ: Cash Flow Management for the US Mid-Market

Why is cash flow management important for a business?

Cash flow management is important because it determines whether a business can meet its obligations, invest, and withstand shocks. For mid-market groups, disciplined cash flow management reduces reliance on expensive short-term funding, protects covenant headroom, improves working capital, and strengthens credibility with boards, investors, and lenders.

How does cash flow management work in a mid-market group?

Effective cash flow management combines daily cash positioning and cash flow monitoring, a structured cash flow plan or program (covering 13-week and longer-term horizons), clear working capital levers on AP/AR and inventory, and standardized reporting. Modern platforms like Agicap automate data consolidation, forecasting, and scenario analysis so finance teams can move from reactive reporting to proactive decision-making.

What is the ideal cash flow forecast horizon for mid-market companies?

A rolling 13-week cash flow forecast offers optimal risk visibility to address board, investor, and bank requirements. Supplement with daily short-term monitoring and, where relevant, annual outlooks for long-term planning.

How can we centralize cash data from multiple banks, ERPs, and systems?

Adopt a treasury platform like Agicap that natively connects with your ERPs, bank accounts, and FP&A solutions. This eliminates manual consolidation, accelerates monthly closes, and gives you a unified, real-time view of group cash positions.

How do we model financial covenants and PE-related metrics in cash flow management?

Build scenario models within your cash flow planning tool to simulate covenant thresholds, DSCR/leverage ratios, and PE/LBO requirements as part of a disciplined cash flow management framework. Automating alerts and stress tests ensures early warnings and gives sponsors, boards, and lenders the transparency they demand.

Can we automate intercompany loans and group-level cash reporting?

Yes. Leading treasury solutions now automate workflows for intra-group loans, interest calculations, and give you consolidated, audit-ready reports. This reduces manual errors and speeds up intercompany reconciliation and group closing.