PE-backed CFO:

Leverage Requires Better Cash Management

Cash management is a strategic priority for CFOs of SMBs/mid-sized companies, especially when the company is backed by a private equity fund.

Agicap’s Private Equity Practice

20% of Agicap's revenue is generated by PE-backed companies.

Why do they trust us? Because in a leveraged environment, cash flow is not just an operational metric—it is the engine of value creation.

Recognizing the high stakes of LBOs, we built Agicap’s Private Equity Practice. Born from our extensive work with leading funds and Operating Partners, this dedicated team supports portfolio CFOs. We provide best practices to both secure day-to-day operations and maximize exit readiness.

The 4 levers of value creation for PE-backed CFOs

Agicap targets operational pain points to free up working capital for growth:

Unlock Internal Funding: Mechanically increase your investment capacity by reducing WCR and accelerating cash repatriation from subsidiaries

Secure Financing Strategy: Use real-time liquidity consolidation to assess your true ability to self-finance vs. the need for external debt.

Strengthen Financial Ratios: Actively monitor your Consolidated Net Debt. Improve your leverage profile to stay compliant with banking covenants and negotiate better financing terms (margin ratchet).

Agicap is the trusted partner for financial transformations

Your Challenge: Secure cash upstreaming. You must extract liquidity from operating entities to service the holding company's debt, while leaving enough working capital for local operations.

Our Solution: A centralized liquidity control enabling real-time visibility on cash balances and future cash positions. You can then streamline intercompany transfers without jeopardizing liquidity.

Agicap supports private equity funds throughout their life cycle

A secure, scalable tool that connects to all your banks and ERP systems

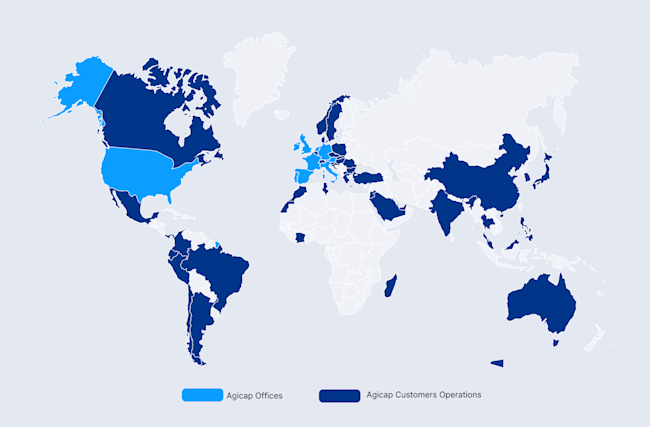

Near-universal banking coverage of key markets (Europe, North America, Asia) and connectivity to any global banking institution via multi-standard integration protocols

Over 50 native integrations with leading ERP systems

A scalable tool that can support your growth, particularly in build-up strategies, large-scale M&A deals, or international expansion

An agile implementation supported by our Private Equity practice experts

One of our Private Equity practice experts will serve as your point of contact throughout the entire process, and will also maintain direct contact with the fund.

A fully managed setup in 3 to 6 months, depending on the scope and complexity.

Guaranteed Priority Access: Premium support at no extra cost

Regular updates to address all customer requests, present new features, and resolve any issues encountered.

Priority access to support 5 days a week with a guaranteed response in under two minutes.

Agicap, the leader in cash management for PE-backed CFOs

Trusted by 8,000 companies worldwide, including 400+ PE-backed firms requiring robust international capabilities.

Direct coverage of 11 key European markets through 5 offices

1 dedicated US market office based in Austin, Texas

50% annual growth over the last 4 years

$170 million raised from Blackfin, Partech, Greenoaks, and AVP