The leading cash flow management software

No more painful Excel sheets. Choose automated and error-free cash flow monitoring instead.

Manage your cash flow

automatically and without errors

Get visibility

on cash flow to anticipate the future

Make decisions

based on your data in real time

Bank synchronization

Securely connect your bank accounts from over 3,000 banks in the US and Europe.

Your cash flow is automatically updated. Don't waste any more time with manual imports of bank transactions in Excel

Automatic categorization of your flows

Define your own incoming and outgoing payment categories plus advanced categorization rules.

Let Agicap's artificial intelligence automatically categorize all your banking transactions. No more manual categorization in Excel.

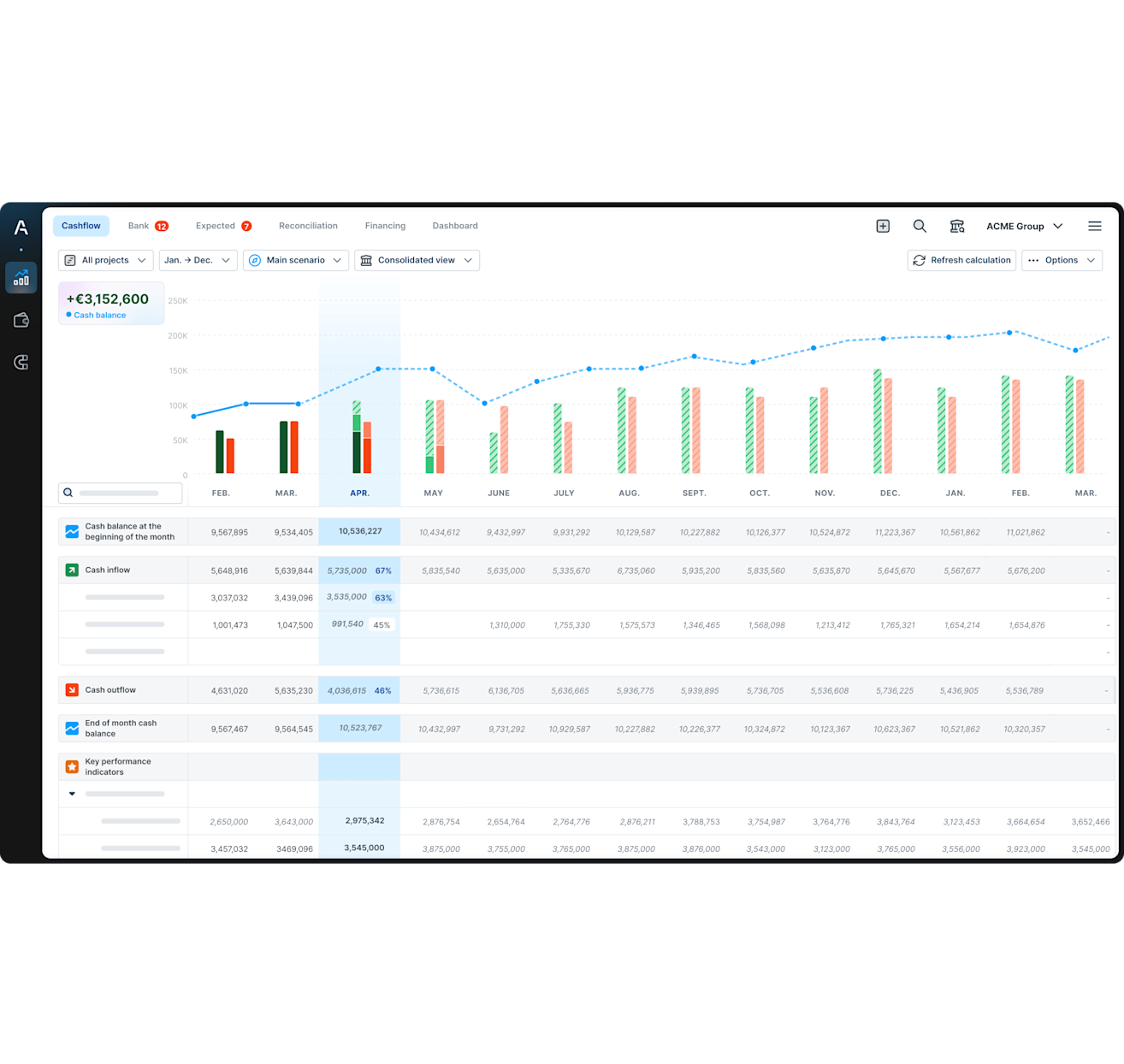

Compare Actual vs. Budget

Easily monitor your cash position in real time

Set your forecasted budgets for each category of receipts and disbursements, check the actual/budget variance at any time and adjust your forecasts

Export your Agicap data

Get all your Agicap treasury data in Excel format in one click

Share it with your collaborators and external partners (e.g. to support your financing requests)

Automatic bank reconciliation

Carry out bank reconciliation in just a few clicks. Agicap automatically suggests the reconciliation between your paid and committed transactions. No more manual checking.

Find out how Agicap can help you better manage your cash flow

Cash flow forecast

Better visibility with a clear and reliable cash flow forecast.

Integration with your tools

Integrate data from your billing tool directly into Agicap.

Reporting and collaboration

Easily collaborate using the same tool, and export key data for your partners.

Frequently Asked Questions

What is cash positioning software, and why is it critical for mid-market companies?

Cash positioning software gives you centralized, real-time visibility over your cash balances across all banks and subsidiaries. This enables better liquidity management, helps avoid overdraft costs, and supports smarter decision-making backed by reliable, up-to-date data. For fast-growing mid-market companies, such visibility is crucial to optimize cash flows, minimize financial risks, and maximize returns across the group—not just within individual entities.

What does Agicap cash positioning software do for mid-sized US companies?

Agicap consolidates all your US and international bank balances and transactions into a single, intuitive dashboard, giving you real-time visibility across every account and subsidiary. Leveraging secure protocols like SWIFT, ACH/Wire (via H2H), SFTP, and OpenAPI, Agicap automatically collects and synchronizes your banking and ERP or accounting data—no more manual imports or time-consuming reconciliations.

The platform provides automated reconciliation suggestions to help you quickly clear accounts and allows you to analyze cash positions at the group, entity, or transaction level. With everything centralized—including excess cash, loans, and fees—your finance team can manage daily liquidity, make data-driven decisions, and optimize cash usage from one secure, unified interface.

Can Agicap cash positioning software be integrated with my existing ERP system?

Yes. Agicap seamlessly integrates with over 400 accounting solutions and ERP systems commonly used by mid-market companies. With out-of-the-box connectors, API, and SFTP capabilities, Agicap enables secure, two-way data synchronization for invoices, P&L reports, purchase orders, and more. This eliminates manual data entry and keeps your forecasts accurate and up to date, without needing to leave the tools your finance team already knows.

For unique systems or more advanced needs, Agicap offers a robust public API, allowing your IT team or integrator to build custom connections between Agicap and your preferred business applications. This flexible integration ecosystem ensures Agicap fits smoothly into your existing workflow and scales with your business as it grows.

How fast can Agicap cash positioning software be implemented?

Agicap cash positioning software can be fully implemented within 3 to 6 months, offering a much faster and more flexible deployment compared to enterprise-first TMS solutions, which typically require 6 to 18 months. The implementation process is managed directly by Agicap’s experienced employees—sometimes with the support of an integrator—ensuring a close partnership and responsive communication throughout the project. This is in contrast to traditional TMS deployments, which are often outsourced and involve more complex and lengthy processes.

Agicap’s approach relies on standard connectivity (such as direct bank communication, APIs, or SFTP server integration) and ERP connectors, removing the need for heavy IT projects or intricate customization. As a result, your finance teams can quickly start leveraging real-time consolidated cash data, gaining value from the solution much sooner than with legacy alternatives.

Can Agicap handle multi-bank, multi-entity, and multi-currency needs for mid-market firms?

Yes. Agicap is designed for companies operating across multiple banks, entities, and currencies—whether you’re managing regional subsidiaries or global operations. The platform centralizes all your accounts, so you can monitor balances and cash flows at the group, entity, or even transaction level, all from a single dashboard.

Agicap also streamlines multi-currency payments: you can generate payment files in the required formats and currencies for each of your banks, ensuring smooth processing and compliance with international standards like NACHA and ISO 20022. This makes it easy to consolidate reporting, automate conversions (including instant USD and other currencies), and simplify the complexities of international treasury management for mid-market businesses.

How much does an automated cash positioning solution cost?

Pricing for Agicap’s automated cash positioning solution is tailored to the specific needs and scale of your business. Factors such as the number of bank accounts and entities, the level of integration required with your accounting and ERP systems, and your desired modules (such as forecasting, payment automation, or analytics) determine your exact investment.

Agicap offers transparent, subscription-based pricing without hidden fees or costly IT projects—so you can predict your costs and see a fast return on investment. For a customized quote and a clear view of the features included for your business, our team is happy to provide a tailored proposal based on your requirements.