Cash Flow Forecast Excel Template

Download a free cash flow forecast Excel template

This template will help you:

Project monthly cash inflows and outflows for 12 months

Avoid costly cash shortages and overdrafts

Automate calculations with built-in formulas

Improve financial visibility and decision-making

Save time with a ready-to-use structure

Start planning your cash flow easily and confidently today!

All businesses need to plan for the future.

In the short-term, CFOs need to avoid cash shortages which would otherwise trigger costly emergency borrowing.

In the long-term, senior staff need an accurate picture of the cash landscape in order to make informed decisions about investment or additional financing.

On average, US mid-sized companies experience an unexpected cash shortfall of over $50,000 every 20 days, with 43% relying on unreliable cash flow forecasts—according to Agicap’s 2025 Mid-Market Survey.

Time for action, then. We have a cash flow forecast template for excel you can download for free and use immediately.

Download your cash flow forecast template for excel

Download our free cash flow forecast template for excel, and take the first step to mastery of your cash flow.

How it works: simply enter your debits and credits for each month, and the forecasting engine will show you a rolling net balance for each month - projecting a whole calendar year into the future.

- Save time: a full's year planning is ready to go

- Make no mistakes: automated formulas do the work

- Improve financial visibility: stop guessing, and trust the figures instead

But bear in mind - if your business is set up as a group with multiple subsidiaries, you will need far more forecasting power.

Watch this brief video to see how Agicap effortlessly handles cash forecasting for group structures.

How to use this cash flow statement template

This forecast engine gives you snapshot balance sheets for 12 consecutive months.

You can trust this form of forecasting as it is based on your inputs and historical data, which you enter as you go in the form of revenues and costs - spanning operating, investing and financing cash flows. As a rolling forecast, it takes into account that the actual performance of the company changes over time.

Net cash flow - the key formula

The key formula here is net cash flow.

This is calculated by summing up the revenues and costs for each month to arrive at a closing net balance for the month. **This figure is then used to show the opening balance for the next month. You can then input further revenues and costs when you get to that month. Or enter them in advance as an exercise in scenario planning; scope out the effect of big changes.

The engine will take into account any changes you make to any month and show you the projected end-of-year balance for your business on the December worksheet in cell C4.

Example: cash flow forecast excel

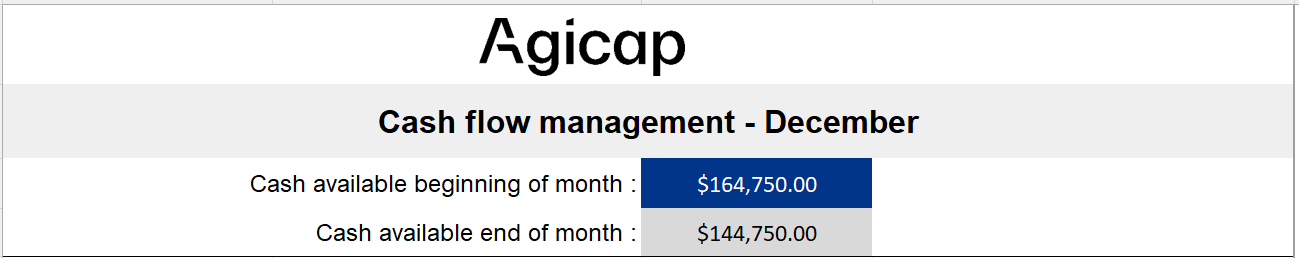

Consider the final sheet in the workbook.

On the tab at the bottom it is entitled "December".

- This sheet shows you in cell C4 at the top what cash will be available at the beginning and end of December.

- Right now it is reporting that the end of year balance will be $144,750.00.

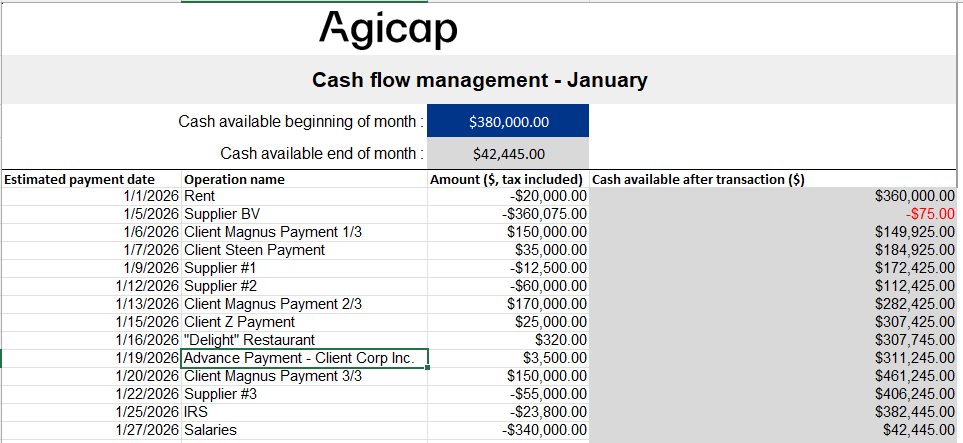

Now consider the January tab, which is the second in the template.

Let's change a single value in this January sheet and see how it affects the current tab and the next ones.

Consider cell C6 on this January worksheet.

This shows a figure of -$20,000.00 for Rent.

Change this figure to -$16,000.00 Immediately we see that the cash available at the end of the month for January (cell: C4) increases.

Finally, check out the December sheet again at the back of the workbook.

We see that the cash available at the end of the month (and, because its December, this means the end of the calendar year) has also increased

The cash flow engine updates your forecasts, reaching out 12 months into the future, as new data comes in.

Who needs Excel templates when you have Agicap cashflow projections?

For cash positioning and forecasting, spreadsheets were the only option for many years. But times have changed.

Many of Agicap's 8,000 clients report that, as their company grew, using spreadsheets just became too complicated and simply not powerful enough to handle data from different business units and turn it into accurate forecasting.

Watch this brief video to see how Agicap client Renova Red used Agicap to revolutionise their management of 53 construction sites in Italy.

Renova Red CFO Marco Casadei says " f or companies that are growing rapidly and for those that need consolidated reporting, Agicap is the ideal tool. "

And, in leveraging Agicap to co-ordinate and level up their cash planning, Renova Red are far from alone.

Agicap takes data from your bank accounts, ERP and other software to make a rolling cashflow projection. With a specifically-designed convertor module, Agicap can even draw data directly from your income statement (P&L).

Why cash forecasting matters — No matter your industry

Businesses in all sectors need cash forecasting.

You could be in retail, for example, like Agicap client Café Coton, and need to plan for seasonal ups and downs in income.

You could be in construction, where you have huge upfront costs, but payments coming in are few and far between.

Whichever sector your business is in, you need to be sure you have enough cash to ensure financial stability and make sound plans**. Cash forecasting** is the answer.

Stuck for time? Get an Agicap expert to show you in minutes how Agicap can level up your cash forecasting with a free demo .

FAQs: cash flow forecast excel

What is cash forecasting?

It's a business priority. You need a weekly cash flow forecast to ensure your business can meet its immediate financial obligations. And strategic decision-makers demand forecasts going far into the future, including even 3-year cash flow projections.

How do I create a business cash flow forecast?

You can use our simple Excel cash flow forecast template here. Or you can allow dedicated software like Agicap to power up your forecasting with live bank account feeds and AI predictive analysis.

How do I forecast cash flow in Excel?

You can build your own cash flow forecasting engine by linking spreadsheets and deploying formulae to calculate a rolling net balance. But it's a lot easier and cost-effective to use software that's designed to do this for you.

How do I build a 13 week cash flow forecast?

The easiest way to do it is to use Agicap's convertor module on your existing P&L. Otherwise, as with a weekly cash flow forecast, you can use spreadsheet software.

What is a cash flow spreadsheet?

It is a simple set of linked worksheets. It takes manual inputs of cash inflows and outflows and uses them to project a rolling net balance.