How Seiven Group Mastered a 30-Day Post-Merger Integration

Guillaume Schaeffer (CEO, former CFO) and Emmanuel Giroux (CFO) explain how the implementation of Agicap enabled the group to consolidate its cash position and integrate in less than a month its new acquisition for financial management.

Read more

Key takeaways

Seiven Group, a major player in post-mortem services, operates within a context of successive leveraged buyouts (LBOs) and ambitious external and organic growth (aiming to double revenue in 5 years), requiring rigorous financial management to comply with bank covenants and secure debt.

To support this build-up, the group sought a tool that could be deployed very quickly in the new entities (e.g., Isofroid in less than 3 weeks), guaranteeing seamless financial integration and immediate consolidated visibility.

Before Agicap, cash management relied on manually consolidated daily statements and a complete lack of working capital indicators, exposing the group to liquidity risks in a market where several competitors have gone bankrupt for the same reasons.

Adopting Agicap has enabled the centralization of cash management, the optimization of working capital by identifying outstanding receivables, the monitoring of foreign exchange risk exposure, and the acceleration of the integration of new acquisitions. The solution now serves as a common foundation to spread a "cash culture" across all subsidiaries.

" The ease of implementation quickly provided us with the necessary oversight on our new acquisitions, encompassing both centralised cash positioning and robust security protocols for all outgoing flows. "

$35M

in revenue

8

brands

100+

employees

Seiven

Customer’s history

Seiven Group is a leading player offering a comprehensive range of services for post-mortem professionals. Organized around two core business areas - funeral services and medical services - the group generates €35 million in revenue and employs approximately 100 people across three locations. It owns eight brands, including an in-house logistics operation.

Following an initial leveraged buyout (LBO) in 2022 to transfer ownership to its current chairman, Alexis Jubert, the group undertook a significant restructuring of its human and financial resources. This strategy accelerated with the acquisition of Isofroid in July 2024, the official launch of the unifying Seiven brand in October 2024, and the completion of a second LBO in October 2025.

Backed by investors such as Généo, BPI France, Sodero, and Unexo, the group now aims to double in size within the next five years. The goal is to reach 200 employees and $70-80 million in revenue, with a strong desire for European expansion.

Customer’s needs

To support this "build-up" strategy and secure its financing, the group absolutely had to modernize its finance stack. The main needs were to:

Eliminate time-consuming manual tasks: The accounting team spent 30 minutes every morning manually consolidating bank balances in Excel, a low-value task prone to errors.

Secure bank covenants: In an LBO context, maintaining strict oversight of cash flow and full visibility into senior debt maturities is essential to ensure ongoing compliance with the banking syndicate.

Manage currency exposure: With significant USD-denominated purchase volumes, the group required precise tracking of exchange rates and foreign currency disbursements to protect its margins.

Digitize processes to ensure remote monitoring: As new subsidiaries are integrated, deploying a common tool and standardized processes is mandatory to ensure headquarters can monitor performance and liquidity remotely.

Solution

Agicap was deployed in successive stages, in line with the group's acquisitions and the addition of new modules.

Cash Position & ERP Integration The implementation of the EBICS TS protocol ensured automated daily retrieval of bank statements, enabling real-time global cash positioning. Direct integration with the ERP automated the injection of the aging balance into forecasts, facilitating more granular monitoring of the Cash Conversion Cycle and proactive management of overdue receivables.

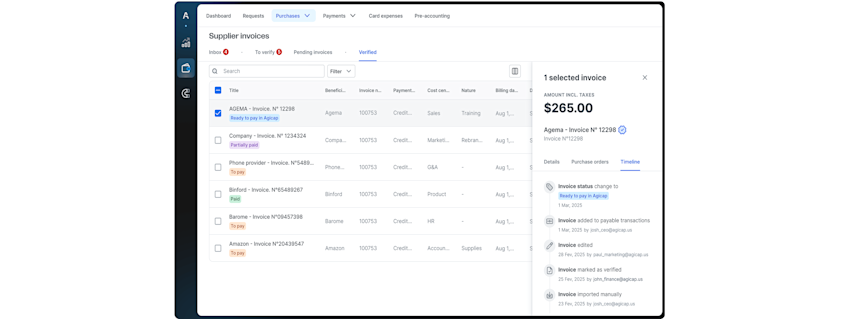

Supplier Cycle (Procure-to-Pay) Following the Isofroid acquisition, the Accounts Payable module was rolled out in under three weeks, digitizing the entire invoice-to-pay workflow. This transition centralized all payment execution within a single multibanking interface, eliminating the need for multiple banking portals and integrating projected outflows directly into the short-term forecast.

Key benefits achieved:

Enhanced Process Security: Secure validation workflows—enforcing segregation of duties—combined with automated IBAN change alerts, have significantly mitigated the risk of internal and external fraud."

WCR Optimization: Granular visibility into cash cycles enabled the group to unlock over €500,000 in liquidity by identifying dormant cash and optimizing payment terms.

" We now have an end-to-end process from supplier invoice integration to payment. This seamless workflow was the decisive factor in our selection process. "

Conclusion

By leveraging Agicap’s modular platform, Seiven Group standardized its treasury processes amidst rising organizational complexity, ensuring real-time compliance with bank covenants and the rapid onboarding of new acquisitions.

Building on this momentum, Seiven is deploying new modules to facilitate the work of its finance department, notably through the centralization of debts and the integration of pre-accounting flows.

Other testimonials of interest

White Rabbit Projects

Business Sector:

Accommodation and catering

Where:

London, United Kingdom