Optimizing Credit Lines and Forecasting: MW.FEP’s Transformation Using Agicap as All-in-one Solution

Alessandro Morisi, CFO of MW.FEP S.p.A, explains how Agicap has enabled them to improve their cash flow forecasts and consequently optimise the use of their credit lines

Read more

Key takeaways

MW.FEP is a 100M€ manufacturing company in Electronic Manufacturing Services (EMS) with more than 400 employees.

The absence of a centralized system forced the finance team to manually consolidate data from 20+ bank accounts in several currencies, leading to limited cash visibility and time-consuming processes

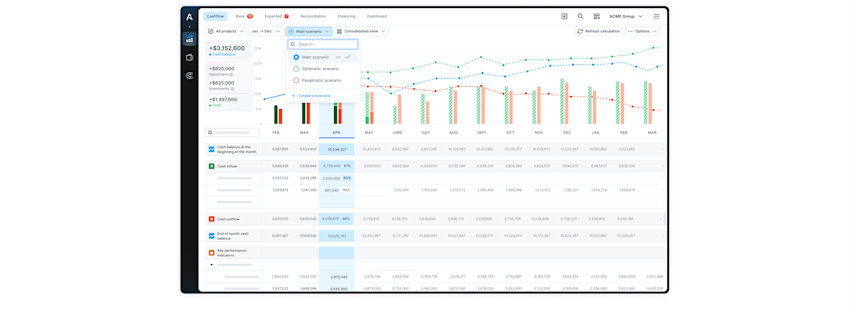

Agicap unified all bank accounts and financial data into a single, real-time platform. This enabled automated integration, improved forecasting, and empowered the finance team’s decision-making with reliable figures such as the forecasted net financial position.

" The benefit of Agicap is that we can see everything in one system only. This all-in-one system helps us spot inaccuracies in a very short amount of time. We identified three big key improvements: optimization of financial management, optimization of the credit line management, and finally, improved forecasting. "

Customer’s history

MW.FEP is a leading Italian manufacturing company with a turnover of approximately €100 million and 400 employees. The company operates multiple plants in Italy, and manages over 13 product lines serving sectors such as aviation, automotive, electrical, railways, and aerospace.

Customer’s needs

As MW.FEP grew and diversified its operations, the finance team faced increasing complexity in managing cash flow and financial processes. The company identified several critical needs that required immediate action:

Centralized management of bank accounts: managing over 20 bank accounts across multiple currencies without a unified system made it challenging to achieve a consolidated view of liquidity and efficiently oversee daily cash movements. With more than 20,000 supplier invoices and 5,000 client invoices processed annually, the sheer volume of daily cash transactions exceeded manual reconciliation and monitoring capabilities.

Integration of non-accounting flows: to build a comprehensive cash flow forecast, the finance team needed to incorporate non-accounting data—such as orders and sales budgets—stored across one ERP system and multiple Excel files.

Optimization of credit line management: the finance team faced challenges in anticipating whether existing credit lines—comprising variable-rate instruments such as overdraft facilities and invoice discounting—would adequately cover the company’s needs during peak business activity. These credit instruments are essential for mitigating high Working Capital Requirements (WCR), as order-to-cash cycle can extend up to three months.

Reduction of manual processes: reliance on fragmented tools and spreadsheets resulted in inefficiencies, increased risk of errors, and limited the finance team’s ability to monitor strategic financial KPIs, such as the net financial position across all accounts and currencies.

Solution

To address these challenges and transform its financial management processes, MW.FEP implemented Agicap as a centralized cash flow management platform. The adoption of Agicap delivered significant improvements across several key areas:

Centralized cash visibility and automated data integration: Agicap consolidated over 20 bank accounts across multiple currencies into a single, real-time dashboard, giving the finance team instant access to the company’s cash position. Synchronization of daily cash movements using an Automated File Transfer (AFT) solution as well as payables, receivables, and non-accounting data ensured all financial information was current and accessible in one place, eliminating manual aggregation and reducing the risk of oversight.

Enhanced credit line management: with Agicap, the finance team could monitor the availability and usage of each credit facility in real time, and run simulations to assess the sufficiency of credit limits under various business scenarios. This proactive approach improved decision-making regarding bank negotiations and working capital planning.

Rolling cash flow forecasting: the implementation of a twelve-month rolling forecast, fully integrated with all bank accounts and financial data, provided greater accuracy and foresight. The finance team could now monitor both actual and projected net financial positions, supporting compliance requirements. Importantly, Agicap enabled the reconciliation of long-term forecasts with detailed short-term cash projections within a single platform, allowing for a unified and consistent view of liquidity across different time horizons.

" Agicap has exactly the picture we need […] it gives us more visibility and more possibility to make the right decision for cash flow management. "

Conclusion

By adopting Agicap, MW.FEP transitioned from a fragmented and reactive financial management approach to a centralized, automated, and strategic system. The solution provided real-time visibility, improved forecasting accuracy, and robust credit line management, empowering the finance team to make informed decisions.

Other testimonials of interest

White Rabbit Projects

Business Sector:

Accommodation and catering

Where:

London, United Kingdom