How the Milexia group saved 2 FTEs by using Agicap's cash management

Jean-Jacques Cressan (Group CFO) and Mathilde Vasseur (Group Treasurer) highlight how Agicap is a boon for the group's "Buy & Build" strategy. The platform has enabled the rapid integration of new acquisitions and provided a unified treasury view, all while maintaining a lean finance department despite the group's expanding footprint.

Read more

Key takeaways

Milexia operates within a context of leveraged buyouts (LBOs) and ambitious external growth. Following a rapid expansion from €40 million to €200 million in revenue, the group now oversees a complex network of 19 entities across Europe and Asia. This scale, combined with the obligations of LBO debt, demands a high level of financial transparency and reporting rigor.

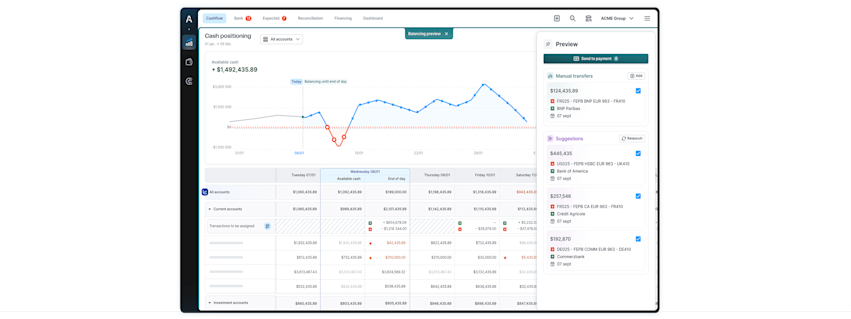

To overcome the limitations of manual Excel-based consolidations, Milexia implemented Agicap in 2023. This transition centralized cash forecasting and secured payment workflows, delivering immediate efficiency gains equivalent to two full-time employees (FTEs) in data processing. Beyond automation, Agicap enables the real-time tracking of critical KPIs—such as net debt—ensuring seamless reporting for investment funds and banking partners.

Agicap functions as Milexia’s unified financial ecosystem, significantly accelerating the integration of M&A targets. By standardizing processes on a single platform, the group can now onboard new acquisitions in just four to six weeks, gaining immediate, granular visibility into the cash flows of every new subsidiary.

" In a period of continuous expansion, Agicap allows us to rapidly deploy a solution that provides immediate clarity on local cash and debt while streamlining our group-wide consolidation. "

$200M

in revenue

19

entities

280+

employees

Milexia Group

Customer’s history

Group Milexia is a European high-tech distributor and integrator specializing in radio frequency, microwave components, and embedded systems. The Group serves mission-critical sectors where precision is non-negotiable, including defense, aerospace, and advanced scientific research.

With a strategic footprint spanning Europe, the United Kingdom, and Asia, the group currently employs approximately 280 people and generates €200 million in revenue.

Milexia's recent historyis defined by accelerated external growth. The 2023 majority stake acquisition by Crédit Mutuel Equity marked the Group’s fifth leveraged buyout (LBO), providing the financial engine necessary to accelerate its international expansion and market consolidation.

Currently overseeing 19 legal entities and 9 operating companies, Milexia maintains a sustained M&A pace of one to two acquisitions per year. This rapid scaling necessitates the harmonization of financial frameworks and the seamless integration of new assets. Central finance, directed from the holding company, is now tasked with enforcing rigorous group standards across all subsidiaries, working in tight coordination with local CFOs to ensure operational excellence.

Customer’s needs

By 2023, Milexia’s manual Excel-dependent cash management processes had reached a breaking point, unable to scale with the group’s rapid M&A pace. The finance department established the following core objectives to modernize their infrastructure:

Ensuring cash availability to finance external growth and secure the repayment of LBO debt.

Reducing the financial integration time of acquisitions to less than 6 weeks by streamlining onboarding (banks, ERP, other processes).

Securing and streamlining payment execution by eliminating manual data entry and implementing segregated tasks.

Establishing a "single source of truth" for real-time consolidated cash flow and short-term forecasting, despite the fragmented landscape of subsidiary-level software and ERPs.

Maximizing cash upstreaming to the holding company and proactively identifying liquidity pressures to manage intra-group financing and "cash pooling" effectively.

Solution

Milexia deployed Agicap to structure its treasury function and support its growth. The implementation focused on three main areas to unify processes across its 19 entities:

Bank Connectivity & Centralized Payment Factory: By leveraging EBICS TS and Host-to-Host protocols, Milexia automated the real-time retrieval of bank statements across its entire global network. This architecture serves as a secure, centralized payment hub, enforcing a strict segregation of duties and multi-level electronic signatures to eliminate fraud risk.

System Interoperability & ERP Integration: The group established direct bridges between Agicap and its diverse ERP landscape via API and SFTP. This integration enables the automatic synchronization of invoices and outstanding orders, transforming static data into a dynamic, forward-looking view of group liquidity.

Advanced Reporting & Debt Oversight: Agicap’s native dashboards provide the holding company with continuous oversight of LBO debt obligations. The finance team now produces sophisticated variance analyses (Actual vs. Forecast) through automated reports, ensuring high-level performance tracking for stakeholders.

Main benefits achieved:

2 FTEs saved on data collection and consolidation.

Reduced integration time: Standardized the financial onboarding process, reducing the time required to integrate new acquisitions to a streamlined 6-week window.

" Working in close alignment with our local CFOs through Agicap has streamlined our entire treasury function (...) Thanks to the use of AGICAP, I now have more time to conduct additional analyses "

Conclusion

The platform acts as a collaborative bridge, allowing corporate and local financial leadership to work in lockstep. This 'dual-oversight' model ensures a 360-degree view of group transactions, which is a critical advantage in an LBO environment where precise liquidity management for debt interest is paramount.

Milexia is now entering the next phase of its digital transformation, leveraging Agicap to streamline accounting workflows. By enabling automated bank reconciliations and entry generation, the group is significantly reducing manual month-end closing cycles.

Other testimonials of interest

White Rabbit Projects

Business Sector:

Accommodation and catering

Where:

London, United Kingdom