How Laukimax Group reduced its DSO by two-thirds thanks to Agicap

Eric Amorim, Deputy Managing Director of the group, explains how he implemented Agicap to regain control over overdue receivables, accelerate the work of his finance department, and secure all cash outflows made by the group.

Read more

Key takeaways

The Laukimax Group, an audiovisual post-production provider, had to restructure its finance department to align with a 'Buy & Build' strategy that grew the organization from one to nine entities.

Prior to Agicap, manual cash management across 60 bank accounts was a major operational bottleneck. Consolidating balances consumed half a day, forecasts were limited to a single week, and excessive 90-day overdue invoices forced the group to finance a heavy working capital burden.

Agicap provided the Laukimax Group with real-time cash visibility and streamlined financial operations. Key outcomes include accelerating the reporting cycle from hours to minutes and optimizing working capital by bringing the average DSO down from 150 days to 46 days.

" We have a single tool for a 360 view of cash flow (...) it's very fluid, we can easily switch from one module to another, from cash forecasting to customer aging balance. "

$25M

in revenue

9

companies

100+

employees

Laukimax Group

Customer’s history

Laukimax Group is a specialist in audiovisual post-production, generating consolidated revenue of €25 million.

Comprising nine entities, including seven operating companies and two holding companies, the group covers the entire technical value chain (dubbing, image/sound post-production, equipment rental, project coordination) for both the fiction market (Netflix, HBO) and the broadcast market (France Télévisions, TF1).

In 2022, the group transitioned from its historical roots in the "Eliote" company to a high-growth platform following an investment from Calcium Capital. This partnership launched an aggressive "Buy & Build" strategy to consolidate a fragmented market, resulting in a series of acquisitions throughout 2023.

However, this rapid scaling introduced significant operational friction. Integrating entities with varying levels of maturity without unified financial processes made manual cash management unsustainable—especially as the new shareholders required immediate, standardized, and reliable reporting.

Customer’s needs

Upon his arrival, Eric Amorim established five core priorities to eliminate financial opacity and support the group’s expansion:

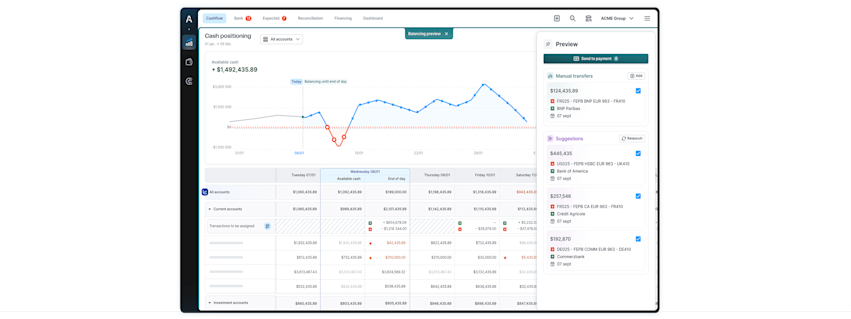

Unified Visibility & Automation: Eliminate manual consolidation by establishing a real-time, 360° view of the group’s 60 bank accounts across all 9 entities, transforming a half-day manual process into instantaneous reporting.

Forecast Reliability & Reporting: Strengthen stakeholder confidence by implementing a reliable three-month rolling cash flow forecast, supplemented by monthly variance analysis to provide the investment fund with granular financial oversight.

Working Capital Optimization: Execute a systematic debt collection strategy tailored to diverse customer segments to aggressively reduce the DSO from its historical peak of 150+ days.

Governance & Security: Mitigate operational risk by centralizing payment approvals and implementing a "four-eyes" principle to standardize and secure the group's payment infrastructure.

Operational Excellence: Modernize the accounting function through automated bank reconciliations and journal entry creation, pivoting the team’s focus from data entry to high-value analysis.

Solution

The Laukimax Group leveraged Agicap to transform its treasury function through three strategic pillars:

Connectivity & Centralization: Establishing a unified financial hub by connecting all banking partners via the EBICS TS protocol. This enabled real-time consolidation and customized dashboards across all nine entities for immediate group-wide visibility.

ERP & Accounting Ecosystem: Implementing automated gateways between Agicap and the group's accounting software (Sage 100, ACD). This integration streamlined the flow of receivables and payment files, while automating bank reconciliations and journal entries.

Targeted Collection Framework: Deploying a tiered recovery strategy—standardizing processes for 80% of the client base while applying bespoke scenarios for key accounts. By integrating sales representatives directly into the workflow, the group ensured high-touch coordination on critical balances.

This implementation has yielded the following benefits:

Dramatic reduction in DSO: the average payment period has decreased from over 150 days to 46 days, and receivables overdue by more than 90 days have virtually disappeared.

Significant time savings: task automation has allowed the accounting team to save approximately one-third of its working time, especially on data entry and reporting.

Near-instant reporting: generating weekly reports for the PE fund now takes 10 minutes, compared to half a day previously.

" Agicap provides the productivity of a full-time debt collector; without it, we would need a dedicated hire just to maintain our current collection performance. "

Conclusion

Transitioning from Excel-based tracking to Agicap has modernized Laukimax Group’s finance function.

This shift has delivered a dual benefit: drastic optimization of working capital and a new standard of reliability in financial communication. With structured consolidation, payment, and collection processes now in place, the group is uniquely positioned to manage its rapid expansion with agility and precision.

Other testimonials of interest

White Rabbit Projects

Business Sector:

Accommodation and catering

Where:

London, United Kingdom