How Comet Software structures its roll-up using Agicap as cash backbone

Damien Duquesne, Group CFO of Comet Software, details the group's roll-up strategy, which relies on Agicap for cash management to ensure a common link and create value in a decentralized organization.

Read moreKey takeaways

Comet Software is a group of vertical software companies specializing in niche markets. With an ambitious external growth strategy, the group has already acquired 9 different companies in 18 months and plans to continue its external growth at the same pace.

One of the many growth challenges of the roll-up led by Comet Software lies in maximizing the self-financing of each acquisition. This involves optimizing cash flow from acquired companies, a complex exercise due to two major challenges:

Some companies must invest in their modernization, which delays their cash flow or even requires a temporary contribution from the group, thus reducing the cash available for new acquisitions.

The diversity of business models within the group results in distinct seasonalities, directly influencing the timing of cash flow.

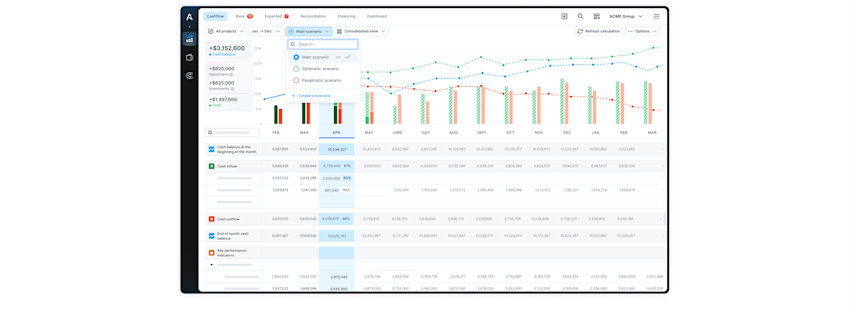

The group grants its companies a large degree of operational autonomy, thus preserving their entrepreneurial agility. Each entity retains its own tools after the acquisition - such as its ERP - resulting in a wide variety of systems used. In this context, Agicap positions itself as the common tool for all companies, providing a consolidated and centralized view of the group's cash flow.

Thanks to the investment and debt management modules, the group closely monitors its cash flow. This ability to precisely control the timing of the group's cash flow needs, as well as the anticipation of cash generation from subsidiaries, are essential elements for any potential financing project (e.g., bank debt).

" As I see in Agicap what money I have available at the holding company level, I know what I can take down and redistribute to subsidiaries if necessary or invest, self-finance new acquisitions, or be certain of meeting the repayment deadlines of my financing. "

€30 million

in revenue (targeting €100 million by 2027)

9

companies

230

Employees

Customer’s history

Founded in March 2024, Comet Software is a French business software group. Operating in the healthcare, financial services, construction, retail, and packaging sectors, the group currently has more than 230 employees and 8,000 customers in France, Belgium, and Luxembourg.

Its development strategy is based on a significant pace of external growth. To this end, the group raised €60 million in April 2024. This fundraising enabled the acquisition of the first companies and accelerated the company's progress toward a first milestone marked by a target of €100 million in revenue by 2027.

These subsidiaries are characterized by varying levels of maturity, which explains why each has its own business models, strategic plan, and tools—with the notable exception of Agicap, which acts as a link between the subsidiaries.

Customer’s needs

The Comet Software Group's ambitious external growth strategy imposes several constraints regarding cash management. Previously, companies closed their accounts annually with a four-month lag (closing in December, figures available in April). Damien Duquesne implemented a monthly closing to increase visibility into the performance of each business.

However, he lacked a tool to secure the group's cash, manage seasonality, and investment and financing capacity, highlight cash performance, and support subsidiary managers (CEOs) in implementing a cash culture. His main needs were:

Consolidated visibility of free cash flow and cash performance. Damien Duquesne was unable to view the consolidated cash balance by company: he had to contact each CEO to obtain the various balances and perform the consolidation manually, which resulted in significant time delays. The lack of automatic updates made it impossible to ensure that the companies had the necessary cash to cover imminent outflows. Furthermore, the group wishes to give subsidiaries the autonomy to manage outflows related to its operational needs (suppliers/employees), but also to transfer excess cash that the subsidiary does not need to manage its business and investments. It is therefore necessary to be able to control the seasonality and working capital requirements of each company.

Decentralization of payments with a centralized monitoring: each manager is responsible for their company's outflows and must therefore validate their transfers. Before Agicap, CEOs had to make their payments via each banking portal, a time-consuming process that prevented the holding company from anticipating future outflows.

Categorization of cash flows to analyze the main expenditure items. The annual closing system in place before Agicap only provided CEOs with visibility into the previous year's expenses once a year. This lack of information prevented them from regularly verifying the usefulness of their teams' expenses, and cash flow forecasting processes were not digitized nor automated.

Integration of interest payments on the final debt. The use of significant debt at the group level requires the group to prepare a solid financing application. A cash flow tool that guarantees the integration of payment deadlines into the cash flow forecast is a critical element for reassuring potential lenders.

Solution

Implementation of a consolidated view of available cash flow. Establishing connections via the EBICS TS protocol allowed Comet Software to access all bank balances in real time.

Automatic updating of the cash flow forecast. Agicap integrates all the information distributed across the various ERP systems to automatically update the short-, medium-, and long-term cash flow forecast. These cash flow projections are essential for Damien Duquesne to anticipate the amounts actually available for upcoming acquisitions in order to maximize their self-financing.

Implementation of a single platform for making payments. In addition to transmitting bank statements, EBICS TS connections allow payments to be initiated directly from Agicap, with a clear segregation of duties. Damien Duquesne is able to make backup payments, including intragroup transfers to the holding company for cash flow updates. even though local managers manage 99% of the cash flows.

Automatic categorization of cash flows & actual vs. forecast monitoring. Agicap facilitates the creation of automatic categorization rules to identify the most significant expense items. This visualization accelerates the cash flow forecasting process and automates reconciliation with actual figures.

Implementation of modules specific to debts and cash investments. Agicap allows the group to integrate the various debts incurred at both the entity and group levels into its cash flow forecasting plan. This module is valuable for automatically providing several key debt-related ratios, including net financial position.

" The fact of being structured, of having a specific debt module in which we can manage interest-only payment debt, is a reassuring asset for the lender and for me. So I use this module a lot. "

Conclusion

Collaborating with Agicap has enabled the Comet Software group to monitor daily the operational and cash flow performance of their three-year strategic plan, aiming to generate €100 million in revenue.

Thanks to Agicap, Damien Duquesne is able to balance self-financing and external financing for future acquisitions.

The daily visibility of cash flows and the user-friendly dashboards also facilitate the work of the CEOs of each entity to accelerate their organic growth and create value.

Finally, in an organization where each entity has its own tools (ERP, invoicing software, HRIS, etc.), Damien Duquesne insisted that Agicap be the only shared tool to ensure that cash flow is controlled both globally at the group level and locally within each subsidiary.

Other testimonials of interest

White Rabbit Projects

Business Sector:

Accommodation and catering

Where:

London, United Kingdom