Why Treasury Maturity Drives PE Value

In the high-stakes environment of a Leveraged Buyout (LBO), the Chief Financial Officer operates under a "double bind": the imperative to drive aggressive growth while simultaneously servicing significant debt.

This article demonstrates how a specialized Treasury Management System (TMS) systematically optimizes the four pillars of value creation: the balance sheet, the income statement, the cash flow statement, and the relationship with Private Equity sponsors.

The Balance Sheet

A mature treasury function transforms the balance sheet into a dynamic tool for deleveraging and investment, primarily by uncovering "trapped cash" and optimizing the debt structure.

Optimizing Investment Capacity and Cash Pooling

The first lever of value is the identification and mobilization of idle cash. In complex groups with multiple subsidiaries, cash is often fragmented, sitting uselessly in local accounts while the holding company draws on expensive credit lines. By centralizing visibility, a CFO can distinguish between operating cash needed for daily runs and excess liquidity available for investment.

This was the precise scenario for an insurance broker-manager for individuals with $175m in revenue. Before digitizing their treasury, they lacked the granularity to separate their own corporate funds from third-party funds held in mandates. Once they implemented Agicap, they could confidently invest their true surplus. This shift generated an additional $470,000 in financial income per year.

Visibility on True Financing Needs

The second lever is the reduction of "just-in-case" borrowing. When a CFO lacks confidence in their short-term forecast, they inevitably over-borrow to buffer against uncertainty. Conversely, accurate forecasting allows for aggressive debt repayment, which directly increases equity value.

A major activewear brand utilized this improved visibility to challenge their debt assumptions. By gaining a reliable view of their liquidity horizon, they realized they were over-capitalized relative to their needs. Consequently, they repaid a $3 million loan ahead of schedule, saving the company $175,000 in annual interest expenses.

Balance Sheet Consolidation and Covenant Management

Finally, the balance sheet reflects the company's ability to handle complex debt structures. As LBOs mature, refinancing often introduces structured debt with stringent covenants. Managing this in spreadsheets is a governance risk. For a rapidly growing group in retail and services with $120m in revenue, the signing of a structured debt package in July 2024 necessitated a shift in tooling. The CFO noted that without having anticipated this complexity by implementing Agicap beforehand, the daily management of these new obligations would have been "unmanageable."

The Income Statement

Treasury management supports the top line by facilitating growth and protecting the bottom line by streamlining operations and financial costs.

Securing Revenue Growth

For many PE-backed firms, revenue growth is driven by "buy-and-build" strategies. The speed at which a new acquisition is integrated determines how quickly it contributes to the group's value. Legacy systems often require months to integrate a new entity's banking flows. A modern TMS accelerates this drastically.

A high-tech distributor with $230m in revenue, used Agicap to standardize their integration process. The Group CFO highlighted that the choice was driven by the ease of deployment compared to heavier legacy systems. Consequently, they are now able to fully integrate the treasury of a new acquisition within 4 to 6 weeks, securing immediate visibility on revenue flows and cash positions.

EBITDA and the Efficiency of the Finance Function

Below the revenue line, treasury maturity drives EBITDA by rationalizing the finance function's cost base. Manual cash management is labor-intensive, involving high-paid analysts logging into banking portals and manipulating data. Automation releases this capacity.

A group of medical biology laboratories with $70m in revenue provides a clear example of this operational leverage. Facing a staggering volume of 380,000 accounting entries per year across their network of laboratories, the finance team was previously bogged down by manual data entry. By leveraging Agicap to automate the generation of accounting entries for their bank journals, they now save one full week per month on their closing process.

Optimization of Expenses Below EBITDA

Further down the P&L, treasury maturity instills a rigorous discipline across all operational expenses. The traditional approach, analyzing budget variances only after invoices are posted (a "post-mortem" review), is inadequate for the high-pressure environment of an LBO where every dollar counts.

Conversely, integrating "Procure-to-Pay" (P2P) control processes provides real-time visibility into commitments before they are even recorded in accounting. This upstream monitoring enforces budget compliance by department and halts overspending before cash is actually consumed. It was this analytical rigor applied to total outflows that enabled a leading engineering firm to scrutinize their cost structure and identify over $1 million in savings.

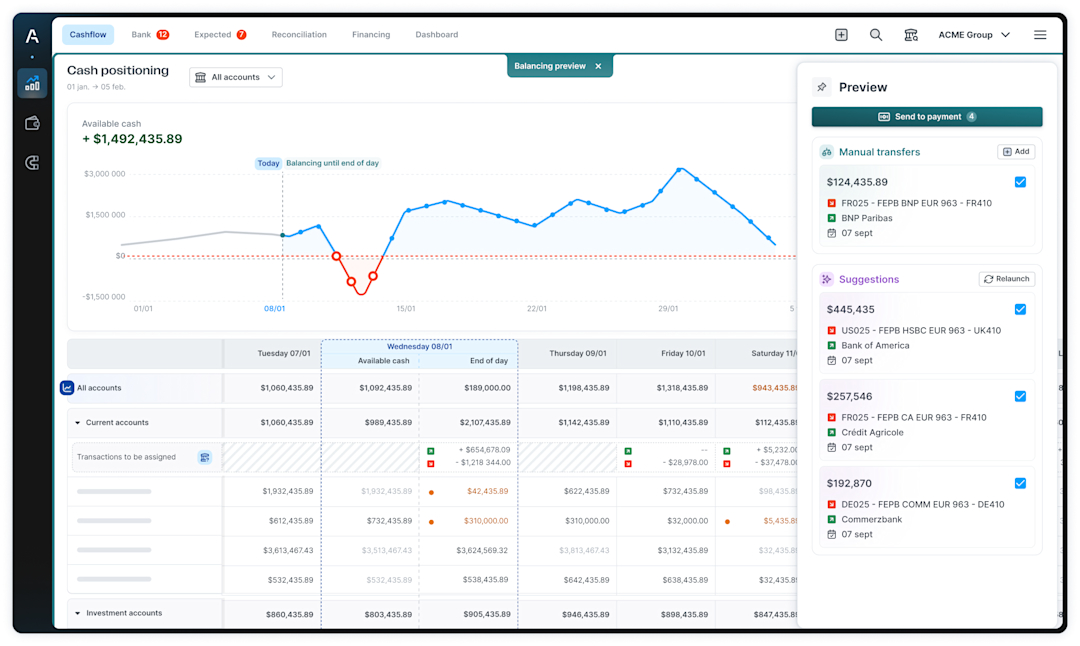

The Cash Flow Statement

Treasury maturity transforms a cash flow statement from a passive report into an active engine for liquidity generation and value creation.

Change Management and Cash Culture

The cash flow statement improves when cash becomes a shared responsibility, not just a treasury concern. A mature tool democratizes access to data, allowing decentralized teams to take ownership of their liquidity impact. A high-tech distributor under its 5th LBO successfully disseminated this "cash culture" across its organization through Agicap. The platform is not only used by the Group Treasurer and Group CFO at the holding level but is also the daily tool for 8 subsidiary CFOs. This alignment ensures that every part of the organization is pulling in the same direction regarding cash generation and preservation.

Converting EBITDA to Cash

The most direct impact a CFO can have on free cash flow is accelerating the conversion of receivables. FP&A can target a lower Days Sales Outstanding (DSO), but Treasury provides the operational means to achieve it.

A B2B e-commerce player leveraged Agicap to automate their collections process. By knowing exactly who had paid and when, they could target their recovery efforts precisely. The result was a 30% reduction in DSO, which mechanically released $4.7 million in available treasury. This "found cash" is non-dilutive capital that can be reinvested or used to deleverage, dramatically improving the cash flow statement's health.

Predictability of Flows

Finally, the quality of the cash flow statement is judged by its predictability. Investors prize reliability over volatility. Moving from static budgeting to dynamic forecasting allows the CFO to anticipate variance. An energy management solutions provider with $100m in revenue achieved a forecast accuracy of greater than 90% by utilizing Agicap. This high degree of predictability allows the board to make strategic decisions with confidence, knowing that the projected cash flows are reliable.

Process with Funds

The ultimate objective of the LBO lifecycle is the exit. The relationship with the Private Equity sponsor is defined by trust, which is built on the speed, accuracy, and transparency of reporting.

Streamlining the Reporting Cycle

Private Equity sponsors demand frequent, detailed monitoring of liquidity, often requiring weekly or even daily updates during volatile periods. For a CFO relying on Excel, this reporting is a recurring "fire drill." Treasury maturity transforms this into a non-event.

An automotive parts manufacturer with $40m in revenue illustrates this shift perfectly. The CFO noted the ease of producing the treasury reporting, stating that at the end of the quarter in September, the report was ready the next day, thanks to Agicap. This immediacy signals to the fund that the company’s treasury is under control. It eliminates the lag between business reality and board visibility, fostering a partnership where time is spent discussing strategy rather than debating the accuracy of the numbers.

Exit Readiness

Ultimately, every LBO is built for an exit. During due diligence, uncertainty is the enemy of valuation. Buyers will discount a company where cash flow data is fragmented. A mature Treasury Management System acts as a signal of institutional quality. It provides an auditable, single source of truth that demonstrates the company’s ability to predict and control its liquidity. This governance reduces the risk premium attached to the asset, directly maximizing the exit multiple and ensuring that the final valuation reflects the company's true potential.

Conclusion

Ultimately, the transition to a mature Treasury Management System is not an IT upgrade; it is a strategic pivot that directly correlates with the exit multiple. By moving from spreadsheet-based inertia to a platform that secures liquidity, compresses working capital, and automates reporting, the CFO transforms the treasury function from a defensive shield into a valuation engine.

This specific expertise in the leveraged environment is why Agicap has become the standard for the industry, currently partnering with over 350 PE-backed companies. We understand that for a portfolio company, cash is not just about solvency. It is the primary metric of optionality. By adopting a solution proven to withstand the scrutiny of top-tier sponsors, you ensure that when the time comes for the exit, your financial infrastructure is as robust as your growth story.