Treasury Management Solution: The Complete Guide for US Mid-Market Finance Leaders (2026 Edition)

Treasury professionals at US mid-market organizations today face a landscape transformed by digital disruption, rising complexity, and growing demands for speed, accuracy, and strategic insight. Managing liquidity across multiple banks, entities, and currencies is now the norm—just as the stakes for compliance, real-time decisions, and risk management have never been higher. For organizations experiencing M&A activity, international expansion, or increased scrutiny from regulations like SOX, US GAAP, and KYC, legacy “Excel-centric” approaches simply no longer suffice.

In this environment, investing in a modern Treasury Management Solution (TMS) has become a strategic imperative. This comprehensive guide examines why the right TMS is essential for US mid-market finance leaders, outlines the latest best practices and selection criteria, and provides a market overview for 2026. We also offer a business-focused comparison of top vendors—highlighting what makes Agicap’s approach uniquely suited to the evolving needs of US organizations.

Why Invest in a Treasury Management Solution?

Addressing Everyday Challenges for US Treasurers & CFOs

- •

Multi-Bank, Multi-Entity, Multi-Currency Complexity: US treasurers in growing organizations routinely manage dozens of bank accounts, across multiple entities and currencies. Manual consolidation is time-consuming and error-prone, especially when international subsidiaries or carve-outs are involved.

- •

Fragmented Manual Processes Across ERPs and Banks: Reconciling transactions between separate accounting systems, ERPs, and bank portals often means hours of repeated downloads, uploads, and copy-paste. This introduces significant risk for inaccuracies.

- •

Visibility Gaps in Real-Time Liquidity and Cash Forecasting: Making cash and liquidity decisions based on outdated or incomplete data can result in unnecessary debt drawdowns, sub-optimal investments, or poorly-timed hedges.

- •

Regulatory and Audit Pressures (SOX, US GAAP, etc.): As compliance, tax, and SOX requirements evolve, so does the need for centralized audit trails, robust controls, and the ability to produce reliable, on-demand reporting for banks, boards, and auditors.

- •

Rising Risk of Errors, Fraud, and Compliance Breaches: Disparate systems and weak process controls expose organizations to fraud, malicious activity, and regulatory penalties, especially in decentralized payment environments.

- •

Operational Overload and Strategic Opportunity Cost: Time spent on routine bank reconciliations and manual report creation limits team bandwidth for strategic treasury activities—such as optimizing working capital or scenario planning for upcoming M&A.

- •

Supporting Growth, M&A, and International Expansion: Scalable, automated TMS infrastructures not only streamline integration for new entities/accounts after acquisitions but also help organizations stay agile as their business footprint expands.

The Stakes: Why Choosing the Right Solution Is Strategic

Selecting an effective Treasury Management Solution isn’t just about solving day-to-day operational issues—it’s about safeguarding your organization’s financial integrity, supporting rapid growth, and enabling confident decision-making. The right platform ensures robust compliance, provides real-time cash visibility, and streamlines treasury processes, allowing your team to focus on more strategic priorities as your business evolves.

What Is a Treasury Management Solution?

Treasury Management Solution: Definition and Key Principles

A Treasury Management Solution, also known as a Treasury Management System (TMS), is an integrated software platform purpose-built to automate, control, and optimize organizations’ treasury, liquidity, cash flow, and payment operations. Whereas legacy “cash management” tools focused mainly on bank reconciliation or payments, modern TMS platforms encompass a comprehensive suite of features:

- •

Real-time cash and liquidity positioning across banks, accounts, and entities

- •

Advanced forecasting and scenario planning

- •

Centralized payment management with multi-level approval and compliance

- •

Full automation of reconciliation, reporting, and audit trails

- •

Seamless integration with ERP/accounting systems (dispersed or centralized)

According to PwC’s 2025 Global Treasury Survey, 94% of organizations now operate a dedicated TMS, underscoring its centrality in managing scale and complexity in today’s treasury functions.

Treasury Management vs. Cash Management: What’s the difference?

Feature | Cash Management Tools | Treasury Management Solution |

|---|---|---|

Scope | Bank account, reconciliation | Full cash/liquidity/investment |

Consolidation | Limited | Group-wide, multi-entity/currency |

Automation | Low/medium | High, with workflow/AI support |

Reporting / Audit | Manual | On-demand, standardized |

ERP or Accounting / Bank Integration | Minimal | Deep and bi-directional |

Security /Compliance | Basic | Policy-driven, robust audit |

Integrated Treasury Management Solutions have become indispensable for mid-market organizations, offering consolidated visibility, compliance, and scalability in an increasingly complex financial environment..

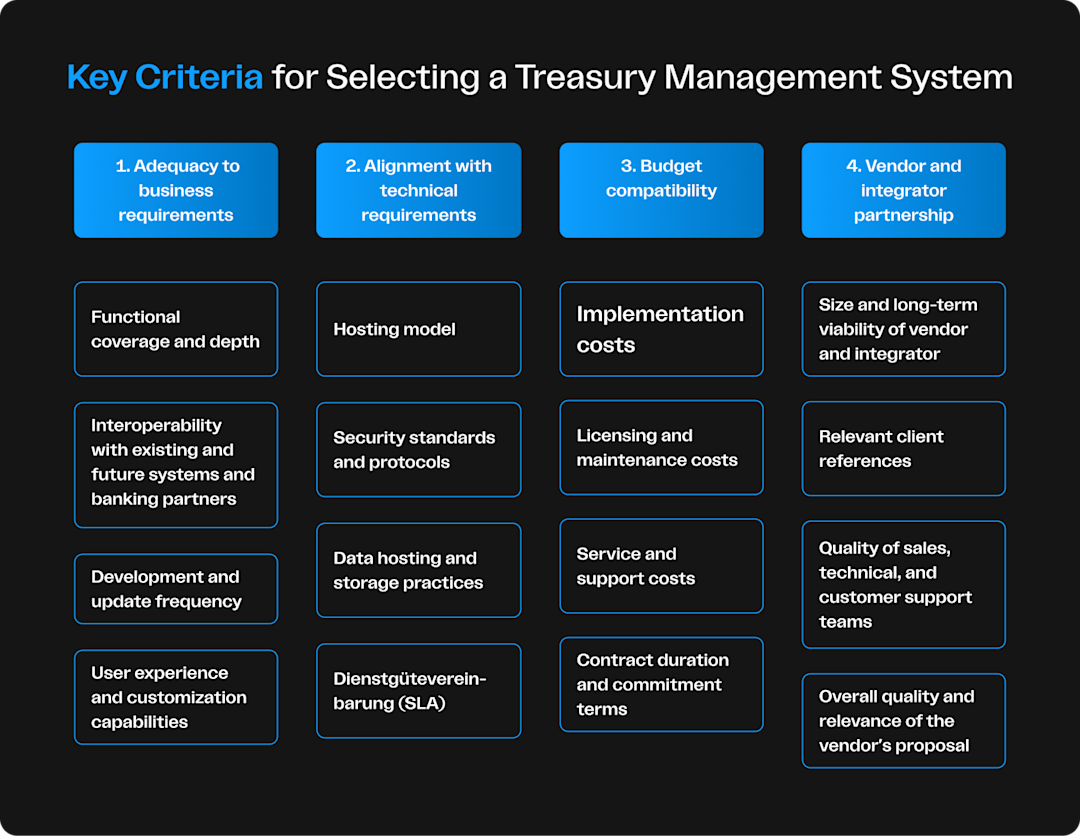

Key Selection Criteria for US Treasurers & CFOs

Organization’s success. For US mid-market finance leaders, these core evaluation criteria are essential to ensure that your chosen platform not only meets today’s requirements, but also supports sustainable, scalable growth:

1. Functional Fit & Innovation

- •

Comprehensive Capabilities: Does the Treasury Management Solution cover all mission-critical functions? (Liquidity management, accurate cash flow forecasting, payment processing, cash pooling, and risk management.)

- •

Modularity and Flexibility: Is the platform modular, scalable, and easily customizable to adapt as your organization grows or needs change?

- •

Seamless Integration: How easily does the solution integrate with your current and future IT landscape—including ERP and accounting systems such as SAP, Oracle, Microsoft Dynamics, and NetSuite?

- •

User Experience: Does the platform offer an intuitive interface, customizable workflows, and role-based access to accommodate distributed or multi-disciplinary treasury teams?

2. Technical and Security Requirements

- •

Deployment Options: What hosting models are available (SaaS/cloud, on-premise, hybrid), and do they align with your organization's IT strategy and compliance standards?

- •

Security and Compliance: Does the provider meet industry-leading security standards (such as ISO 27001, data encryption, and multi-factor authentication), and ensure robust data privacy and regulatory compliance (e.g., SOX, GDPR, CCPA)?

- •

Data Residency and Availability: Where are the data centers located, and how are data residency, uptime, and disaster recovery ensured?

- •

Support Structure: Is there a reliable, multi-channel support offering with clearly defined SLAs and rapid response times?

3. Budget & Contract Terms

- •

Total Cost Transparency: What is the complete cost structure (implementation, licensing, ongoing usage, updates)? Is there transparent pricing for additional modules, users, or features?

- •

Scalable Licensing: Are licensing and support costs adaptable—for instance, as new entities, users, or business modules are added?

- •

Contract Flexibility: What are the contract terms and renewal or cancellation conditions? How easy is it to expand or exit the contract if your requirements change?

- •

Included Services: Are software updates and routine support included in the contract, or are they subject to additional fees?

4. Vendor Partnership & Reputation

- •

Financial Stability & Roadmap: Is the TMS provider financially solid, with a demonstrated commitment to ongoing innovation and product development?

- •

Relevant Experience: Can the provider reference successful projects in your industry or with organizations facing similar treasury complexity?

- •

US-Based Expertise & Support: Are pre-sales, onboarding, and post-implementation support both knowledgeable and locally accessible?

- •

Implementation & Change Management: Are roles and responsibilities between the provider and any implementation partners clearly defined? Does the provider actively support change management throughout and after go-live?

- •

Adaptability: How agile is the vendor in responding to new regulatory, operational, or business requirements as your organization evolves?

What is the Best Treasury Management System (TMS) for 2026? Comparative Overview Table

Provider | Core Features | Strengths | Ideal Use Cases |

|---|---|---|---|

Agicap | Real-time cash visibility, multi-bank/entity, forecasting, payment factory, automated reconciliation, in-house banking, scenario planning, FX risk management | Fast onboarding, modular SaaS, intuitive interface, responsive support, frequent updates | Mid-sized & scaling groups, M&A, rapid international expansion |

Kyriba | Liquidity, risk, payments, FX/hedging, supply chain finance | Global bank network, advanced risk/FX, robust compliance | Large/global corporates with complex risk or global treasury needs |

GTreasury | Core treasury, risk/liquidity management, payments, analytics | Deep functional coverage, sophisticated analytics | Large companies, complex treasury/risk profiles |

TIS | Payment automation, bank connectivity, fraud prevention | Payment HUB, bank-agnostic, strong compliance | Payment centralization across US/international entities |

SAP | Treasury within SAP ERP, cash/risk management | Full SAP integration, end-to-end process control | Large SAP ERP organizations, deep process integration |

Coupa | Treasury and BSM, payments, working capital | Integrated with procure-to-pay, user-friendly | Companies focusing on AP/AR optimization, Coupa users |

FIS/ION | Treasury, capital markets, risk, legacy TMS | Stability, massive scale, feature breadth | Largest multinationals, complex capital markets needs |

7 Best Treasury Management Software for 2026: Detailed Review

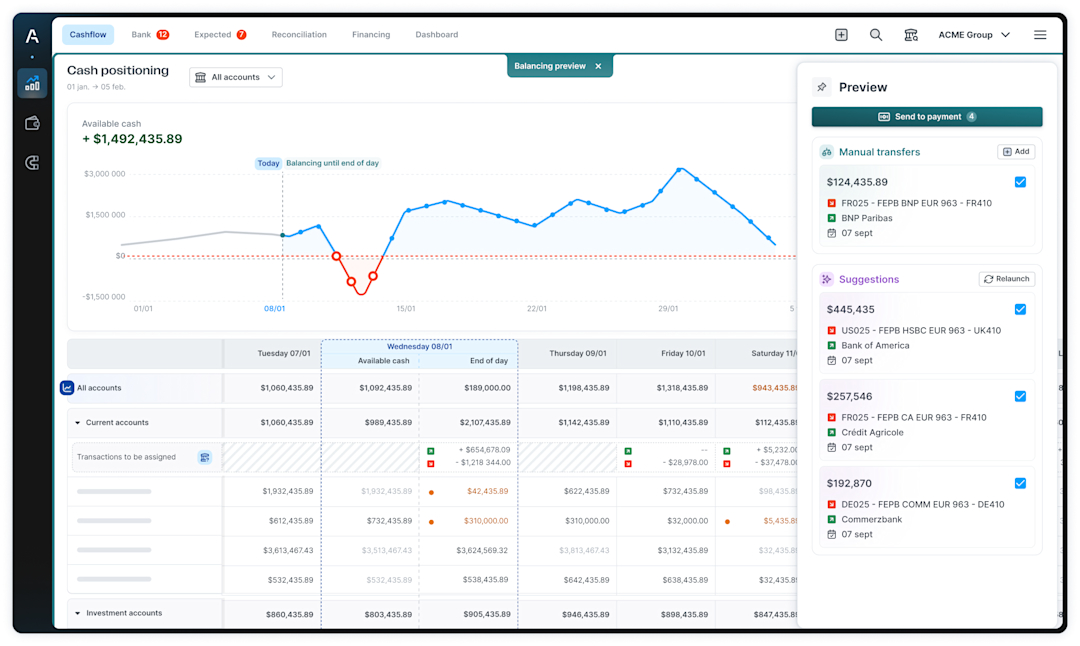

Agicap

Agicap is a modern Treasury Management Solution tailored for mid-sized and internationally expanding organizations. Key features include:

- •

Real-time cash visibility across all banks and entities

- •

Multi-bank connectivity and automated reconciliation

- •

Centralized payment factory: Initiation and approval of ACH, wire, and multi-currency payments across all banks, with automated workflows, NACHA/ISO 20022 compliance, and robust audit trails.

- •

13-week liquidity forecasting and scenario analysis

- •

In-house banking and intercompany financing management

- •

FX risk management and monitoring

- •

Treasury accounting with automated journal entries and ERP integration

Kyriba

A comprehensive and globally recognized TMS platform, Kyriba covers liquidity management, payments, FX risk, and supply chain finance for large corporates. The solution features robust bank connectivity and advanced risk management tools. Its extensive capabilities and flexible architecture make it ideal for organizations with complex international structures, demanding risk coverage, and global treasury operations.

GTreasury

GTreasury provides a unified treasury platform with functionality in cash management, risk analysis, payments, and analytics. Known for advanced reporting and workflow automation, GTreasury is a strong match for enterprises operating across multiple regions or entities and needing detailed financial analytics across the full treasury lifecycle.

TIS

TIS focuses on payment centralization, bank connectivity, and fraud prevention, serving as a global payment hub for multinational businesses. The platform streamlines payment processes, standardizes formats, and enhances compliance and security. It is particularly effective for organizations seeking to consolidate and automate their disbursement and payment operations across a diverse international banking landscape.

SAP

SAP’s treasury module is fully integrated within the SAP ERP suite, delivering end-to-end cash, risk management, and full process traceability. The solution enables complete audit capability and group-wide standardization. SAP Treasury is a strategic fit for organizations standardized on SAP, looking for seamless integration between treasury, accounting, procurement, and other core enterprise functions.

Coupa

Coupa Treasury is part of the broader Coupa Business Spend Management platform. It focuses on streamlining AP/AR, payments, and working capital through an intuitive, user-friendly interface. Organizations already using Coupa for procurement benefit from unified workflows, spend visibility, and API-driven integration, making it a strong choice for companies looking to connect treasury closely with procurement and finance operations.

FIS/ION (including former Sungard and Ambit platforms, as well as ION/Quantum for large multinationals)

FIS and ION offer enterprise-grade Treasury Management System (TMS) platforms supporting complex treasury, risk, and capital markets functions for very large corporates and financial institutions. These solutions deliver extensive product coverage, scalability, and stability, and include former Sungard and Ambit platforms as well as ION/Quantum. They are most suitable for multinational organizations with advanced requirements in global cash, derivatives, and financial risk management.

Benefits of Treasury Management Solutions

When building a business case for a Treasury Management Solution, it’s essential to consider the four key value dimensions: growth, financial performance, risk management, and operational efficiency. The relevance of each may vary depending on your organization’s strategy and market context; the examples below illustrate how a modern TMS can deliver measurable impact.

1. Growth & Strategic Agility

- •

Finance investments more effectively by optimizing working capital, freeing up cash that can be redeployed into expansion projects.

- •

Fuel company expansion through faster cash mobilization and streamlined onboarding of new entities (post-M&A or international growth).

- •

Reduce cash buffers across accounts, potentially lowering idle balances by 10–50% and releasing capital for strategic initiatives.

2. Financial Performance

- •

Accelerate cash inflows by reducing DSO and optimize outflows by increasing DPO.

- •

Streamline internal cash flow with automated intercompany netting and liquidity pooling, ensuring funds are positioned where needed most.

- •

Reduce required cash buffers to minimize idle balances.

- •

Increase invested cash, improve investment rates, and reduce borrowed amounts and borrowing rates.

- •

Gain transparency on bank fees for better negotiation and cost control.

- •

Enhance your net financial result by optimizing working capital, reducing overdraft penalties, and directing more cash to high-yield opportunities.

3. Risk Management

- •

Mitigate liquidity, FX, and interest rate risks with real-time forecasting and scenario analysis

- •

Support regulatory and banking compliance (SOX, KYC, US GAAP) with built-in controls and audit trails

- •

Reduce errors and fraud through automated processes and robust user controls

4. Operational Efficiency

- •

Save time and reduce manual workload via automated reconciliation and payment workflows

- •

Increase treasury team productivity, enabling more focus on strategic and high-value activities

Why Choose Agicap? Key Value for US Mid-Market Companies

Agicap stands out as a treasury solution tailored to the needs of US mid-market companies. Customer feedback consistently highlights ease of use, rapid time-to-value, and strong support, making it a compelling option for finance and treasury teams looking to modernize without heavy IT involvement. Key benefits include:

Rapid Implementation and Fast ROI

- •

Average go-live within 3–6 months—compared to 12–18 months for enterprise TMS.

- •

Handled by Agicap’s in-house US team, meaning smoother onboarding, less drain on internal resources.

A recent customer example is Hennecke Group, whose CFO Yves Souguenet highlights:

“A decisive factor in choosing Agicap was the ability to implement the solution without mobilizing our internal IT resources. It’s Plug & Play—a project led by Finance, for Finance, with no technical complexity.”

Cost-Effective, Modular SaaS Pricing

- •

Pay only for modules your treasury needs; scale up as your business grows.

- •

Regular platform updates and enhancements included—no hidden fees

US-Based Support and Expertise

- •

Dedicated account manager and local support team

- •

Responsive assistance by phone, chat, or email—expert answers within minute

User-Centric, Intuitive Design

- •

Intuitive web/mobile interface accelerates adoption among finance/treasury users.

- •

Fast user adoption and high-quality data input

Comprehensive Feature Set for the Mid-Market

- •

Real-time visibility across all banks, accounts, currencies, and entities

- •

Automated bank statement retrieval and reconciliation

- •

Advanced cash flow modeling, scenario planning, and group-wide pooling

- •

Centralized, multi-currency payment factory with robust compliance and fraud controls

- •

Automated treasury accounting and seamless ERP integration

Agile, Continuously Evolving Platform

- •

Cloud-native for instant collaboration and scalability

- •

Twice-monthly feature releases addressing customer and regulatory needs

Scalable for Growth, M&A and Complexity

- •

Fast onboarding of new entities and accounts—ideal for post-acquisition or international expansion

- •

Supports complex group structures and ongoing business evolution

Agicap empowers finance leaders with the visibility, efficiency, and flexibility needed to drive treasury performance—without the complexity of traditional enterprise TMS systems.

Customer Success Story: Hennecke Group

Hennecke Group, a €160M mid-market manufacturing leader operating across five countries and multiple ERPs or accounting solutions, transitioned to Agicap for daily cash management. This shift delivered real-time visibility and reduced the workload from 32 hours/week to just 2, saving over 1,200 hours annually.

Implementation was truly plug-and-play, requiring no internal IT resources—a decisive factor for an agile finance team. As Yves Souguenet, Group CFO, notes:

“The introduction of Agicap has brought a new level of efficiency and reliability to our cash management. We have saved more than 1,200 hours a year, minimized errors, and now have real-time information at our fingertips.”

Expert Checklist: How to Choose the Right Treasury Management Solution

- •

Map your landscape: List entities, bank accounts, currencies, and core systems.

- •

Define your needs: Clarify treasury functions, reporting, and compliance requirements.

- •

Check integration: Ensure easy connections to your ERPs / accounting solutions and banks.

- •

Assess scalability: Verify agility for growth, M&A, or regulatory changes.

- •

Review support: Confirm onboarding process, training, and SLAs.

- •

Test usability & controls: Pilot key workflows; evaluate security and approval features.

A clear, focused checklist ensures your TMS investment meets both current and future treasury priorities.

Ready to see how Agicap can streamline and future-proof your treasury operations?

Book your personalized demo with Agicap today.

FAQ: Treasury Management Solution for US Companies

What’s the key difference between a TMS and standard ERP financial modules?

While many ERPs include finance/cash features, a TMS is purpose-built to consolidate cash and liquidity group-wide, automate treasury workflows, and enforce payment/fraud controls across multiple banks and entities. Most ERPs lack the depth and workflow tools for proactive treasury management.

How long does it typically take to implement a TMS for a US mid-market group?

Modern SaaS TMS such as Agicap can be fully live in 3–6 months (sometimes faster), while traditional/legacy TMS may take 12–18 months due to complex integrations and customizations.

Is cloud-based TMS secure and compliant for US operations?

Yes. Leading platforms are SOC, ISO, and GDPR compliant, with robust multi-factor authentication and audit trails. Agicap, for example, offers policy-driven controls and secure US data hosting.

Can TMS handle international growth and M&A, not just US operations?

Modern TMS solutions are designed for this—Agicap enables instant onboarding of new international entities and integrates multi-currency, multi-bank data for consolidated control.

Which types of treasury management technology solution companies should mid-market firms consider?

Mid-market firms should prioritize modern, cloud-based Treasury Management System (TMS) providers that offer strong bank/ERP integrations, automation for cash visibility and payments, and fast, low-IT implementation. Solutions specifically designed for multi-bank, multi-entity mid-market groups are preferable to heavy enterprise platforms or basic bank tools. Bank “treasury services” can complement a TMS, but rarely replace it for group-wide control.

Do we need external treasury management advisors in addition to a TMS?

Not necessarily. If your needs are standard (cash visibility, forecasting, payments, basic risk) and your TMS vendor offers solid onboarding and best practices, a separate advisor is often optional. External advisors become useful for complex topics—large M&A, in-house banking, sophisticated FX/hedging, or major operating model redesign.