Supplier Payment Software & Accounts Payable Automation: Features, Comparison & Guide for US Mid-Market Businesses

In the rapidly evolving world of corporate finance, supplier payment software has become indispensable for US mid-market CFOs, treasurers, and finance controllers seeking to modernize group-level operations, meet stringent compliance standards, and optimize working capital. With auditors, lenders, and management demanding real-time, reliable cash and liability data—especially across multiple entities— automating AP processes is no longer optional: it’s a critical tool for accurate financial management.

What Is Supplier Payment Software? Definition & How It Fits into Accounts Payable Automation Solutions

Definition

Supplier payment software—often referred to as payment automation software or as part of modern AP automation —goes far beyond digitalizing payables. For US mid-market groups, it’s a strategic engine to:

- •

Centralize and automate invoice processing across all business units or subsidiaries;

- •

Provide consolidated, real-time insights into committed supplier outflows, directly impacting group net working capital and cash position;

- •

Support audit-ready, SOX-compatible processes, and enable finance to move away from error-prone manual controls.

How It Works (End-to-End Workflow)

A modern supplier payment software typically supports the following workflow:

- •

Automated invoice processing and intake: Capture supplier invoices from multiple sources (email, scanned documents, electronic portals, etc.), often using OCR (optical character recognition) to extract data automatically.

- •

Approval workflows (customizable, multi-step): Route invoices to the appropriate approvers for review, with built-in escalation, reminders, and compliance controls (budget guidelines for instance).

- •

2/3-way matching (invoice, PO, delivery): Automatically compares invoices with corresponding purchase orders and delivery notes to ensure consistency and prevent errors or fraud.

- •

Payment execution: Supports multiple payment methods (ACH, wire, virtual cards, checks), scheduling, and batch payment runs, often integrated directly with banks or payment providers.

- •

Real-time visibility into payment status: Dashboards and automated alerts keep teams updated on payment progress, outstanding approvals, and upcoming due dates.

- •

Seamless integration with accounting/ERP and bank systems: Ensures continuous data flow, reducing redundant entries, and supports consistent, audit-ready records.

- •

Security features: End-to-end audit trails, user role controls, duplicate/fraud detection, and compliance tools (e.g., OFAC/sanctions checks, SOX readiness).

Key Benefits of Supplier Payment Software

Adopting advanced supplier payment software delivers far more than just time savings through automation. For US mid-market finance leaders, the right platform provides these high-impact benefits:

- •

Dramatic process efficiency gains: Automate invoice capture, validation, approvals, and payment execution end-to-end—enabling finance teams to significantly increase productivity without increasing headcount. According to Ardent Partners (2025), “Best-in-Class” AP teams report an invoice exception rate of only 9%, compared to 22% for all others—a 59% improvement. Fewer exceptions mean less time spent correcting errors, chasing manual approvals, and managing rework, directly accelerating processing times and cash visibility.

- •

Reduction of financial and compliance risk: Minimize the likelihood of payment errors, fraud, and non-compliance with SOX-ready, audit-trail-centric workflows. Guarantee that every step—from approval to payment—is documented, role-based, and instantly accessible for auditors or internal controls.

- •

Real-time, group-level cash visibility: Achieve a unified, up-to-date view of supplier liabilities and committed outflows across every subsidiary or business unit. Directly support group net working capital optimization ensuring upcoming AP payments are taken into account in cash forecasts.

- •

Accelerated closings and reliable, audit-ready data: Digital AP workflows and instant data consolidation speed up month-end and quarter-end closes. Exportable entries and reconciliations enable finance teams to respond faster to audit requests and enhance the organization’s readiness for both internal and external reviews.

- •

Scalability and efficiency during growth or M&A: Flexible, multi-entity platforms let you centralize, standardize, and scale AP processes rapidly when onboarding new entities, entering new markets, or managing group reorganizations—all without sacrificing speed or control.

- •

Supplier relationship and working capital optimization: Timely, predictable payments protect supplier trust and allow you to systematically capture early payment discounts and enforce negotiated payment terms. By closely linking AP with cash management, your treasury team can actively arbitrate payment timing and improve working capital performance without excess financing costs.

- •

Powerful decision support: With consolidated dashboards and scenario analysis, finance leaders gain actionable insights for cash planning, debt coverage, investment decisions, and negotiating payment terms—helping the business move from reactive processing to genuinely strategic financial management.

- •

Cost control and predictable scaling: Eliminate opaque per-transaction fees and manual process costs. A transparent, scalable pricing structure means your process can support significant invoice and payment growth without unpredictable budget impacts.

Key Challenges And Business Impacts For US Mid-Market Finance Leaders

Despite digital advances, many mid-sized US groups remain reliant on manual or fragmented AP processes—leading to the following pain points with direct business implications:

- •

Manual or fragmented processes increase the risk of payment errors, duplicate invoices, and late supplier settlements. This not only damages supplier relationships but may result in late fees, missed early payment discounts, and even reputational risk.

- •

Limited visibility into consolidated group cash/liabilities impairs strategic cash management. Without real-time visibility into committed outflows, group treasurers cannot optimize intercompany transfers, ensure compliance with debt covenants, or anticipate short-term funding needs—risking unnecessary interest expenses and penalties.

- •

Spreadsheet-based AP tracking slows down month-end closes and increases audit risk. Manual reconciliations lead to errors, version control issues, and time-consuming responses to auditors or internal stakeholders—jeopardizing SOX compliance and extending closing cycles.

- •

Disparate systems across entities hinder financial agility amidst growth or M&A. Finance leaders lack a unified platform to adapt approval workflows to group policies, scale operations, or quickly onboard new subsidiaries, putting scalability and governance at risk.

Top 12 Supplier Payment Solutions

Selecting the right supplier payment software can be a game changer for mid-sized US companies searching for efficiency, control, and real-time cash visibility. The table below compares leading platforms—highlighting their core features, main strengths, and the types of businesses they best serve. This overview is designed to help finance leaders quickly identify which solution aligns with their organization’s day-to-day workflows and strategic objectives.

Solution | Key Features | Strengths | Best Fit |

|---|---|---|---|

Agicap | - Centralized invoice capture (multi-channel) | User-friendly, real-time AP & cash integration, highly scalable, modular | Multi-entity, group-level finance teams seeking unified AP and treasury |

AvidXchange | - Automated invoice capture | Performance in high-volume invoice environments, electronic payments at scale | Real estate, construction, vendor-heavy industries |

Tipalti | - Global/multi-entity AP automation | International payments, compliance automation, onboarding at scale | Companies with global suppliers, SaaS/platform economies |

Medius | - Intelligent invoice data capture - PO/invoice/delivery matching | End-to-end automation, analytics & reporting | Data-driven finance teams, organizations with complex spend |

Sage Intacct / AP Automation | - Embedded AP within cloud ERP suite | One platform for AP and accounting, native reporting | Firms already on or adopting Sage ecosystem |

PaymentWorks | - Digital supplier onboarding | Risk mitigation, Digital traceability, Fraud protection | Organizations prioritizing vendor risk, higher education, public sector |

Yooz | - OCR-based invoice capture | Intuitive UI, quick onboarding, low maintenance | SMBs & mid-market firms prioritizing ease of use |

Stampli | - Invoice collaboration/chat | Cross-team collaboration, process transparency, fast approvals | Teams needing distributed AP responsibility or complex approvals |

MineralTree | - Automated invoice capture | Fast deployment, cash visibility, security | Firms seeking simple but effective AP automation with cash focus |

Bill.com | - Digital invoice capture | Intuitive, payments network | SMBs, QuickBooks / Xero / NetSuite users wanting seamless payments |

QuickBooks Payments | - Vendor payments integrated natively in QuickBooks Online | Deep integration with accounting, all-in-one visibility, minimal setup | Small businesses on QuickBooks Online |

Ramp | - Invoice capture & bill payments (ACH, check) | Unified spend and AP management, user experience | SMBs & mid-market US-based companies seeking integrated card, bill pay, and spend controls |

Solution Reviews – Supplier Payment Platforms for US Mid-Market

Below is a brief review of each solution and how they address mid-market needs:

Agicap

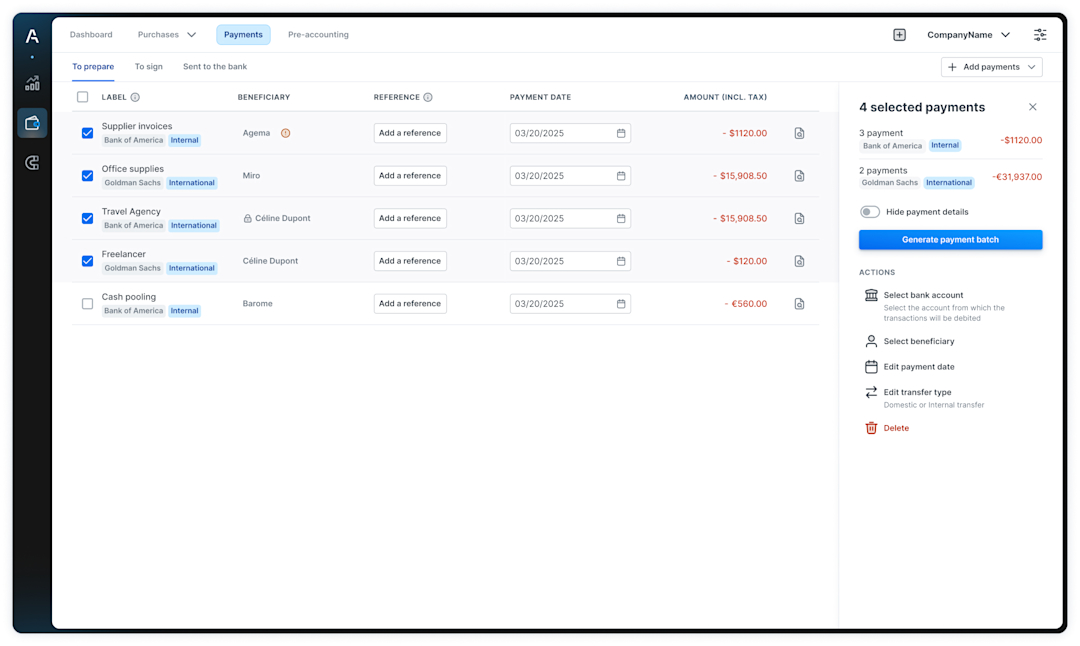

Agicap is a unified supplier payment and cash management platform designed to help mid-market finance teams gain full visibility and control over accounts payable, invoice workflows, and liquidity. The software centralizes every aspect of supplier invoicing and payments on one platform—eliminating manual steps and supporting smarter, real-time cash management.

Key features include:

- •

Centralization of all supplier invoices and related documents (any format or channel)

- •

Automated invoice capture with advanced OCR

- •

Direct ERP integration for purchase order collection and invoice matching

- •

2-way and 3-way matching (PO, invoice, delivery) to reduce errors and fraud

- •

Customizable, multi-level approval workflows to enforce compliance

- •

Integrated, secure multi-bank and multi-currency payment execution with approval workflows and full audit trail

- •

Real-time dashboards for invoice status and payment planning

- •

Automated reconciliation suggestions to support accurate closings

- •

Pre-accounting automation and easy export to ERP/accounting software

- •

Instant synchronization between AP activity, cash forecasting, and liquidity planning

Best for: Finance leaders looking for an all-in-one solution to automate supplier payments, gain real-time cash visibility, and manage multi-entity group structures efficiently.

AvidXchange

AvidXchange is a AP automation platform purpose-built for mid-market US businesses, particularly those managing a high volume of vendor invoices, such as in real estate, construction, and facilities management. The solution automates invoice intake, digitalizes approval workflows, and supports payment execution via multiple channels—including ACH, checks, and virtual cards.

Its strengths include robust integrations with major ERP environments or accounting solutions and the ability to streamline electronic payments at scale. AvidXchange is well-suited for organizations that value ERP/accouting compatibility and efficient, high-volume invoice management.

Tipalti

Tipalti offers a unified, cloud-based AP platform catering to businesses with international suppliers, multiple subsidiaries, or complex payment needs. Key features include supplier onboarding portals, global mass payment execution in local currencies, and built-in compliance checks covering tax, regulatory, and anti-fraud requirements.

Tipalti distinguishes itself with automated, scalable workflows that simplify vendor management on a global scale. The solution is a strong fit for organizations with international operations or regulatory complexity seeking end-to-end AP process automation.

Medius

Medius provides advanced AP automation solutions tailored to organizations seeking data-driven process optimization. The platform features intelligent invoice capture, automated PO/invoice/delivery matching, customizable approval chains, and in-depth analytics dashboards for spend visibility.

Medius stands out for its end-to-end workflow automation and advanced reporting, making it ideal for finance teams that prioritize ERP or accounting integration, analytics, and process transparency.

Sage Intacct / Sage AP Automation

Sage Intacct is a leading US cloud ERP suite with an embedded AP module. It automates invoice capture, streamlines approval queues, and seamlessly syncs accounts payable data with general ledger and financial reporting functions.

This solution offers intuitive native integration between AP and accounting, enabling finance teams to unify their financial operations in a single ecosystem. It is best suited for organizations already using or transitioning to the Sage platform.

PaymentWorks

PaymentWorks specializes in secure digital onboarding, vendor verification, and payment validation for the US mid-market. Key features include automated KYC and sanctions screening, digital vendor profile management, and secure integration with downstream payment systems.

This makes PaymentWorks particularly valuable for organizations with strict compliance requirements, focusing on fraud prevention and supplier risk management during onboarding.

Yooz

Yooz is a cloud-first AP automation solution designed for mid-market and SMB organizations prioritizing rapid deployment and ease of use. It leverages OCR technology for document capture, streamlines entry with template-based automation, and offers intuitive approval workflow builders.

Yooz remains popular due to its modern interface, quick onboarding process, and minimal IT maintenance requirements, making it suitable for fast-growing teams upgrading from manual or semi-automated AP processes.

Stampli

Stampli is an AP automation platform that focuses on collaboration and communication throughout the invoice lifecycle. It offers flexible workflow engines, centralized invoice chat tools, and integration capabilities with leading ERP or accounting systems.

With real-time notifications and transparent audit trails, Stampli is a preferred choice for organizations where AP processes require the input and approval of multiple teams or departments.

MineralTree

MineralTree offers straightforward AP automation and payments with strong US banking integrations, and role-based access. Its strengths are easy deployment and secure payment workflows for mid-market firms.

MineralTree is best suited for businesses that want efficient, reliable AP automation and visibility over cash movement without extensive customization requirements.

Bill.com

Bill.com is a widely adopted cloud-based AP and payments platform for SMBs and mid-sized organizations. It automates invoice entry, supports recurring payment workflows, and connects natively with leading accounting software such as QuickBooks, Xero, and NetSuite.

Renowned for its intuitive design, broad payment network, and hassle-free integrations, Bill.com appeals to companies seeking to streamline AP and payments with minimal friction and extensive accounting sync.

QuickBooks Payments

QuickBooks Payments is the native vendor payment platform fully integrated within QuickBooks Online (QBO). It simplifies the process of issuing payments, managing invoices, and keeping payables and receivables consolidated within a single accounting environment.

With fast setup, deep data integration, and a unified financial dashboard, QuickBooks Payments offers excellent value for small to midsize businesses already using QBO and seeking seamless end-to-end financial management.

Ramp

Ramp is a spend management and accounts payable platform for US-based mid-market companies. It enables users to capture invoices, route them through approval workflows, and execute supplier payments via ACH or check. The platform combines accounts payable automation with corporate card management and includes real-time integrations with accounting softwares.

Ramp provides tools for tracking spend across both card and bill payments, managing vendor information, and ensuring that expenses are synced to accounting records. It is positioned for organizations seeking an integrated approach to employee spending and supplier payments within a unified system.

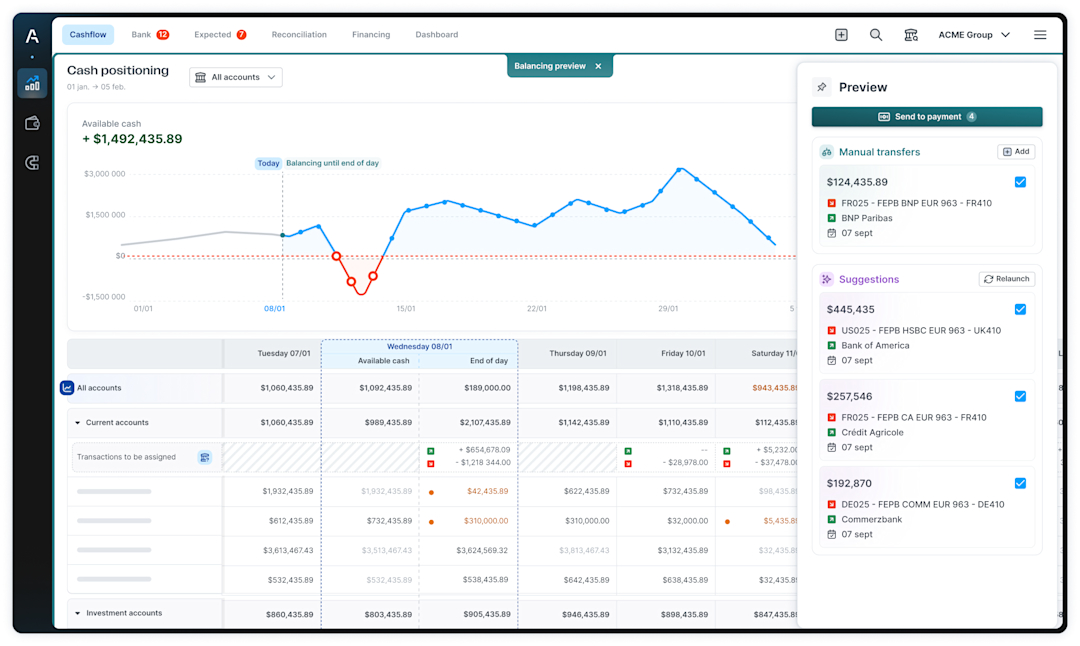

How Agicap Goes Beyond Traditional Supplier Payment Software

Unlike traditional AP platforms that focus primarily on invoice automation and supplier payments, Agicap extends its scope to cover both transactional AP processes and comprehensive liquidity forecasting and planning across multiple entities, currencies, and banks.

This integration enables finance teams to not only automate payables, but also to forecast future cash positions, run simulations, and make more informed decisions with a single, consolidated source of truth for all cash flows—something not typically offered by standard AP automation providers.

Unified & Advanced AP Workflow

- •

Complete procure-to-pay coverage: Manage every step, from purchase requests and PO collection to invoice capture, approval, and payment execution—fully centralized.

- •

Automated 2/3-way matching: Advanced matching between POs, invoices, and goods receipts reduces errors, prevents fraud, and simplifies audit preparation.

- •

Customizable, multi-level approval logic: Easily configure approval chains to match any internal policy or compliance standards, enabling higher accountability and transparency.

Real-Time Cash & AP integration

- •

Direct link between AP and cash forecasting: Every invoice or payment action instantly updates cash forecasts and the liquidity dashboard, ensuring up-to-date cash visibility.

- •

Multi-entity/group-level management: Consolidate liabilities, payment schedules, and cash positions across subsidiaries, bank accounts, and currencies, ideal for US companies with complex structures.

Seamless Integration, Fast Deployment

- •

Rapid connection to US ERPs or accounting tools, banks, and payment providers: Out-of-the-box connectors and open APIs ensure data flows from AP to treasury to accounting without manual intervention.

- •

Real-time collaboration: Distributed teams can review, approve, and monitor accounts payable processes in parallel, increasing efficiency and control.

- •

Modular and flexible: Deploy Agicap as a full, all-in-one treasury & AP platform, or integrate with your existing systems for unified, up-to-date financial data and consolidated cash visibility.

Cost-Effective And Predictable Pricing

- •

No per-transaction fees: Unlike most supplier payment solutions that charge significant variable fees based on payment volume, Agicap offers a transparent pricing structure without per-transaction fees—enabling predictable costs and substantial savings as your payments scale.

Strategic Financial Management

- •

Bridging AP, AR, and treasury: The unified platform supports agile, strategic decision-making and future-ready finance operations, helping businesses go beyond process automation to drive genuine financial performance gains.

Supplier Payment Software: Are You Covering the essentials? The checklist

To meet the demands of modern mid-market finance, your supplier payment solution should address these advanced requirements:

- •

Dynamic, policy-driven approval workflows—automatically routing invoices based on amount, business unit, and vendor risk level.

- •

Seamless multi-entity, multi-currency, and multi-bank support—with native integration.

- •

Comprehensive, export-ready audit trails—facilitating both group-level and statutory (SOX, internal) audits without manual intervention.

- •

Real-time, API-based integration with your ERP or accounting solutions and general ledger—eliminating manual re-entry and reducing reconciliation errors.

- •

Rapid entity onboarding and centralized policy deployment—enabling swift adaptation to M&A, growth, or reorganization scenarios.

- •

Transparent and predictable cost structure—with clear total cost of ownership (TCO) and no hidden process or transaction fees.

- •

Central management of supplier payment terms and discount policies—ensuring that negotiated payment terms are consistently applied across entities and vendors, and that early-payment discounts are systematically captured.

Self-assessment:

Does your current AP infrastructure deliver the governance, scalability, and cash flow visibility required for a rapidly evolving mid-market environment? Go beyond basic automation: critically evaluate your platform’s ability to support centralized control, regulatory compliance, and actionable, real-time financial data across your group

Ready to take control?

See how you can automate supplier payments from request to reconciliation, gain group-wide cash visibility, and empower your finance team for the future—all in one platform.

FAQ – Supplier Payment Software

What is the difference between AP automation and supplier payment software?

AP automation platforms digitize and streamline the entire accounts payable process—including invoice capture, validation, approval workflows, and the export or posting of accounting entries. Many AP automation solutions now also include supplier payment functionality: initiating and executing payments, managing bank integrations, and tracking payment status. In this sense, supplier payment software is a key component within an end-to-end AP automation solution, covering the final step of paying vendors, often with enhanced controls and integration with cash management.

How does supplier payment software improve audit readiness?

With digital audit trails, approval histories, and unified data exports, these platforms make it easy to demonstrate compliance, rapidly respond to audit queries, and reduce risk of fraud or duplicate payments.

What should mid-market companies look for when selecting supplier payment software?

Key priorities include : easy integration with existing ERP/accounting/bank systems, advanced approval workflow customization, multi-entity or group-level consolidation, real-time reporting, and transparent (predictable) pricing.

Will supplier payment software integrate with my existing tools?

Most modern platforms (including Agicap, AvidXchange, Tipalti, and Bill.com) offer prebuilt integrations or open APIs, ensuring seamless data transfer with popular US accounting, ERP, and banking systems.

What is Bill.com used for in AP automation vs Agicap?

Bill.com is widely used as a cloud-based AP and payments platform for SMBs and mid-sized businesses. It focuses on digitizing invoice entry, automating recurring payments, and syncing payables with accounting tools like QuickBooks, Xero, and NetSuite—making it a strong fit for companies that want straightforward AP automation and an easier way to pay vendors.

Agicap, by contrast, is designed for mid-market groups that need to manage accounts payable together with multi-entity cash visibility and liquidity planning. Beyond invoice and payment workflows, Agicap links AP data directly to cash forecasting, group-wide treasury views, and multi-bank integrations, helping finance leaders steer working capital and liquidity—not just automate invoice payments.