Guide to Risk Management Software for Mid-Market Treasury and Finance Leaders

Risk management has become central to success for US mid-market treasury and finance leaders. Today’s multi-entity mid-market groups—whether rapidly growing, PE-backed, or operating under complex ownership—face increased complexity from business uncertainty and fluctuating markets—all of which heighten exposure to funding shortfalls, rising financing costs. For teams balancing growth with limited resources, reactive or spreadsheet-driven processes simply can’t provide the control or confidence stakeholders demand.

This guide offers a pragmatic, US-focused perspective on selecting and deploying risk management software tailored for the mid-market. You’ll learn which features actually move the needle for group-wide cash visibility, proactive forecasting, credit and market risk management, and how modern solutions can accelerate your transition to more automated, real-time, and resilient risk oversight.

What Is Risk Management Software?

Key Functions and Benefits

At its core, risk management software in a finance and treasury context is a digital risk management tool that centralizes the identification, assessment, monitoring, and mitigation of all financial risks faced by corporate groups. Unlike manual or spreadsheet-based systems, a true risk management solution provides:

- •

Streamlined, real-time risk identification and prioritization across cash, credit, FX, and operations.

- •

Automated data aggregation from across all entities, banks, and currencies, ensuring a single, up-to-date source of financial truth.

- •

Proactive reporting, scenario modeling, and workflow automation, dramatically improving speed and accuracy compared to manual processes.

The result? Finance leaders move from reactive problem-solving to proactive, data-informed risk control—reducing blind spots, facilitating governance, and delivering greater confidence to stakeholders.

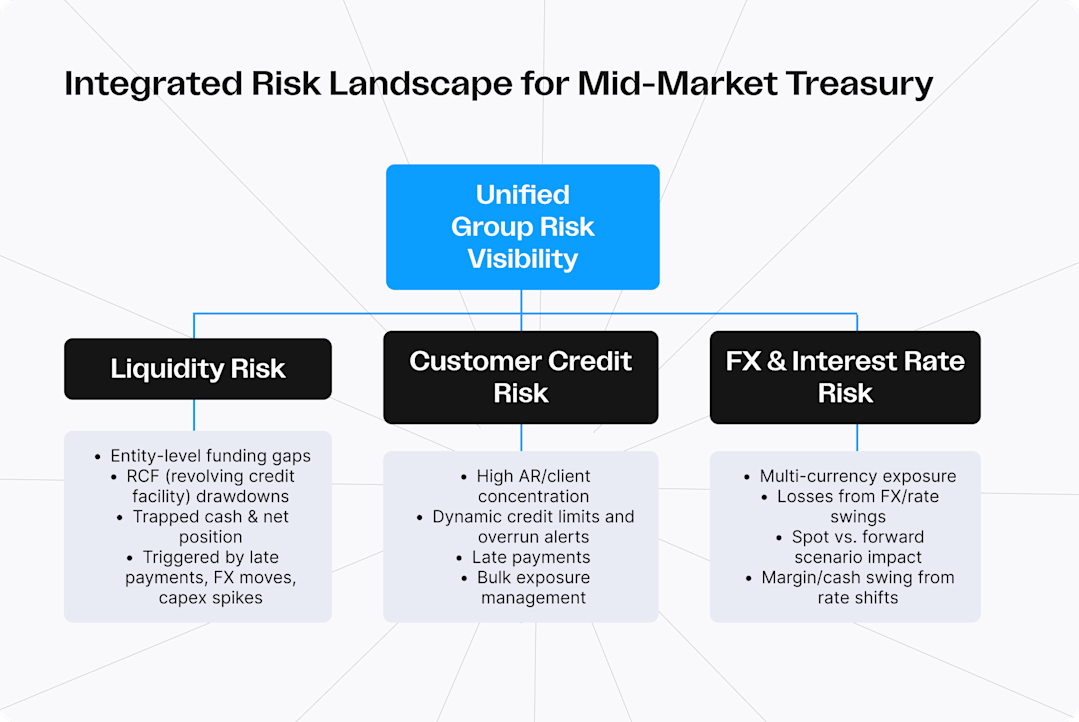

Types of Risks Managed: Real-World, Group-Level Control Beyond the Basics

Risk exposures for US mid-market groups are deeply interconnected, often spanning across legal entities, currencies, commercial lines, and external funding partners. Effective risk management software must give finance leaders not just a “partial view,” but a unified and actionable lens on all major risk verticals relevant to complex, fast-growing organizations.

Liquidity Risk

Liquidity risk in today’s mid-market context is multi-dimensional:

- •

It is not only about the group’s overall cash but about entity-level funding gaps, intra-group lending breakdowns, and the real possibility of unplanned RCF (revolving credit facility) drawdowns—sometimes triggered by late collections, FX shifts, or capex spikes.

- •

True risk management requires real-time net liquidity position measurement: the ability to instantly see, at both group and subsidiary level, how much liquidity is “trapped,” where the next shortfall could occur, and whether available borrowing lines (RCF/credit lines) are correctly sized and cost-optimized.

- •

This is especially critical during M&A, seasonal spikes, or when market events (rate hikes, geopolitical shocks) stress buffer policy or covenant headroom.

Customer Credit Risk

AR concentration is a key vulnerability: a late payment from a major customer can directly trigger a group-level liquidity crunch or force RCF activation. Advanced platforms allow finance teams to set and monitor dynamic credit limits, automate risk notifications, and quickly bulk-update exposure controls—reducing both margin erosion and urgent funding needs.

The goal isn’t just credit control, but minimizing downstream liquidity risk and optimizing capital allocation—for example, sizing credit limits to avoid unnecessary RCF draws or funding costs.

Foreign Exchange (FX) & Interest Rate Risk

Exposure often arises from the juxtaposition of US and non-US revenue, payables, investments, and especially debt issued in variable-rate or foreign currencies.

The challenge: Real-time, consolidated tracking of how much the group stands to gain or lose as currency and rate markets shift. A delayed client payment in EUR, coupled with rising USD rates, can stress not only the P&L but also the net group cash position and FX hedging strategies.

Integrated platforms empower teams to:

- •

Aggregate all open FX positions

- •

Run multi-scenario stress tests (hedged/unhedged, spot/forward) on liquidity and margin impact at both granular and group-currency levels

- •

Track the true cost/benefit of hedging programs

No single risk can be managed in isolation. True risk management platforms for mid-market groups provide holistic, real-time oversight at every level—entity, group, and region—and turn forward-looking risk data into concrete action on cash, credit and FX.

Unique Risk Management Challenges for US Mid-Market Finance Teams

Characteristics of the US Mid-Market Enterprise

For US-headquartered groups between $100M and $500M revenue, risk management is fundamentally more complex than for single-entity businesses or large enterprises with deep bench strength. Typical characteristics include:

- •

Multi-Entity, Multi-Currency, Multi-Bank Structure: Treasury teams are accountable for risk across 5–50 operating entities, each potentially with its own banking network, currencies, AR/AP processes, and local compliance requirements. The absence of a unified real-time picture amplifies the risk of undetected funding gaps, trapped cash, or FX mismatches.

- •

Lean treasury teams, complex automation needs: Staffing is often tight relative to the group’s complexity, making advanced automation, consolidation, and speed essential.

- •

PE/bank oversight & rapid growth: M&A, PE sponsor demands, DSO pressure, and changing regulatory expectations (SOX, US GAAP, IFRS) increase the need for up-to-date, unified risk management.

- •

Interconnected Global Operations: Revenue streams, cost centers, and risk exposures increasingly stretch across continents, making consolidated risk decisions on liquidity, credit, and FX not only complex but business-critical.

Key Pain Points

- •

Manual Data Aggregation: Reliance on spreadsheets and fragmented data flows means time-consuming, error-prone, and nuanced group reporting—often leading to slow or incomplete visibility into cash, credit, and risk.

- •

Lack of Group-wide Risk Visibility: Treasurers and CFOs often face blind spots ; they cannot instantly see net liquidity, customer concentration, or FX exposure aggregated across all regions, entities, and accounts, undermining both daily operations and board-level decisions.

- •

Inaccurate/Delayed Forecasting: Static, snapshot-based cash and risk forecasts don’t offer the agility needed for fast decision-making, making stress testing and scenario modeling extremely difficult.

- •

Reactive Instead of Proactive Risk Management: Cash shortfalls, FX losses, and overdue customer accounts are commonly identified only after the fact, making it impossible to prevent margin erosion or maintain discipline with lenders or boards

- •

Weak Controls over Credit & FX Exposures: Ad-hoc management of credit limits or hedges under-exposes groups to profit/margin erosion, and makes it impossible to justify or optimize strategies to external stakeholders.

- •

Compliance & Audit Gaps: Audit trails are difficult to produce and processes are prone to manual override or error, calling into question the robustness of risk oversight and making board reporting more burdensome and less credible.

- •

Difficulty Adapting to Growth/Change: M&A, international expansion, and business model changes quickly render spreadsheet or “add-on” solutions obsolete.

The Evolving Regulatory Landscape of 2025 in the US

To manage risk proactively, US mid-market finance leaders must also track a regulatory environment that grows more complex every year. According to KPMG’s 2025 Regulatory Challenges report, four themes are reshaping risk management standards:

- •

Regulatory Divergence: KPMG forecasts that “regulatory divergence and legal challenge will continue to drive high operational, risk, and compliance challenges—and potential reputational risk.” With new administration and shifting agency leadership priorities, companies must remain vigilant and adaptable, aligning with evolving expectations even as global and US regulatory focus changes direction or intensity.

- •

Tech & Data Risk: Increased focus from regulators on AI adoption, data security, audit trails, and overall system control. Emerging state-level and federal policies on trusted AI, cybersecurity, and privacy are creating a patchwork of expectations for how risk management software handles sensitive finance data.

- •

Operational & Financial Resilience: Boards, auditors, and creditors now expect live risk reporting, robust scenario-based business continuity, and sophisticated stress-testing. Outdated systems do not pass modern tests.

- •

Financial Crime & Fraud Risk: AML, fraud, sanction, and transparency expectations are rising, increasing the need for dynamic, traceable reporting and automation across the risk landscape.

A modern risk management platform must not only meet but anticipate these evolving compliance, governance, and security demands.

Core Capabilities to Look for in Risk Management Software

Selecting the right risk management software is about more than checking feature boxes—it means enabling mid-market treasury teams to manage multi-entity risk in real time with minimal friction.

Real-Time Cash and Liquidity Visibility

- •

Group-Consolidated, Drill-Down Dashboards: Instantly visualize net liquidity position not just at the group level, but by legal entity, division, or currency. Identify trapped cash, idle balances, intra-group funding gaps, or surplus at risk of negative carry.

- •

Bank, ERP, and Intercompany Data Integration: Live aggregation from all banks, ERPs, and systems reduces manual errors and supports faster, smarter funding decisions.

Advanced Cash Flow Forecasting & Scenario Analysis

- •

Multi-Dimensional Forecasting: Go beyond static projections with tools that incorporate AR aging, supply chain volatility, capex calendar, FX/interest rate exposures, and loan maturity schedules.

- •

Scenario Templates & Stress Testing: Simulate “what-if” events (Sudden payment delays or DSO increases, market shocks, covenant triggers) and see P&L and liquidity impact groupwide. Adjust cash buffers, funding strategy, or hedging in direct response.

Customer Credit Risk Management

- •

Dynamic credit limits: Centrally set, monitor, and enforce customer limits, factoring in true payment history, sector risk, and concentration exposure.

- •

Automated alerts: Escalate overdue and overrun accounts, prioritize high exposure clients, manage risk at scale.

- •

Multi-channel follow-up: Automated, sequenced dunning via email, phone, and mail—streamlined for compliance and AR KPIs.

FX and Interest Rate Risk Monitoring

- •

Group FX Exposure Consolidation: Real-time, end-to-end view of open positions, unhedged exposures, and future cash flows, mapped at both single-entity and consolidated levels.

- •

In-Platform Hedging Scenario Analysis: Simulate spot/forward outcomes, assess margin impacts from rate swings, and instantly update exposure as market rates change.

- •

Integrated with Treasury Stack: FX and rate risk analytics fully embedded in the same platform as cash, AR/AP and forecasting—eliminating silos, duplicate work and “Excel risk.”

Group-Wide Collaboration and Transparency

- •

Role-Based, Granular Permissions: Define user rights by role (CFO, Treasury Manager, Local Controller, FP&A, AR…) and by entity or region, ensuring controlled access and full accountability.

- •

Real-Time, Shareable Reporting: Instantly serve up drillable, board-ready dashboards and period-end reports, aligning all business units and senior leadership around a single, up-to-date view of group risk.

Expert mid-market teams need more than digitization—they need a platform built to deliver granular, real-time, group-wide risk insight, automation, and scenario agility, without overwhelming lean treasury resources.

Comparative Overview: Risk Management Platforms for Mid-Market Treasury

Feature & Fit Comparison Table

Software | Features | Main Advantages | Target Fit |

|---|---|---|---|

Agicap | Unified SaaS platform for group liquidity, dynamic cash flow forecasting, FX and interest rate risk, centralized credit control, scenario modeling, AR/AP automation, | Real-time group-wide risk visibility, scenario analytics, automated workflows, fast SaaS deployment, multi-entity multi-bank coverage. | US mid-market firms seeking integrated control across liquidity, credit, and FX risk. |

Kyriba | Cloud TMS with modules for liquidity/cash management, payments, FX risk, credit facilities, hedge accounting, cash forecasting, reporting. | Extensive functionality, configurability, global bank integrations, modular architecture. | Large enterprises, upper mid-market, global treasury operations. |

TIS | Payment and liquidity hub, multi-bank integration, liquidity pooling, payment risk and compliance tools, centralized cash visibility. | Payment connectivity, rapid implementation, multi-bank cash pooling, security controls. | Groups focused on centralization of payment and cash processes. |

HighRadius | AR automation, credit risk analytics, receivables forecasting, DSO & working capital dashboards, automated dunning, dispute management. | AR process automation, customer credit evaluation, collections analytics, working capital optimization. | Mid-market/large firms with high AR/credit exposure and advanced receivables processes. |

GTreasury | TMS covering cash/liquidity, payments, investments, debt, hedge accounting, FX/interest rate exposure analytics, custom reporting, cash pooling. | Comprehensive treasury and risk modules, hedge/risk accounting, modular workflow design. | Organizations managing complex treasury and risk workflows, including global and multi-entity groups. |

Solution Overview

Agicap

A unified SaaS platform tailored for US mid-market finance teams, enabling centralized, real-time risk management across all entities and banks.

- •

Group-wide liquidity dashboards: Consolidated, drill-down views by entity, bank, and currency.

- •

Dynamic cash flow forecasting: Scenario modeling for payments, collections, FX, interest rates, and capex events.

- •

FX and interest rate risk analytics: Real-time dashboards and in-platform exposure tracking.

- •

Centralized customer credit monitoring: Automated limit management, risk alerts, and prioritization.

- •

Workflow automation: Integrated AR/AP management; multi-channel, sequenced dunning routines.

- •

Multi-bank, multi-entity integration: Native APIs for data reliability and single-source reporting.

Kyriba

An end-to-end treasury management system delivering modular solutions for global cash, liquidity, payments, FX and interest rate risk, cash forecasting, hedging, and advanced bank connectivity. Highly adaptable for large-scale and international treasury functions.

TIS

A cloud-native platform focused on the centralization of payment processes, multi-bank connections, cash pooling, and payment fraud controls. Designed for rapid deployment across groups looking to streamline payment and cash visibility operations.

HighRadius

An AR automation leader providing receivables forecasting, DSO and working capital analytics, credit risk monitoring, intelligent collections workflows, and dispute management. Focused on optimizing accounts receivable cycles and credit control.

GTreasury

GTreasury provides a treasury management suite with support for cash and liquidity management, FX and interest rate analytics, payments, investments, debt/credit lines, hedge accounting, and custom reporting. Designed for organizations with comprehensive treasury and exposure management structures.

How to Select the Right Risk Management Software for Your Treasury Function

Choosing the right risk management software demands a careful evaluation of fit, automation, analytics, usability, and vendor expertise. Use the criteria below to ensure your solution delivers true control and actionable insight at group scale.

Evaluate Technical and Functional Fit

- •

Assess real multi-entity/multi-currency coverage: Ensure the platform delivers consolidated risk, liquidity, and FX views at both group and entity levels, integrates every banking partner, and manages complex intercompany flows.

- •

Native vs. “bolt-on” modules: Favor solutions with embedded cash, credit, and FX risk features—rather than systems requiring multiple point integrations or external vendor add-ons, which introduce reporting silos and reconciliation risks.

- •

US compliance & global operations: Confirm the platform supports US GAAP, SOX, and any global regulatory obligations relevant for your subsidiaries or cross-border flows.

Assess Automation and Forecasting Sophistication

- •

Dynamic, rules-based automation: Look for software that automates workflows for data consolidation, limit monitoring, AR follow-up, and audit logging—minimizing reliance on spreadsheets or manual intervention.

- •

Advanced forecasting and scenario modeling: Evaluate the platform’s ability to run stress tests and enable rapid “what-if?” analysis across cash, working capital, and hedging.

- •

Early warning and decision triggers: Prefer solutions with configurable alerts for threshold breaches (liquidity, utilization, exposure), enabling immediate action to protect margin and covenant headroom.

Consider UX, Collaboration, and Change Management Needs

- •

Adoption by lean teams: Prioritize intuitive SaaS interfaces that fit lean or decentralized treasury structures, support collaboration across entities, and adapt to skill levels from CFOs to business unit controllers.

- •

Deployment and training: Assess time-to-value, onboarding resources, documentation, and vendor support for both initial rollout and ongoing user enablement.

Evaluate Vendor Track Record and Support Model

- •

US mid-market expertise: Select vendors with documented success supporting multi-entity US organizations at your scale and complexity; request references.

- •

Service and responsiveness: Probe for high-touch implementation, local customer support, and agile response to product queries and regulatory changes.

- •

Ongoing innovation: Favor solutions with a clear product roadmap, frequent upgrades, and openness to client-driven enhancements, especially as risk/regulatory climates shift.

Let’s see how these principles translate into practice with a deep dive on Agicap’s approach for US mid-market companies.

Agicap in Action: Group-Level Risk Management for US Mid-Market Finance

Liquidity Risk Management

- •

Real-time, group-wide cash visibility: Instantly consolidate cash across entities, banks, and currencies.

- •

Scenario-Driven Forecasting: Model stress events, simulate funding gaps, and evaluate RCF needs using dynamic, interactive projections.

- •

Automation Reduces Manual Risk: No more spreadsheet errors or delays; bank reconciliations, data imports, and consolidations are automated

Customer Credit Risk Management

- •

Set and monitor credit limits per customer: Assign and review limits based on health/history.

- •

Automated alerts, overrun calculation, bulk management: Surface high-risk clients immediately for AR prioritization; take action in bulk, with workflow support for multi-entity portfolios.

- •

Automated multi-channel follow-up routines: Ensure no overdue receivable is neglected, and collections are prioritized by risk.

- •

Transparency about limitations: There’s no automated scoring or direct credit insurer integration yet; only one limit per customer, per currency; multi-currency exposures aren’t aggregated.

FX Risk Management

- •

Live, real-time FX visibility: Instantly consolidate and convert group-wide multi-currency flows.

- •

Central platform for FX exposure and hedging: Model and monitor spot vs. forward impact, hedge positions, and scenario outcomes, all in one place.

- •

Embedding with cash/AR/AP stack: Unifies data and process, enabling efficient risk insight and policy adherence—no siloed spreadsheets or third-party add-ons.

Always-on, board-ready reporting:

Live dashboards and auto-export features replace manual board packs; group-level compliance and audit needs met with traceable, real-time updates.

Operational Efficiency and Adoption

- •

Modern, SaaS-native UI: Fast deployment, adoption, and collaboration for lean teams—removing “legacy” project complexity.

- •

Process consistency: Builds control, reduces errors, and improves transparency across the business.

Ready to see these capabilities in action?

Book a personalized demo with an Agicap expert to discover how your team can gain group-wide visibility, automate risk workflows, and model scenarios in real time—tailored to your mid-market finance environment.

Best Practices for Implementing Risk Management Software

1. Align Objectives: Business, Risk, and Treasury Integration

- •

Engage all key stakeholders : CFO, treasury/finance, FP&A, business units, and IT.

- •

Define group-wide risk appetite and escalation workflows—ensuring risk priorities align with both strategic growth and funding policy.

- •

Establish target KPIs (e.g., net liquidity position, credit concentration, FX-at-risk, forecast accuracy) linked to board/PE reporting or lending covenants.

2. Data Preparation and Robust Integration

- •

Audit all existing data sources (bank accounts, AR/AP, credit limits, FX exposure) and clean up legacy/duplicate records to ensure a single source of truth.

- •

Structure master data (financial entities, customer IDs, counterparties, currencies) to support entity-level and consolidated reporting.

- •

Leverage automated (API, Host-to-Host, …) bank and business tool feeds wherever possible to eliminate manual uploads, prevent timing gaps, and maximize real-time accuracy.

3. Phased Rollouts, Change Management, and Adoption

- •

Pilot with strategically important entities, risk domains, or business units before scaling to the full group.

- •

Provide role-based training and documentation mapped to key user journeys (treasury/AR teams, controllers, CFOs), ensuring process adoption and feedback collection.

- •

Set up a clear roadmap for phasing in additional modules (e.g., FX risk, credit, workflow automation), adjusting for organizational priorities.

4. Continuous KPI Tracking, Governance, and Iterative Improvement

- •

Establish a regular risk review cadence at group level—board pack frequency, audit schedules, rolling risk reporting.

- •

Monitor actionable KPIs : forecast variance (plan vs. actual), AR risk and DSO trend, scenario coverage, automation rate, and time spent on manual processes.

Treat risk management software implementation as a cross-functional transformation, not an IT project. The highest-performing mid-market groups combine automation with discipline in data, governance, and process feedback—ensuring the platform drives measurable, sustainable improvements in risk control and decision quality.

Future Trends in Risk Management Software for Treasury

AI-Enhanced Forecasting and Scenario Simulation

Treasury software is moving rapidly toward machine learning and AI-driven analytics, empowering finance teams to proactively anticipate cash, credit, and FX risks. Predictive scenario modeling—incorporating real business drivers and “what-if” stress tests—is becoming the new standard for risk planning and resilience.

Continuous Monitoring and Exception-Based Decision-Making

Drawing on insights from McKinsey’s “The future of risk: How global trends are reshaping risk management,” future-ready risk management is all about continuous, real-time portfolio monitoring, with automated alerts and interventions by exception. This enables finance organizations to move beyond periodic, manual controls to dynamic, data-driven oversight.

Operational Integration and Unified Data

Software is breaking down organizational silos by integrating cash, credit, FX, and scenario tools within a single platform. This enables holistic risk profiling, root-cause analysis, and more coordinated treasury–FP&A alignment, reflecting the convergence of risk management domains predicted across industries.

Real-Time, Automated Reporting and Compliance

While periodic board packs remain standard, there is a growing demand for on-demand dashboards and faster insight in response to volatility. Regulatory and audit pressures are also increasing, making automated traceability, audit trails, and up-to-date reporting essential to support SOX, lending, and PE requirements in the mid-market.

Human-in-the-Loop and Agile Workflows

As automation advances, treasury teams will increasingly play a supervisory and strategic role—interpreting data, challenging scenarios, and overseeing exception management, rather than focusing on routine task execution. Regular process review and upskilling around scenario analysis, compliance, and automation will become core to the function.

Key takeaway: As highlighted by McKinsey, continuous monitoring, advanced analytics, and unified, real-time platforms will set the standard for risk management in the years ahead. By adopting these approaches, US mid-market organizations can increase resilience, enable more strategic decision-making, and ensure their risk function remains a business driver—not a bottleneck.

Conclusion

For today’s US mid-market finance teams, risk management software is more than a digital upgrade—it's an operational necessity for driving agility, resilience, and informed decisions. The new standard is real-time, group-wide visibility and scenario control across liquidity, credit, and FX risks, backed by audit-ready workflows and seamless board or lender reporting.

To stay ahead, risk leaders must move beyond legacy silos and manual processes, selecting partners who combine mid-market expertise with automation, analytics, and modern usability. Involving all stakeholders—from treasury to FP&A and boardrooms—ensures risk management becomes not just a compliance requirement, but a lever for performance and strategic growth.

Next steps:

- •

Map your group’s current risk and data challenges,

- •

Define key objectives and KPIs with all stakeholders,

- •

Evaluate platforms for real fit (not just features),

- •

Build a roadmap for adoption—focusing on adoption, usability, and continuous improvement—to turn risk from a constraint into a strategic asset.

Frequently Asked Questions (FAQ) About Risk Management Software

What is the best risk management software for mid-market finance teams?

There isn’t a one-size-fits-all answer, as the best risk management software depends on your group’s complexity, risk profile, and operational needs. Mid-market organizations should prioritize solutions that provide real-time, multi-entity visibility, scenario modeling, credit/FX risk integration, automation, and US regulatory fit. Leading solutions for this segment include Agicap, Kyriba, GTreasury, TIS, and HighRadius—each serving different treasury profiles.

Which tool is commonly used for risk management in corporate treasury?

Commonly used tools include modular Treasury Management Systems (TMS) like Kyriba and GTreasury, specialized AR/credit platforms like HighRadius, and unified SaaS solutions like Agicap, which is tailored for multi-entity, mid-market environments. Legacy spreadsheets and custom ERP modules are still used, but increasingly replaced by modern platforms for efficiency and auditability.

What are the key features to look for in risk management software?

Essential features include group-wide cash and liquidity dashboards, real-time data integration from banks and ERPs, dynamic forecasting and scenario analysis, centralized credit risk control, FX and interest rate risk monitoring, automated workflows, audit-ready traceability, and customizable reporting for board.

Why is real-time, group-level risk visibility important for mid-market treasury teams?

With multiple entities, currencies, and bank relationships, mid-market teams face complex, time-sensitive exposure to liquidity gaps, credit risk, and FX volatility. Real-time, group-level visibility allows proactive management, faster decision-making, scenario simulation, and the ability to respond before issues impact funding, covenants, or compliance.

Can risk management software replace manual Excel processes entirely?

Yes, for most risk, cash, and treasury needs: leading platforms automate data aggregation, risk calculation, scenario modeling, credit/FX monitoring, and reporting. While some custom or non-standard analysis may remain, software dramatically reduces manual work, reconciliations, and the risk of error—enabling teams to focus on high-value, strategic tasks.