Leveraging ChatGPT to Improve the Efficiency of Corporate Financial Management

The financial sector is undergoing a profound transformation, triggered by the advent of artificial intelligence (AI). AI is radically redefining financial management paradigms, introducing new models and approaches. Just a few years ago, AI was considered a “futuristic” technology with limited real-world application, but today it has become a tangible, accessible, and increasingly widespread tool that businesses can — and should — leverage strategically to maximize efficiency, saving both time and resources. The skepticism toward this solution has largely vanished and its use in financial departments has grown exponentially in recent years, revolutionizing processes, optimizing operations, and opening new business frontiers.

It is estimated that, globally, the generative AI market in finance will increase by 28.1% between 2023 and 2032, rising from $1.09 billion to $9.48 billion (Source: Statista).

In this article, we will explore why generative AI technologies like ChatGPT are becoming key players in the financial sector and how they can be used to optimize a company’s financial management by presenting examples of effective prompts.

Why ChatGPT is Revolutionary for Finance

ChatGPT, developed by OpenAI, falls under the category of Generative Pre-trained Transformer models, an advanced type of language model that, drawing from a base of pre-programmed data, can respond to specific requests (prompts) by generating original content in a natural and coherent manner, imitating the style and structure of human language.

The use of GPT models, of which ChatGPT is one of the most well-known examples, is rapidly gaining traction across many business sectors, but the phenomenon is particularly pronounced in the financial field, which is at the forefront of AI integration. In fact, the tendency to adopt cutting-edge, innovative solutions, along with the intrinsic characteristics of this sector—chiefly the need to manage massive volumes of data—has created fertile ground for artificial intelligence. Thanks to their ability to process information in real-time, AI tools like ChatGPT integrate seamlessly into daily operations, offering significant contributions in terms of efficiency and accuracy.

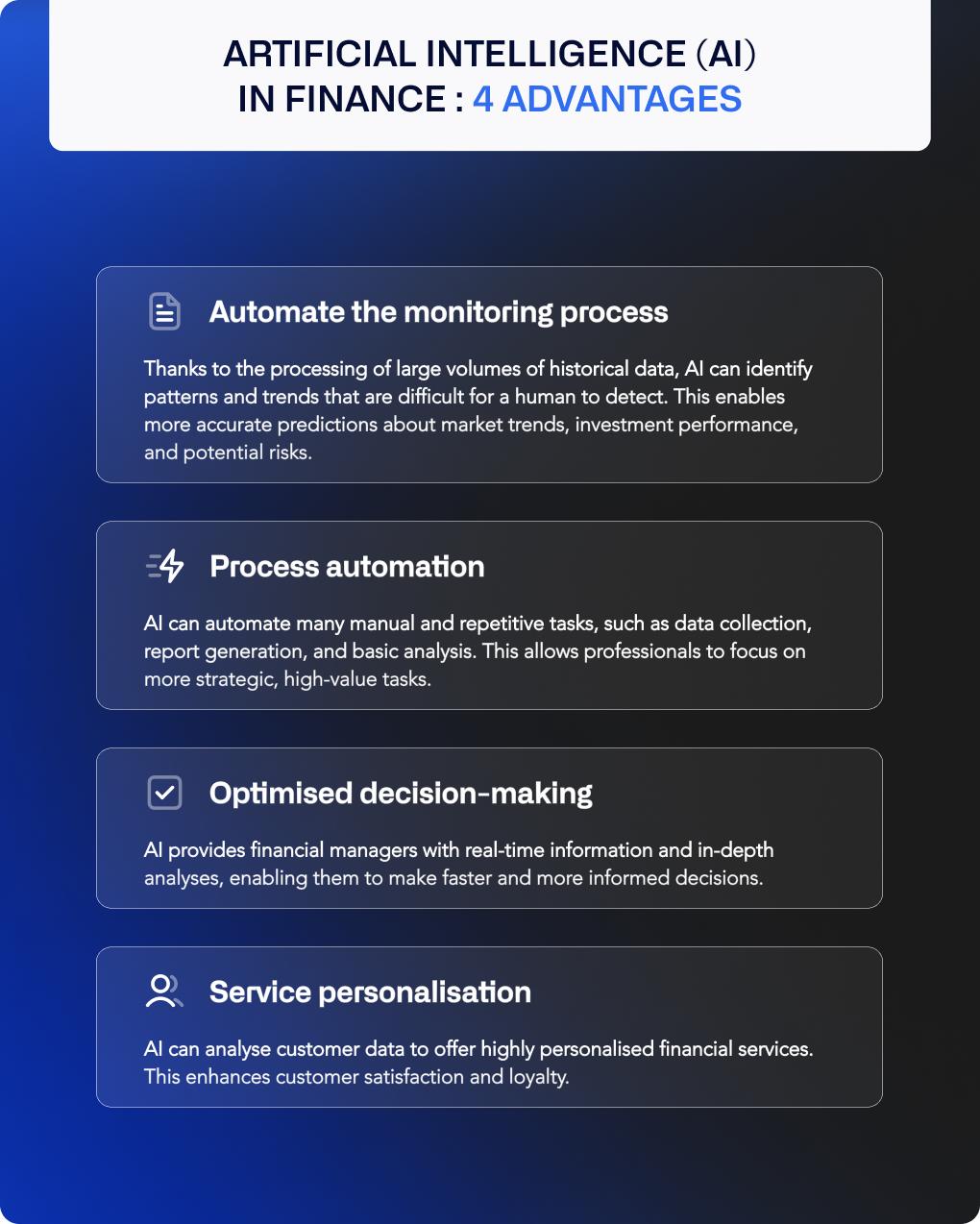

One of the key advantages ChatGPT offers financial managers lies in large-scale data analysis. AI allows for the rapid processing of enormous volumes of financial data (news, reports, market data, etc.), identifying patterns and anomalies that would be impossible for human analysts to detect, with results that are incredibly detailed, precise, reliable, and fast. Another benefit is the personalization of financial services: through data analysis, AI can identify the specific needs and desires of each client and offer them tailored solutions and advice, enhancing customer satisfaction and loyalty. Moreover, through predictive analysis, it is possible to forecast market trends, risks, and investment opportunities more accurately, enabling more informed and strategically effective decision-making.

Beyond advanced data analysis, AI is a key tool for process automation. In the financial field, this translates into the ability to delegate repetitive and administrative tasks to technology, such as generating reports or extracting information from complex documents, reducing the workload of professionals and allowing them to focus on higher-value tasks. This leads to more efficient resource management, improving overall productivity and significantly reducing operating costs.

In summary, the integration of ChatGPT and other AI models in the financial sector not only enhances operational efficiency and accuracy but also provides a new strategic perspective that can transform how information is managed and decisions are made.

Practical Applications of ChatGPT in Financial Departments

ChatGPT positions itself as an indispensable ally for financial managers, enabling them to optimize a wide range of processes, improve operational efficiency, and achieve more precise and timely results. Artificial intelligence not only automates repetitive tasks but also offers strategic support, allowing for quicker and more informed decisions based on in-depth data analysis.

In particular, artificial intelligence can provide significant support in the following areas:

- Cash Flow and Liquidity Management

ChatGPT can analyze historical and current data to accurately forecast future cash flows, identifying potential shortages or imbalances in liquidity and suggesting corrective strategies, thus enabling more accurate cash flow planning. By using AI, it is possible to eliminate the main issues associated with manual cash flow analysis and forecasting, such as lack of precision and time consumption.

Example: An e-commerce company could use ChatGPT to accurately predict sales volume during the holiday season and plan for the necessary supply and liquidity to meet high demand, avoiding liquidity issues or stock shortages.

- Risk Management and Fraud Prevention

AI can monitor transactions in real-time, identifying anomalies that could indicate fraudulent activities. Similarly, this tool can assist financial managers in evaluating credit and investment risks, helping them make informed decisions.

Example: A financial institution could use ChatGPT to detect credit card fraud patterns, such as unusual purchases or transactions in geographically distant locations.

- Regulatory Compliance

The use of AI technologies can help companies automatically generate reports and documents that comply with legal and regulatory requirements, ensuring compliance and reducing the risk of penalties.

Example: A company in the banking sector could use ChatGPT to quickly and accurately create prudential supervision reports, avoiding manual errors and ensuring regulatory compliance.

- Reporting and Documentation

Automating reporting is one of ChatGPT’s strengths, as it can quickly and accurately generate financial reports, balance sheets, income statements, and other accounting documents. AI reduces the risk of human errors and accelerates the data consolidation process, providing more precise results in less time.

Example: A multinational company could use ChatGPT to consolidate financial data from various subsidiaries worldwide, reducing the time needed for report generation and ensuring they are accurate and complete.

Practical Guide: How to Make the Most of ChatGPT and Write Effective Prompts

To fully leverage the potential of ChatGPT and similar tools in the financial field, it is essential to know how to formulate effective prompts. A well-structured prompt acts as a guide for the model, directing its response toward the desired output. Constructing it according to certain requirements is thus crucial for achieving satisfactory results. Here are some useful tips for creating your prompts:

- Be specific and detailed

To obtain a targeted and effective response, avoid overly generic questions. The more details you provide, the more precise and aligned with expectations the result will be.

For example, instead of asking, ‘how can I improve risk management?’ try ‘what are the key risk metrics for an equity portfolio in a high-volatility environment?’

Clearly state the objective of the analysis—are you looking for a general overview, or are you interested in evaluating specific metrics?—and openly highlight any areas you’d like to explore further.

A particularly useful tip is to assign ChatGPT a specific role, such as CFO or Controller, specifying its background and skills (education, professional experience, etc.) so that you receive responses generated from the perspective of an industry expert.

- Contextualize your request

Clearly describe the context in which you intend to use the results of the analysis. For instance, if the goal is to evaluate an investment, specify your risk profile and time horizon. Be sure to mention any constraints or limitations as well.

- Use clear and concise language

Avoid wordiness and ambiguous terms, which could lead to misinterpretation. Short, simple sentences, specific terms, and direct requests will help the tool properly understand your query and generate relevant and accurate responses.

Bonus tip: In many cases, to achieve more precise and coherent results, it is advisable to break down requests to ChatGPT into multiple sequential phases, allowing you to refine and perfect the output as you go.

ChatGPT in the Financial Field: Examples of Effective Prompts

Now that we’ve provided the instructions, it’s time to see them applied in practice. Below, we will look at two practical examples of effective prompts applied to two different financial processes: cash flow analysis and risk management.

Example 1 - Cash Flow Analysis

Prompt: ‘You are a corporate finance expert with in-depth knowledge of cash flows. I ask you to analyze the attached income and expense statement for the last financial year of a biotech startup. Considering the typical characteristics of a growing startup, such as high investments in research and development and low initial margins, identify the main drivers of operational and financial cash flow. Pay particular attention to any imbalances between income and expenses and identify areas where liquidity management can be optimized. Describe your analysis clearly and concisely, highlighting the strengths and weaknesses of the cash flow.’

Why is this prompt effective?

- It is precise and detailed: the prompt clearly defines the goal (cash flow analysis) and the context (biotech startup), assigning the AI a specific role (corporate finance expert), thereby setting a well-defined scope for the output.

- It explicitly states the expectations: the request for a clear and concise description of the strengths and weaknesses of the cash flow provides precise guidance on the expected output, ensuring a well-structured and useful response.

- It is well-structured: the prompt follows a logical structure, starting with a clear definition of the goal and continuing with a detailed description of the context and expectations.

- It uses simple and direct language, eliminating any ambiguity.

Example 2 - Risk Management and Fraud Detection

Prompt: You are the Chief Financial Officer (CFO) of a large global manufacturing company. The company is considering a major acquisition in the Asian market. Analyze the potential financial risks associated with this operation, taking into account factors such as exchange rates, credit risk, and country-specific risks. Propose financial hedging strategies to mitigate these risks and ensure the financial sustainability of the operation.

Why is this prompt effective?

- It clearly and thoroughly defines the context: the prompt places the AI in the role of a CFO, highlighting its responsibilities in assessing the financial risks associated with a strategic decision like an acquisition.

- It provides a clear objective: the goal of the analysis is well-defined—assess financial risks and propose concrete solutions.

- It is specific in details: the prompt clearly outlines the factors to consider (exchange rates, credit risk, country-specific risks), guiding the AI toward a focused and relevant response.

- It is clear and concise: the language used is simple and direct, free of unnecessary technical jargon.

Challenges and Considerations

Up to this point, we have explored the potential of ChatGPT, highlighting the numerous benefits it can offer. However, like any tool, artificial intelligence also has limitations that are essential to understand and consider in order to fully leverage its potential.

ChatGPT is not unerring

First and foremost, it is crucial to emphasize that the responses generated by ChatGPT are not infallible. Despite efforts to refine the models and provide precise instructions, AI can make mistakes, especially when dealing with specific data or complex topics. In some cases, ChatGPT may generate information that seems plausible but is actually false or unfounded, present fabricated facts as true, or cite nonexistent sources or studies. These are known as “hallucinations”. This can happen for several reasons: the data on which the model is trained may be incomplete, outdated, or contain biases; the interpretation of the requests may be inaccurate; or simply due to the inherent limitations of language models. Therefore, it is always necessary to verify and validate the information obtained, especially in critical contexts such as financial analysis. Despite its advanced capabilities, ChatGPT remains an auxiliary tool and not a substitute. Human oversight remains an essential and indispensable element to ensure the accuracy and reliability of the results.

Security and Privacy

Secondly, the use of ChatGPT in the financial sector raises important issues related to security and data protection. When dealing with extremely sensitive financial data, it is essential to ensure that this information is not exposed to the risk of breaches. Companies should implement strict measures to protect confidential information and ensure that ChatGPT is used in compliance with GDPR privacy regulations. In particular, it is crucial to:

- Provide staff with adequate training on the privacy and security practices to adopt;

- Establish clear and detailed internal policies on the use of ChatGPT, specifying what data can be input into the model, what precautions to take, and how to handle any incidents;

- Conduct regular assessments to identify and mitigate potential risks associated with the use of ChatGPT, such as the accidental disclosure of confidential information.

In Conclusion

The introduction of AI tools like ChatGPT has marked a pivotal moment in the financial sector, offering an unprecedented potential for transformation and innovation. From the analysis of complex data to the automatic generation of reports, from the development of accurate and reliable predictive models to the creation of innovative strategies, ChatGPT can support financial managers in numerous ways, delivering improvements in efficiency, productivity, speed, and costs like never before.

However, implementing artificial intelligence in financial processes requires a careful and thoughtful approach. On the one hand, it is important to remember that, as powerful and sophisticated as it may be, even ChatGPT is not free from errors; it can provide inaccurate, fabricated, or unfounded information. Its use must, therefore, be accompanied by a thorough verification process and human oversight. Moreover, challenges related to privacy and data security must be addressed, adopting adequate measures to protect sensitive information.

That said, if used with proper awareness and caution, ChatGPT represents a unique opportunity to innovate and optimize financial processes. Over time, companies that embrace this technology with intelligence and foresight will find themselves in a privileged position compared to those who choose to ignore it.

If you want to learn more about how to leverage ChatGPT to optimize your company’s financial processes—from cash flow management to report generation—and get practical tips for crafting effective prompts, you can download our dedicated ebook.