After the Templates: What Comes Next in Scalable Liquidity Management for CFOs

Many companies discover too late that profitability does not guarantee liquidity. As forecasting cycles remain monthly but cash moves daily, the gap between accrual performance and real-time liquidity can create hidden risk. In a recent webinar on cash flow management at scale, Josh Aharonoff (from YourCFOGuy) and Brandon Barnes unpacked the structural disconnect between FP&A and treasury—and what finance teams must change to close it.

From Spreadsheet Control to Integrated Cash Performance

Josh Aharonoff, CPA, is a fractional CFO and founder of Mighty Digits, as well as the creator of YourCFOGuy.com, where he shares the Excel frameworks he personally uses—tools that have been downloaded by more than 10,000 finance professionals. He has advised over 100 high-growth companies and joined this webinar to guide finance leaders through the evolution of cash management practices, the Excel templates used to manage liquidity, and the point at which those tools start to reach their limits.

He was joined by Brandon Barnes, who leads go-to-market for Agicap in North America, bringing a treasury technology perspective to the discussion. Together, they explored the widening gap between FP&A and cash management, the growing operational demands placed on lean finance teams, and the structural shift from spreadsheet-driven visibility to integrated cash performance platforms.

For CFOs, treasurers, and finance leaders at mid-sized and scaling companies, the message was clear: managing cash is no longer about checking a bank balance. It is about building a liquidity infrastructure that can withstand volatility, support growth, and meet the rising expectations of boards and investors.

It’s Not About Managing Cash. It’s About Staying Alive.

One slide in the presentation captured the urgency succinctly: “It’s not about managing cash. It’s about keeping profitable companies alive.”

That framing is not rhetorical. Aharonoff shared firsthand experience from the recent interest rate cycle, when rising rates and tightening capital markets exposed structural weaknesses in companies that were profitable on paper but fragile in liquidity.

“You’ve heard the term cash is king,” Aharonoff said. “Some people like to take it further and say cash flow is king.”

When external financing becomes more expensive—or inaccessible—liquidity discipline becomes existential. Companies that rely solely on accrual-based reporting may not recognize short-term exposure until it is too late.

Barnes reinforced this point from a treasury perspective. Many organizations, he noted, operate under the assumption that if payroll is covered and vendors are paid, liquidity is “fine.” But in a higher-rate environment, cash carries an opportunity cost. Idle balances, poorly timed debt drawdowns, or inefficient allocation across accounts can erode value quietly.

The stakes are no longer limited to avoiding insolvency. They include optimizing return on excess cash, managing debt intelligently, and preserving strategic flexibility.

The FP&A and Cash Management Disconnect

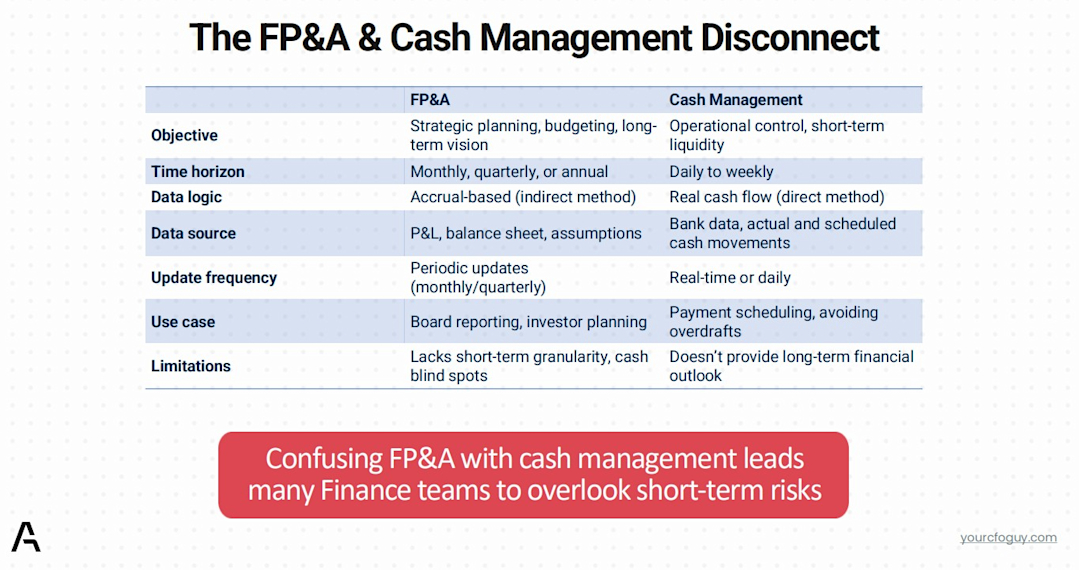

One of the central themes of the webinar was the structural difference between FP&A and cash management.

FP&A is designed for strategic planning. It is accrual-based, typically monthly or quarterly, and anchored in the income statement and balance sheet. Its outputs serve board reporting, budgeting, and investor communications.

Cash management, by contrast, is operational and short-term. It relies on direct cash flows—actual and scheduled bank movements—updated daily or in real time. Its use case is tactical: payment scheduling, overdraft avoidance, and liquidity preservation.

Aharonoff warned that confusing the two disciplines leads to blind spots. As the slide notes, conflating FP&A with cash management “leads many Finance teams to overlook short-term risks” In practice, the issue often manifests in timing gaps. Monthly forecasts may be updated 10 to 20 days after month-end close. Meanwhile, liquidity risks can materialize in days.

Barnes framed the distinction operationally: “Cash management is really more of a tactical and operational either daily or weekly maneuver for companies as they continue to grow.”

The takeaway for finance leaders is structural: accrual profitability does not guarantee liquidity resilience. Both systems must coexist, but they serve different time horizons and different decisions.

Why This Matters Now: Structural Pressures on Finance Teams

Aharonoff outlined four forces reshaping liquidity management:

Cash is expensive.

Boards expect weekly visibility.

Finance teams are smaller, doing more.

AI is changing what’s possible.

Each of these pressures compounds the others.

Higher interest rates increase the cost of debt and the opportunity cost of idle cash. Boards, especially in PE- or VC-backed environments, increasingly demand weekly cash runway reporting rather than monthly summaries. At the same time, finance teams remain lean, often juggling controllership, FP&A, treasury, and operational finance responsibilities.

Aharonoff emphasized that technology has shifted expectations: “The bar is being raised. I’m a huge believer that the stronger the processes and the tools that you’re using, the more time you have to drive strategic insights.”

In other words, manual liquidity tracking is not merely inefficient—it crowds out higher-value analysis.

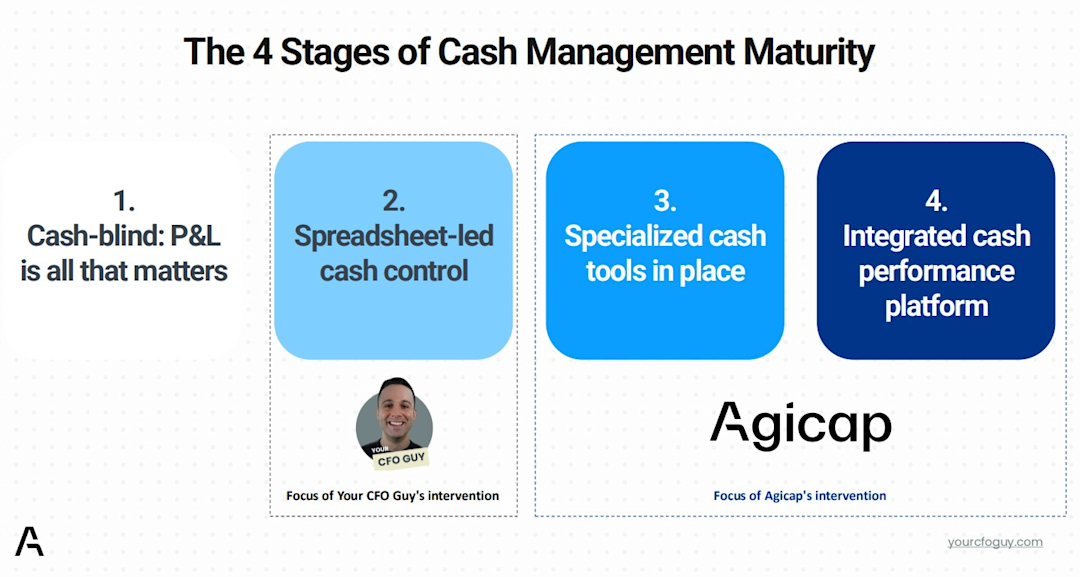

The Four Stages of Cash Management Maturity

To contextualize this evolution, Agicap presented a maturity model: “The 4 Stages of Cash Management Maturity”:

Most small and mid-sized organizations operate in Stage 2. Excel is the control system. It works—until complexity increases.

Barnes noted that the inflection point often occurs around $75–100 million in revenue, when multi-entity structures, multiple banks, or higher transaction volumes strain spreadsheet-based processes.

But revenue alone is not the only trigger. Complexity—acquisitions, international entities, multi-currency exposure—can accelerate the need for specialized tools even in smaller firms.

The question is not whether spreadsheets are sufficient today. It is whether they will scale tomorrow.

The Five Templates Every CFO Uses—And Where They Break

At the heart of the webinar were five Excel templates that Aharonoff uses in practice:

Summarized Cash Flows

Cash Flows Dashboard

Cashout Dashboard

Summary Weekly Cash Flow

3-Statement Model

These tools represent a robust Stage 2 system.

The three-statement model connects income statement, balance sheet, and cash flow statement through the indirect method. It is structurally sound and enables scenario modeling. The summarized dashboard improves readability for executives who may not parse a full statement of cash flows.

The cashout dashboard is particularly powerful for startups and high-growth firms. By adjusting funding assumptions, leaders can immediately visualize projected cash-out dates—creating a forcing function for fundraising or cost control decisions.

However, Aharonoff acknowledged the limits. Weekly direct-method cash forecasting—mapping actual collections, payroll runs, vendor payments, and debt service—requires manual data manipulation. It cannot rely solely on accrual statements.

As he put it, “This information is a lot more challenging to put together because you can’t just use your income statement and balance sheet.”

This is where spreadsheets begin to break—not because Excel lacks computational power, but because manual data extraction, categorization, and reconciliation consume disproportionate time and introduce risk.

From Visibility to Execution: The Case for Treasury Platforms

Barnes demonstrated how specialized platforms address these limitations by integrating direct bank feeds and ERP connectivity. Agicap connects to banks and accounting systems through APIs, consolidating actual and scheduled cash movements. The shift is structural: from periodic, indirect modeling to continuous, direct cash positioning.

The platform ingests bank transactions in real time, categorizes inflows and outflows—often using machine learning—and overlays expected AR and AP schedules. This allows daily cash positioning, overdraft risk detection, and automated internal transfers.

Barnes explained that many teams underestimate the time cost of manual liquidity management. Logging into multiple bank portals, exporting transactions, reconciling with the accounting software data, and rebuilding forecasts in Excel is operationally expensive. Automation is not just about convenience—it is about redeploying finance capacity.

Critically, treasury platforms also enable multi-entity consolidation and multi-currency conversion—areas where spreadsheets grow fragile. International operations, intercompany funding, and debt scheduling can be visualized centrally rather than across disconnected files.

Forecasting Accuracy and Scenario Discipline

Another advantage highlighted in the demonstration was scenario management.

Short-term forecasts can be built using actual bank and ERP data for the next 13 weeks. Longer-term projections can convert P&L forecasts into cash forecasts, aligning direct and indirect views.

Barnes emphasized that forecasting accuracy improves when historical customer payment behavior is analyzed. Instead of assuming invoice due dates, the system can estimate actual collection timing based on prior performance—refining liquidity projections at the customer level.

For CFOs managing concentrated revenue bases, this granularity is strategic. A single delayed enterprise customer can shift liquidity materially.

Scenario modeling—optimistic, pessimistic, expansion-driven—can be layered on top of the baseline. This bridges treasury operations with strategic planning.

Organizational Implications: Who Owns Liquidity?

An important operational question surfaced during the webinar: when does a company need a dedicated treasurer?

Barnes suggested that in many organizations, the platform itself delays the need for a full-time treasury hire. Instead, controllers, VP Finance leaders, or FP&A heads can incorporate liquidity management into their responsibilities more efficiently.

However, as complexity increases—multi-entity, debt structures, investment portfolios—the treasury function may become distinct.

The more fundamental issue is governance. Liquidity management cannot remain a secondary task performed “after everything else.” It must have defined ownership, clear processes, and reliable systems.

Practical Takeaways for Finance Leaders

Several strategic conclusions emerge from the discussion.

First, liquidity management is no longer episodic. It must be continuous. Monthly visibility is insufficient in volatile environments.

Second, the distinction between accrual and cash logic is not academic. It shapes how quickly risks surface.

Third, technology has reset the expectation baseline. Boards and CEOs increasingly expect real-time visibility, scenario agility, and data confidence.

Fourth, spreadsheets remain powerful—but they are not a treasury system. They are a modeling tool. At a certain scale or complexity, integration, automation, and auditability matter more than formula flexibility.

Finally, liquidity management is a capital allocation discipline. It determines whether excess cash earns yield, whether debt is optimized, and whether growth initiatives are funded at the right moment.

If your Excel models are starting to break under growth and complexity, it’s time to modernize your liquidity infrastructure.

Schedule a demo with Agicap to discover how to centralize cash across entities, automate bank data, and scale liquidity management with confidence.