FP&A Budgeting vs Cash Management: What’s the difference and how should finance teams link them?

In corporate finance, FP&A (Financial Planning & Analysis) and cash management are often confused. Yet the two disciplines serve distinct purposes: FP&A focuses on long-term financial planning and strategy, while cash management centers on short-term liquidity, daily positioning, and operational agility. Understanding where one ends and the other begins is key to turning strategic plans into day-to-day cash certainty.

FP&A vs. Cash Management: Understanding the overlap and the differences

What is FP&A?

FP&A encompasses the tools and processes organizations use for budgeting, forecasting, and long-term financial planning. FP&A teams play a critical role in developing key financial tools, including forecasted profit and loss (P&L) statements and forecasted balance sheets. These projections of some of the 3 statements rely on an accrual-based logic, where revenues and expenses are recognized when earned or incurred, regardless of the actual cash movement.

FP&A teams can rely on specialized solutions—such as Anaplan, Datarails, and NetSuite Planning and Budgeting—to develop, maintain, and update their financial models.

The data available in these models is key for the other members of the finance team.

Typically, annual or multi-year cash flow projections are built with the data supplied by the FP&A team using the indirect methodology: starting from the forecasted P&L and balance sheet, then adjusting for non-cash items and working capital changes.

What is cash management?

Cash management sits at the heart of operational finance. It is the discipline focused on steering, controlling, and optimizing all cash inflows and outflows in real time, using the direct method. Unlike accrual-based forecasts, cash management relies on actual and scheduled cash movements—bank transactions, invoices, payables, receivables, and all upcoming commitments. This transaction-level approach delivers maximum accuracy, immediate visibility, and the ability to make truly actionable decisions every day.

Why the confusion between FP&A and cash management?

Confusion often arises because both FP&A and treasury teams produce “cash forecasts” but with very different approaches and goals.

As explained above, FP&A produces long-term cash forecasts using the indirect, accrual-based method. Treasury teams, in contrast, rely on up-to-date, transaction-level data to ensure day-to-day control and real-time cash decision-making.

Limitations of indirect FP&A forecast

FP&A tools show clear limitations for daily cash management :

- •

Granularity is too low: Forecasts are consolidated monthly or quarterly. They almost never offer daily visibility, which is essential for operational cash decisions.

- •

Misses true cash timing: Because the forecasts are built on accrual accounting logic, they don't accurately show when cash actually enters or leaves the bank. This creates mismatches between projected and real cash flow.

- •

Data is not real-time: Forecasts are updated periodically (monthly or weekly), not continuously, so they lag behind actual business activity.

- •

Gaps between forecast and reality: Payment delays, unexpected expenses, or timing mismatches frequently create cash flow surprises that forecasts don’t pick up until it’s too late.

For example: A monthly FP&A forecast might show a $400,000 surplus for December. But if $650,000 in payments are due early in the month while $1,250,000 in customer receipts arrive later, the business can experience a costly cash crunch before the month is even half over.

Cash management in action: From forecasting to daily decisions

Cash management is much more than forecasting—it's about taking action, every single day. Treasury teams don’t just ask “What will our cash position be next quarter?”, Instead, they’re focused on real-life decisions:

- •

Can we pay our suppliers this Friday, and cover payroll next week?

- •

Is it safe to invest in growth projects, or will it put us at risk of a cash shortfall?

- •

Can we optimize cash currently in surplus and earn additional income, rather than leaving it idle?

Effective treasury means actively managing liquidity, optimizing payments, securing the right financing, and responding instantly to changes. Unlike FP&A, which updates forecasts periodically, treasury operates in real-time—safeguarding liquidity, minimizing costs, managing risk, and giving the business the confidence to grow.

Why P&L is not cash and why that matters: choosing the right forecasting approach for each horizon

As covered above, accrual-based statements like the profit and loss statement (P&L), do not reflect the actual timing of cash movements. While the P&L is a vital tool for measuring profitability and meeting compliance requirements, it cannot reveal when cash will be available or needed for day-to-day operations. This explains why businesses can sometimes appear profitable on paper but still face cash shortfalls or conversely, have cash on hand yet show weak earnings.

In volatile conditions, it’s real cash on hand—not accounting profit—that dictates whether you can meet immediate obligations and seize new opportunities.

Three forecast horizons, two methodologies

Accurate cash forecasting requires using the right approach for each time horizon: a direct, cash-based method for the short and medium term, and an indirect, accrual-based method for the long term. Clearly distinguishing between these two approaches strengthens both day-to-day agility and long-term strategic planning.

Short-term forecasts (Cash methodology, direct approach):

- •

Horizon: 3 to 15 days, updated daily. Each day, the finance team projects the end-of-day cash balance for every bank account and legal entity. This enables a fully consolidated, group-wide cash position to be calculated and reviewed for each day of the next 2 weeks.

- •

Focus: Based on real and scheduled inflows/outflows—bank data, invoices, payables/receivables, and upcoming commitments.

- •

Tools: Treasury and cash management solutions (e.g. Agicap)

- •

Benefit: Real-time liquidity insight enables proactive daily cash management and rapid response to gaps or surpluses.

Medium-term forecasts (Cash methodology, direct approach):

- •

Horizon: 13 weeks, with weekly granularity. Each week, the finance team projects the cash position at the end of the week (e.g., every Friday) across all bank accounts and entities, producing a consolidated group view for the next 13 weeks. Intra-week cash movements are not detailed.

- •

Focus: Combines current cash positions with expected flows and business assumptions (seasonality, sales pipeline, recurring costs).

- •

Tools: Treasury and cash management solutions (e.g. Agicap)

- •

Benefit: Enables anticipation of future cash needs or surplus, supports tactical planning, and bridges day-to-day operations with strategic goals.

Long-term cash forecasts (Accrual methodology, indirect approach):

- •

Horizon: 12–18 months or more, projected and consolidated at month-end for the entire group for the next 12-18 months.

- •

Focus: Forecasts are based on P&L and balance sheet projections, adjusted for non-cash items and working capital changes. The resulting cash position is consolidated for the group as a whole and only at monthly intervals—so there’s no insight into cash movements within the month, nor into which specific accounts or entities the cash will be held.

- •

Tools: Typically managed in FP&A platforms.

- •

Benefit: Offers a strategic, high-level view to support long-term planning and major business decisions, though it does not provide detailed or actionable visibility for day-to-day cash management.

By aligning each methodology to its appropriate horizon, organizations can secure day-to-day liquidity, optimize mid-term cash management, and support sustainable long-term growth.

Synergy in action: How FP&A and treasury collaborate effectively

Far from being redundant, FP&A and cash management complement and reinforce each other. Strategic clarity from FP&A, combined with operational precision from cash management, forms the foundation of modern financial leadership.

Integrating solutions like NetSuite Planning and Budgeting and Agicap lets finance teams anticipate major cash needs, respond rapidly to real-time developments, and generate more accurate cash forecasts—while strengthening collaboration across the organization.

Pairing a strategic FP&A solution with a real-time cash management software such as Agicap, empowers finance teams to:

- •

Manage risk: Anticipate major cash needs and ensure the means to cover them.

- •

React quickly: Leverage real-time dashboards to act on long-term insights (invest, borrow, adapt plans as needed).

- •

Improve accuracy: Translate accrual-based forecasts into actionable, short-term cash projections to surface timing gaps.

- •

Enhance collaboration:Align finance, treasury, and operations with both up-to-date data and the long-term plan.

Short-term cash visibility: the critical missing link

In today’s unpredictable business climate, mid-market finance teams face operational challenges that can’t be solved by long-term planning alone. Without up-to-date insight into cash positions and upcoming movements, companies may be caught off guard by a missed customer payment, a last-minute supplier demand, or unexpected overdraft fees.

Best practice in treasury management now calls for rolling, real-time cash flow forecasts—typically updated daily, stretching 13 weeks ahead—to clarify exactly what’s available to spend or invest at any given time. Short- and medium-term cash visibility is no longer a luxury—it's an essential requirement for agility and for preventing avoidable cash shortfalls.

This raises a fundamental question: Is it enough to rely on FP&A, or does your team also need the actionable edge that real-time cash management delivers?

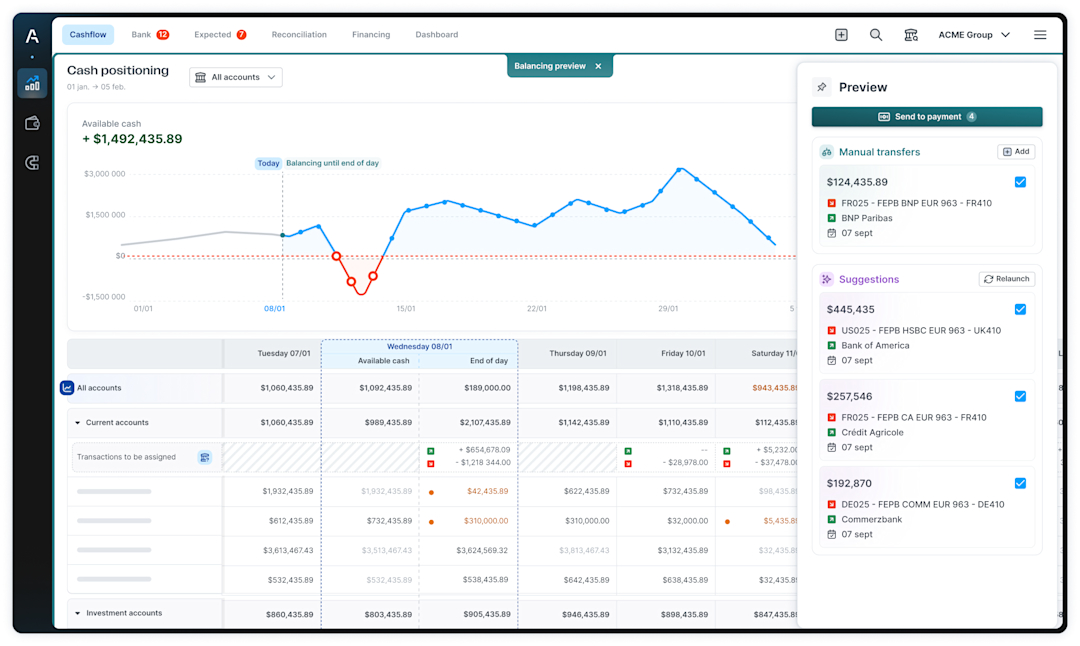

How Agicap connects FP&A and real-time cash management

Agicap bridges the gap between strategic FP&A planning and daily cash realities by layering real-time cash visibility and control on top of your existing finance stack. By integrating seamlessly with FP&A and ERP or accounting tools, Agicap enables teams to automate and centralize cash data, monitor group-wide positions in real time, build accurate forecasts on a daily to 13-week rolling horizon, and streamline reconciliation and collections. This gives finance leaders instant, actionable insight to make confident decisions day after day.

Key benefits for finance teams

- •

Higher available cash: Free up liquidity previously tied up in excess cash buffers, subsidiaries, or overdue receivables thanks to consolidated forecasts and improved visibility.

- •

Improved financial results: Anticipate funding needs and optimize cash usage to reduce bank fees, factoring costs, and interest expenses.

- •

Lower operational costs: Eliminate repetitive manual tasks such as updating forecasts and reconciling transactions, saving both time and reducing errors.

- •

More strategic focus: Automate routine processes so finance teams can shift their focus from data entry to analysis and decision-making.

Client spotlight: MN Custom Homes

MN Custom Homes, a leading US property developer, transformed their cash management with Agicap. By connecting Agicap to their ERP, the team gained :

- •

Real-time, consolidated visibility on cash for every project and entity

- •

Automated daily and weekly forecasts updated with live bank and receivables data

- •

Effortless scenario modeling for project delays or cost shifts

- •

Simplified reconciliations and streamlined workflows, reducing manual workload

- •

Stronger controls and governance through customized dashboards and permissions

Result: Fewer manual processes, higher-quality data, and increased decision-making confidence—reducing the risk of cash shortfalls and unlocking better investment outcomes.

"With Agicap, it’s easy to see exactly where our cash stands every day, run scenarios, and make better decisions fast. We’ve completely transformed the way we manage cash flow across entities — and can react far more quickly to any financial challenges." – CFO, MN Custom Homes

Bridging the gap today: take control of your cash management

In a fast-moving and unpredictable business environment, relying solely on accrual-based budgets or long-term plans is no longer enough. Real financial clarity and true resilience only comes when you can see and act on your cash position, every single day.

By pairing modern FP&A with robust, real-time cash management, finance teams gain more than just visibility: they empower the business to anticipate challenges, seize new opportunities, and make decisions with confidence.

Agicap bridges this crucial gap—bringing you daily, actionable cash insight, connected workflows, and the ability to turn forecasts into results.

Ready to bridge the gap between planning and real cash control? Book a personalized Agicap demo today and see how you can achieve instant cash visibility, smarter workflows, and confident decision-making—every single day.

FP&A vs Cash Management: Frequently Asked Questions

What is the main difference between FP&A and cash management?

FP&A focuses on long-term strategic planning, budgeting, and forecasting, while cash management deals with real-time tracking and control of the company’s daily cash flows and liquidity.

Why do FP&A forecasts sometimes fail to predict cash shortages?

FP&A forecasts often use accrual-based logic and the indirect method, which may not reflect the exact timing of cash inflows and outflows. This can result in unexpected cash shortfalls because actual cash movements are not always aligned with accounting entries.

How can finance teams effectively connect FP&A and cash management?

Finance teams can bridge the gap by integrating real-time cash management tools, such as Agicap, with their FP&A systems. This approach links strategic planning with daily cash operations, providing accurate insights and enabling more agile and informed financial decision-making.

What are common cash management challenges?

Common challenges include limited visibility into real-time cash positions, difficulties in forecasting short-term liquidity, delayed collection of receivables, synchronization issues across bank accounts, and responding quickly to unexpected expenses or revenue delays.