Factoring Management Software: Streamline and Scale Receivables Financing

Receivables financing—including both invoice factoring and invoice discounting—has evolved well beyond a niche working capital tool. Today, it stands as a strategic pillar for US mid-market organizations focused on growth and cost efficiency. According to the Invoice Factoring Market Report 2025, the global factoring market is projected to grow at a compound annual growth rate (CAGR) of 11.5%, reaching USD 3.46 trillion by 2025 and a staggering USD 5.34 trillion by 2029.

For CFOs and treasury leaders, this rapid expansion signals a shift in how companies approach working capital optimization. Organizations leveraging receivables financing solutions can access liquidity faster and at a lower cost than those that still rely primarily on short-term bank loans or costly overdraft facilities. As the financial landscape shifts, businesses that don’t adopt advanced receivables financing solutions risk paying more for their working capital needs—and missing opportunities for growth, efficiency, and risk mitigation.

This guide provides actionable strategies and best practices for selecting, deploying, and optimizing advanced receivables financing management software. Discover how digital platforms like Agicap can dramatically improve group-wide visibility, compliance, and decision-making across entities, currencies, and providers.

What Is Factoring Management Software?

Definition and Core Concepts

Factoring management software is an advanced financial platform purpose-built for mid-market finance teams to centralize, automate, and optimize all operational and strategic processes related to invoice factoring. Unlike spreadsheets or basic AR tools, these solutions offer true group-wide visibility—across business units, subsidiaries, currencies, and multiple factoring providers.

At its core, factoring management solutions:

- •

Connect directly to AR ledgers and ERPs or accounting tools,

- •

Track eligible invoices, settled and outstanding advances,

- •

Monitor overall facility usage and headroom in real time.

Factoring vs. Invoice Financing: Understanding the Difference

While this guide centers on Factoring Management Software, it’s important for US mid-market finance leaders to understand how invoice factoring and invoice financing—two major subcategories of accounts receivable financing—differ in practice

Invoice factoring means selling your receivables to a third party (the factor), who advances cash and typically manages collections. The specific allocation of credit risk depends on the contract structure (see recourse vs. non-recourse below).

Invoice financing, by contrast, keeps ownership of invoices with your business. Here, your receivables are used as collateral for a loan or line of credit from a finance provider. Your company remains responsible for collections and customer relationships, and invoices stay on your balance sheet until paid.

Both methods improve liquidity, but have different implications for operations, customer relationships, and risk management. Modern software platforms (like Agicap) can seamlessly track both factored and financed invoices, adapting dunning workflows, audit trails, and reporting for either model.

For finance teams, understanding these distinctions is essential to select the right solution and build efficient, compliant processes—whether selling receivables or simply leveraging them for financing.

Recourse vs. Non-Recourse Factoring: Key Contractual Differences

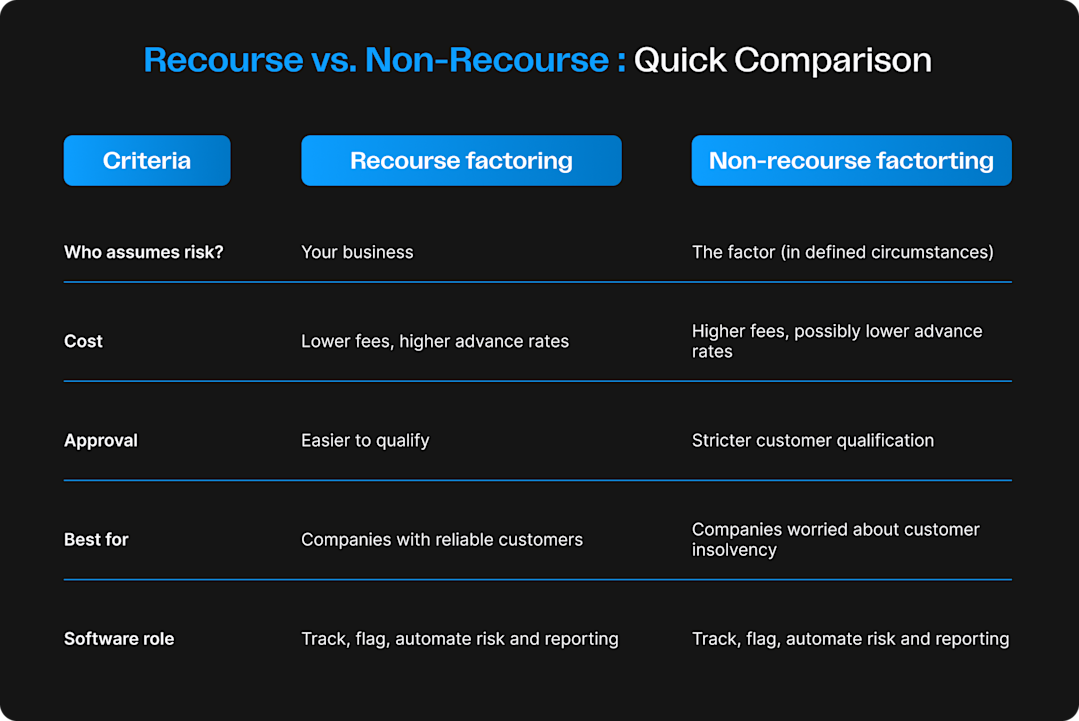

An important aspect for finance teams implementing factoring management software is the distinction between recourse and non-recourse factoring.

Recourse factoring means your business retains ultimate responsibility if a customer does not pay—the factor can "recourse" or charge back unpaid invoices to you. This approach usually comes with lower fees and higher advance rates, but places more risk on your company should your customer default.

Non-recourse factoring shifts the risk of customer non-payment to the factor—meaning the factor absorbs the loss if the customer fails to pay, typically due to insolvency or bankruptcy. While this provides greater protection, it often comes with higher fees and/or more stringent approval criteria.

Always ensure recourse and non-recourse contracts are clearly tracked, so risk and compliance are properly managed.

How is this different from classic receivable financing tools or legacy Treasury Management Systems (TMS)?

- •

Legacy factoring tools: Typically limited to basic invoice submission and workflow—they rarely address multi-provider, multi-entity scenarios, and generally lack robust facility analytics or cross-group consolidation.

- •

Conventional Treasury Management Systems (TMS): Designed for large enterprise routines, they are often slow to deploy, rigid, and costly for mid-market groups. Most lack the specialized factoring, real-time AR integration, and cash forecasting capabilities needed for today’s agile finance function.

- •

Modern factoring management solutions (like Agicap): Bring true automation, cloud flexibility, and strategic integration—bridging AR, cash forecasting, facility tracking, and scenario analysis—all tailored for the workflow and reporting needs of mid-market and high-growth groups.

Why US Mid-Market Companies Are Turning to Factoring Platforms

US mid-market finance leaders are rapidly moving beyond spreadsheets and fragmented administrative processes to manage their factoring operations. The realities of multi-entity business structures, cross-currency AR, and the pressure from private equity sponsors or lenders are exposing the limitations of manual tracking and legacy tools.

Key drivers for upgrading to modern factoring management software include:

- •

Fragmented Credit Line Visibility & Monitoring:

Managing multiple credit lines—each with its own limits, advance rates, and usage—with various factoring providers is a complex task. Without a centralized dashboard, US finance teams lack real-time clarity on drawn balances, available headroom, or facility utilization rates. This “blind spot” often leads to over- or under-utilization of credit, missed refinancing windows, and suboptimal allocation of working capital—directly affecting liquidity and cost of funds.- •

Administrative Burden and Manual Risk:

High manual workload—from invoice eligibility decisions, reconciliations, to settlements—drains resources away from high-impact analysis. Human error can easily result in funding on ineligible invoices, missed collections, or non-compliance events requiring costly remediation.- •

Delayed Cash Forecasts: When factored receivable updates lag behind in the cash forecast, liquidity planning becomes unreliable and real cash flow performance is obscured. This can trigger unnecessary short-term borrowing, missed investment opportunities, or last-minute surprises for group treasury and the board.

- •

Multientity/Multicurrency Complexity: Consolidating exposures, headroom, and settlements across different subsidiaries, business units, and providers is error-prone when done manually. This leads to “trapped cash,” unforeseen FX exposures, and inefficient transfers between US and international operations.

- •

Opaque Costs and Margin Impact: Lack of line-by-line fee transparency complicates true margin and cost allocation by customer, facility, or region. Many US mid-market groups end up overpaying for AR financing or are unable to benchmark provider terms group-wide.

Sticking with manual processes increases compliance risk, leaves working capital trapped, and puts mid-market finance teams at a strategic disadvantage versus competitors leveraging automation and analytics. Factoring management software delivers the visibility, scalability, and rigor required for modern US working capital strategy.

Core Capabilities and Key Selection Criteria

Essential Features for Factoring Management Software (Mid-Market Needs)

While some of these capabilities are standard across traditional factoring solutions, advanced features—such as real-time multi-provider headroom analytics and automated treasury integration—are rapidly emerging as new best practices for US mid-market and PE-backed groups. When evaluating providers, ensure any platform considered can truly support your organization’s multi-entity structure, operational complexity, and compliance standards.:

Invoice Management & Tracking

- •

Register, categorize, and monitor all customer invoices eligible for factoring.

- •

Track the entire lifecycle of each invoice—status, submission, advance, collection, dispute, or overdue.

Factoring Facility Management

- •

Provide a centralized dashboard of all factoring agreements, lines of credit, and provider relationships—enabling instant drilldown by entity, product, customer, contract, or provider.

- •

Visualize drawn amounts, real-time headroom, and advance rates simultaneously, minimizing the risk of overutilizing facilities (which can erode margins through financing costs) and helping you strike the right balance between external funding and self-financing your working capital. With accurate forecasting and monitoring, you can optimize your use of factoring—using it when truly beneficial, while relying on internal resources when possible.

Customer & Provider Database

- •

Maintain complete records of customers (debtors) and all your factoring partners (banks, providers).

Reporting & Analytics

- •

Comprehensive Reporting: Generate reports on outstanding and financed invoices, collected funds, and facility utilization by entity, customer, or provider.

- •

Export Capabilities: Export statements and reports for management, auditors, or providers in just a few clicks.

User Access Controls

- •

Assign granular permissions by role, entity, or business unit—enforcing segregation of duties across complex group structures.

- •

Track all user activity with a full audit trail, supporting SOX, lender, or sponsor compliance requirements.

Expert tip: For US mid-market and multi-entity groups, these features ensure real-time transparency, reduce compliance risk, and position finance to drive smarter funding and working capital optimization. Always prioritize platforms that natively integrate with your AR, cash, and treasury environment to avoid data silos or error-prone workflows.

How to Evaluate and Select a Factoring Management Solution: the checklist

When evaluating factoring management software for a US mid-market or multi-entity group, focus on more than a feature checklist. Seek a solution that accelerates value, adapts to your growth, and truly integrates into your treasury and AR ecosystem.

- •

Integration & Time-to-Value

- •

Does the tool natively connect to your ERP, AR ledger, and bank accounts?

- •

How long from sign-on to go-live? Does it require heavy IT involvement?

- •

Is the integration flexible enough to support transitions between providers or future upgrades?

Scalability & Modularity

- •

Can you seamlessly add new entities, business units, currencies, or factoring partners as your group grows?

Is the solution modular—letting you deploy just the features you need, and expand later as complexity increases?

User Experience & Support

- •

Is the interface intuitive for finance/treasury users (not just IT users)?

Is onboarding managed by product and finance experts who understand mid-market realities?

What’s the support model—multi-channel, responsive, and available in your time zone?

Advanced Feature Set (Beyond the Basics)

- •

Real-time, group-wide facility usage and available headroom

Centralized audit trail and robust compliance management (SOC1/SOX ready)

Critical Vendor Questions

- •

“How is factoring activity reflected in cash forecasts?”

“Do you support multiple providers, currencies, and cross-entity consolidation?”

What is the typical time from contract to first facility go-live for a mid-market group?

Expert Tip: Always demo the solution with real data from your group. Challenge providers to show live, consolidated headroom tracking, automated AR-bank syncing, and a full facility audit trail—across multiple entities and providers.

Why Choose a Treasury Platform Like Agicap Over Standard Factoring Tools

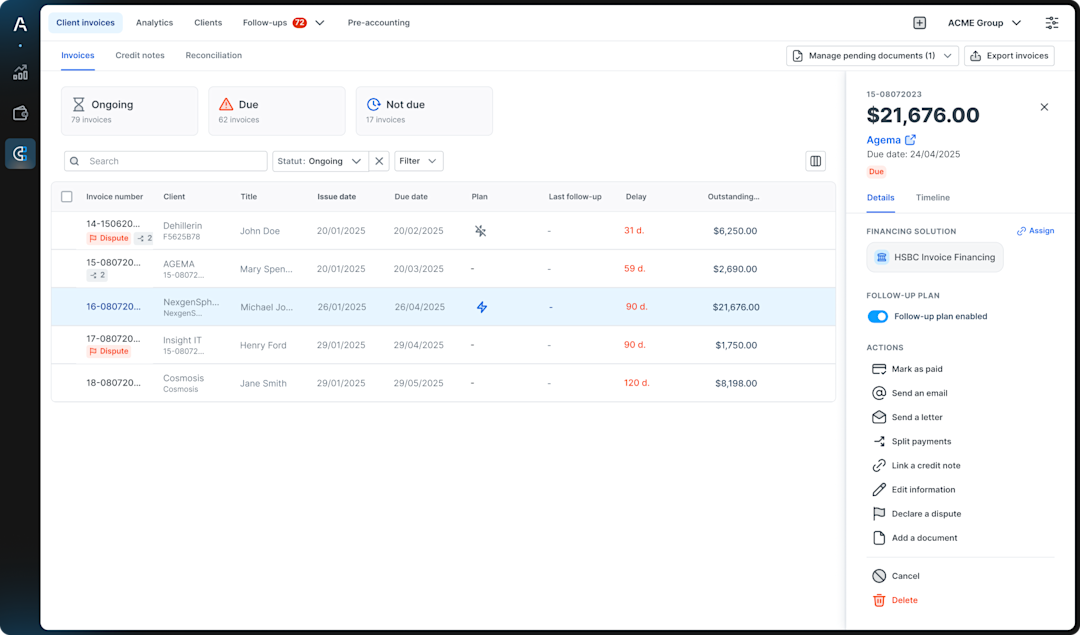

Modern US mid-market finance teams expect more than basic, siloed factoring management. Agicap delivers a unified treasury management platform, offering advanced features that go far beyond what legacy factoring tools provide.

Seamless Integration between AR and Cash Forecasting (Key Differentiator)

Agicap’s most powerful advantage is the real-time link between accounts receivable and group cash forecasting. Every factored or financed invoice, settlement, or dispute automatically synchronizes with your cash position and forecasts. This ensures liquidity planning is always based on accurate, up-to-date data—dramatically reducing the risk of overestimating available cash or double-counting expected inflows. By connecting AR and treasury in one platform, finance teams can make faster, more precise funding and investment decisions.

Real-Time, Group-Wide Visibility

Agicap consolidates all credit lines and provider exposures into a single dashboard. CFOs, controllers, and group treasury teams can instantly monitor usage, remaining headroom, and utilization across every entity, currency, and provider—eliminating manual consolidation and uncertainty.

Dunning Management Adapted to Financing Context

Agicap can adapt dunning and reminder workflows according to the financing method:

- •

For fully sold (non-recourse) invoices where the factor manages collection, the platform can suspend internal reminders to prevent duplicate or conflicting communication with the customer, improving the client experience and ensuring contractual compliance.

- •

For invoices under discounting/financing or confidential factoring where your company keeps collection responsibility, reminders continue as normal, helping ensure prompt payment.

Automated, Proactive Monitoring

Facility utilization and maturing advances are all tracked in real time, with configurable alerts for thresholds or exceptions. Whether scaling to new facilities or adding new providers, Agicap adapts seamlessly.

Advanced Analytics and Scenario Modeling

Drill down on exposures, concentration risk, costs, and deductions. Benchmark headroom across subsidiaries to optimize working capital and funding costs.

Fast, User-Friendly SaaS Deployment

Agicap is cloud-native, modular, and designed for finance—not IT—teams. Most groups are up and running in weeks, with no heavy customization or long implementation cycles.

In summary: Agicap empowers US mid-market groups to move from reactive, admin-heavy factoring to proactive, strategic cash and working capital management—achieving transparency and efficiency that old-school factoring tools simply can’t match.

Curious how Agicap can transform your factoring process? Book a demo with our experts now.

Factoring Management Software: Transforming Treasury and Working Capital Strategy

Improved Cash Flow Visibility & Forecasting

- •

Real-time factoring data, directly synced with AR and treasury, empowers US mid-market groups with 360° cash visibility across all entities and providers.

- •

The core benefit: Accurate modeling of future inflows from invoices—including those you plan to factor—empowers finance teams to make smarter decisions about when and how much to use factoring. By forecasting which invoices may need to be sold to the factor (and simulating the impact on available liquidity), mid-market groups can proactively unlock trapped cash, minimize unexpected funding gaps, and avoid costly short-term borrowing.

Example: With Agicap, companies like Maison Mirabeau were able to anticipate cash needs and strategically select which invoices to factor, resulting in a 50% reduction in factoring costs.

Enhanced Working Capital Control & Compliance

- •

Automated tracking of DSO performance, factoring costs, advance rates, and counterparty concentration—critical for audit, lender, or PE and board reporting.

- •

Proactive alerts for approaching facility limits enhance risk oversight and policy adherence, especially in regulated or fast-growth environments.

Boosted Operational Efficiency

- •

Agicap streamlines many aspects of reconciliation and reporting by centralizing the tracking of receivables financing operations alongside AR and treasury. While direct connectivity with factoring providers isn’t automated, having all information in one place reduces manual effort and the risk of errors, enabling finance teams to focus on value-added analysis and strategic decisions rather than administrative tasks.

- •

Finance teams can redirect focus to scenario modeling, strategic working capital planning, and performance optimization—rather than back-office reconciliations.

Multi-Entity, Multi-Currency Optimization

Group-level dashboards remove the blind spots and silos of classic factoring management : providing real-time utilization and exposures, regardless of subsidiary, provider, or currency.

Cost and Margin Transparency

- •

Real-time, granular visibility into all fees, financing costs, and discounting charges gives CFOs and controllers the insights needed to precisely measure the impact of factoring on net margin. By clearly attributing factoring costs by customer, product line, or region, teams can make informed choices—negotiating better terms with providers, sharpening their pricing strategies, or re-evaluating customer profitability.

- •

Remember: Frequent use of factoring impacts net profit through financial charges and additional fees—understanding and tracking this effect is essential for optimizing both pricing and funding strategy.

In short, modern receivables financing management software like Agicap empowers finance teams to optimize liquidity, safeguard margins, and make data-driven decisions—transforming the way mid-market organizations manage working capital.

Factoring Management Software FAQ

What is factoring management software and how is it different from basic AR or ERP tools?

Factoring management software centralizes the tracking, forecasting, and control of all factoring activities—delivering real-time visibility into funding lines, eligibility, and cost, far beyond what a standard AR or ERP module can offer.

Can factoring management software handle multiple providers or currencies?

Leading solutions offer multi-provider and multicurrency capabilities out-of-the-box—enabling true group-wide visibility with no manual consolidation.

What is invoice discounting software and how does it differ from factoring management software?

Invoice discounting software helps manage financing facilities where invoices are used as collateral but stay on your balance sheet and you keep control of collections. It usually tracks pledged invoices, headroom, settlements, and fees for a specific discounting line. Factoring management software is broader: it centralizes multiple receivables financing methods (factoring, discounting, etc.) across entities and providers, and often links them directly to cash visibility and forecasting.

How does factoring activity impact cash flow forecasting?

Dedicated platforms integrate factoring inflows and outflows directly into dynamic cash flow forecasts—reflecting real expected receipts, repayments, and headroom, rather than approximations or lagged manual updates.

What are the main business benefits of automating factoring management?

Automation reduces manual workload, errors, and compliance risk; improves cash flow visibility; makes working capital more productive; and empowers finance to optimize costs and provider relationships.

What’s the difference between invoice factoring and invoice financing?

Invoice factoring involves selling your invoices to a provider, who advances cash and may take over collections—except in confidential factoring, where you still handle collections.

Invoice financing uses invoices as collateral for a loan, and you always remain responsible for collections.

Both improve liquidity, but only factoring may transfer collection responsibility to the provider, depending on the arrangement.